The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how UFP Technologies (NASDAQ: UFPT) and the rest of the drug development inputs & services stocks fared in Q1.

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

The 8 drug development inputs & services stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 4%.

While some drug development inputs & services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.4% since the latest earnings results.

Best Q1: UFP Technologies (NASDAQ: UFPT)

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ: UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

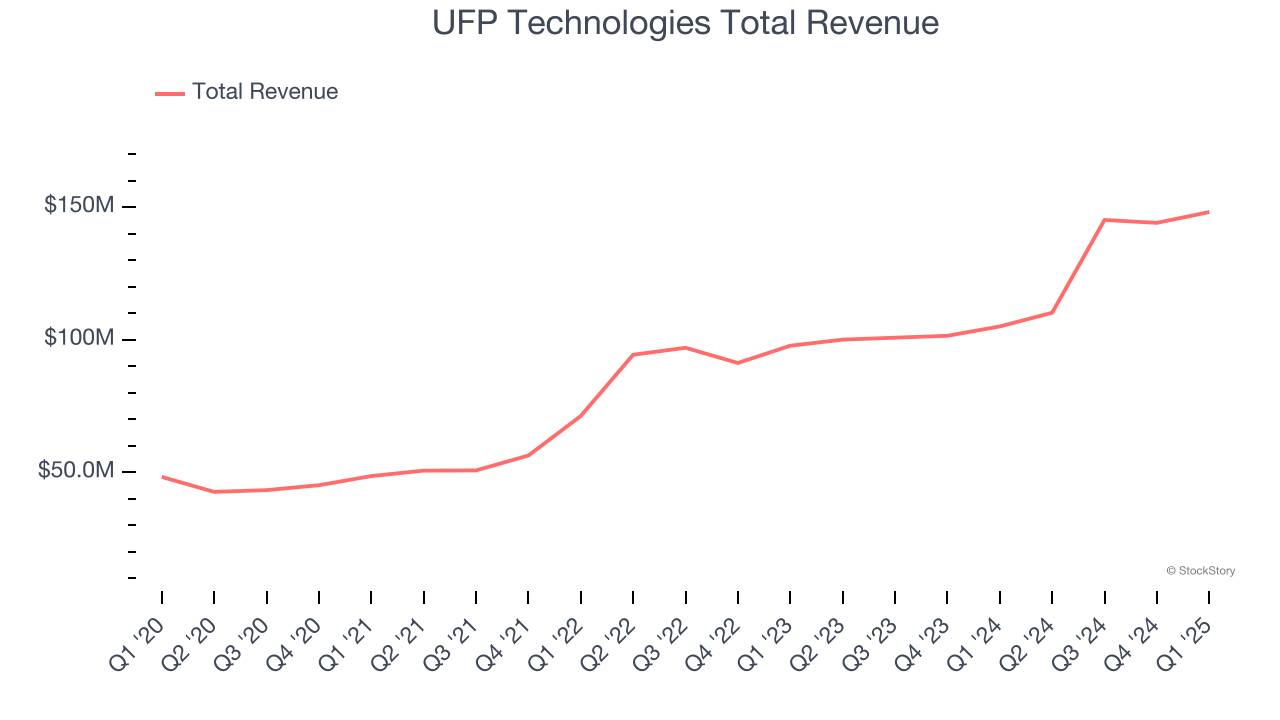

UFP Technologies reported revenues of $148.1 million, up 41.1% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ EPS estimates.

“I am very pleased with our first quarter results and continued progress on a number of key strategic fronts,” said R. Jeffrey Bailly, Chairman & CEO.

UFP Technologies achieved the fastest revenue growth of the whole group. The stock is up 17.8% since reporting and currently trades at $232.20.

Is now the time to buy UFP Technologies? Access our full analysis of the earnings results here, it’s free.

Charles River Laboratories (NYSE: CRL)

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE: CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

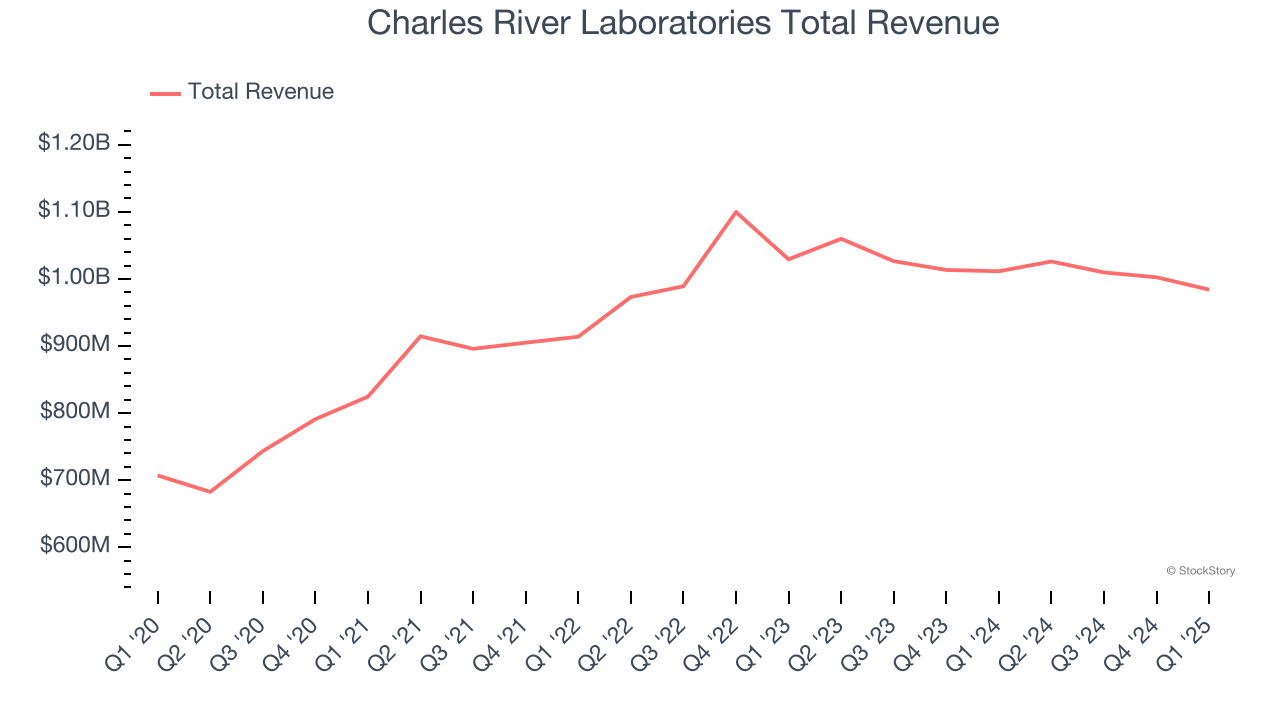

Charles River Laboratories reported revenues of $984.2 million, down 2.7% year on year, outperforming analysts’ expectations by 4.6%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 17.1% since reporting. It currently trades at $135.04.

Is now the time to buy Charles River Laboratories? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Azenta (NASDAQ: AZTA)

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ: AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

Azenta reported revenues of $143.4 million, up 5.2% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 3.4% since the results and currently trades at $26.28.

Read our full analysis of Azenta’s results here.

Fortrea (NASDAQ: FTRE)

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ: FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

Fortrea reported revenues of $651.3 million, down 1.6% year on year. This number surpassed analysts’ expectations by 7.1%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Fortrea pulled off the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is down 31% since reporting and currently trades at $4.25.

Read our full, actionable report on Fortrea here, it’s free.

West Pharmaceutical Services (NYSE: WST)

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE: WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

West Pharmaceutical Services reported revenues of $698 million, flat year on year. This result beat analysts’ expectations by 2%. It was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

The stock is down 2.4% since reporting and currently trades at $212.55.

Read our full, actionable report on West Pharmaceutical Services here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.