Financial advisory firm Lazard (NYSE: LAZ) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.4% year on year to $929.4 million. Its non-GAAP profit of $0.80 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Lazard? Find out by accessing our full research report, it’s free.

Lazard (LAZ) Q4 CY2025 Highlights:

- Assets Under Management: $254.3 billion vs analyst estimates of $260.9 billion (12.4% year-on-year growth, 2.5% miss)

- Revenue: $929.4 million vs analyst estimates of $814.7 million (14.4% year-on-year growth, 14.1% beat)

- Pre-tax Profit: $84.95 million (9.1% margin)

- Adjusted EPS: $0.80 vs analyst estimates of $0.69 (16.2% beat)

- Market Capitalization: $4.99 billion

"2025 demonstrates our ongoing focus on executing our Lazard 2030 long-term growth strategy, with record revenue in Financial Advisory and record gross inflows in Asset Management," said Peter R. Orszag, CEO and Chairman of Lazard.

Company Overview

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE: LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Revenue Growth

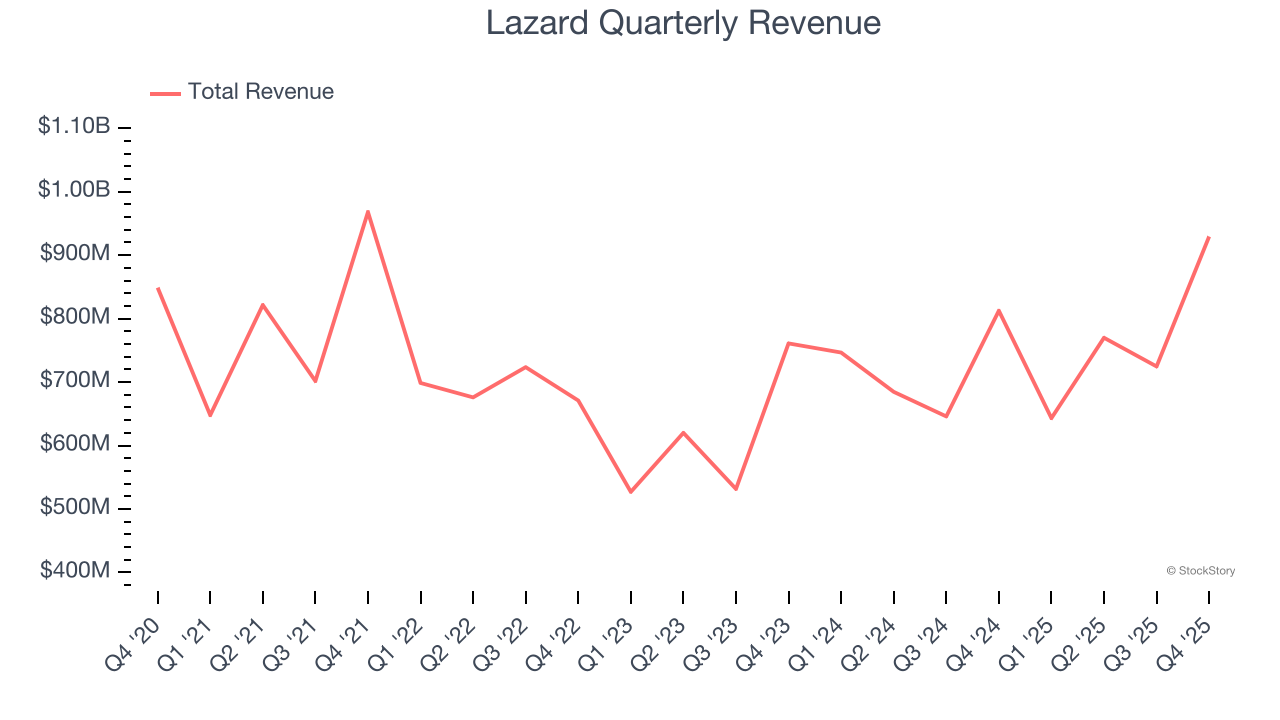

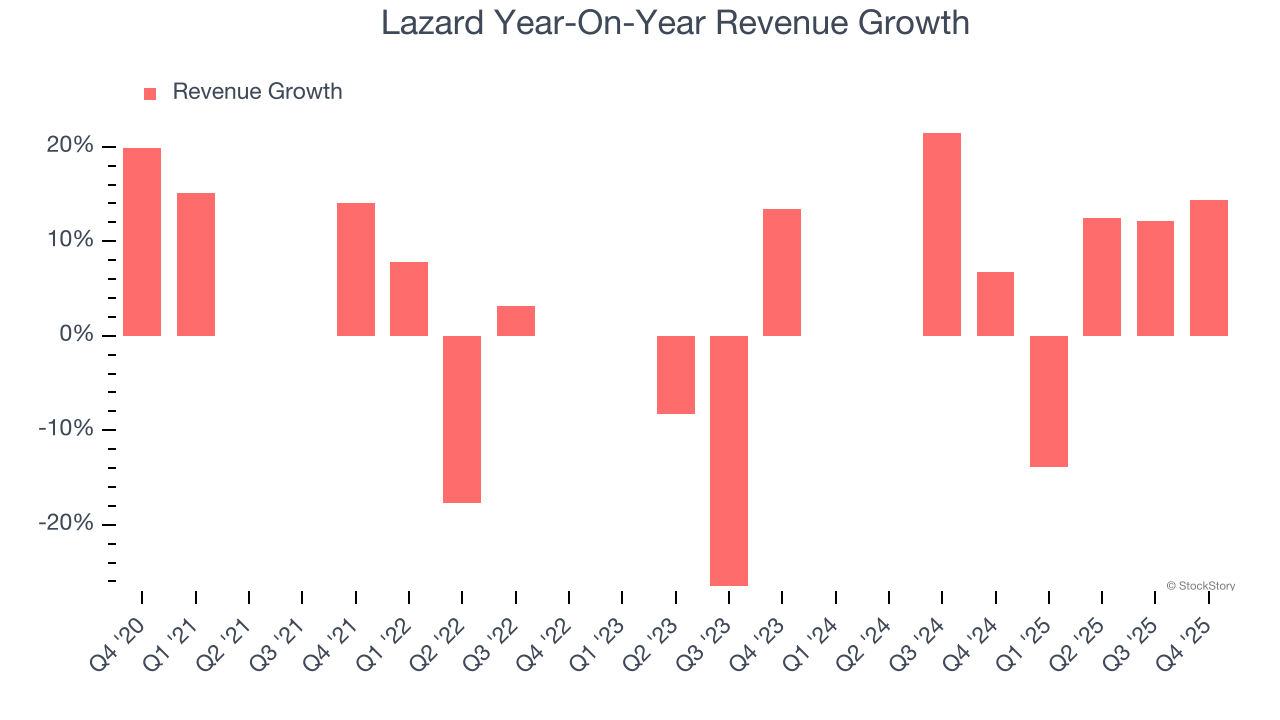

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Lazard grew its revenue at a sluggish 4% compounded annual growth rate. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Lazard.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Lazard’s annualized revenue growth of 12.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lazard reported year-on-year revenue growth of 14.4%, and its $929.4 million of revenue exceeded Wall Street’s estimates by 14.1%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Assets Under Management (AUM)

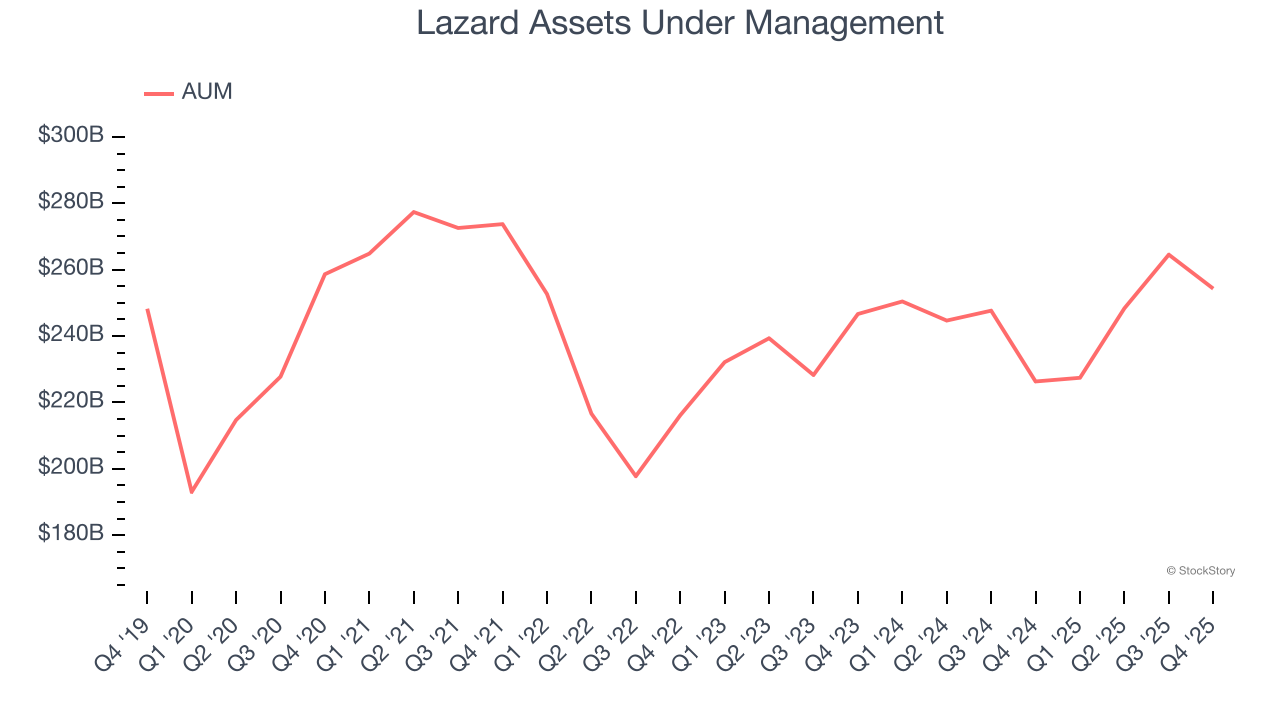

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

Lazard’s AUM has grown at an annual rate of 2.2% over the last five years, much worse than the broader financials industry and slower than its total revenue. When analyzing Lazard’s AUM over the last two years, we can paint a similar picture as it recorded 2.5% annual growth. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

In Q4, Lazard’s AUM was $254.3 billion, falling 2.5% short of analysts’ expectations. This print was 12.4% higher than the same quarter last year.

Key Takeaways from Lazard’s Q4 Results

We were impressed by how significantly Lazard blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its AUM missed. Zooming out, we think this was a mixed print. The stock remained flat at $52.90 immediately after reporting.

Indeed, Lazard had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).