We WANT to be optimistic, don't we? I mean investors are a generally optimistic group – we are betting on things being better in the future than they are today – it's kind of our underlying investing thesis that causes us to be investors in the first place. What separates us from the average luxury bunker buyer is that we feel obstacles can be overcome and conflicts will be resolved and our innate ingenuity will solve almost any problem . For example, Eli Lilly is up today on nice results and, unfortunately, an 81% increase in sales of their Covid treatment and Trulicity (diabetes) sales are up 20% as we all sat on our asses for 2 years but Kudos to LLY for coming up with a better solution and that's Tirzeatide, which just finished a large-scale study showing an amazing 22.5% (not a typo) average weight loss for people who combined the drug with a healthy diet and exercise. LLY is not cheap at $271Bn with $8Bn in earnings and $13Bn in debt but MRNA sure is at $57Bn with $10Bn in earnings and $10Bn in CASH!!! Expectation are the Covid shots will wind down but Covid wasn't why they started the company – it simply proved the value of what they can accomplish. Don't worry Moderna investors, there will be other horrible diseases we need vaccines for – and now they will have about $20Bn in CASH!!! going forward to fund R&D with. LLY expects to make $7.5Bn with their weight-loss pills but MRNA can come up with a vaccine so you don't gain the weight in the first place. That's not where Moderna's focus is, however, their current pipeline looks like this: We'll hear more about it on their May 4th Conference Call but these were the original goals for the company – Covid was just a bonus that proved their methodology could lead to workable vaccines – why abandon them now? Traders (not investors) are certainly feeling the pressure as the stock is 66.6% off it's highs but that's a sign to invest, not divest. All Biotechs are…

We WANT to be optimistic, don't we?

I mean investors are a generally optimistic group – we are betting on things being better in the future than they are today – it's kind of our underlying investing thesis that causes us to be investors in the first place. What separates us from the average luxury bunker buyer is that we feel obstacles can be overcome and conflicts will be resolved and our innate ingenuity will solve almost any problem.

For example, Eli Lilly is up today on nice results and, unfortunately, an 81% increase in sales of their Covid treatment and Trulicity (diabetes) sales are up 20% as we all sat on our asses for 2 years but Kudos to LLY for coming up with a better solution and that's Tirzeatide, which just finished a large-scale study showing an amazing 22.5% (not a typo) average weight loss for people who combined the drug with a healthy diet and exercise.

LLY is not cheap at $271Bn with $8Bn in earnings and $13Bn in debt but MRNA sure is at $57Bn with $10Bn in earnings and $10Bn in CASH!!! Expectation are the Covid shots will wind down but Covid wasn't why they started the company – it simply proved the value of what they can accomplish. Don't worry Moderna investors, there will be other horrible diseases we need vaccines for – and now they will have about $20Bn in CASH!!! going forward to fund R&D with.

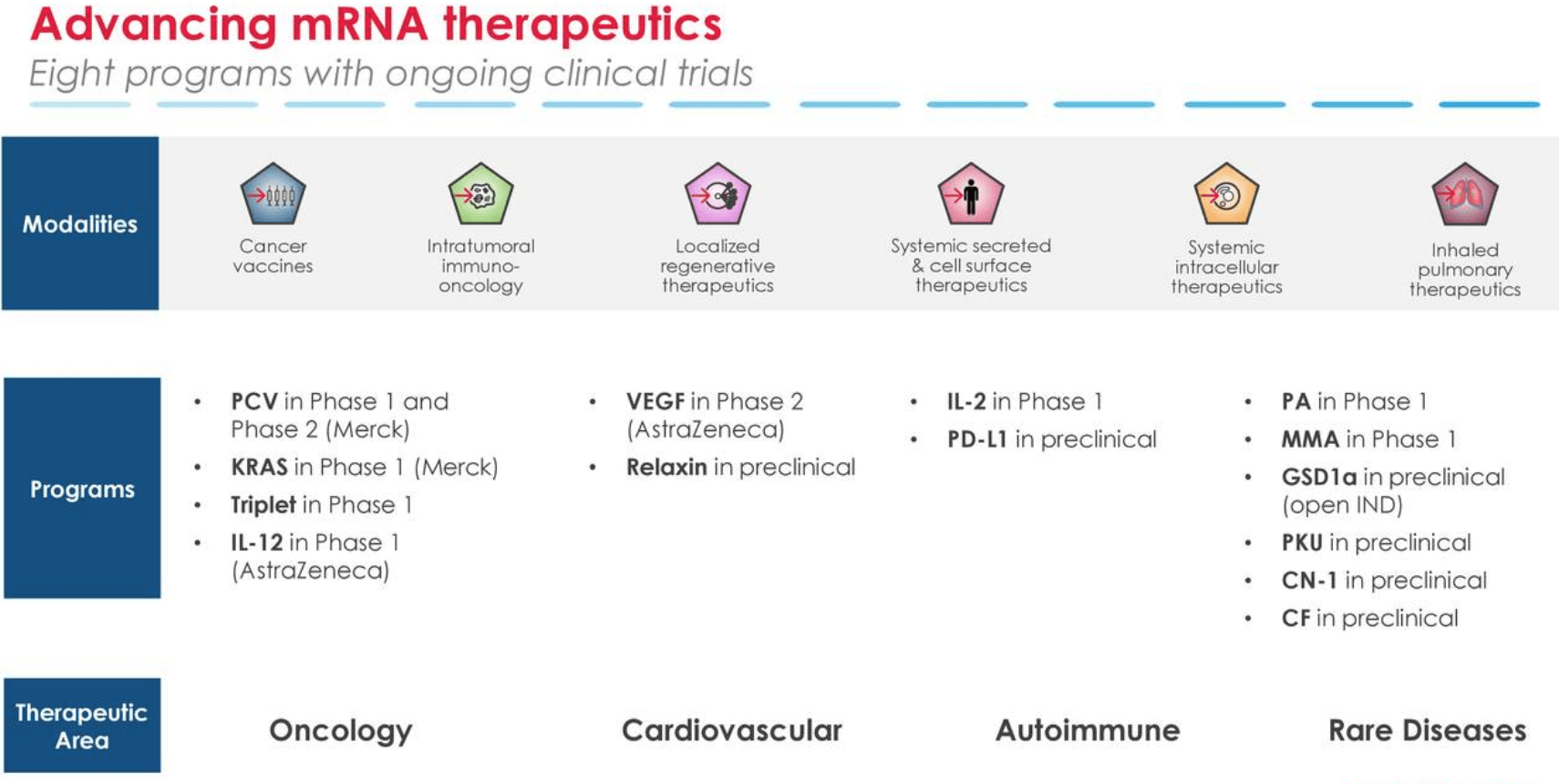

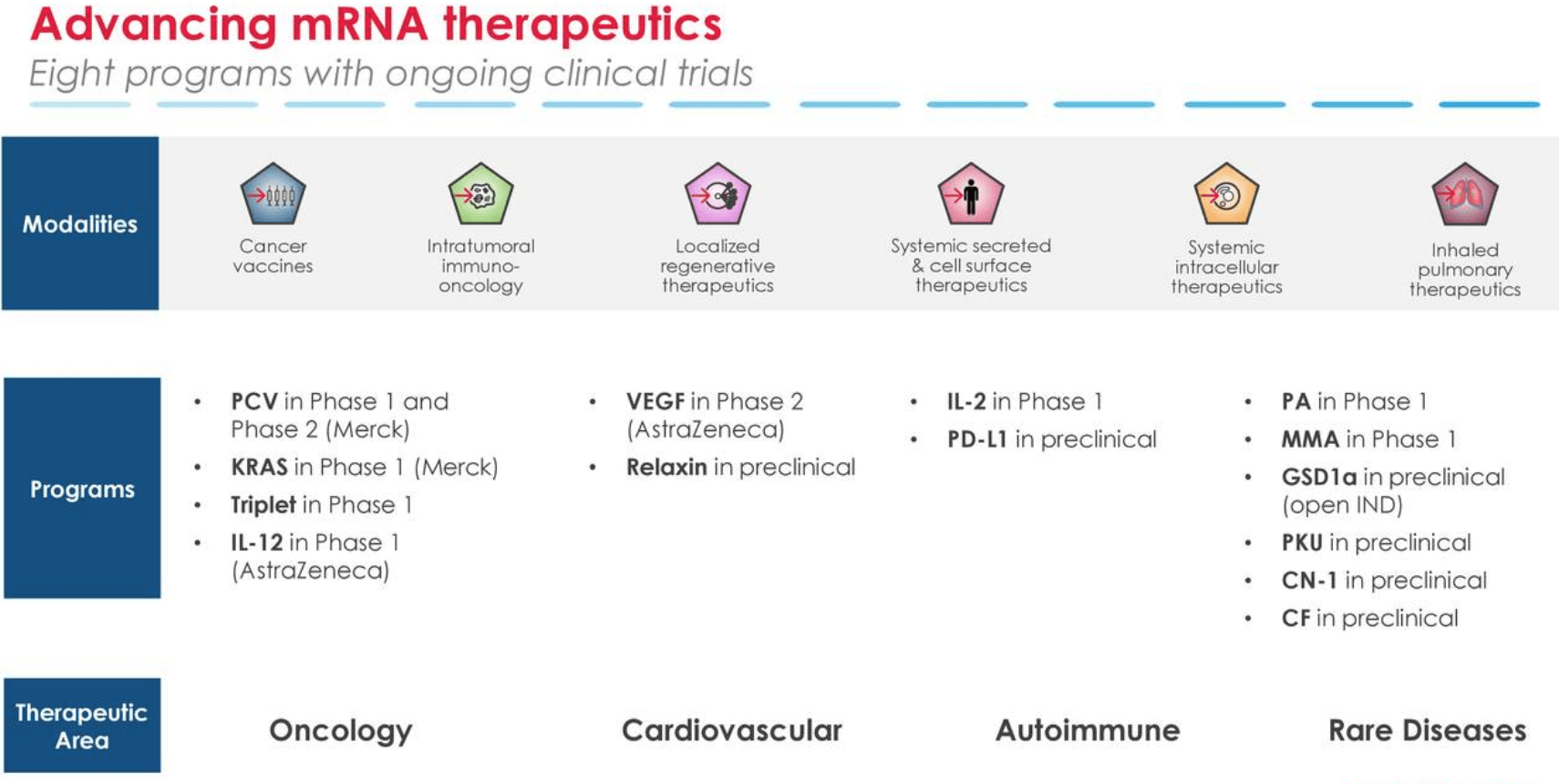

LLY expects to make $7.5Bn with their weight-loss pills but MRNA can come up with a vaccine so you don't gain the weight in the first place. That's not where Moderna's focus is, however, their current pipeline looks like this:

We'll hear more about it on their May 4th Conference Call but these were the original goals for the company – Covid was just a bonus that proved their methodology could lead to workable vaccines – why abandon them now? Traders (not investors) are certainly feeling the pressure as the stock is 66.6% off it's highs but that's a sign to invest, not divest.

All Biotechs are…