Granite Construction trades at $94.12 per share and has stayed right on track with the overall market, gaining 6.5% over the last six months. At the same time, the S&P 500 has returned 7.6%.

Is now the time to buy GVA? Find out in our full research report, it’s free.

Why Does GVA Stock Spark Debate?

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE: GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

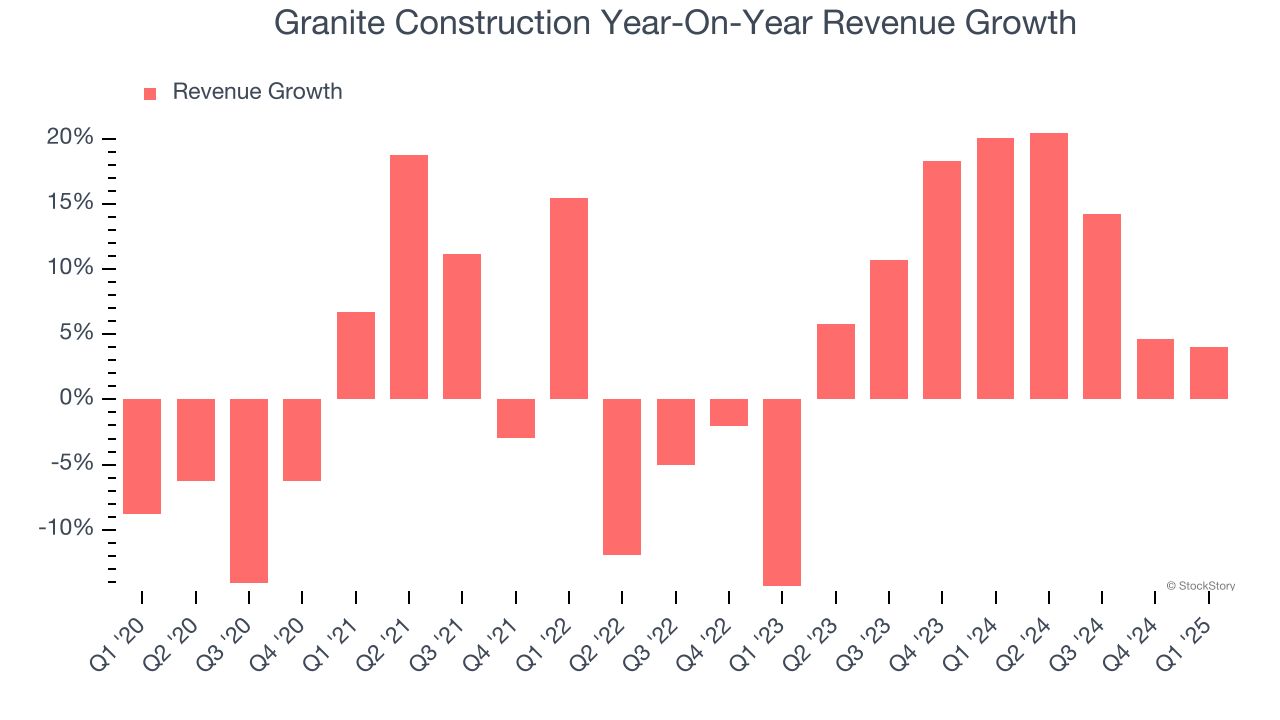

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Granite Construction’s annualized revenue growth of 12.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

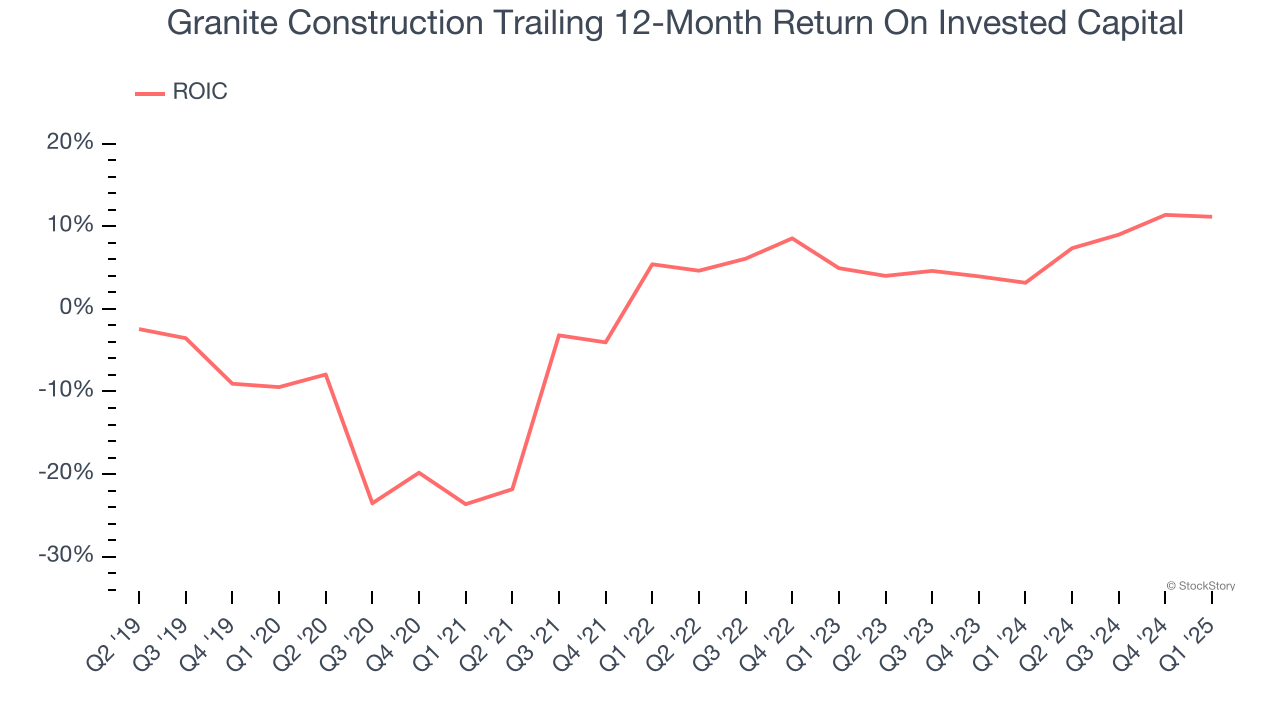

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Granite Construction’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

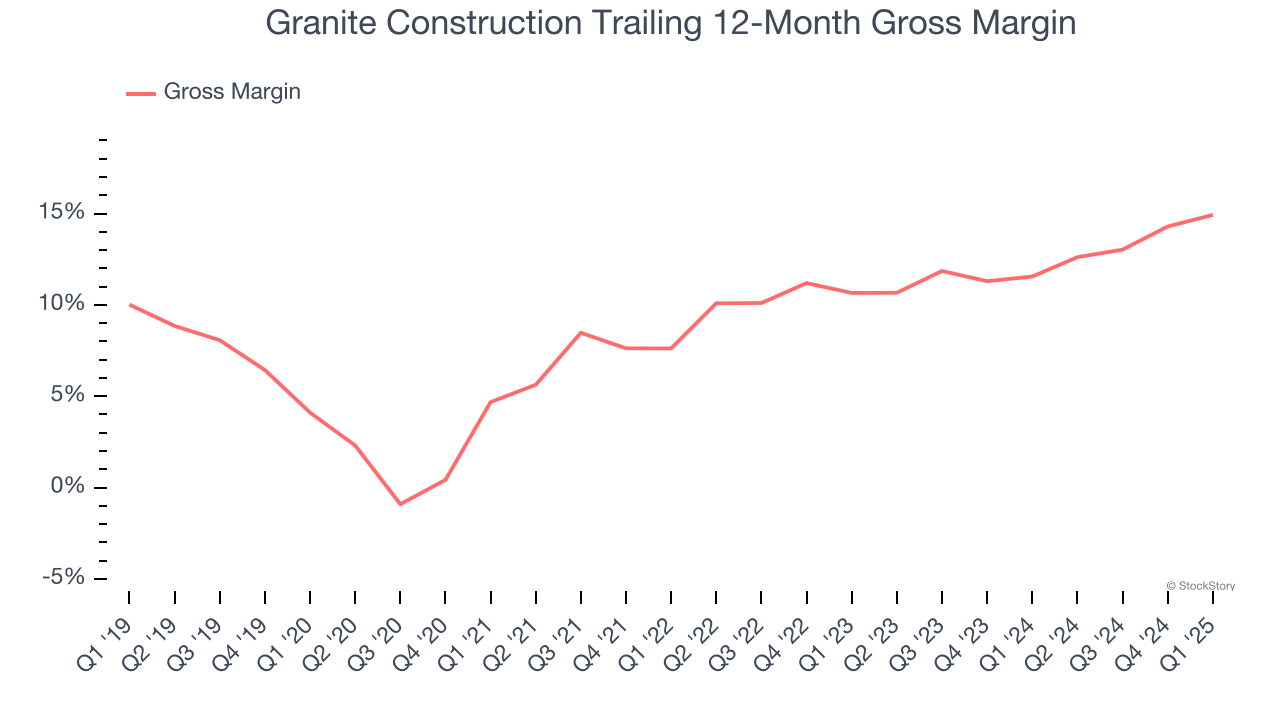

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Granite Construction has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 10.1% gross margin over the last five years. That means Granite Construction paid its suppliers a lot of money ($89.86 for every $100 in revenue) to run its business.

Final Judgment

Granite Construction’s merits more than compensate for its flaws, but at $94.12 per share (or 8.8× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Granite Construction

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.