Vita Coco trades at $33.70 per share and has stayed right on track with the overall market, losing 5.7% over the last six months while the S&P 500 is down 1.9%. This may have investors wondering how to approach the situation.

Following the drawdown, is now the time to buy COCO? Find out in our full research report, it’s free.

Why Does Vita Coco Spark Debate?

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Two Positive Attributes:

1. Elevated Demand Drives Higher Sales Volumes

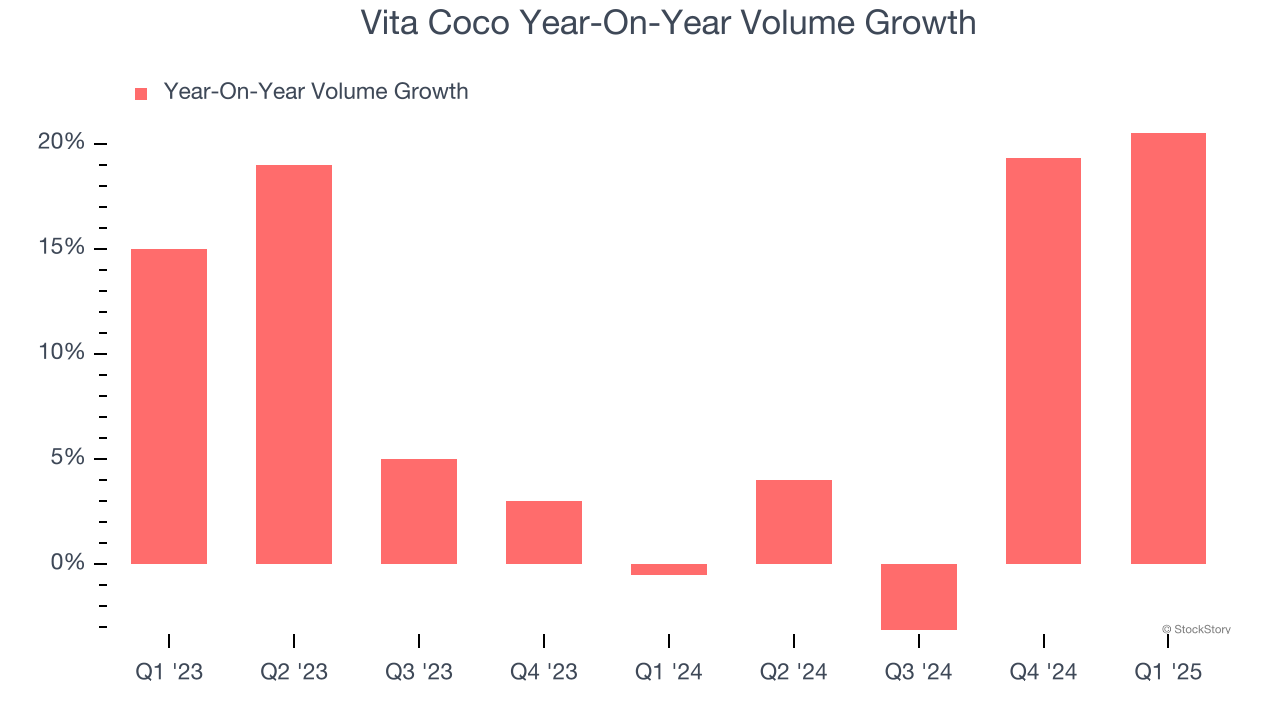

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vita Coco’s average quarterly volume growth was a robust 8.4% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

2. Outstanding Long-Term EPS Growth

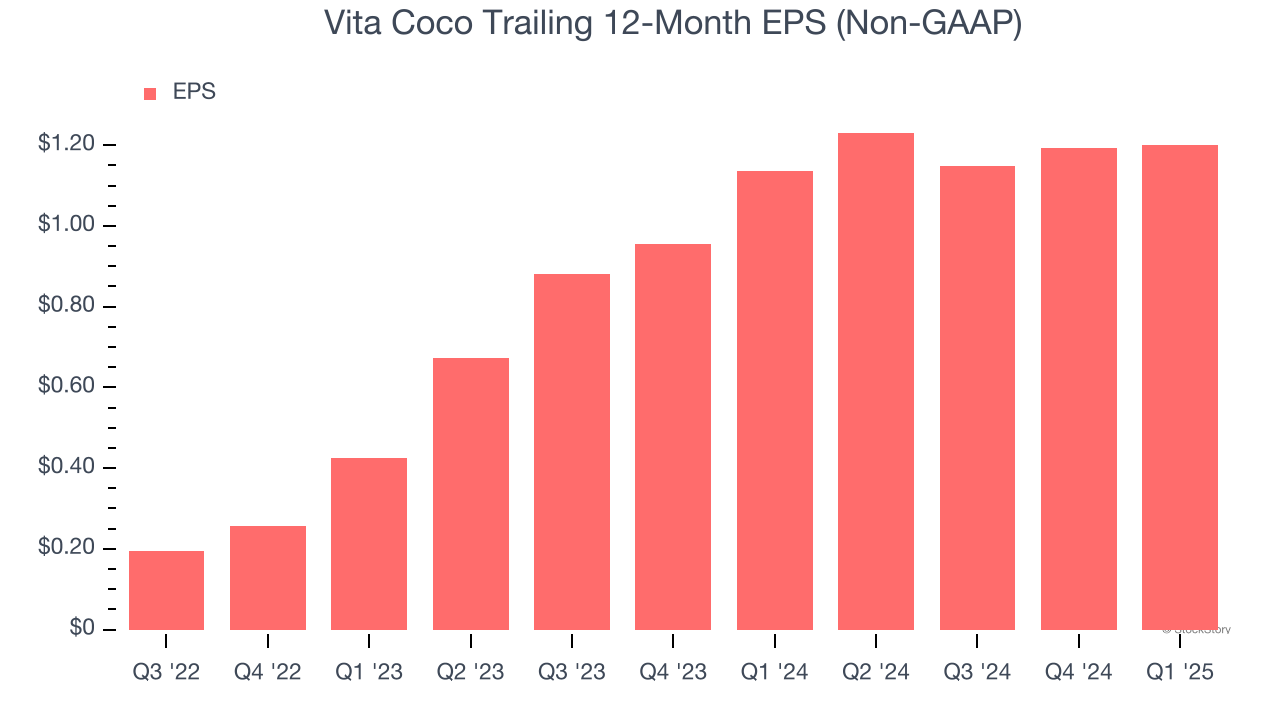

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vita Coco’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

Free Cash Flow Margin Dropping

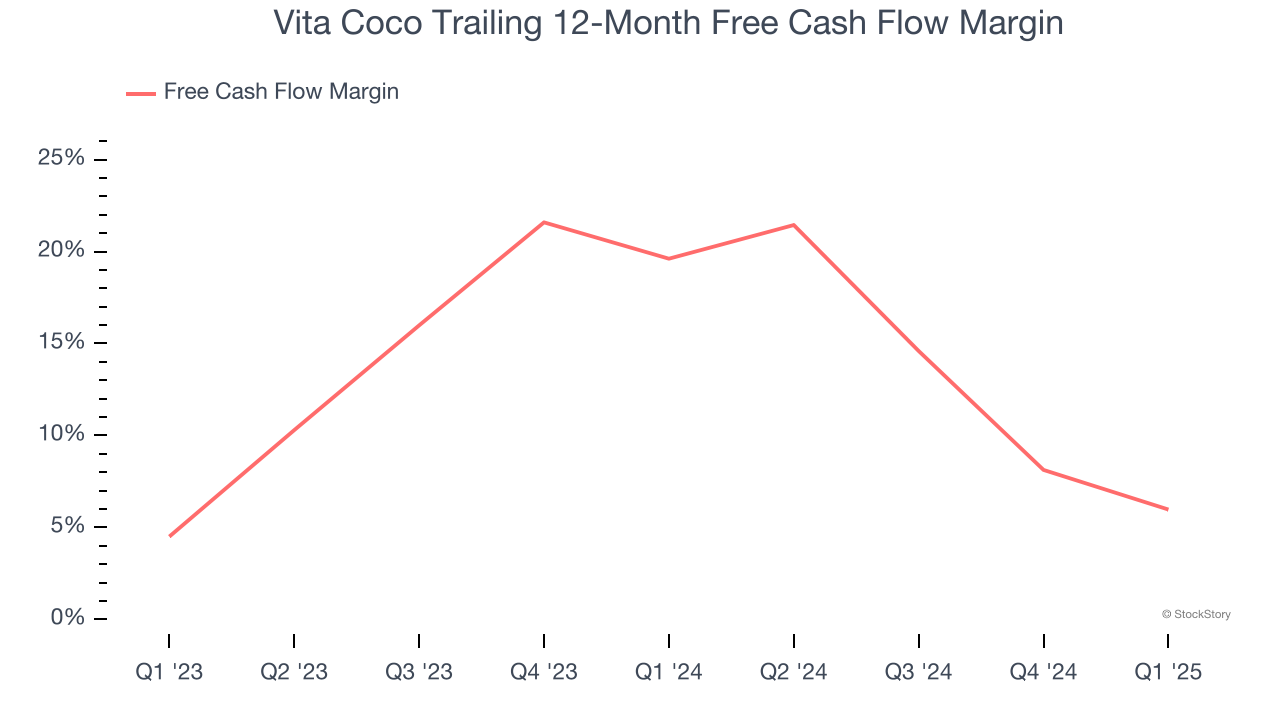

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Vita Coco’s margin dropped by 13.6 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Vita Coco’s free cash flow margin for the trailing 12 months was 6%.

Final Judgment

Vita Coco’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 28.8× forward P/E (or $33.70 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Vita Coco

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.