The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how IBM (NYSE: IBM) and the rest of the it services & consulting stocks fared in Q4.

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

The 8 it services & consulting stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 0.8% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 22.6% since the latest earnings results.

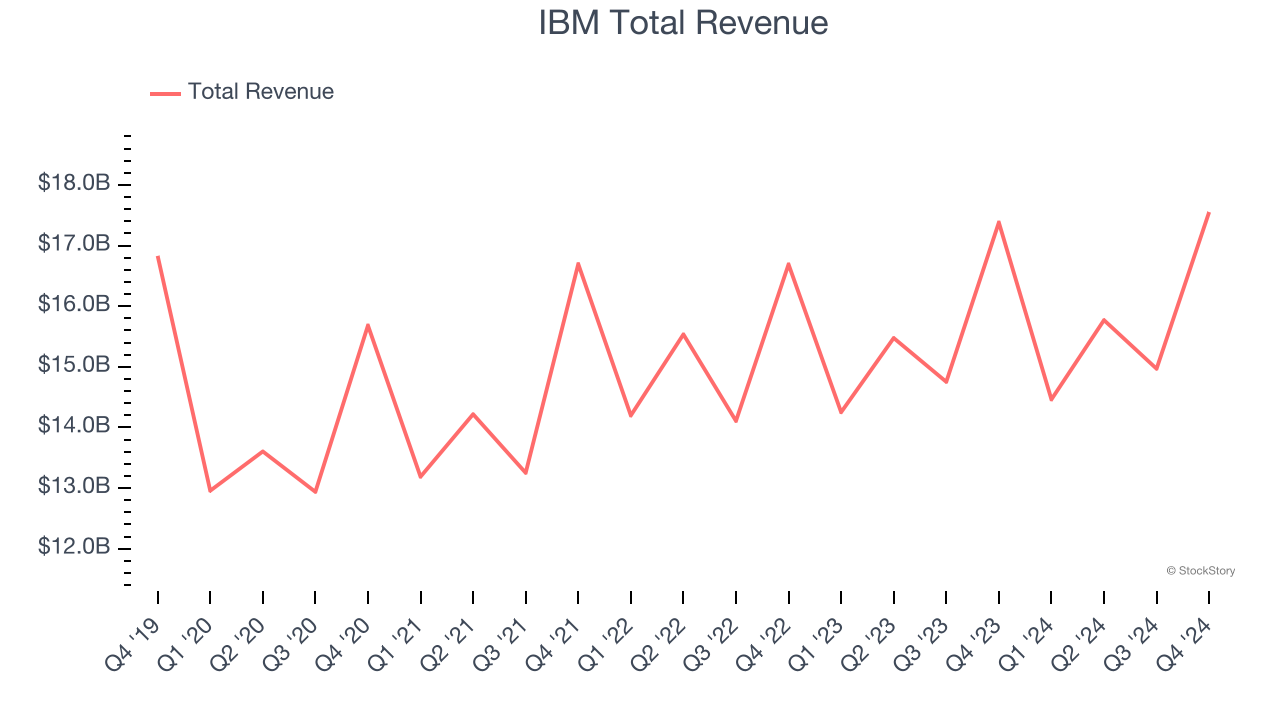

IBM (NYSE: IBM)

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE: IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IBM reported revenues of $17.55 billion, flat year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EPS estimates but a miss of analysts’ operating income estimates.

"We closed the year with double-digit revenue growth in Software for the quarter, led by further acceleration in Red Hat. Clients globally continue to turn to IBM to transform with AI. Our generative AI book of business now stands at more than $5 billion inception-to-date, up nearly $2 billion quarter over quarter," said Arvind Krishna, IBM chairman, president and chief executive officer.

The stock is up 4.4% since reporting and currently trades at $238.79.

Is now the time to buy IBM? Access our full analysis of the earnings results here, it’s free.

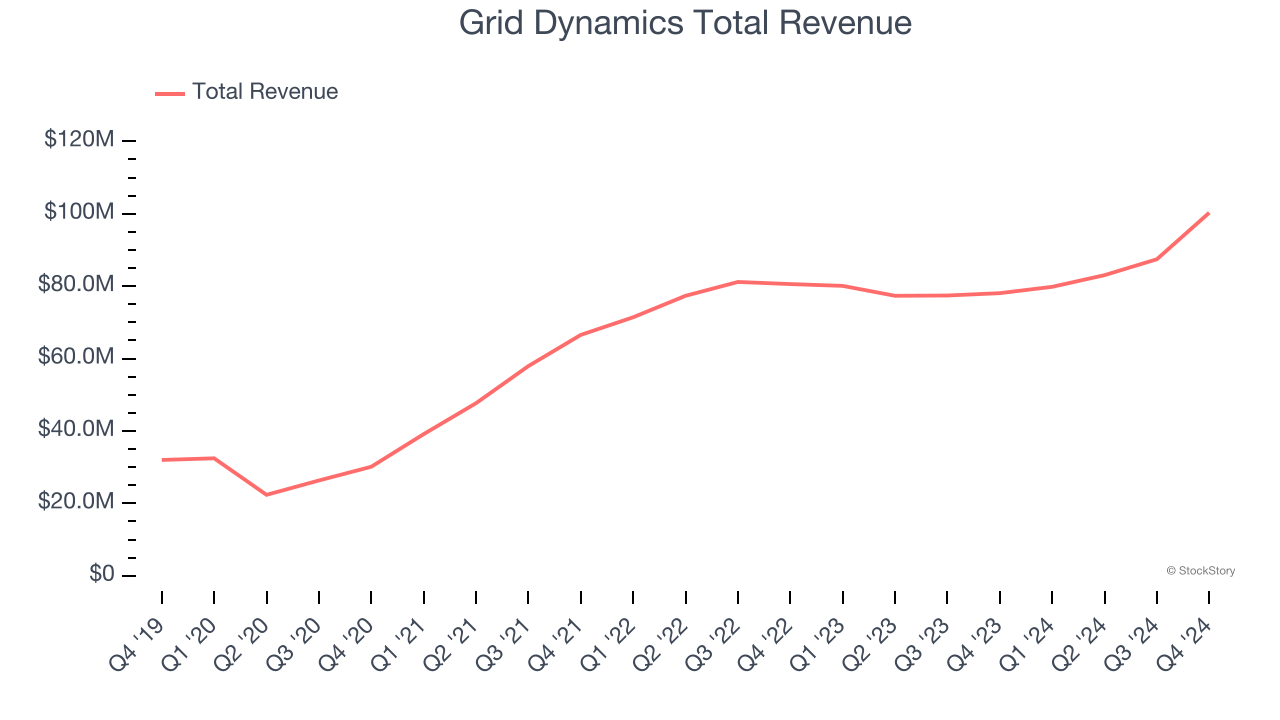

Best Q4: Grid Dynamics (NASDAQ: GDYN)

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics reported revenues of $100.3 million, up 28.5% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Grid Dynamics scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 12.2% since reporting. It currently trades at $17.99.

Is now the time to buy Grid Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: ASGN (NYSE: ASGN)

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE: ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

ASGN reported revenues of $985 million, down 8.3% year on year, falling short of analysts’ expectations by 1.5%. It was a mixed quarter with EBITDA and EPS exceeding analysts' estimates.

ASGN delivered the slowest revenue growth in the group. As expected, the stock is down 29.3% since the results and currently trades at $62.09.

Read our full analysis of ASGN’s results here.

Accenture (NYSE: ACN)

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE: ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Accenture reported revenues of $17.69 billion, up 9% year on year. This number topped analysts’ expectations by 3.2%. It was a very strong quarter as it also put up a decent beat of analysts’ EPS estimates.

The stock is down 17.4% since reporting and currently trades at $287.

Read our full, actionable report on Accenture here, it’s free.

DXC (NYSE: DXC)

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE: DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

DXC reported revenues of $3.23 billion, down 5.1% year on year. This print lagged analysts' expectations by 0.9%. Zooming out, it was actually a strong quarter as it produced an impressive beat of analysts’ EPS estimates.

DXC had the weakest full-year guidance update among its peers. The stock is down 36.1% since reporting and currently trades at $14.45.

Read our full, actionable report on DXC here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.