Horace Mann Educators has been treading water for the past six months, recording a small loss of 4.6% while holding steady at $42.57. The stock also fell short of the S&P 500’s 6% gain during that period.

Is now the time to buy Horace Mann Educators, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Horace Mann Educators Will Underperform?

We're swiping left on Horace Mann Educators for now. Here are three reasons there are better opportunities than HMN and a stock we'd rather own.

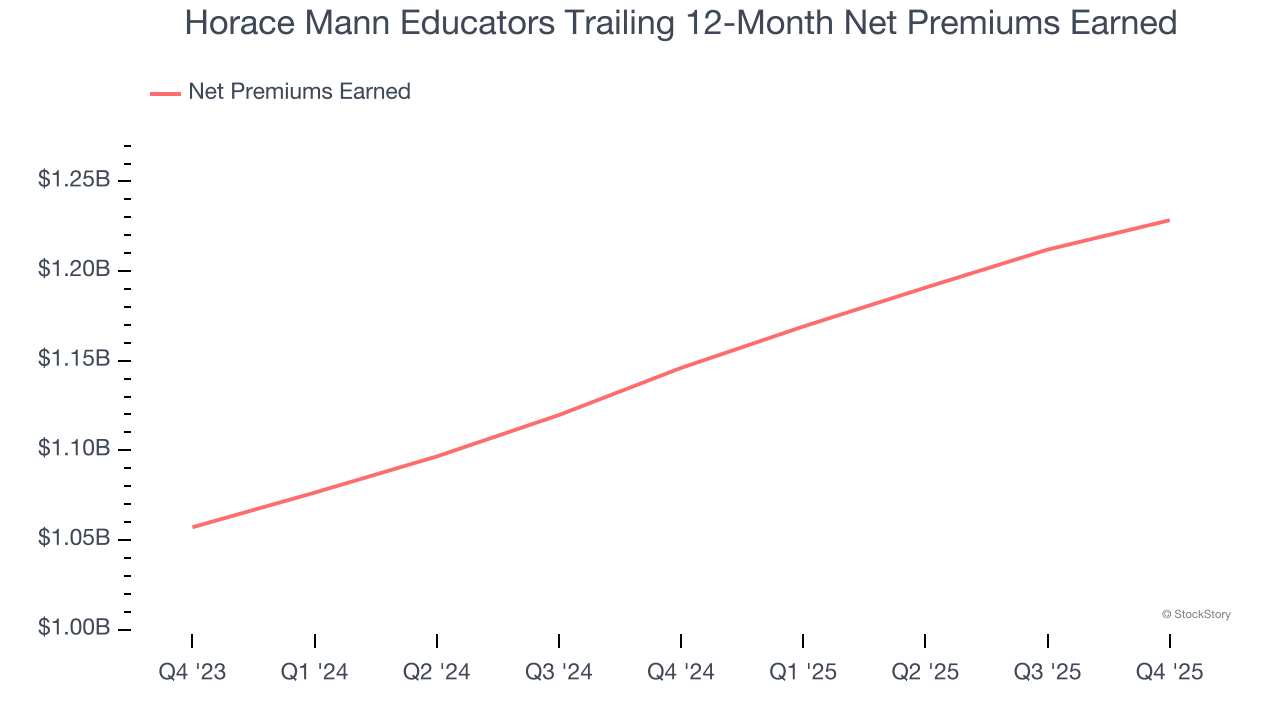

1. Net Premiums Earned Point to Soft Demand

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Horace Mann Educators’s net premiums earned has grown at a 5.7% annualized rate over the last five years, worse than the broader insurance industry and in line with its total revenue.

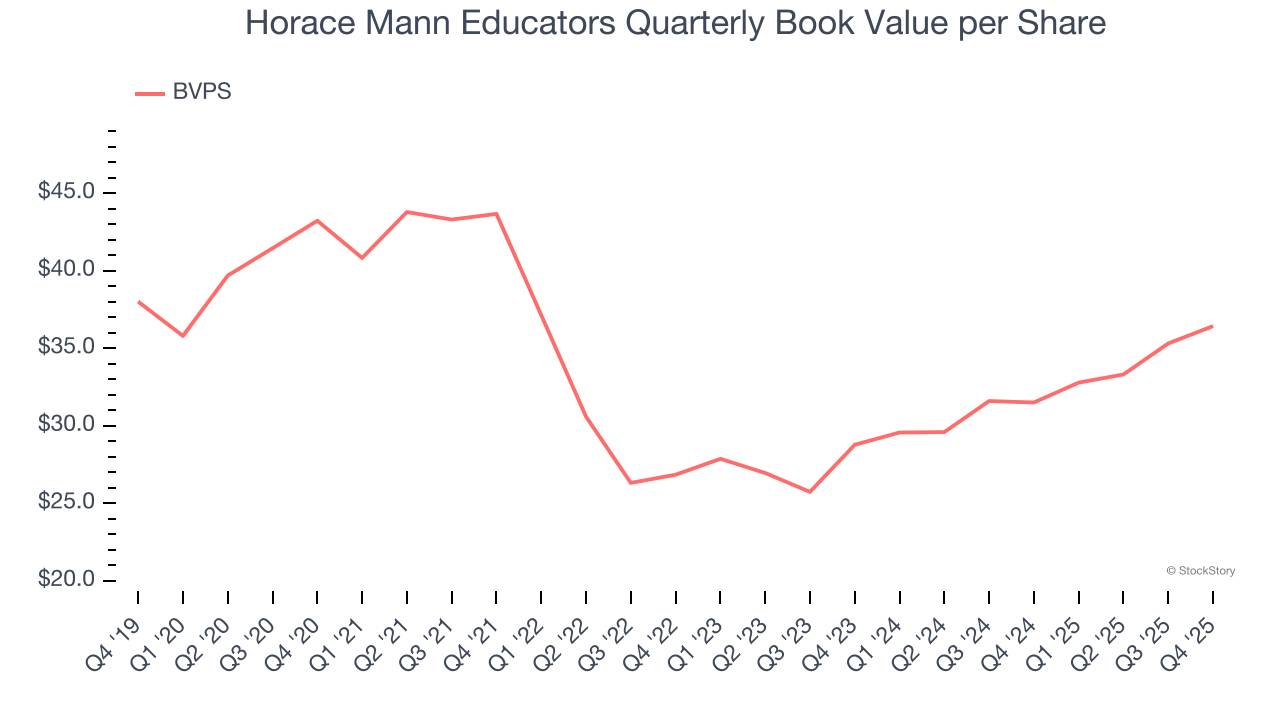

2. BVPS Growth Demonstrates Strong Asset Foundation

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Although Horace Mann Educators’s BVPS declined at a 3.4% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at a decent 12.5% annual clip (from $28.78 to $36.43 per share).

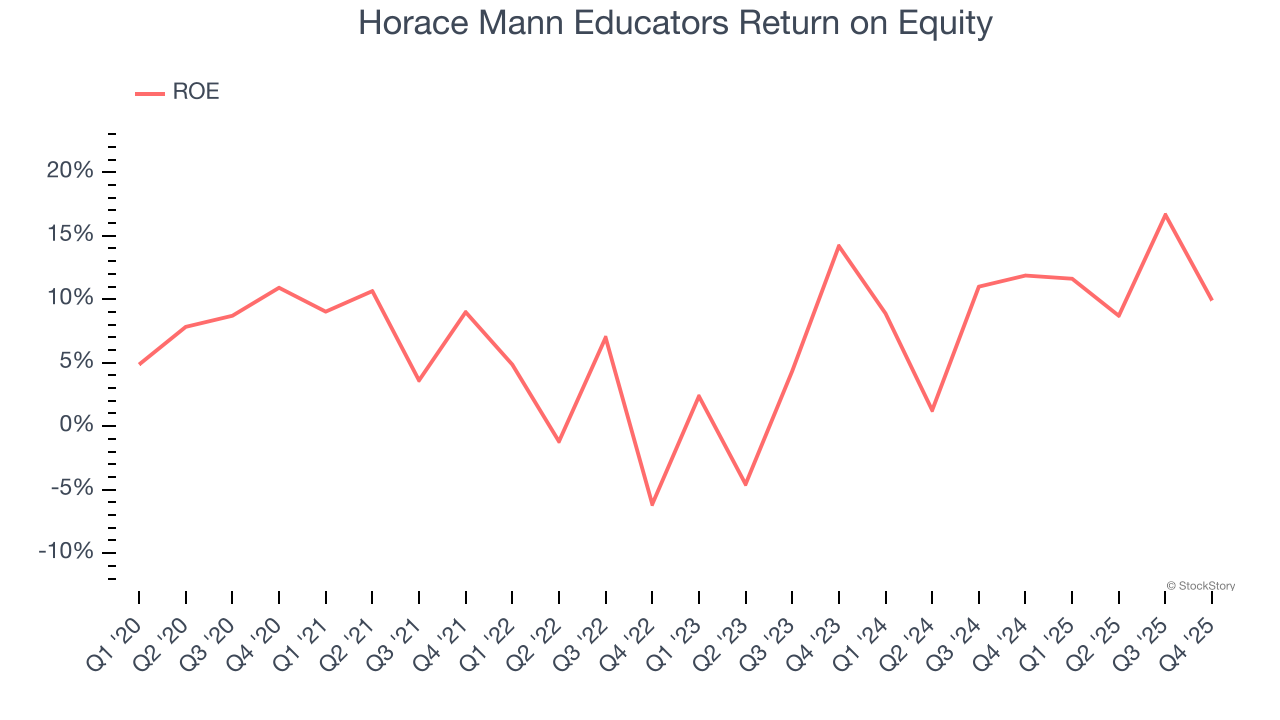

3. Previous Growth Initiatives Haven’t Impressed

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Horace Mann Educators has averaged an ROE of 6.6%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

We see the value of companies helping consumers, but in the case of Horace Mann Educators, we’re out. With its shares underperforming the market lately, the stock trades at 1.1× forward P/B (or $42.57 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Horace Mann Educators

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.