What a brutal six months it’s been for Humana. The stock has dropped 20.9% and now trades at $195.56, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for HUM? Find out in our full research report, it’s free.

Why Are We Positive On Humana?

With over 80% of its revenue derived from federal government contracts, Humana (NYSE: HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

1. Long-Term Revenue Growth Shows Momentum

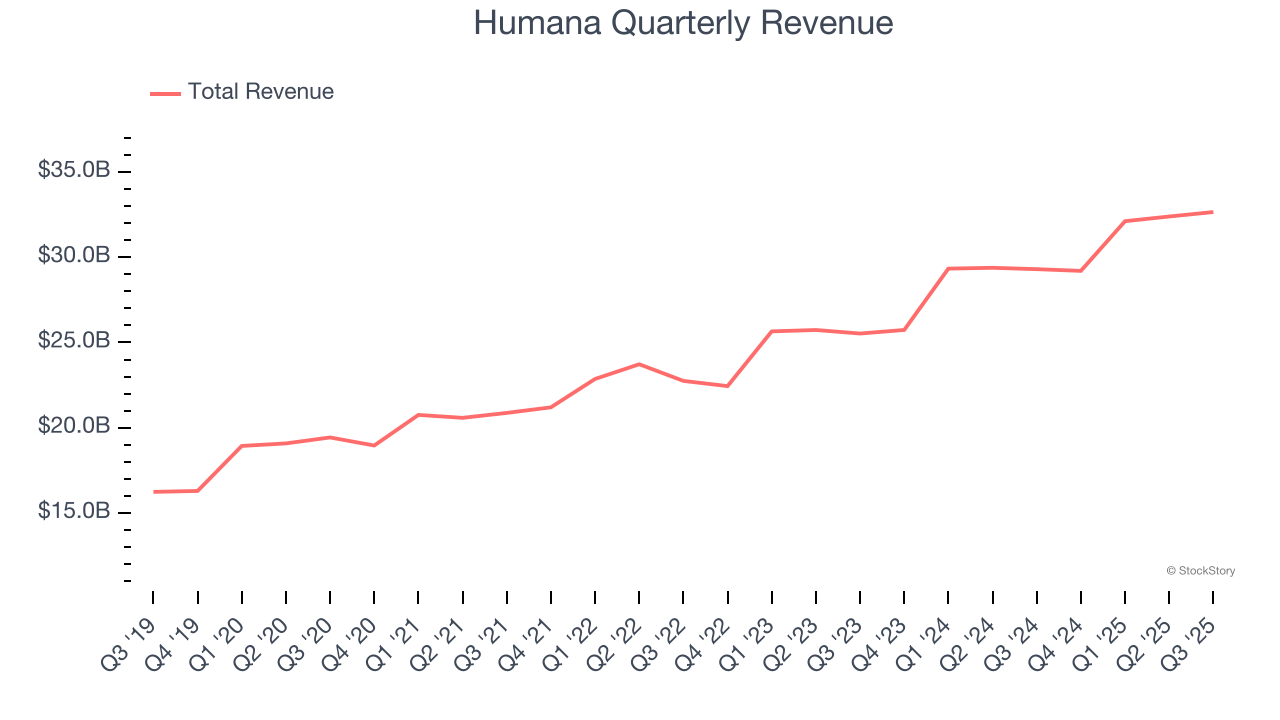

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Humana’s 11.4% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $126.3 billion in revenue over the past 12 months, Humana is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Humana’s five-year average ROIC was 34.4%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons Humana is a rock-solid business worth owning. After the recent drawdown, the stock trades at 14.7× forward P/E (or $195.56 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.