As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at air freight and logistics stocks, starting with C.H. Robinson Worldwide (NASDAQ: CHRW).

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 6 air freight and logistics stocks we track reported a strong Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 3.5% below.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

C.H. Robinson Worldwide (NASDAQ: CHRW)

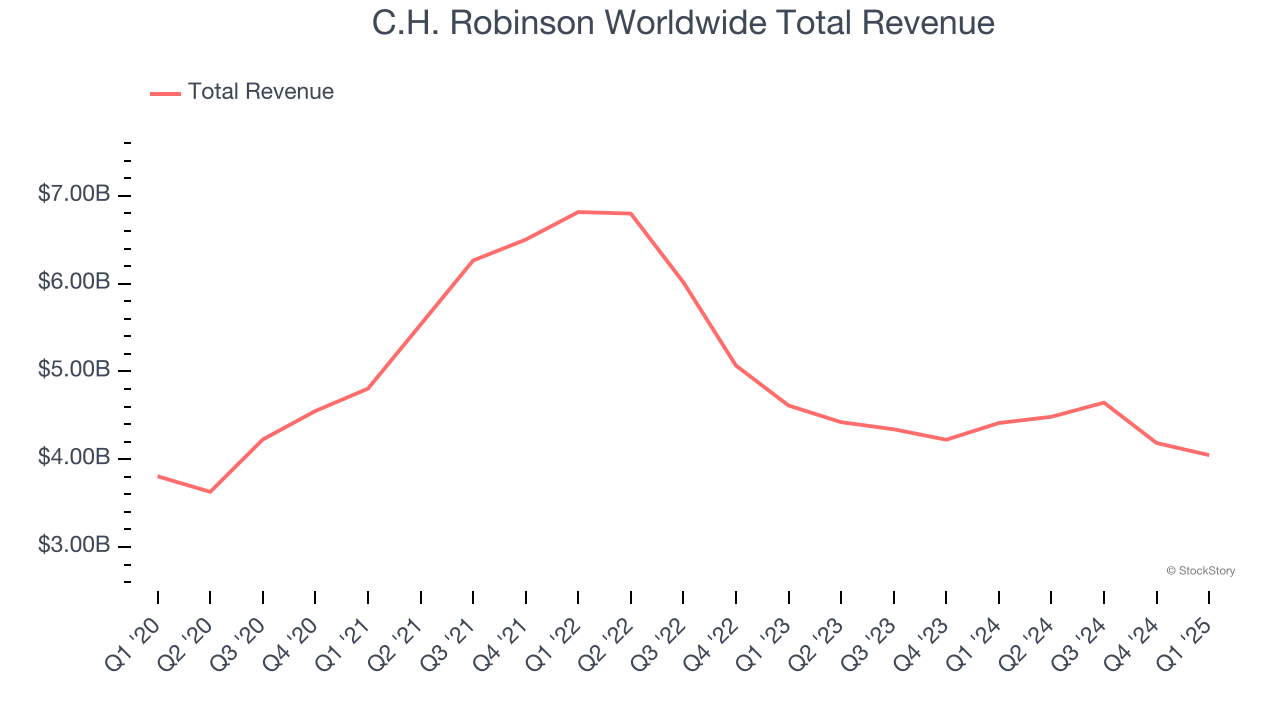

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ: CHRW) offers freight transportation and logistics services.

C.H. Robinson Worldwide reported revenues of $4.05 billion, down 8.3% year on year. This print fell short of analysts’ expectations by 4.9%, but it was still a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

"Our first quarter results reflect progress in the disciplined execution of the strategies that we shared at our Investor Day in December — to take market share and expand our margins. We’re not waiting for a market recovery to improve our financial results, and the strategies that the Robinson team is executing are relevant in any market environment," said President and Chief Executive Officer, Dave Bozeman.

Interestingly, the stock is up 8.3% since reporting and currently trades at $96.52.

Is now the time to buy C.H. Robinson Worldwide? Access our full analysis of the earnings results here, it’s free.

Best Q1: Expeditors (NYSE: EXPD)

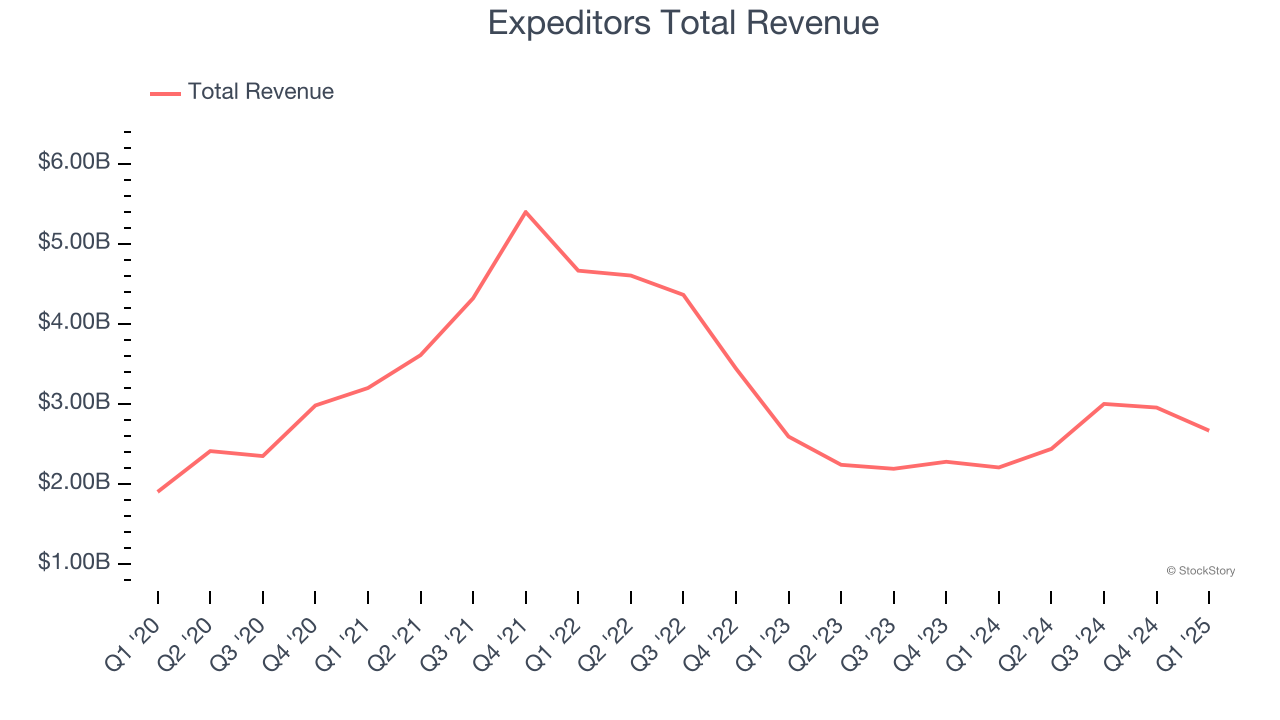

Expeditors (NYSE: EXPD) offers air and ocean freight as well as brokerage services.

Expeditors reported revenues of $2.67 billion, up 20.8% year on year, outperforming analysts’ expectations by 3.6%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Expeditors achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.7% since reporting. It currently trades at $116.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Hub Group (NASDAQ: HUBG)

Started with $10,000, Hub Group (NASDAQ: HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

Hub Group reported revenues of $915.2 million, down 8.4% year on year, falling short of analysts’ expectations by 5.7%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Hub Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 2.7% since the results and currently trades at $34.05.

Read our full analysis of Hub Group’s results here.

United Parcel Service (NYSE: UPS)

Trademarking its recognizable UPS Brown color, UPS (NYSE: UPS) offers package delivery, supply chain management, and freight forwarding services.

United Parcel Service reported revenues of $21.55 billion, flat year on year. This result topped analysts’ expectations by 2.1%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ sales volume estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $97.09.

Read our full, actionable report on United Parcel Service here, it’s free.

GXO Logistics (NYSE: GXO)

With notable customers such as Nike and Apple, GXO (NYSE: GXO) manages outsourced supply chains and warehousing for various companies.

GXO Logistics reported revenues of $2.98 billion, up 21.2% year on year. This number surpassed analysts’ expectations by 1.4%. It was a very strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates.

GXO Logistics scored the fastest revenue growth among its peers. The stock is up 6.1% since reporting and currently trades at $40.43.

Read our full, actionable report on GXO Logistics here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.