Since December 2024, Federal Signal has been in a holding pattern, posting a small loss of 4.4% while floating around $93.99.

Does this present a buying opportunity for FSS? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Are We Positive On Federal Signal?

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE: FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

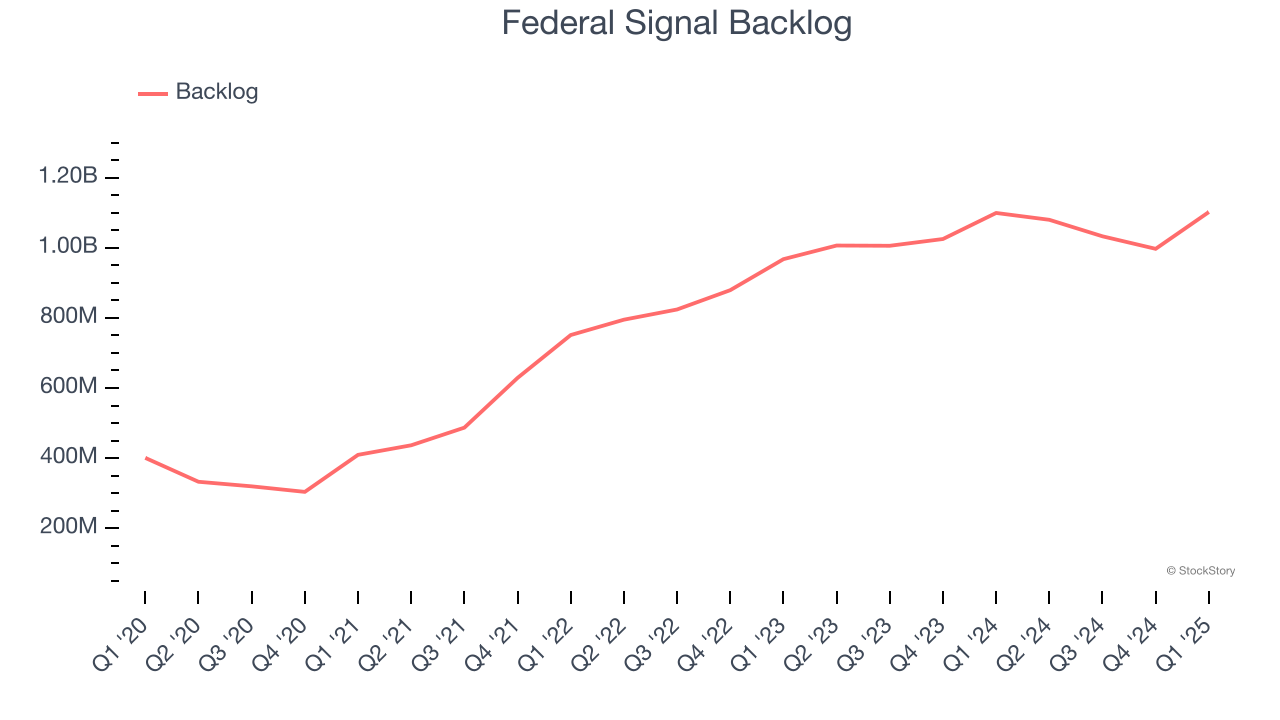

1. Surging Backlog Locks In Future Sales

We can better understand Heavy Transportation Equipment companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Federal Signal’s future revenue streams.

Federal Signal’s backlog punched in at $1.10 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 10.8%. This performance was impressive and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Federal Signal for the long term, enhancing the business’s predictability.

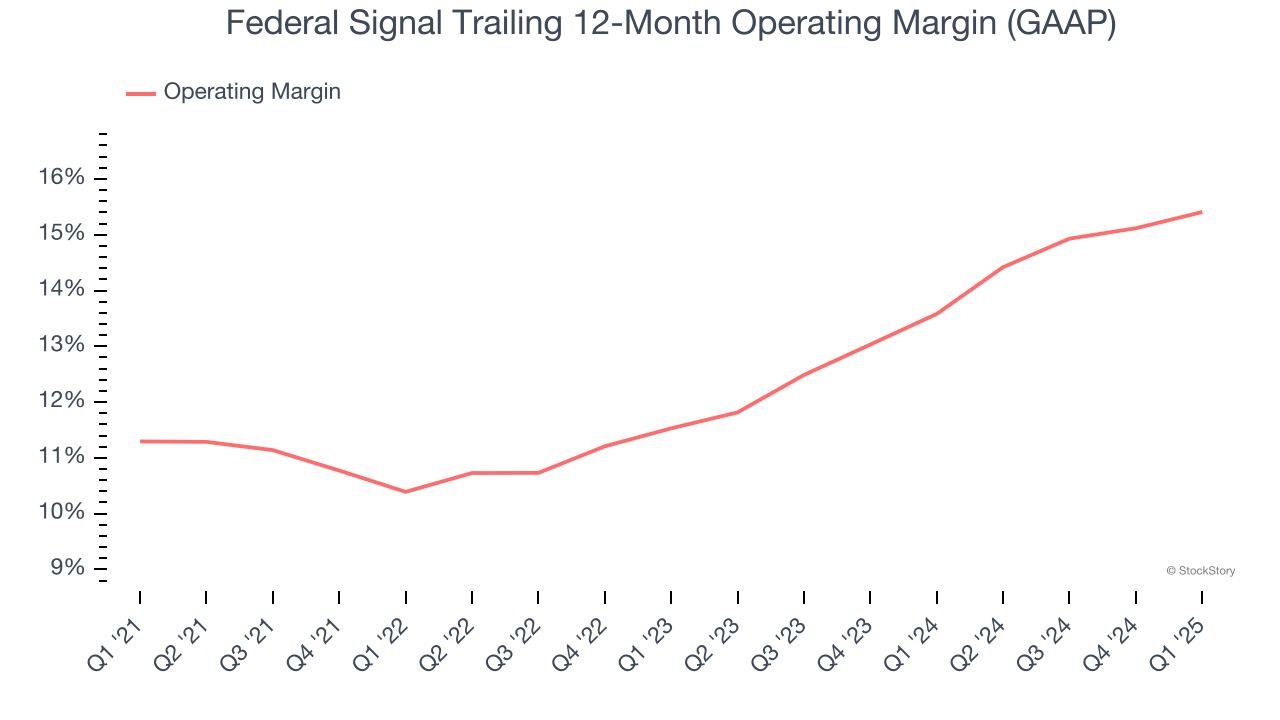

2. Operating Margin Rising, Profits Up

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Federal Signal’s operating margin rose by 4.1 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 15.4%.

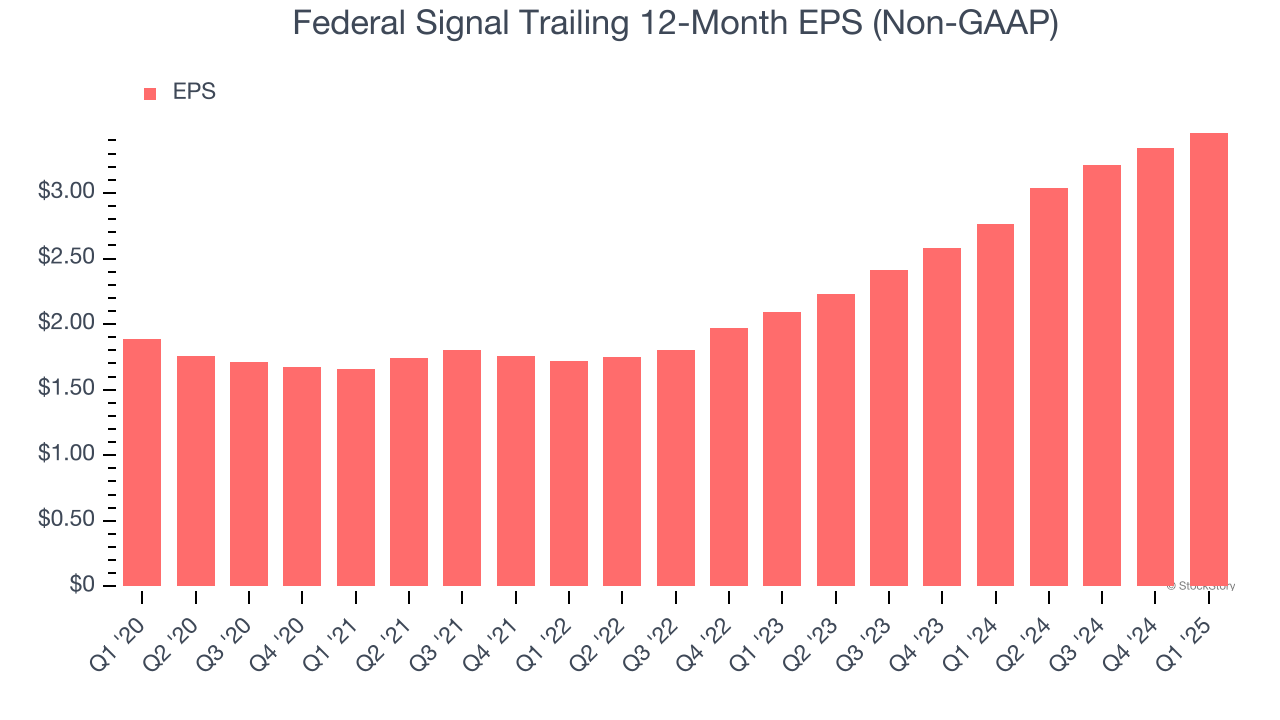

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Federal Signal’s EPS grew at a remarkable 12.9% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why Federal Signal ranks highly on our list, but at $93.99 per share (or 24.5× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.