Trane Technologies currently trades at $434.41 and has been a dream stock for shareholders. It’s returned 326% since July 2020, more than tripling the S&P 500’s 93.9% gain. The company has also beaten the index over the past six months as its stock price is up 11.7% thanks to its solid quarterly results.

Following the strength, is TT a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On Trane Technologies?

With low-pressure heating systems as its first product, Trane (NYSE: TT) designs, manufactures, and sells HVAC and refrigeration systems, the former to commercial and residential building customers and the latter to commercial truck manufacturers.

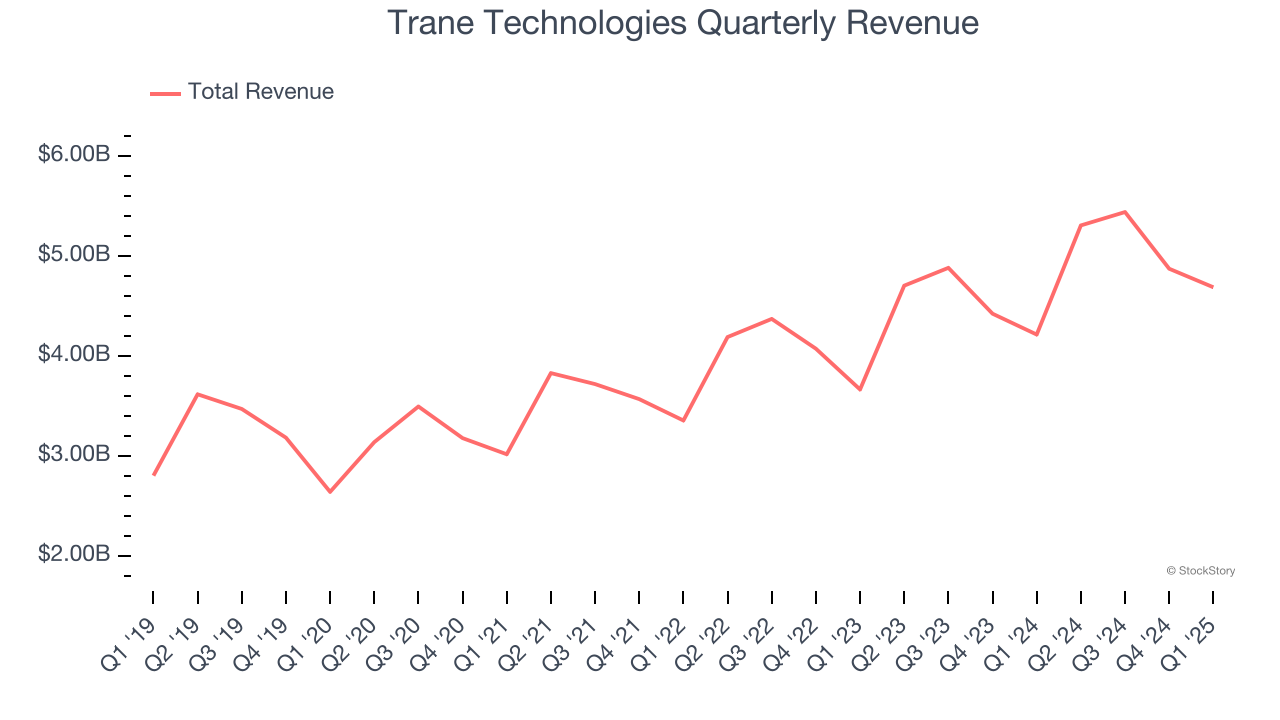

1. Long-Term Revenue Growth Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Trane Technologies grew its sales at a solid 9.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

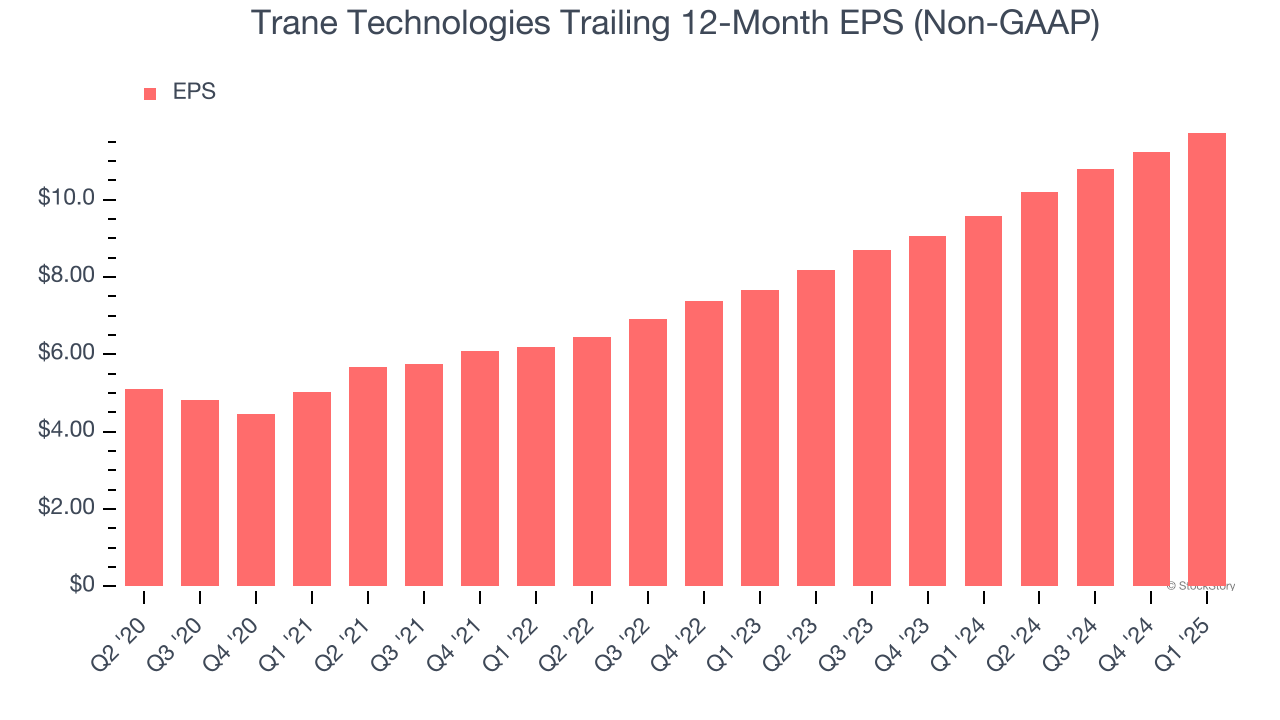

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Trane Technologies’s EPS grew at a spectacular 17.2% compounded annual growth rate over the last five years, higher than its 9.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

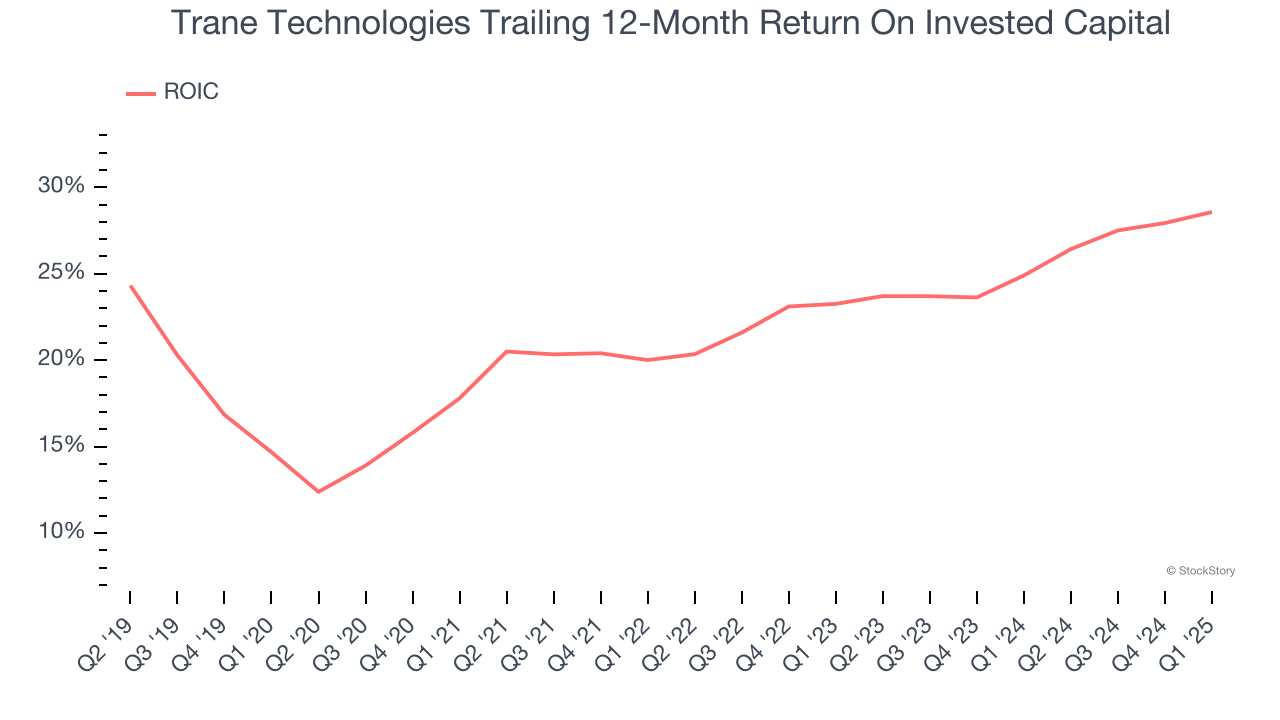

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Trane Technologies’s five-year average ROIC was 22.9%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on Trane Technologies, and with its shares beating the market recently, the stock trades at 33.4× forward P/E (or $434.41 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.