In a move that has sent shockwaves through the global semiconductor industry, China has officially activated a functional Extreme Ultraviolet (EUV) lithography prototype at a high-security facility in Shenzhen. The development, confirmed by satellite imagery and internal industry reports in late 2025, represents the most significant challenge to Western chip-making hegemony in decades. By successfully generating the elusive 13.5nm light required for sub-7nm chip production, Beijing has signaled that its "Manhattan Project" for semiconductors is no longer a theoretical ambition but a physical reality.

The immediate significance of this breakthrough cannot be overstated. For years, the United States and its allies have leveraged export controls to deny China access to EUV machines produced exclusively by ASML (NASDAQ: ASML). The activation of this domestic prototype suggests that China is on the verge of bypassing these "chokepoints," potentially reaching 2nm semiconductor independence by 2028-2030. This achievement threatens to dismantle the "Silicon Shield"—the geopolitical theory that Taiwan’s dominance in advanced chipmaking serves as a deterrent against conflict due to the global economic catastrophe that would follow a disruption of its foundries.

A "Frankenstein" Approach to 13.5nm Light

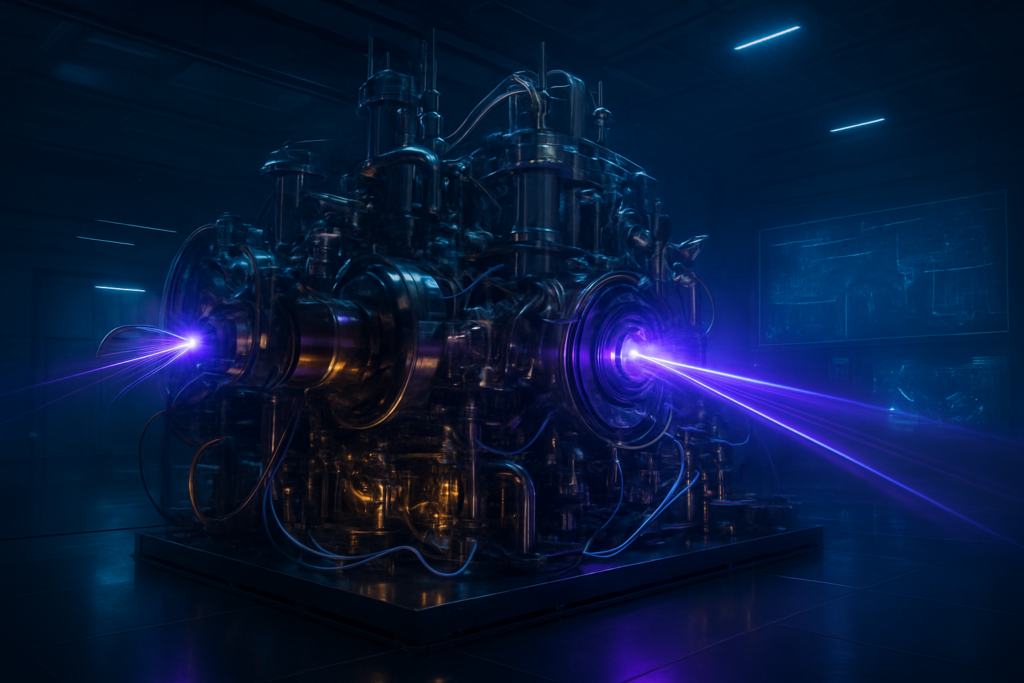

The Shenzhen prototype is not a sleek, commercial-ready unit like the ASML NXE series; rather, it is described by experts as a "hybrid apparatus" or a "Frankenstein" machine. Occupying nearly an entire factory floor, the device was reportedly constructed using a combination of reverse-engineered components from older Deep Ultraviolet (DUV) systems and specialized parts sourced through complex international secondary markets. Despite its massive footprint, the machine has successfully achieved a stable 13.5nm wavelength, the holy grail of modern lithography.

Technically, the breakthrough hinges on two distinct light-source pathways. The first, a solid-state Laser-Produced Plasma (LPP) system developed by the Shanghai Institute of Optics and Fine Mechanics (SIOM), has reached a conversion efficiency of 3.42%. While this trails ASML's 5.5% industrial standard, it is sufficient for the low-volume production of strategic AI and military components. Simultaneously, a second prototype at a Huawei-linked facility in Dongguan is testing Laser-induced Discharge Plasma (LDP) technology. Developed in collaboration with the Harbin Institute of Technology, this LDP method is reportedly more energy-efficient and cost-effective, though it currently produces lower power output than its LPP counterpart.

The domestic supply chain has also matured rapidly to support this machine. The Changchun Institute of Optics, Fine Mechanics and Physics (CIOMP) has reportedly delivered the critical alignment interferometers needed to position reflective lenses with nanometer-level precision. Meanwhile, companies like Jiangfeng and MLOptics are providing the specialized mirrors required to bounce EUV light—a task of immense difficulty given that EUV light is absorbed by almost all materials, including air.

Market Disruption and the Corporate Fallout

The activation of the Shenzhen prototype has immediate and profound implications for the world's leading tech giants. For ASML (NASDAQ: ASML), the long-term loss of the Chinese market—once its largest growth engine—is now a certainty. While ASML still holds a monopoly on High-NA EUV technology required for the most advanced nodes, the emergence of a viable Chinese alternative for standard EUV threatens its future revenue streams and R&D funding.

Major foundries like Semiconductor Manufacturing International Corporation, or SMIC (HKG: 0981), are already preparing to integrate these domestic tools into their "Project Dragon" production lines. SMIC has been forced to use expensive multi-patterning techniques on older DUV machines to achieve 7nm and 5nm results; the transition to domestic EUV will allow for single-exposure processing, which dramatically lowers costs and improves chip performance. This poses a direct threat to the market positioning of Taiwan Semiconductor Manufacturing Company, or TSMC (NYSE: TSM), and Samsung Electronics (KRX: 005930), as China moves toward self-sufficiency in the high-end AI chips currently dominated by Nvidia (NASDAQ: NVDA).

Furthermore, analysts predict that China may use its newfound domestic capacity to initiate a price war in "mature nodes" (28nm and above). By flooding the global market with state-subsidized chips, Beijing could potentially squeeze the margins of Western competitors, forcing them out of the legacy chip market and consolidating China’s control over the broader electronic supply chain.

Ending the Era of the Silicon Shield

The broader significance of this breakthrough lies in its impact on global security and the "Silicon Shield" doctrine. For decades, the world’s reliance on TSMC (NYSE: TSM) has served as a powerful deterrent against a cross-strait conflict. If China can produce its own 2nm and 5nm chips domestically, it effectively "immunizes" its military and critical infrastructure from Western sanctions and tech blockades. This shift significantly alters the strategic calculus in the Indo-Pacific, as the economic "mutually assured destruction" of a semiconductor cutoff loses its potency.

This event also formalizes the "Great Decoupling" of the global technology landscape. We are witnessing the birth of two entirely separate technological ecosystems: a "Western Stack" built on ASML and TSMC hardware, and a "China Stack" powered by Huawei and SMIC. This fragmentation will likely lead to incompatible standards in AI, telecommunications, and high-performance computing, forcing third-party nations to choose between two distinct digital spheres of influence.

The speed of this development has caught many in the AI research community by surprise. Comparisons are already being drawn to the 1950s "Sputnik moment," as the West realizes that export controls may have inadvertently accelerated China’s drive for innovation by forcing it to build an entirely domestic supply chain from scratch.

The Road to 2nm: 2028 and Beyond

Looking ahead, the primary challenge for China is scaling. While a prototype in a high-security facility proves the physics, mass-producing 2nm chips with high yields is a monumental engineering hurdle. Experts predict that 2026 and 2027 will be years of "trial and error," as engineers attempt to move from the current "Frankenstein" machines to more compact, reliable commercial units. The goal of achieving 2nm independence by 2028-2030 is ambitious, but given the "whole-of-nation" resources being poured into the project, it is no longer dismissed as impossible.

Future applications for these domestic chips are vast. Beyond high-end smartphones and consumer electronics, the primary beneficiaries will be China's domestic AI industry and its military modernization programs. With 2nm capability, China could produce the next generation of AI accelerators, potentially rivaling the performance of Nvidia (NASDAQ: NVDA) chips without needing to import a single transistor.

However, the path is not without obstacles. The precision required for 2nm lithography is equivalent to hitting a golf ball on the moon with a laser from Earth. China still struggles with the ultra-pure chemicals (photoresists) and the high-end metrology tools needed to verify chip quality at that scale. Addressing these gaps in the "chemical and material" side of the supply chain will be the next major focus for Beijing.

A New Chapter in the Chip Wars

The activation of the Shenzhen EUV prototype marks a definitive turning point in the 21st-century tech race. It signifies the end of the era where the West could unilaterally dictate the pace of global technological advancement through the control of a few key machines. As we move into 2026, the focus will shift from whether China can build an EUV machine to how quickly they can scale it.

The long-term impact of this development will be felt in every sector, from the price of consumer electronics to the balance of power in international relations. The "Silicon Shield" is cracking, and in its place, a new era of semiconductor sovereignty is emerging. In the coming months, keep a close eye on SMIC's (HKG: 0981) yield reports and Huawei's upcoming chip announcements, as these will be the first indicators of how quickly this laboratory breakthrough translates into real-world dominance.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.