Over the past six months, Federal Signal’s shares (currently trading at $76.31) have posted a disappointing 18.2% loss while the S&P 500 was down 7.3%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for FSS? Find out in our full research report, it’s free.

Why Is Federal Signal a Good Business?

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE: FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

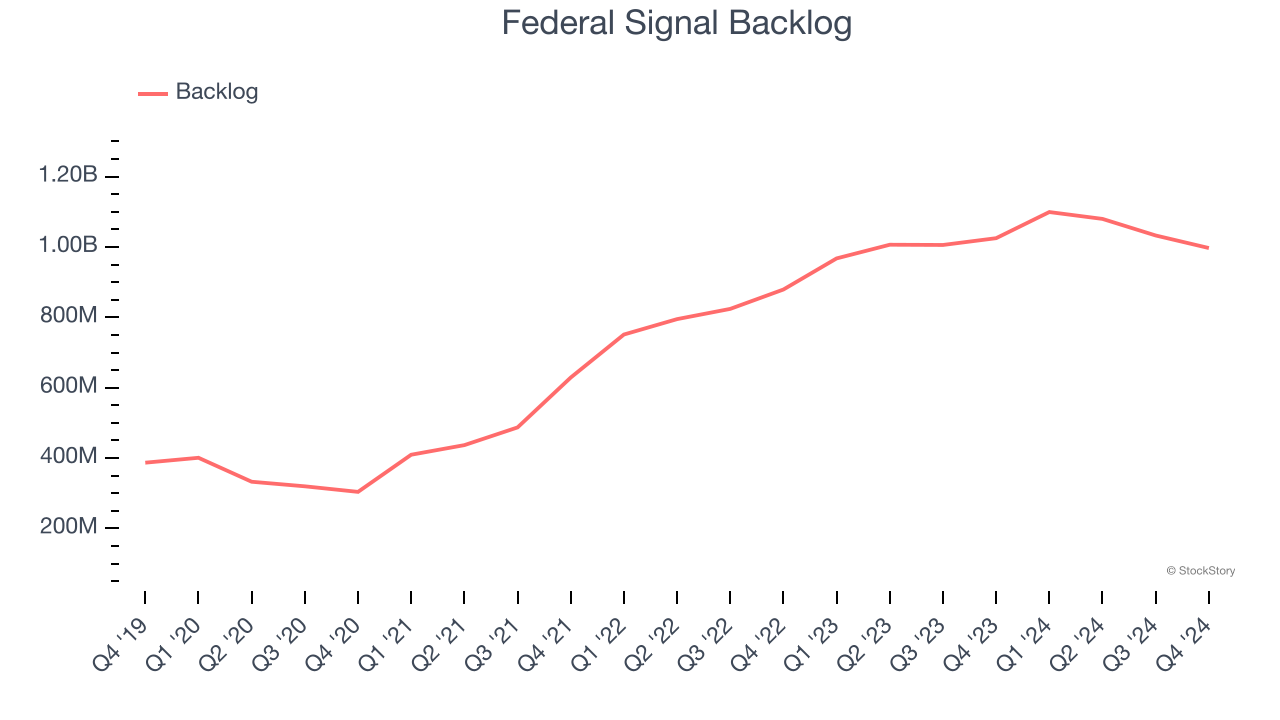

1. Surging Backlog Locks In Future Sales

In addition to reported revenue, backlog is a useful data point for analyzing Heavy Transportation Equipment companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Federal Signal’s future revenue streams.

Federal Signal’s backlog punched in at $997.1 million in the latest quarter, and over the last two years, its year-on-year growth averaged 14.4%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Federal Signal for the long term, enhancing the business’s predictability.

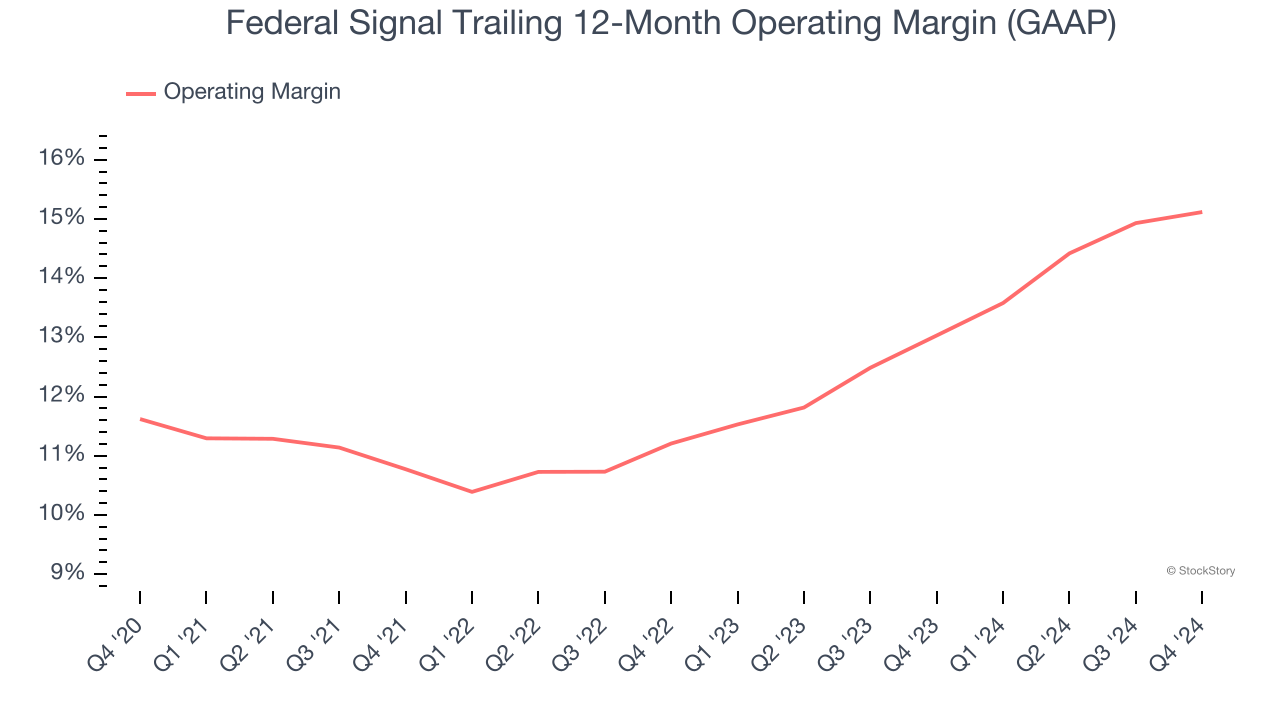

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Federal Signal’s operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 15.1%.

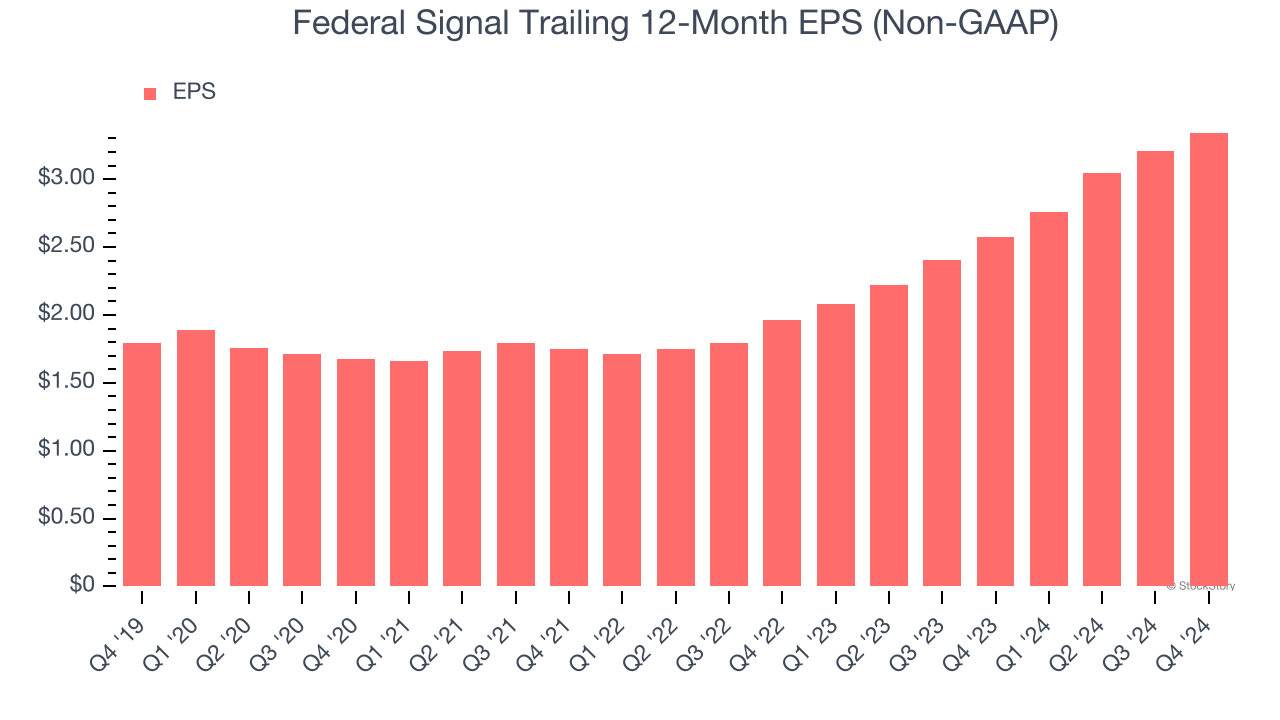

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Federal Signal’s EPS grew at a remarkable 13.3% compounded annual growth rate over the last five years, higher than its 8.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons Federal Signal is a rock-solid business worth owning. With the recent decline, the stock trades at 20.5× forward price-to-earnings (or $76.31 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Federal Signal

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.