Allison Transmission trades at $89.71 per share and has stayed right on track with the overall market, losing 10.1% over the last six months while the S&P 500 is down 7.3%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy ALSN? Find out in our full research report, it’s free.

Why Does Allison Transmission Spark Debate?

Helping build race cars at one point, Allison Transmission (NYSE: ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Two Positive Attributes:

1. EPS Increasing Steadily

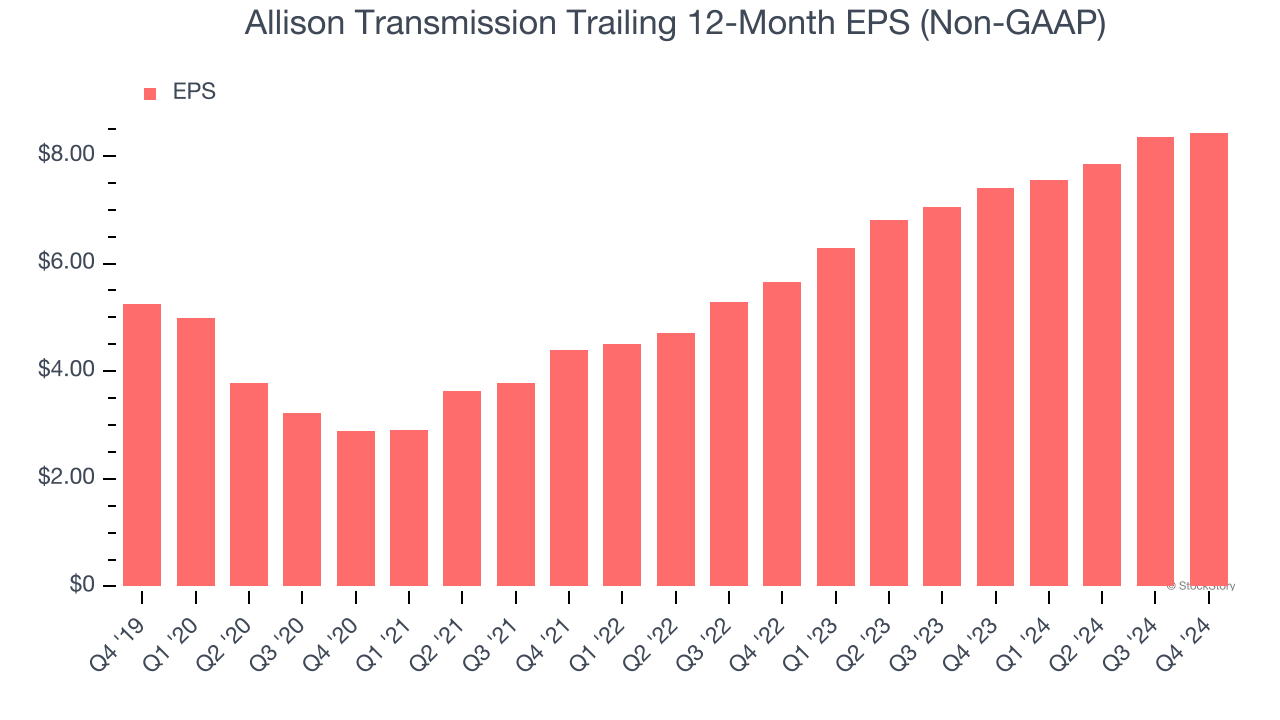

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Allison Transmission’s EPS grew at a solid 9.9% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

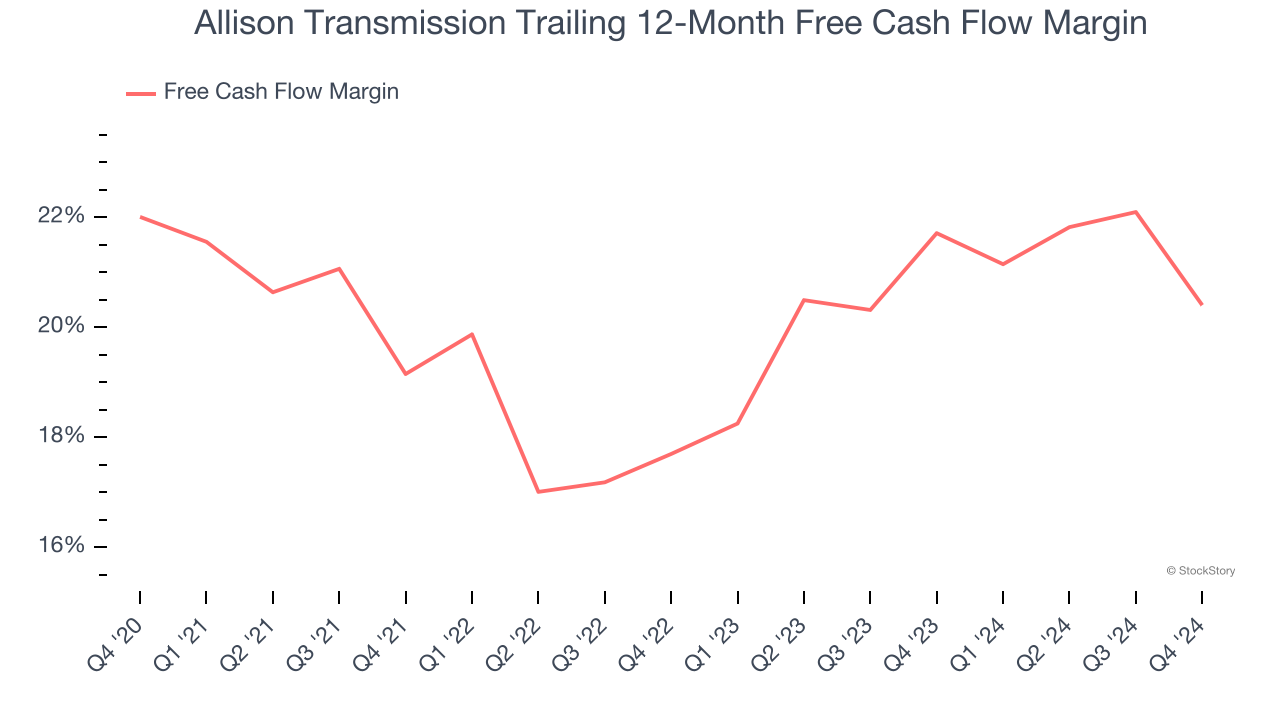

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Allison Transmission has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.2% over the last five years.

One Reason to be Careful:

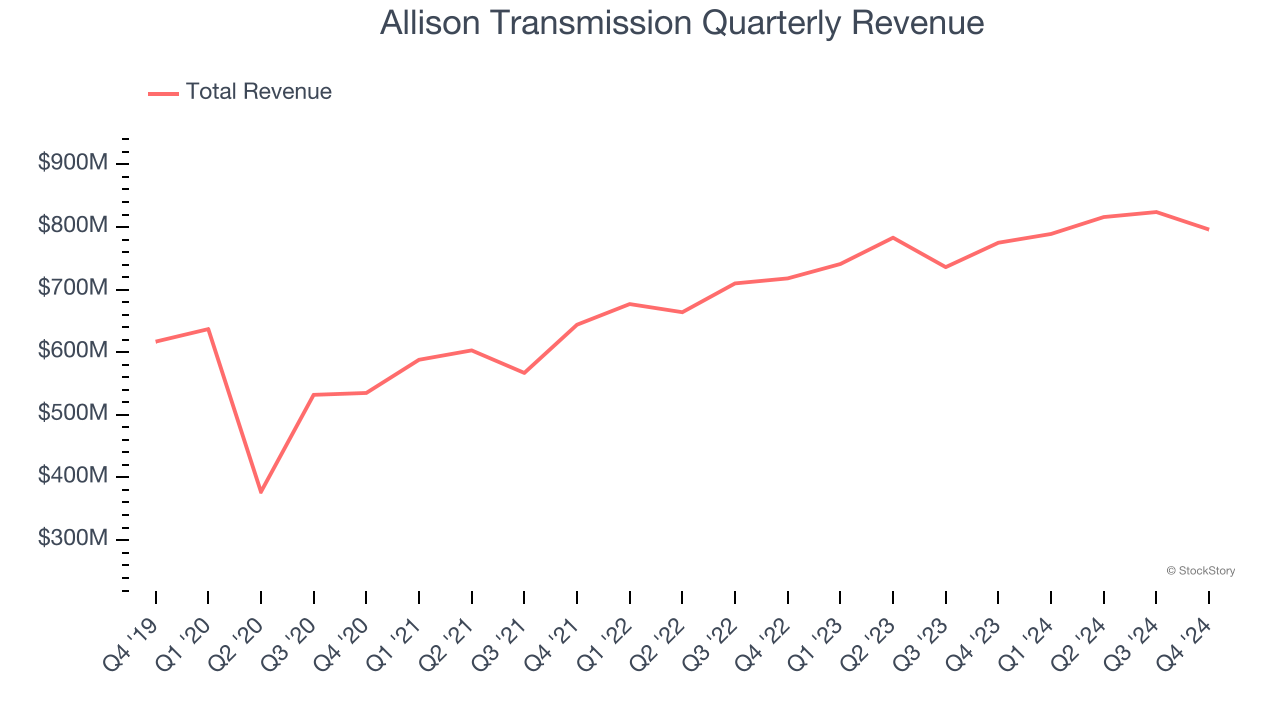

Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Allison Transmission’s sales grew at a sluggish 3.6% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Allison Transmission.

Final Judgment

Allison Transmission’s merits more than compensate for its flaws. With the recent decline, the stock trades at 10.1× forward price-to-earnings (or $89.71 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Allison Transmission

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.