Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Columbia Financial (NASDAQ: CLBK) and the best and worst performers in the thrifts & mortgage finance industry.

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

The 15 thrifts & mortgage finance stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was 0.7% above.

Thankfully, share prices of the companies have been resilient as they are up 5.6% on average since the latest earnings results.

Columbia Financial (NASDAQ: CLBK)

Founded during the Roaring Twenties in 1926 and headquartered in Fair Lawn, New Jersey, Columbia Financial (NASDAQ: CLBK) operates federally chartered savings banks in New Jersey that offer traditional banking services including loans, deposits, and insurance products.

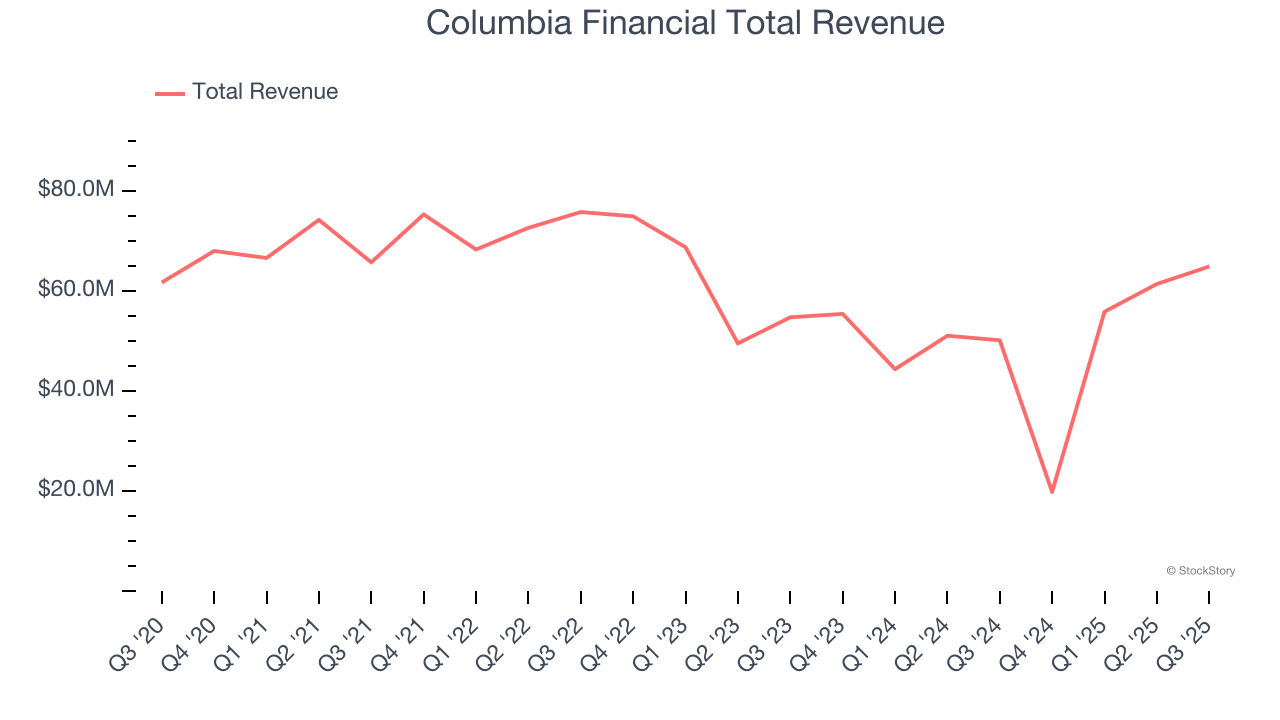

Columbia Financial reported revenues of $64.91 million, up 29.4% year on year. This print exceeded analysts’ expectations by 15.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ revenue and EPS estimates.

Interestingly, the stock is up 15.9% since reporting and currently trades at $16.44.

Is now the time to buy Columbia Financial? Access our full analysis of the earnings results here, it’s free.

Best Q3: Ellington Financial (NYSE: EFC)

Operating under the guidance of Ellington Management Group, a respected name in structured credit markets, Ellington Financial (NYSE: EFC) acquires and manages a diverse portfolio of mortgage-related, consumer-related, and other financial assets to generate returns for investors.

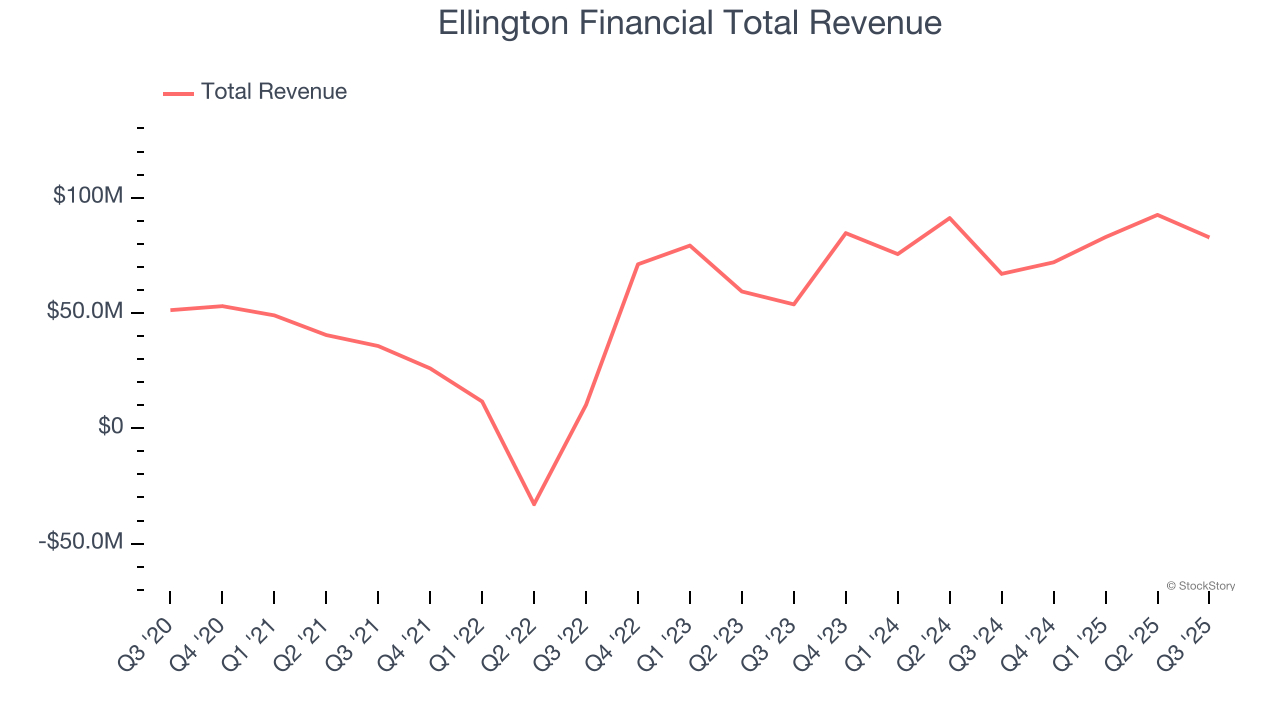

Ellington Financial reported revenues of $82.76 million, up 23.6% year on year, outperforming analysts’ expectations by 4.9%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 2.7% since reporting. It currently trades at $14.05.

Is now the time to buy Ellington Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: WaFd Bank (NASDAQ: WAFD)

Founded in 1917 and rebranded from Washington Federal in 2023, WaFd (NASDAQ: WAFD) is a bank holding company that provides lending, deposit services, and insurance through its Washington Federal Bank subsidiary across eight western states.

WaFd Bank reported revenues of $188.3 million, up 7.6% year on year, falling short of analysts’ expectations by 2.6%. It was a softer quarter as it posted a significant miss of analysts’ revenue estimates and a miss of analysts’ net interest income estimates.

As expected, the stock is down 3.3% since the results and currently trades at $32.61.

Read our full analysis of WaFd Bank’s results here.

Ladder Capital (NYSE: LADR)

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE: LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

Ladder Capital reported revenues of $57.48 million, down 15.4% year on year. This number came in 0.7% below analysts' expectations. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ net interest income estimates but a significant miss of analysts’ tangible book value per share estimates.

The stock is up 1.7% since reporting and currently trades at $11.16.

Read our full, actionable report on Ladder Capital here, it’s free.

AGNC Investment (NASDAQ: AGNC)

Born during the 2008 financial crisis when mortgage markets were in turmoil, AGNC Investment (NASDAQ: AGNC) is a real estate investment trust that primarily invests in mortgage-backed securities guaranteed by U.S. government agencies or enterprises.

AGNC Investment reported revenues of $836 million, up 122% year on year. This result surpassed analysts’ expectations by 42.3%. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

AGNC Investment delivered the biggest analyst estimates beat among its peers. The stock is up 15.9% since reporting and currently trades at $11.71.

Read our full, actionable report on AGNC Investment here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.