As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at healthcare distribution & related services stocks, starting with Patterson Companies (NASDAQ: PDCO).

Healthcare distributors operate scale-driven business models that thrive on high volumes. Their recurring revenue streams from contracts with hospitals, pharmacies, and healthcare providers provide stability, but profitability can be squeezed by powerful stakeholders on both sides (suppliers and customers), pricing pressures, and regulatory changes. Looking ahead, the sector is positioned for growth due to increasing demand for healthcare services driven by an aging population and advancements in medical technology. However, rising operational costs, potential drug pricing reforms, and supply chain vulnerabilities present potential headwinds. Additionally, the push for digitalization and value-based care creates opportunities for innovation but requires significant investment to remain competitive.

The 4 healthcare distribution & related services stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 0.9%.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

Weakest Q4: Patterson Companies (NASDAQ: PDCO)

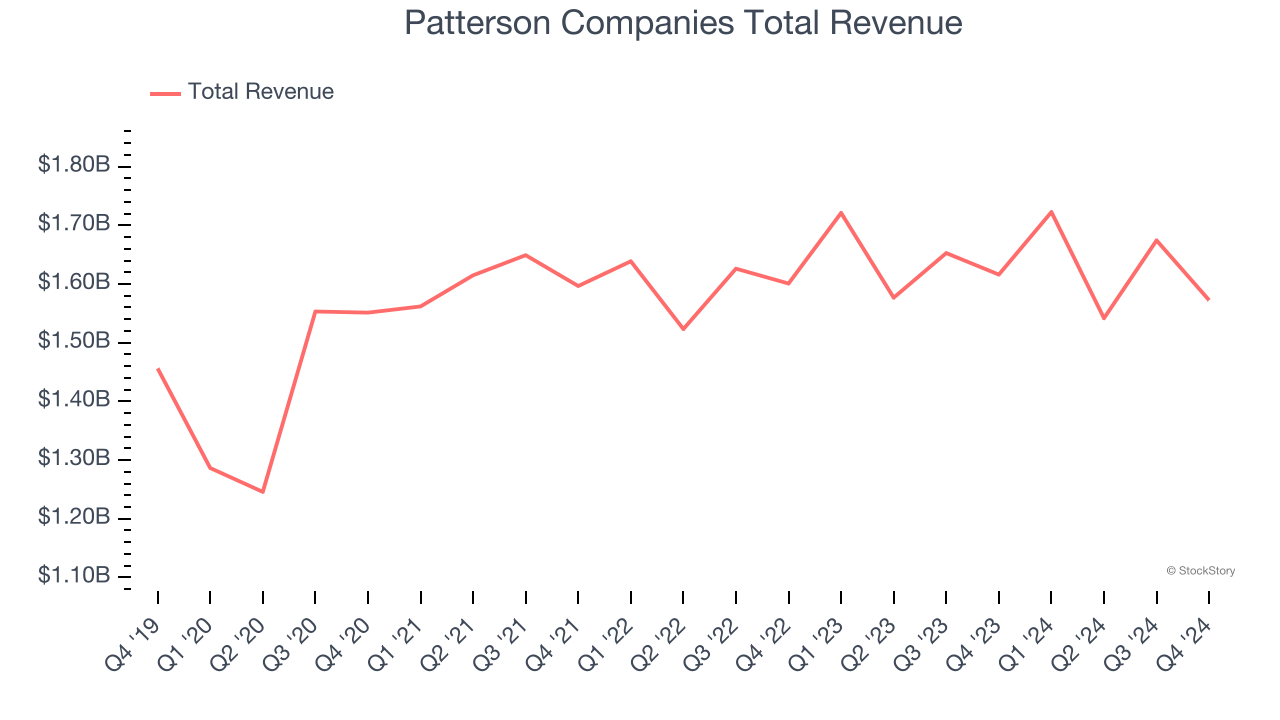

With roots dating back to 1877 and serving over 150,000 customers across North America and the UK, Patterson Companies (NASDAQ: PDCO) is a specialty distributor that supplies dental practices and animal health professionals with equipment, consumables, pharmaceuticals, and practice management software.

Patterson Companies reported revenues of $1.57 billion, down 2.7% year on year. This print fell short of analysts’ expectations by 4%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS and organic revenue estimates.

“As we continue to progress toward closing our transaction with Patient Square Capital, our team remains focused on executing our strategy,” said Don Zurbay, President and CEO of Patterson Companies.

Patterson Companies delivered the weakest performance against analyst estimates of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $31.25.

Read our full report on Patterson Companies here, it’s free.

Best Q4: Cardinal Health (NYSE: CAH)

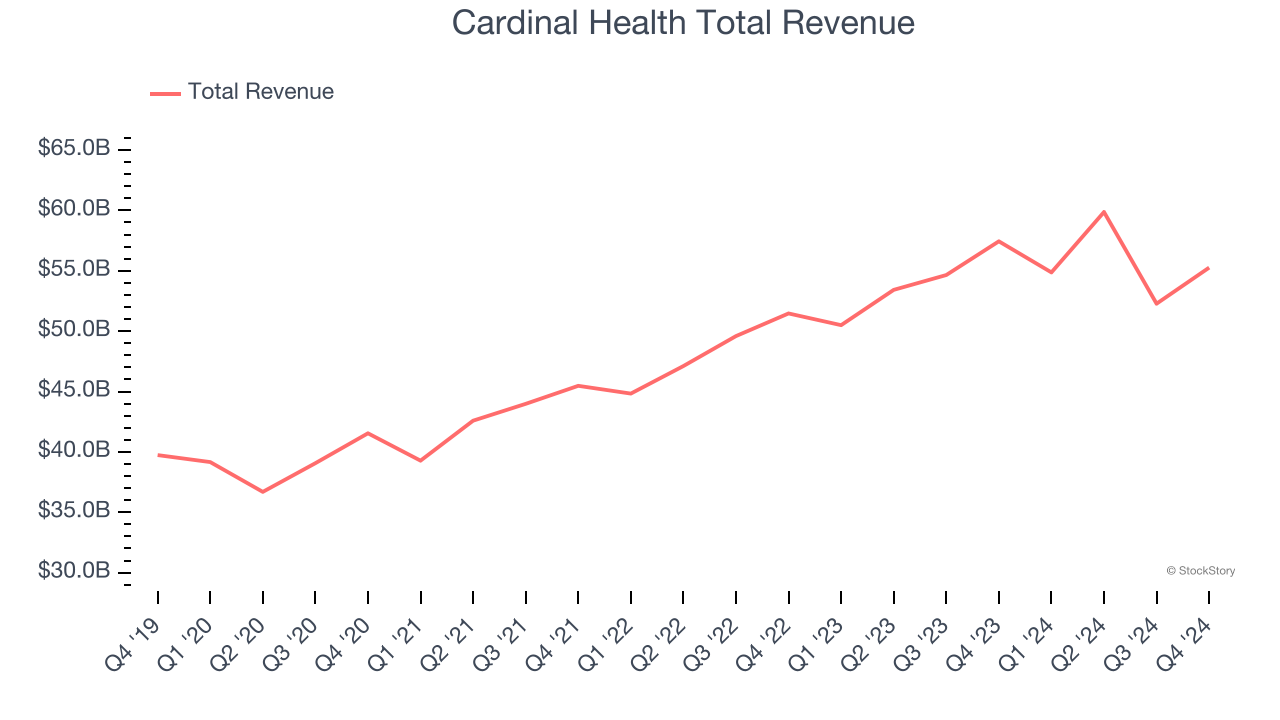

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE: CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Cardinal Health reported revenues of $55.26 billion, down 3.8% year on year, outperforming analysts’ expectations by 0.9%. The business had a strong quarter with a decent beat of analysts’ EPS estimates.

Cardinal Health delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.8% since reporting. It currently trades at $132.52.

Is now the time to buy Cardinal Health? Access our full analysis of the earnings results here, it’s free.

Owens & Minor (NYSE: OMI)

With roots dating back to 1882 and operations spanning approximately 80 countries, Owens & Minor (NYSE: OMI) is a healthcare solutions company that manufactures medical supplies, distributes products to healthcare providers, and delivers medical equipment directly to patients.

Owens & Minor reported revenues of $2.70 billion, up 1.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 12.5% since the results and currently trades at $7.76.

Read our full analysis of Owens & Minor’s results here.

McKesson (NYSE: MCK)

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE: MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

McKesson reported revenues of $95.29 billion, up 17.8% year on year. This result missed analysts’ expectations by 0.7%. Overall, it was a slower quarter for the company.

McKesson scored the fastest revenue growth among its peers. The stock is up 14.7% since reporting and currently trades at $696.01.

Read our full, actionable report on McKesson here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.