Even during a down period for the markets, EverQuote has gone against the grain, climbing to $23.18. Its shares have yielded a 30.4% return over the last six months, beating the S&P 500 by 35.7%. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy EverQuote, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the momentum, we're cautious about EverQuote. Here are two reasons why you should be careful with EVER and a stock we'd rather own.

Why Is EverQuote Not Exciting?

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

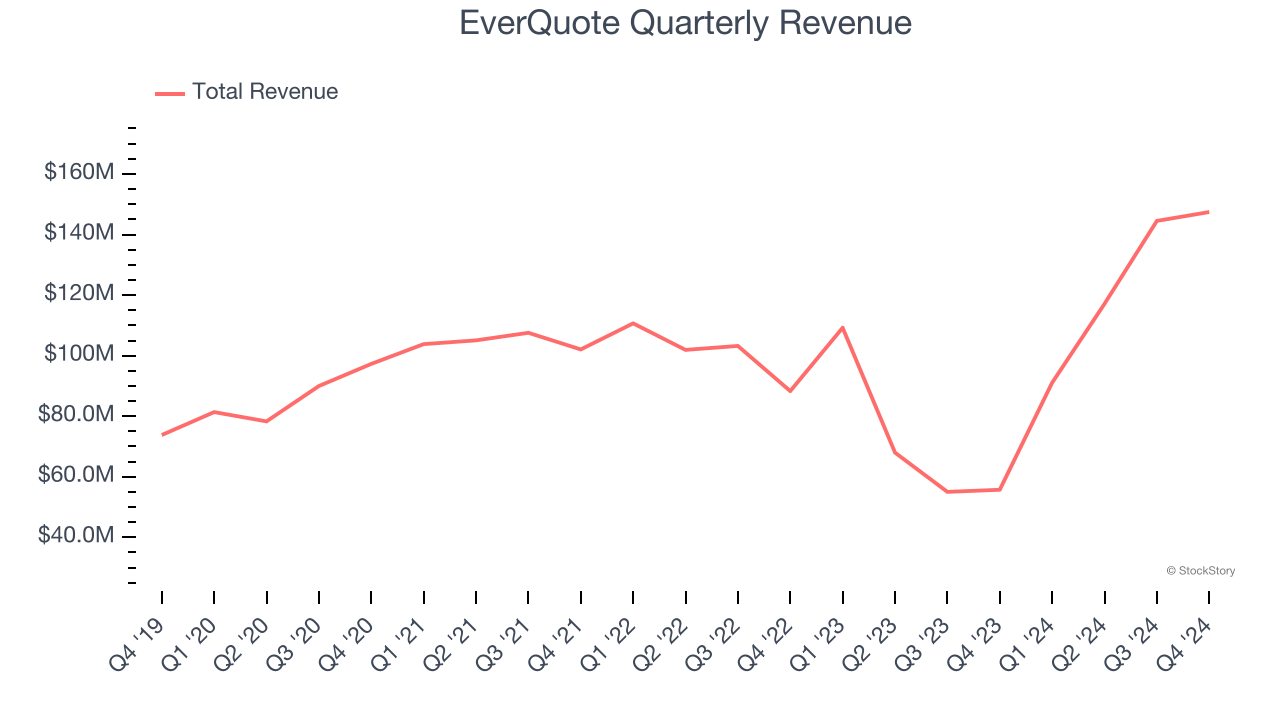

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, EverQuote’s sales grew at a tepid 6.1% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector.

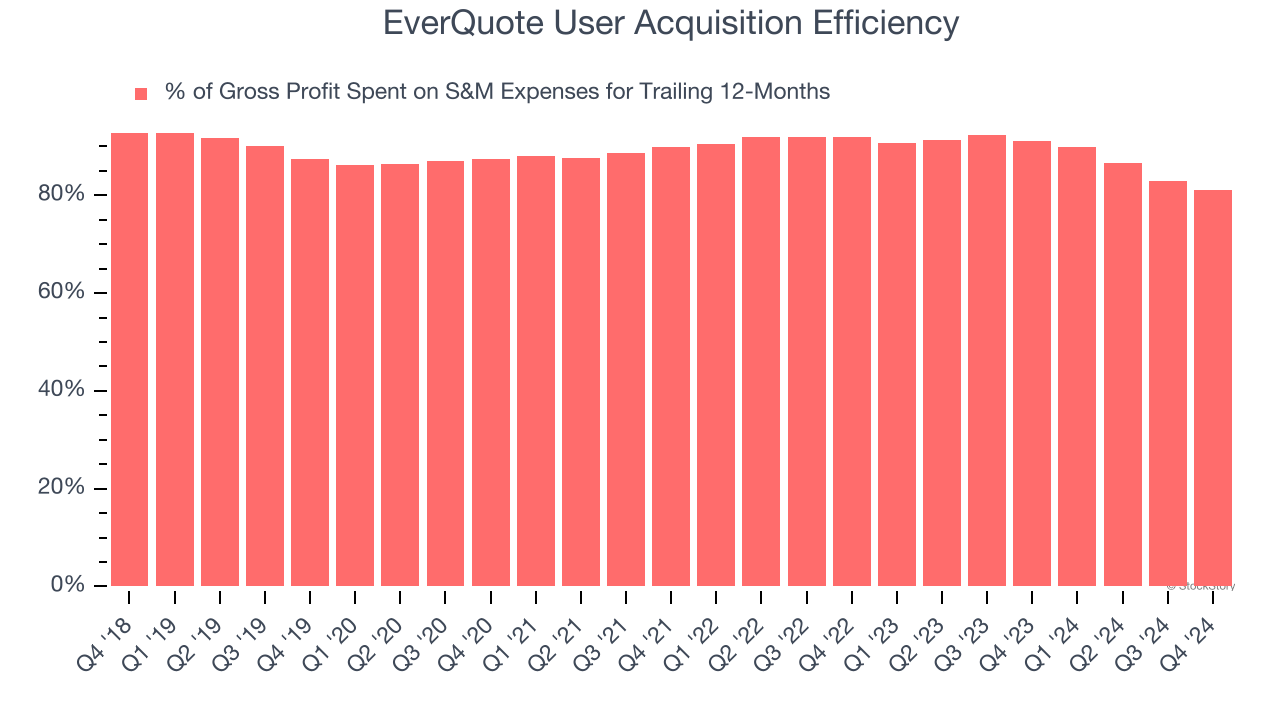

2. Poor Marketing Efficiency Drains Profits

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like EverQuote grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for EverQuote to acquire new users as the company has spent 81% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between EverQuote and its peers.

Final Judgment

EverQuote’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 13.4× forward EV-to-EBITDA (or $23.18 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of EverQuote

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.