We have a boring week ahead. That's good as it will give things a chance to settle down. There are only two Fed speakers scheduled (both Wednesday) and not much data and earnings, so far, have been mixed: Here's what lies ahead this week and we'll see if past sector performance is a good predictor of future results: Both Fed speakers come ahead of the 10-year note auction – it's still critical to the Fed that people buy those at low rates or their whole plan goes off the rails – along with our economy. CPI comes on Thursday and, other than that, a bit of Consumer Sentiment and that's it for data this week. As I said, dull. Generally, the market has trended higher in dull, low-volume weeks and this week, we don't have time to lay about as our bounce chart is wrecked and we need to be over those strong bounce lines by Friday or the whole week can be written off as a consolidation for a move lower – so let's watch our levels carefully: Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong) S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong) Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong) …

We have a boring week ahead.

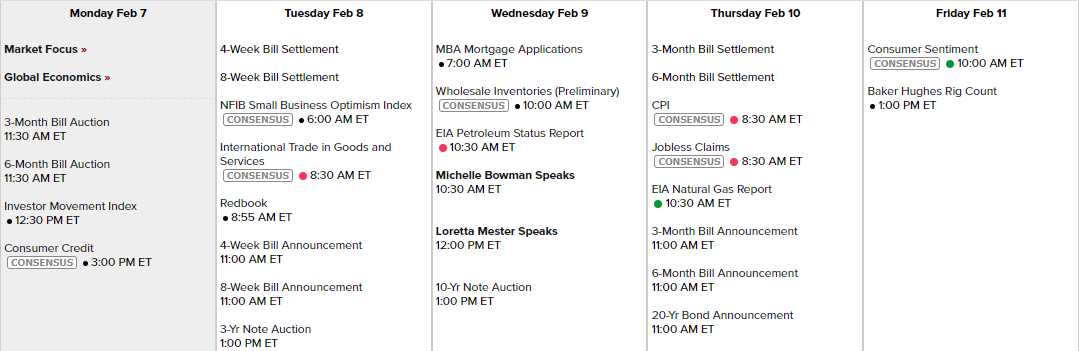

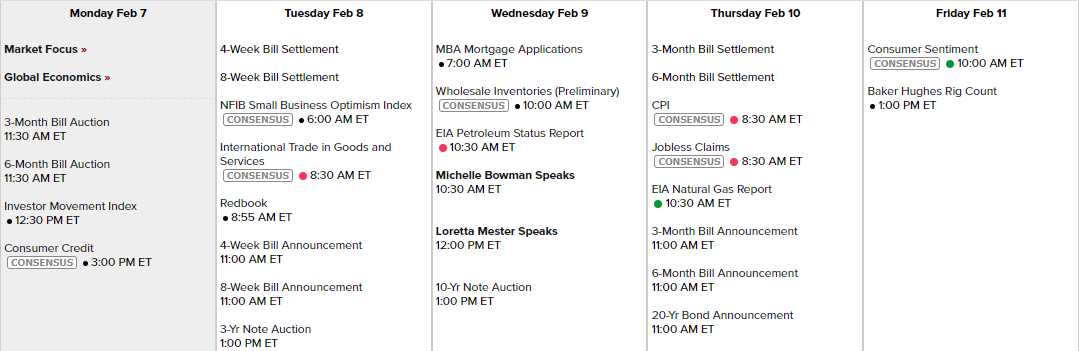

That's good as it will give things a chance to settle down. There are only two Fed speakers scheduled (both Wednesday) and not much data and earnings, so far, have been mixed:

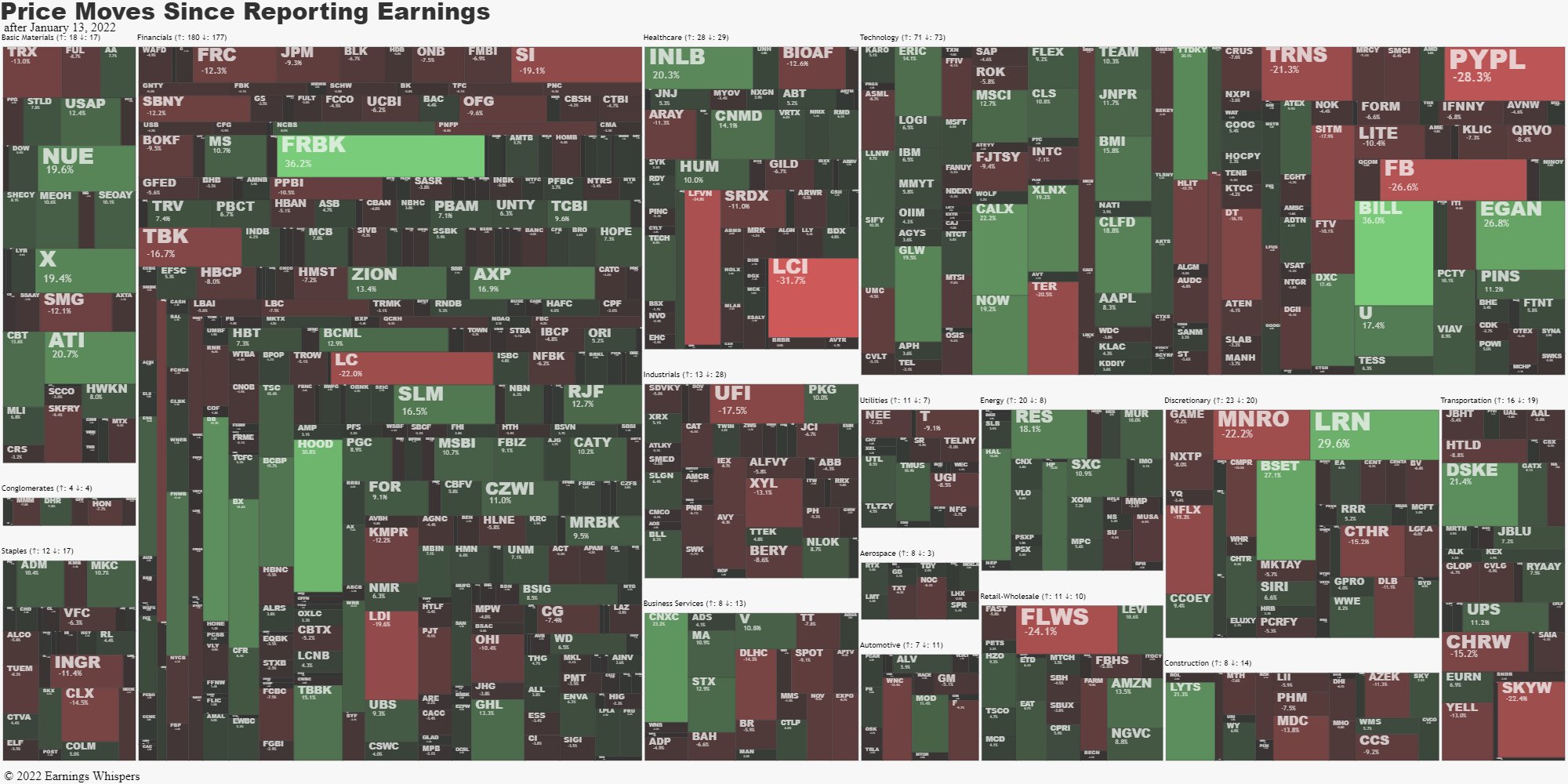

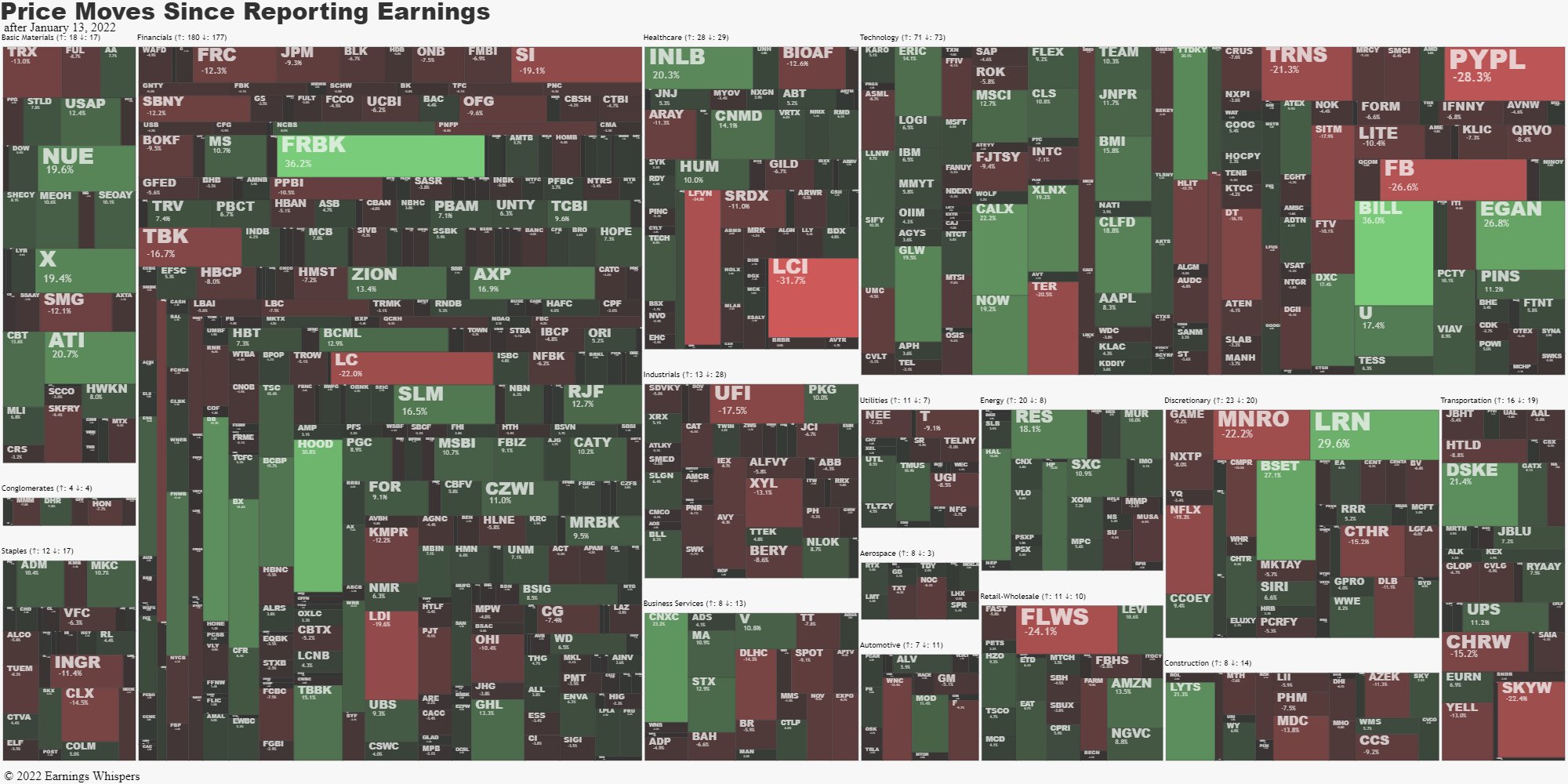

Here's what lies ahead this week and we'll see if past sector performance is a good predictor of future results:

Both Fed speakers come ahead of the 10-year note auction – it's still critical to the Fed that people buy those at low rates or their whole plan goes off the rails – along with our economy. CPI comes on Thursday and, other than that, a bit of Consumer Sentiment and that's it for data this week. As I said, dull.

Generally, the market has trended higher in dull, low-volume weeks and this week, we don't have time to lay about as our bounce chart is wrecked and we need to be over those strong bounce lines by Friday or the whole week can be written off as a consolidation for a move lower – so let's watch our levels carefully:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

…