Recently, Paul Xu, CEO of Klein Labs, introduced TARS Protocol, the project they built, how to bring a paradigm shift in the field of crypto investment.

As we know, in traditional finance, firms go for public offerings (IPOs/SEOs) with shown work and prestige, and under regulation. Firms that secure funding in earlier stages do so through private investing routines where the investors have the upper hand in setting the stage for the agreement.

In DeFi, however, this process is monetized to a variety of investors who do not have the upper hand in setting terms to compensate for the risk they take. Projects secure funds in the early stages through mutually signed legal documents called Simple Agreement for Future Tokens (SAFT). These documents set the terms of the agreement, including the token release schedules. Mind you, abiding by these agreements solely depend on the fund-raising project, and specifically, on the project developers or managers who have access to sensitive keys.

“While individual investors have virtually zero power in allocating such rights or any voting opportunity to set measures against this, even Venture Capitals (VCs) that invest tens of thousands of dollars on the new projects cannot afford to pursue local legal action against the offenders’ area of residence in most cases. The manual fundraising and distribution procedures are also highly susceptible to hacking and phishing attempts on both investor and project sides which is a significant security hazard”, said Paul.

TARS Protocol(https://tars.pro/) provides the much-needed safety measures, restoring trust on the investor side, and ultimately adding significant value to DeFi early-asset fundraising and investments.

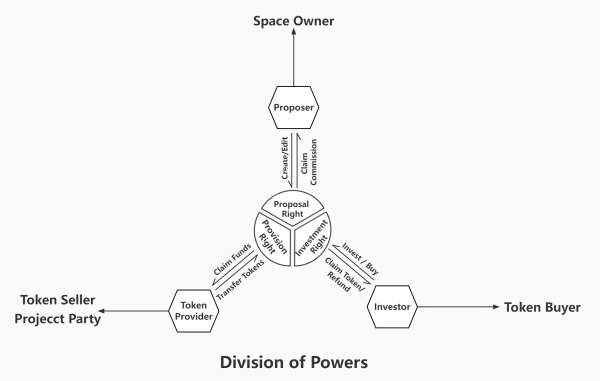

The design of TARS introduces the idea of division of powers, similar to the separation of powers in political terms. As we know, separation of powers refers to the division of a state’s government into branches, each with separate, independent powers and responsibilities, so that the powers of one branch are not in conflict with those of the other branches. The intention behind a system of separated powers is to prevent the concentration of power by providing for checks and balances.

“We believe that in the world of Web 3, code is law. Therefore, in the TARS product Operation Mechanism, the division of powers is adopted to effectively balance and safeguard the legitimate rights and interests of all parties involved”, Paul added.

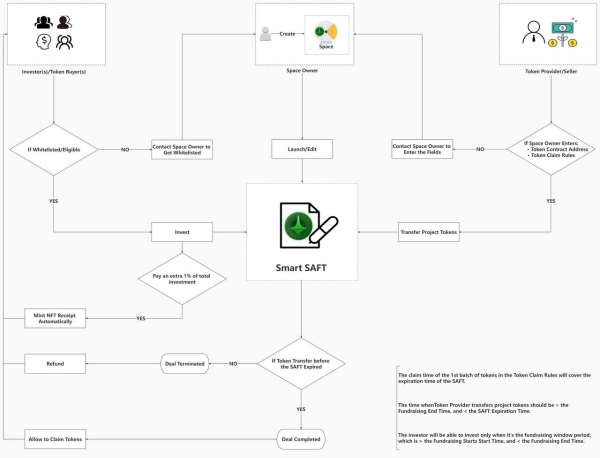

Taking the Smart SAFT as an example, although the proposer has the same interests as the investor, it has no right to touch the investor’s funds; the Token Provider can not complete the deal until it has successfully fulfilled its transfer obligations; investors can claim refunds when the deal failed and are no longer passive and vulnerable. The following flowchart provides a clearer picture of the checks and balances between the participants in the Smart SAFT.

About TARS Protocol:

TARS is an automated Web3 protocol providing trustable on-chain solutions for investment relationships. Built on Non-Custodial, Secure & Audited Smart Contracts, TARS provides a simple, safe, and collaborative infrastructure for crypto users to rebuild influence and trust on Web3.

View more about TARS Protocol on Twitter:

https://twitter.com/tarsprotocol

Media Contact

Company Name: TARS Foundation Ltd.

Contact Person: Anthony Won

Email: Send Email

Country: Singapore

Website: https://tars.pro/