Looking back on regional banks stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Cadence Bank (NYSE: CADE) and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 99 regional banks stocks we track reported a satisfactory Q2. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 3.6% on average since the latest earnings results.

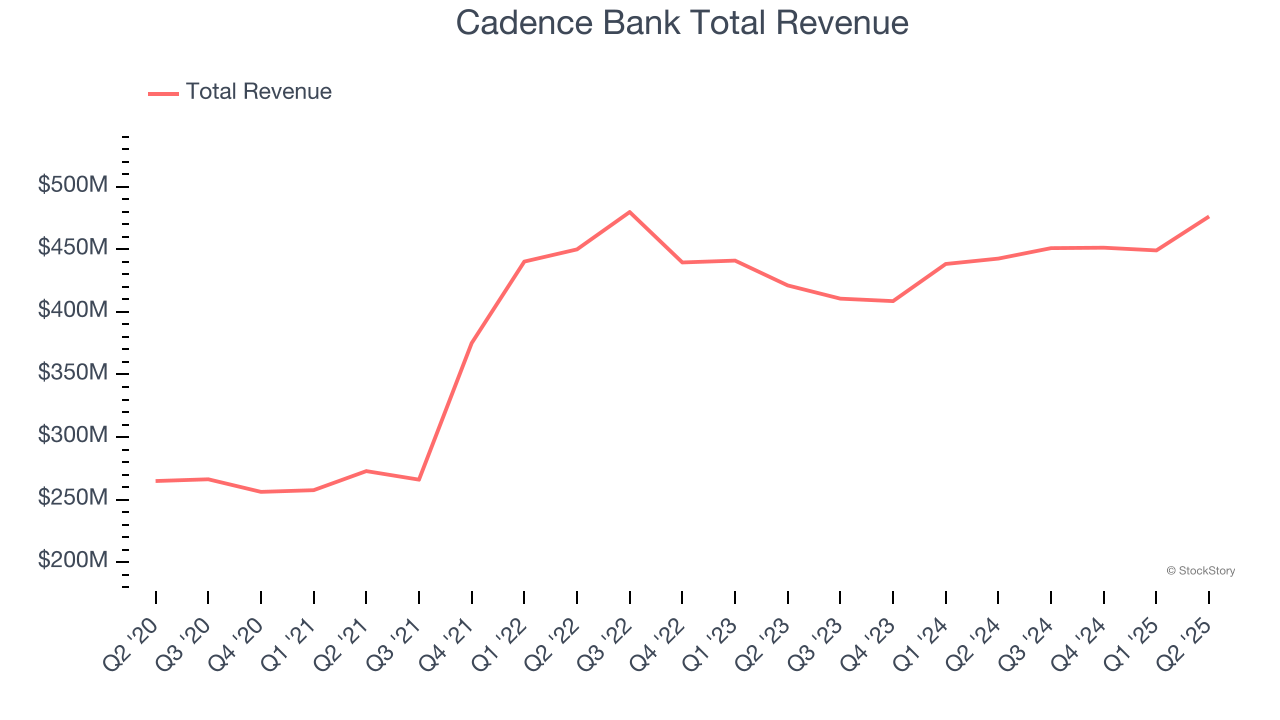

Cadence Bank (NYSE: CADE)

With roots dating back to 1885 and a strategic focus on middle-market commercial lending, Cadence Bancorporation (NYSE: CADE) is a bank holding company that provides commercial banking, retail banking, and wealth management services to middle-market businesses and individuals.

Cadence Bank reported revenues of $476.3 million, up 7.6% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ tangible book value per share estimates.

Interestingly, the stock is up 4% since reporting and currently trades at $37.42.

Is now the time to buy Cadence Bank? Access our full analysis of the earnings results here, it’s free.

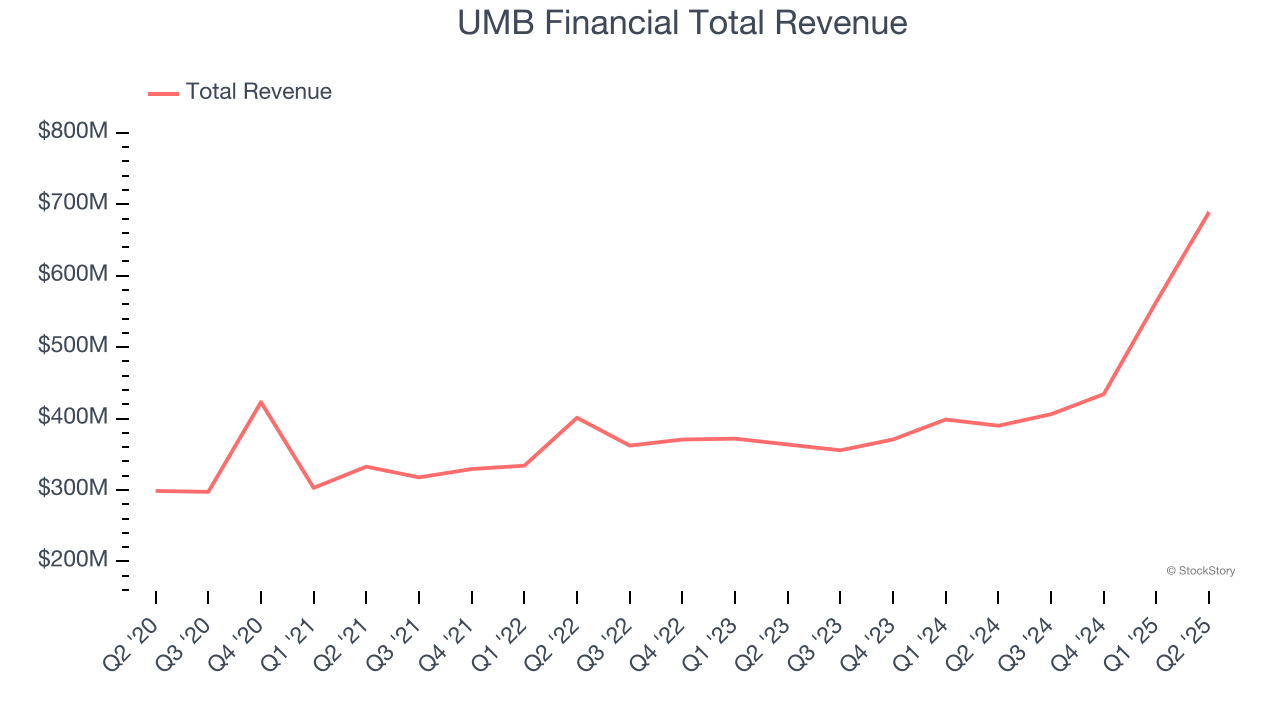

Best Q2: UMB Financial (NASDAQ: UMBF)

With roots dating back to 1913 and a name derived from "United Missouri Bank," UMB Financial (NASDAQ: UMBF) is a financial holding company that provides banking, asset management, and fund services to commercial, institutional, and individual customers.

UMB Financial reported revenues of $689.2 million, up 76.7% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with a beat of analysts’ EPS and tangible book value per share estimates.

The market seems happy with the results as the stock is up 10.7% since reporting. It currently trades at $121.45.

Is now the time to buy UMB Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Coastal Financial (NASDAQ: CCB)

Pioneering the intersection of traditional banking and financial technology in the Pacific Northwest, Coastal Financial (NASDAQ: CCB) operates as a bank holding company that provides traditional banking services and Banking-as-a-Service (BaaS) solutions to consumers and businesses.

Coastal Financial reported revenues of $119.4 million, down 11.7% year on year, falling short of analysts’ expectations by 21.5%. It was a disappointing quarter as it posted a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 12.2% since the results and currently trades at $113.81.

Read our full analysis of Coastal Financial’s results here.

United Bankshares (NASDAQ: UBSI)

With roots dating back to 1982 and a strong presence in the Mid-Atlantic region, United Bankshares (NASDAQ: UBSI) is a bank holding company that provides commercial and retail banking services through its United Bank subsidiary across multiple states.

United Bankshares reported revenues of $306 million, up 19.6% year on year. This number topped analysts’ expectations by 2.6%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ net interest income estimates and a beat of analysts’ EPS estimates.

The stock is up 3.2% since reporting and currently trades at $38.05.

Read our full, actionable report on United Bankshares here, it’s free.

BankUnited (NYSE: BKU)

Born from the ashes of a failed Florida thrift during the 2009 financial crisis, BankUnited (NYSE: BKU) is a regional bank that provides commercial lending, deposit services, and treasury solutions to businesses and consumers primarily in Florida and the New York metropolitan area.

BankUnited reported revenues of $273.9 million, up 9.5% year on year. This print beat analysts’ expectations by 3%. It was a very strong quarter as it also put up a beat of analysts’ EPS estimates and a narrow beat of analysts’ net interest income estimates.

The stock is down 1.6% since reporting and currently trades at $38.15.

Read our full, actionable report on BankUnited here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.