As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the semiconductor manufacturing industry, including Lam Research (NASDAQ: LRCX) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 24% since the latest earnings results.

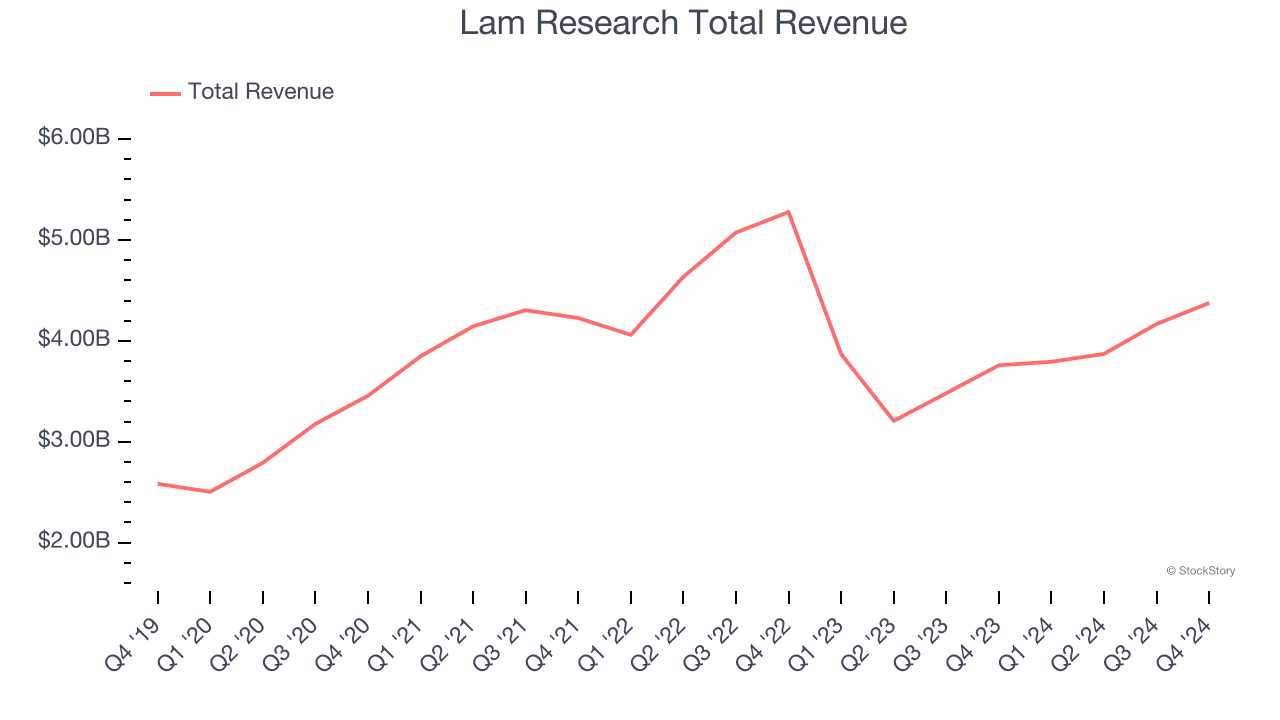

Lam Research (NASDAQ: LRCX)

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ: LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $4.38 billion, up 16.4% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"Lam is executing at a high level at a pivotal moment for semiconductor manufacturing. Increasing demands on chip performance play into Lam's strengths, with advanced deposition and etch applications set to comprise a growing share of WFE," said Tim Archer, Lam Research's President and Chief Executive Officer.

The stock is down 9.1% since reporting and currently trades at $68.35.

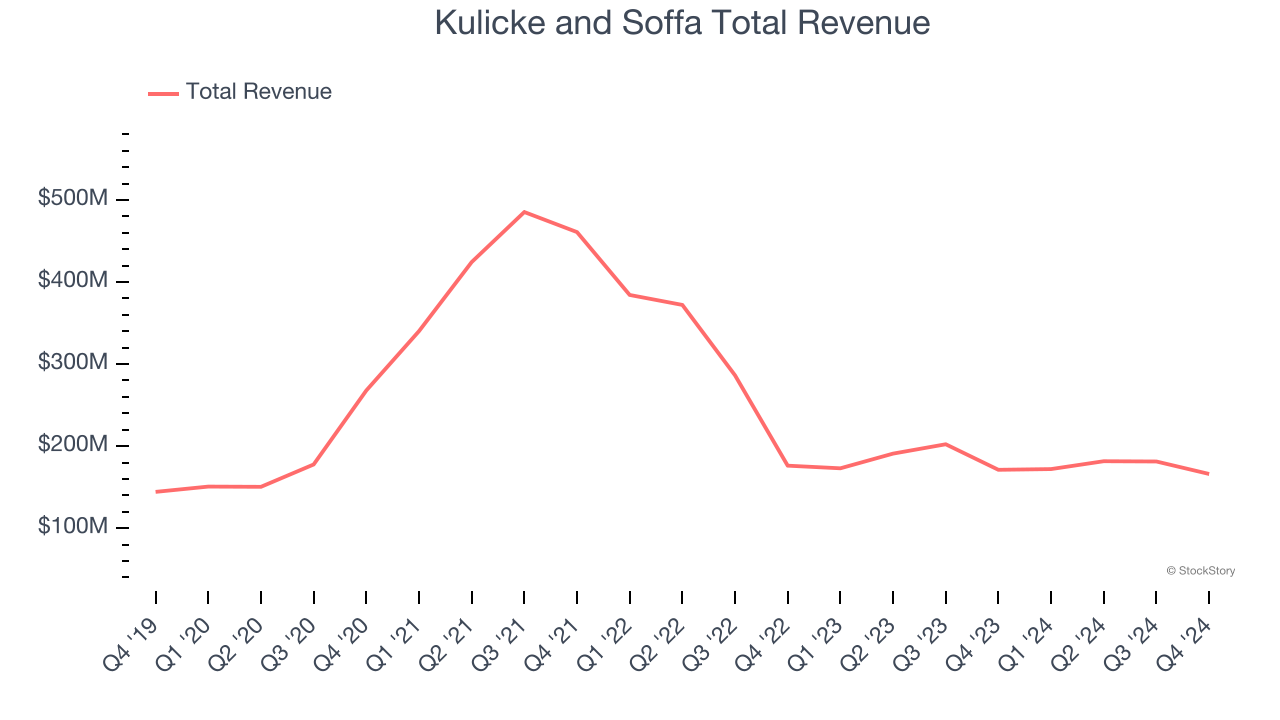

Best Q4: Kulicke and Soffa (NASDAQ: KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $166.1 million, down 3% year on year, outperforming analysts’ expectations by 0.7%. The business had a very strong quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The stock is down 30.5% since reporting. It currently trades at $30.18.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: FormFactor (NASDAQ: FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $189.5 million, up 12.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 34.1% since the results and currently trades at $27.10.

Read our full analysis of FormFactor’s results here.

Entegris (NASDAQ: ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $849.8 million, up 4.6% year on year. This number topped analysts’ expectations by 3.3%. It was a very strong quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 32.2% since reporting and currently trades at $70.50.

Read our full, actionable report on Entegris here, it’s free.

Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $212.1 million, down 1.9% year on year. This print surpassed analysts’ expectations by 1%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The stock is down 7.4% since reporting and currently trades at $19.20.

Read our full, actionable report on Photronics here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.