Dell’s stock price has taken a beating over the past six months, shedding 31.9% of its value and falling to $85.70 per share. This might have investors contemplating their next move.

Is now the time to buy Dell, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're swiping left on Dell for now. Here are three reasons why we avoid DELL and a stock we'd rather own.

Why Do We Think Dell Will Underperform?

Founded by Michael Dell in his University of Texas dorm room in 1984 with just $1,000, Dell Technologies (NYSE: DELL) provides hardware, software, and services that help organizations build their IT infrastructure, manage cloud environments, and enable digital transformation.

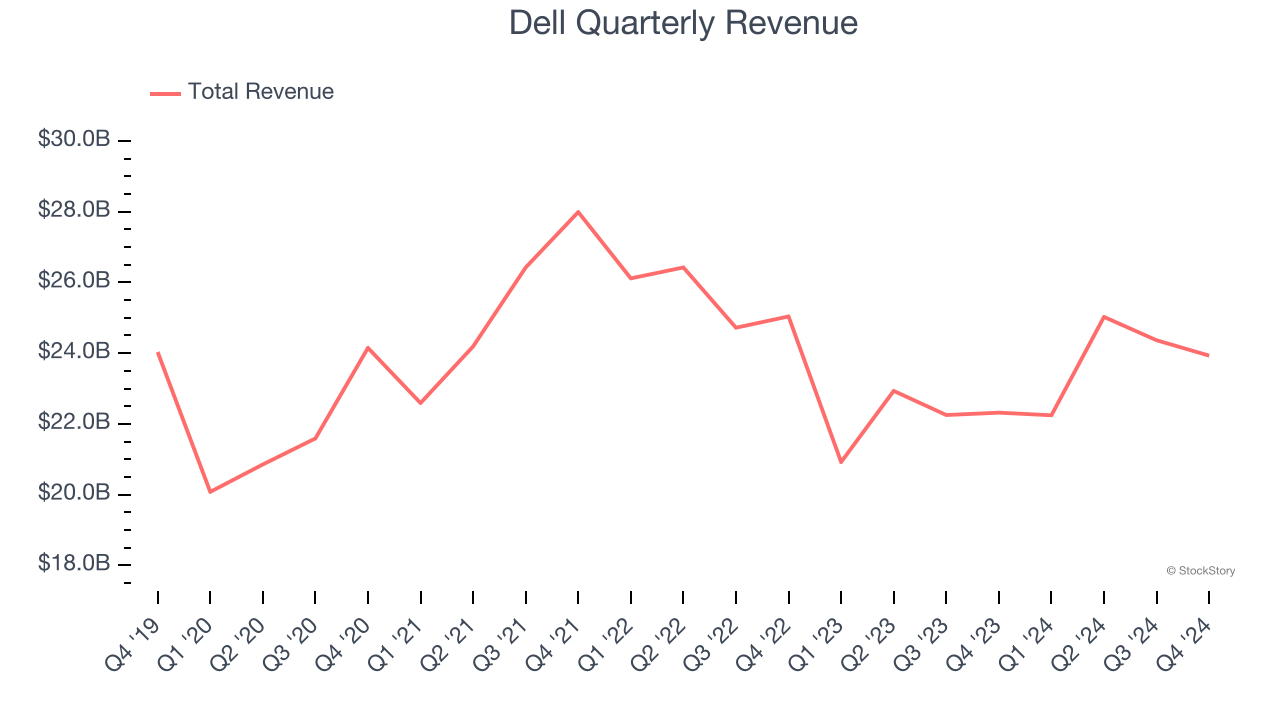

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Dell struggled to consistently increase demand as its $95.57 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

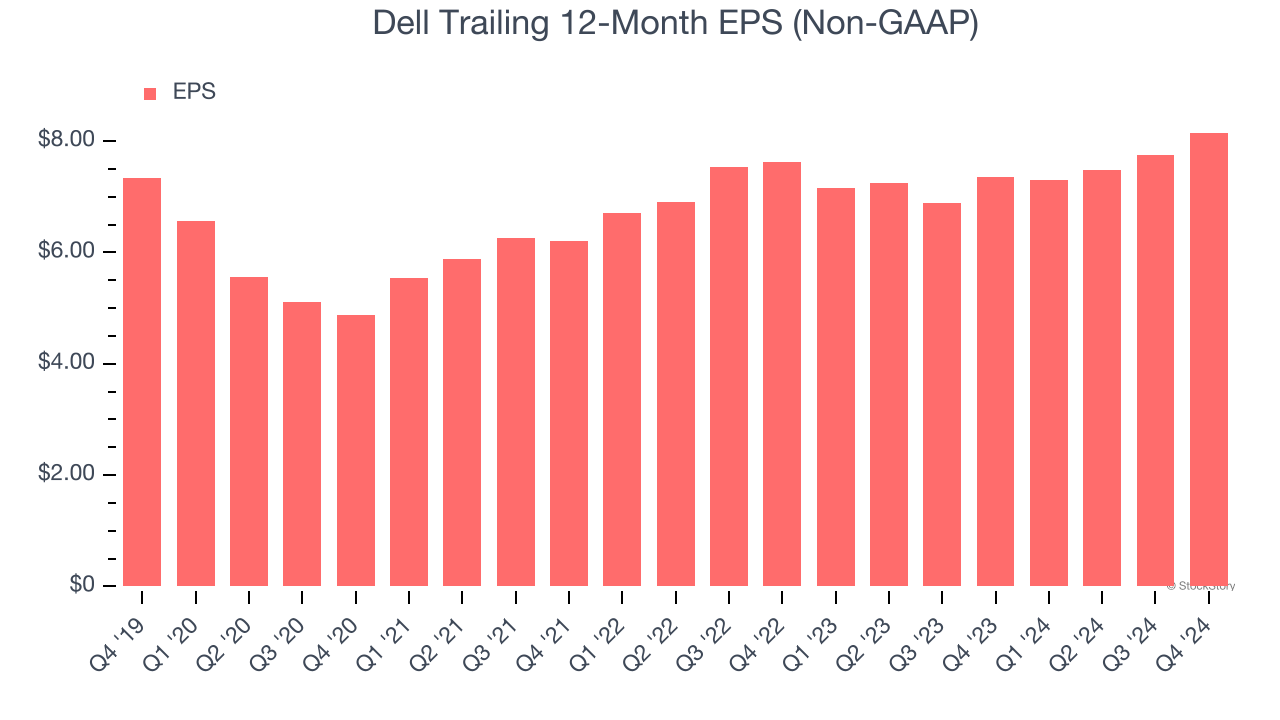

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Dell’s EPS grew at a weak 2.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

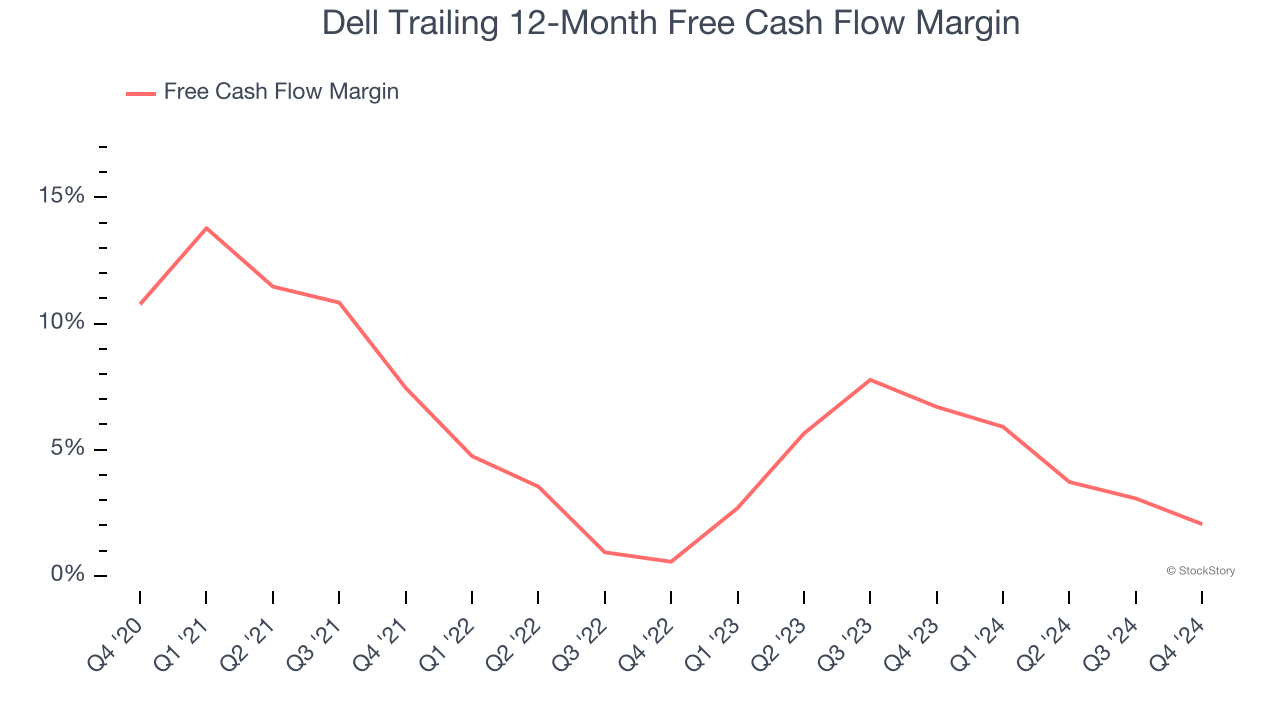

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Dell’s margin dropped by 8.7 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Dell’s free cash flow margin for the trailing 12 months was 2%.

Final Judgment

We see the value of companies helping consumers, but in the case of Dell, we’re out. After the recent drawdown, the stock trades at 9.2× forward price-to-earnings (or $85.70 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Dell

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.