Digital infrastructure provider Applied Digital (NASDAQ: APLD) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 22.1% year on year to $52.92 million. Its non-GAAP loss of $0.08 per share was 22% above analysts’ consensus estimates.

Is now the time to buy Applied Digital? Find out by accessing our full research report, it’s free.

Applied Digital (APLD) Q1 CY2025 Highlights:

- Revenue: $52.92 million vs analyst estimates of $64.48 million (22.1% year-on-year growth, 17.9% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.10 (22% beat)

- Adjusted EBITDA: $10.02 million vs analyst estimates of $16.94 million (18.9% margin, 40.9% miss)

- Operating Margin: -35.8%, up from -73.2% in the same quarter last year

- Free Cash Flow was -$251.6 million compared to -$2.33 million in the same quarter last year

- Market Capitalization: $1.18 billion

"We are confident in the progress we are making and remain committed to delivering sustainable, long-term value for our investors,” said Applied Digital Chairman and CEO Wes Cummins.

Company Overview

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Enterprise Networking

The Enterprise Networking subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products and services like switches, firewalls, and datacenter hosting services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $221.2 million in revenue over the past 12 months, Applied Digital is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

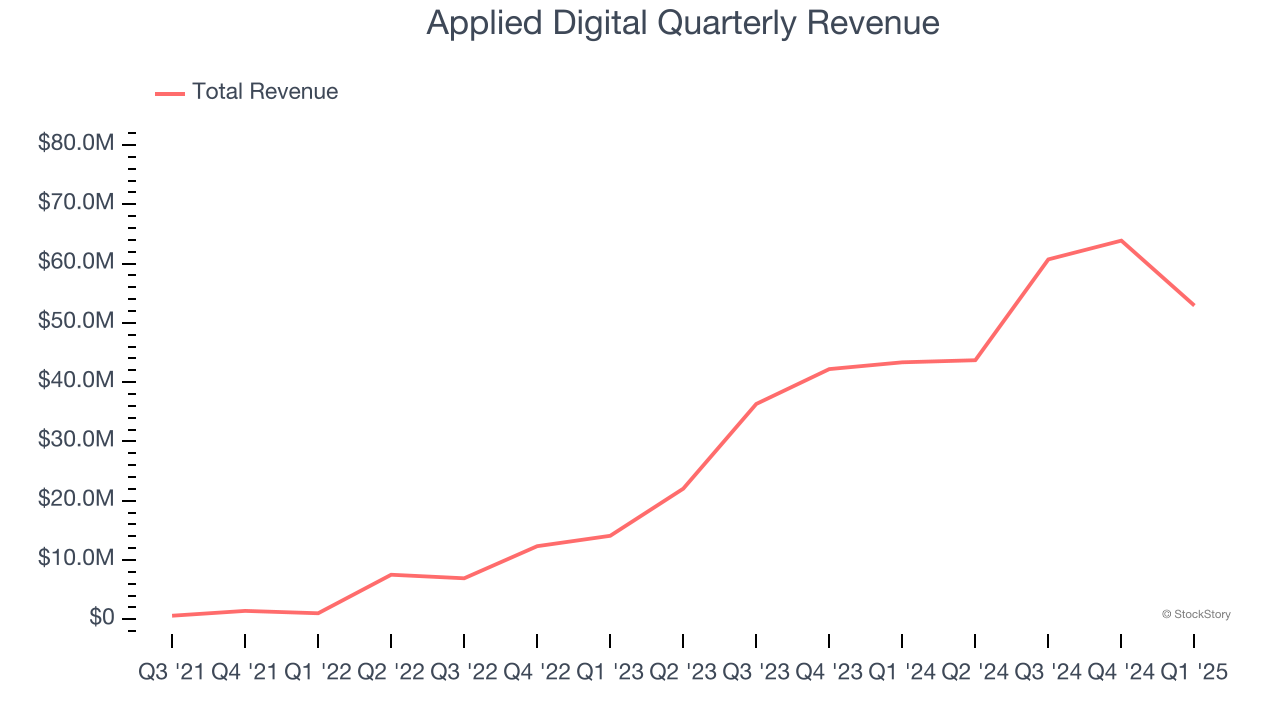

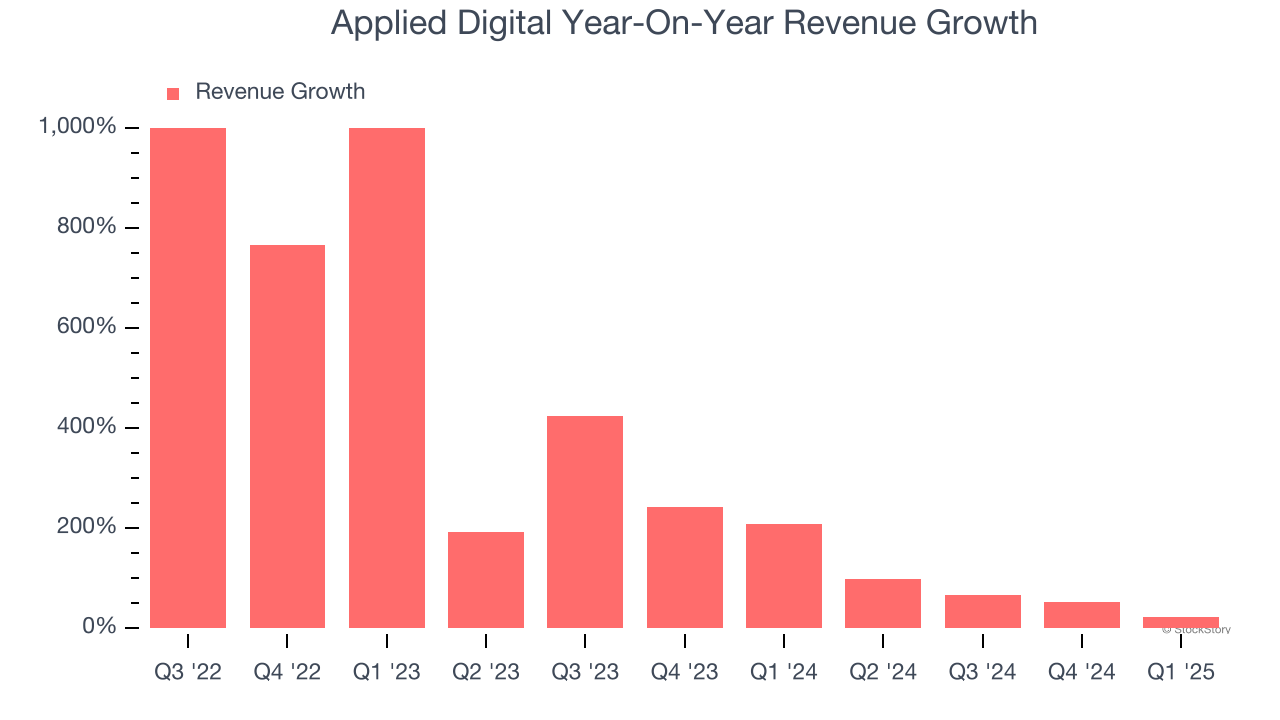

As you can see below, Applied Digital’s 287% annualized revenue growth over the last three years was incredible. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Applied Digital’s annualized revenue growth of 133% over the last two years is below its three-year trend, but we still think the results suggest healthy demand.

This quarter, Applied Digital generated an excellent 22.1% year-on-year revenue growth rate, but its $52.92 million of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 67.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

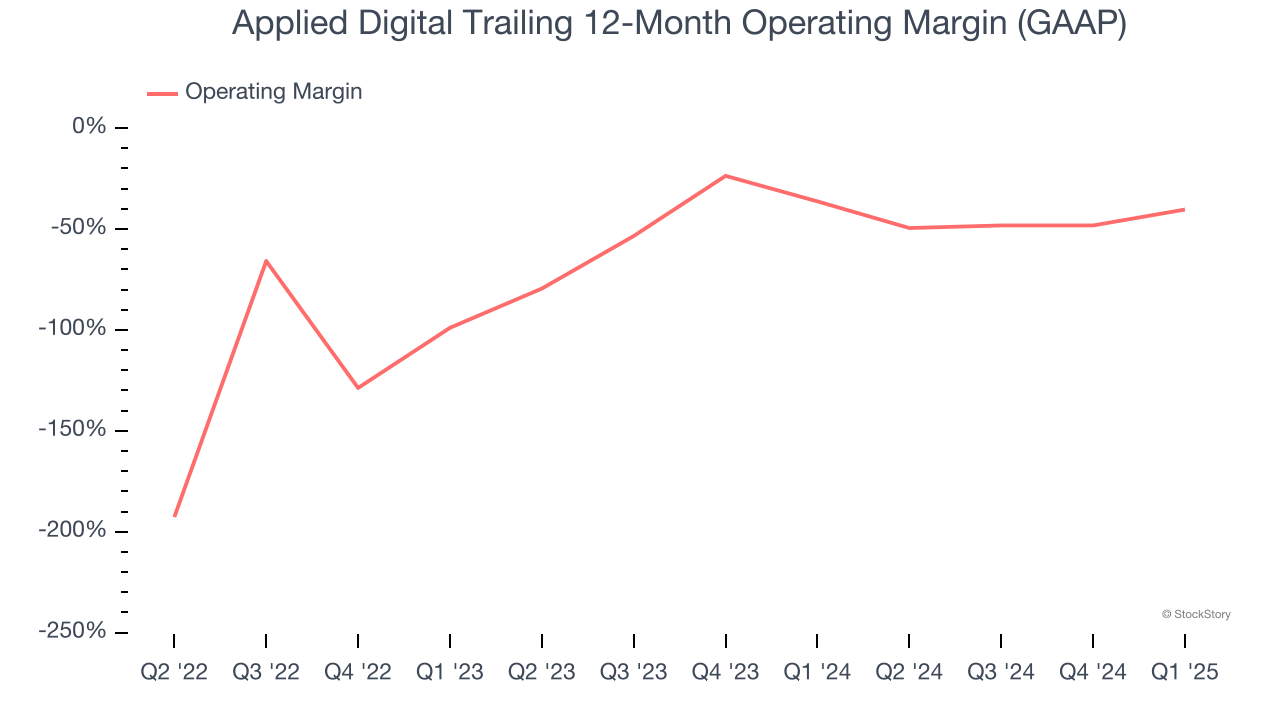

Applied Digital’s high expenses have contributed to an average operating margin of negative 48.5% over the last four years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Applied Digital’s operating margin rose over the last four years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Applied Digital’s operating margin was negative 35.8% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

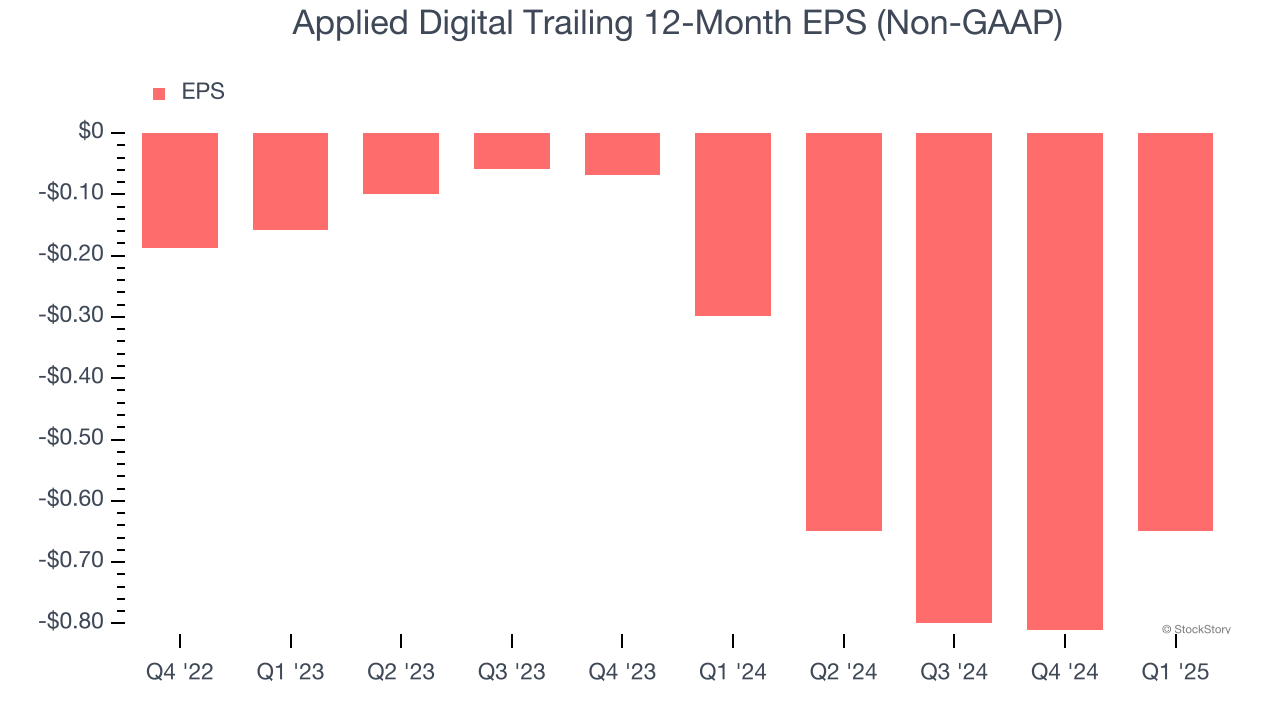

Applied Digital’s earnings losses deepened over the last two years as its EPS dropped 103% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q1, Applied Digital reported EPS at negative $0.08, up from negative $0.24 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Applied Digital’s full-year EPS of negative $0.65 will reach break even.

Key Takeaways from Applied Digital’s Q1 Results

It was great to see Applied Digital beat past analysts’ EPS expectations this quarter. On the other hand, its revenue and EBITDA missed significantly, making this a tough quarter. Shares traded down 6.2% to $5.04 immediately following the results.

Big picture, is Applied Digital a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.