Shareholders of Mission Produce would probably like to forget the past six months even happened. The stock dropped 20% and now trades at $9.78. This may have investors wondering how to approach the situation.

Is now the time to buy Mission Produce, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we don't have much confidence in Mission Produce. Here are three reasons why we avoid AVO and a stock we'd rather own.

Why Do We Think Mission Produce Will Underperform?

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

1. Fewer Distribution Channels Limit its Ceiling

With $1.31 billion in revenue over the past 12 months, Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Low Gross Margin Reveals Weak Structural Profitability

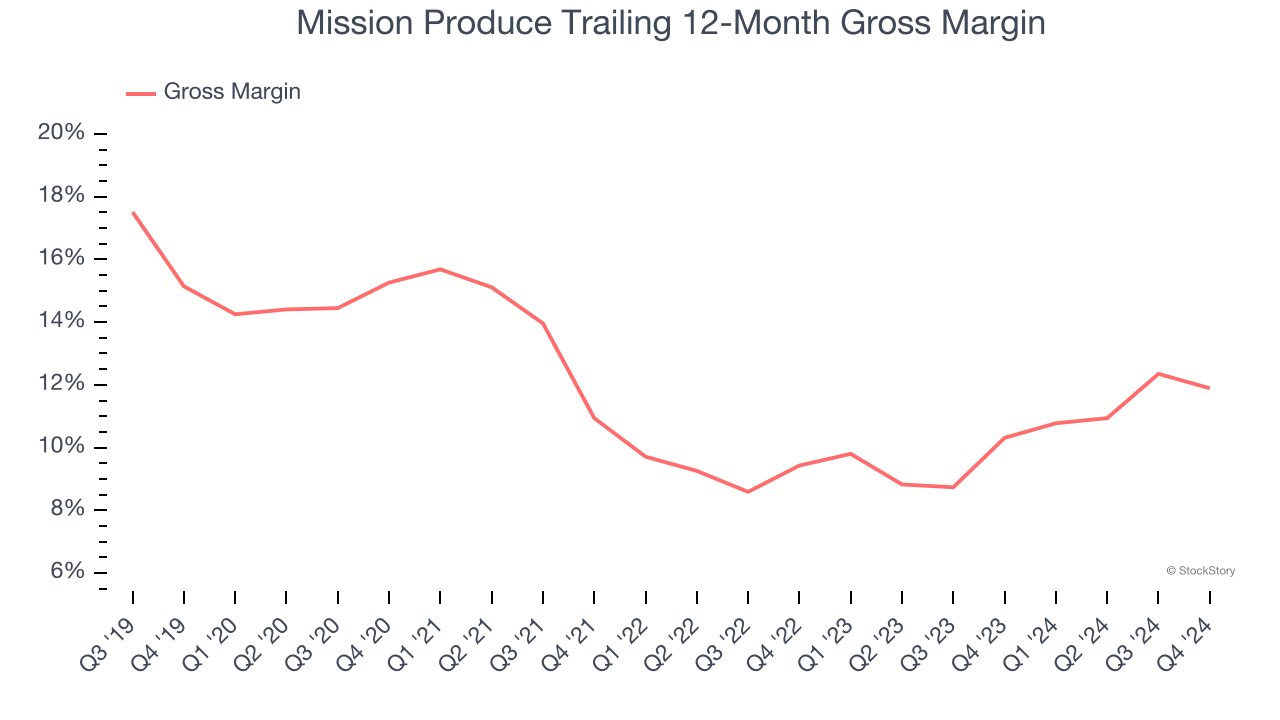

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Mission Produce has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 11.2% gross margin over the last two years. That means Mission Produce paid its suppliers a lot of money ($88.79 for every $100 in revenue) to run its business.

3. Previous Growth Initiatives Haven’t Impressed

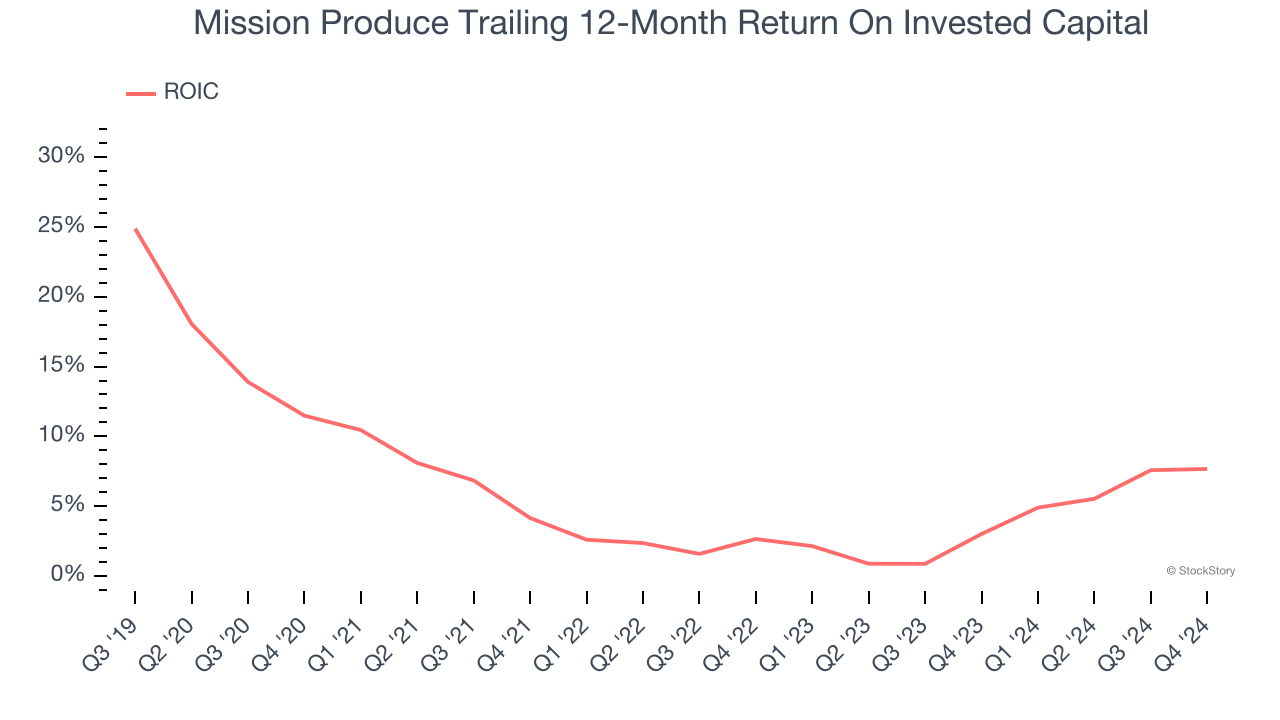

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Mission Produce historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Mission Produce falls short of our quality standards. Following the recent decline, the stock trades at 8.6× forward EV-to-EBITDA (or $9.78 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than Mission Produce

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.