The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how RingCentral (NYSE: RNG) and the rest of the video conferencing stocks fared in Q4.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 25.9% since the latest earnings results.

Weakest Q4: RingCentral (NYSE: RNG)

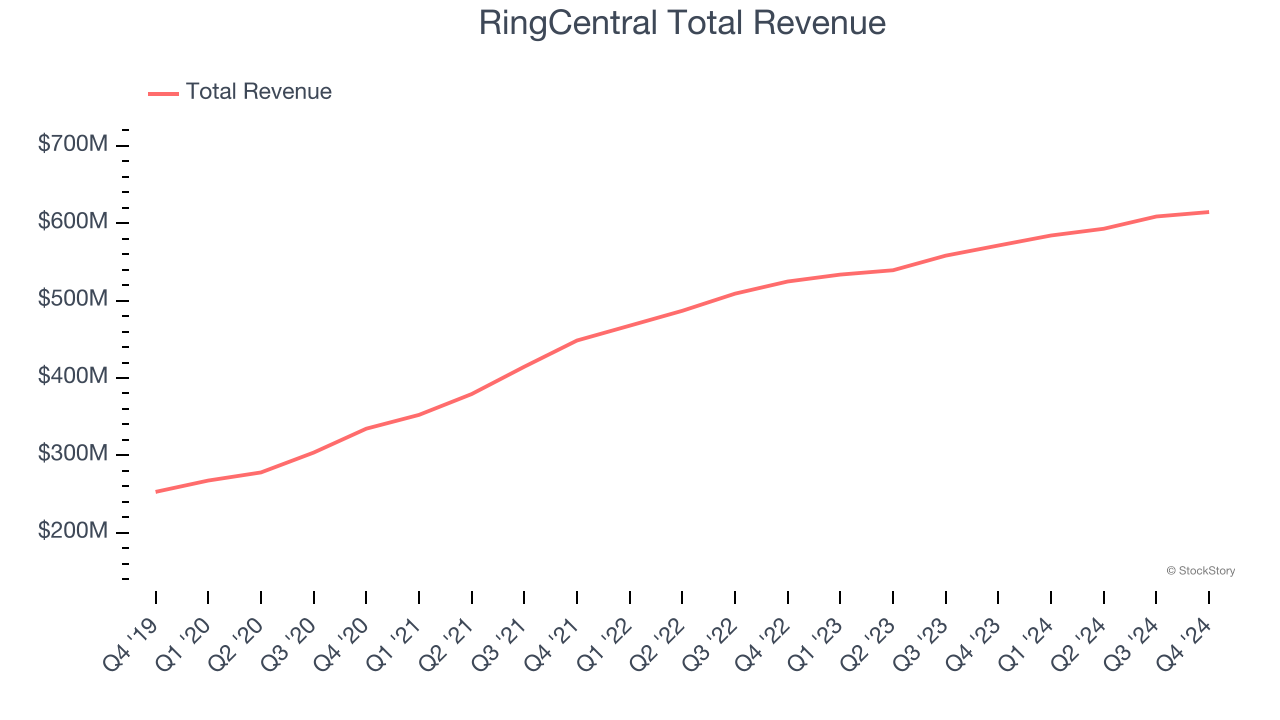

Founded in 1999 during the dot-com era, RingCentral (NYSE: RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $614.5 million, up 7.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with EPS guidance for next quarter missing analysts’ expectations and a miss of analysts’ annual recurring revenue estimates.

"We had a good fourth quarter, capping a strong year,” said Vlad Shmunis, RingCentral's founder and CEO.

The stock is down 20% since reporting and currently trades at $24.61.

Read our full report on RingCentral here, it’s free.

Best Q4: Five9 (NASDAQ: FIVN)

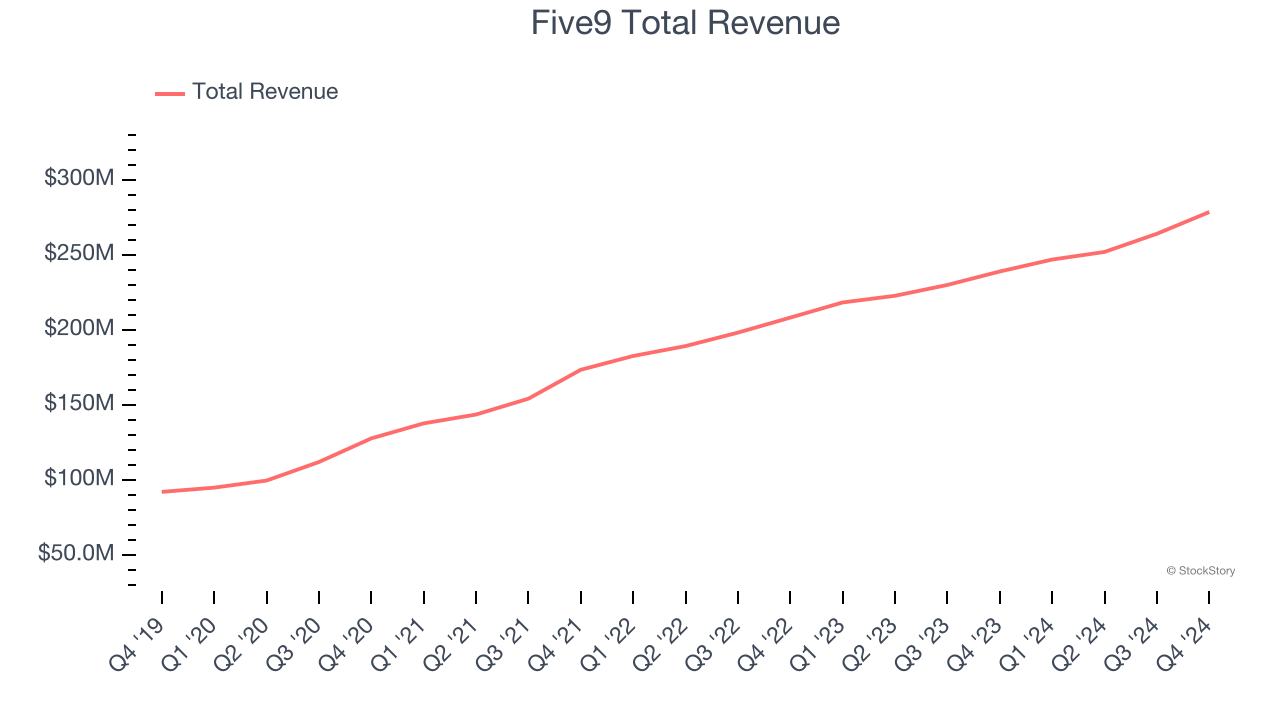

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

Five9 reported revenues of $278.7 million, up 16.6% year on year, outperforming analysts’ expectations by 4%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

Five9 delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 40.4% since reporting. It currently trades at $24.93.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it’s free.

8x8 (NASDAQ: EGHT)

Founded in 1987, 8x8 (NYSE: EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $178.9 million, down 1.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a slight miss of analysts’ billings estimates.

8x8 delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 36% since the results and currently trades at $1.83.

Read our full analysis of 8x8’s results here.

Zoom (NASDAQ: ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ: ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom reported revenues of $1.18 billion, up 3.3% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also logged accelerating growth in large customers but full-year EPS guidance missing analysts’ expectations.

Zoom had the weakest full-year guidance update among its peers. The company added 93 enterprise customers paying more than $100,000 annually to reach a total of 4,088. The stock is down 7.2% since reporting and currently trades at $75.22.

Read our full, actionable report on Zoom here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.