Globalstar currently trades at $19.99 and has been a dream stock for shareholders. It’s returned 330% since April 2020, blowing past the S&P 500’s 91% gain. The company has also beaten the index over the past six months as its stock price is up 12%.

Is now still a good time to buy GSAT? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is Globalstar a Good Business?

Known for powering the emergency SOS feature in newer Apple iPhones, Globalstar (NASDAQ: GSAT) operates a network of low-earth orbit satellites that provide voice and data communications services in remote areas where traditional cellular networks don't reach.

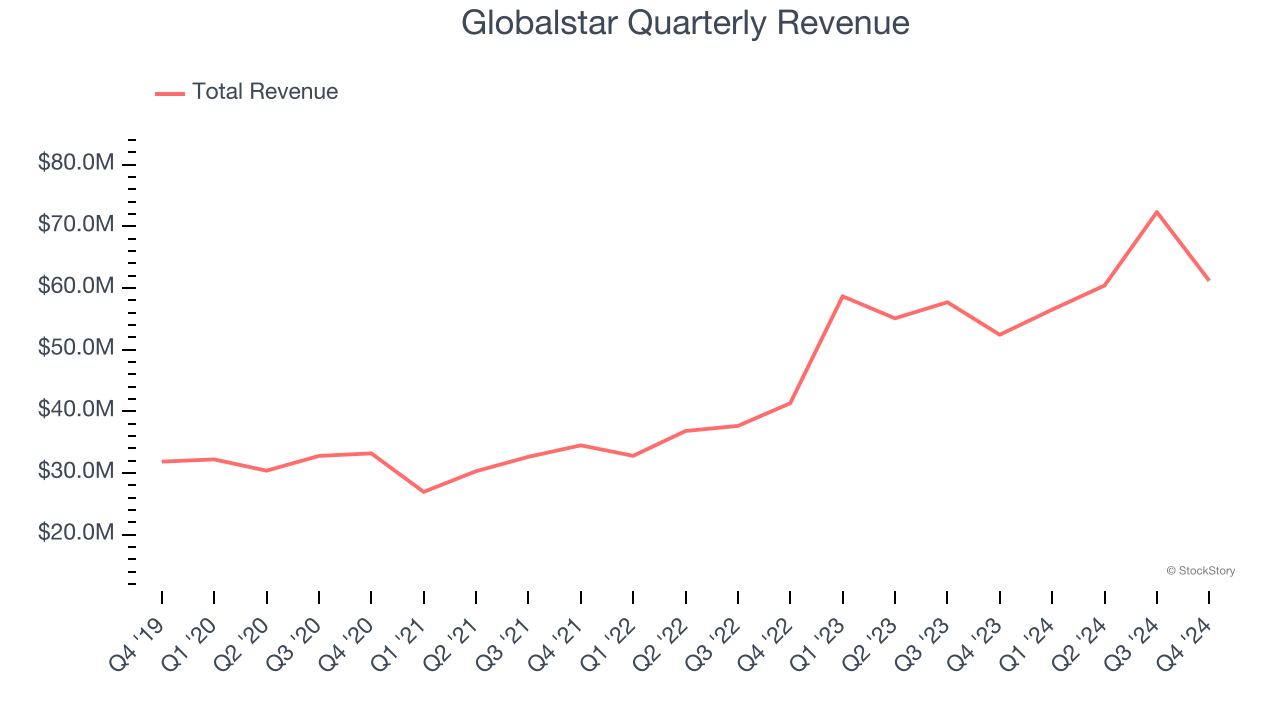

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last four years, Globalstar grew its sales at an incredible 18.1% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

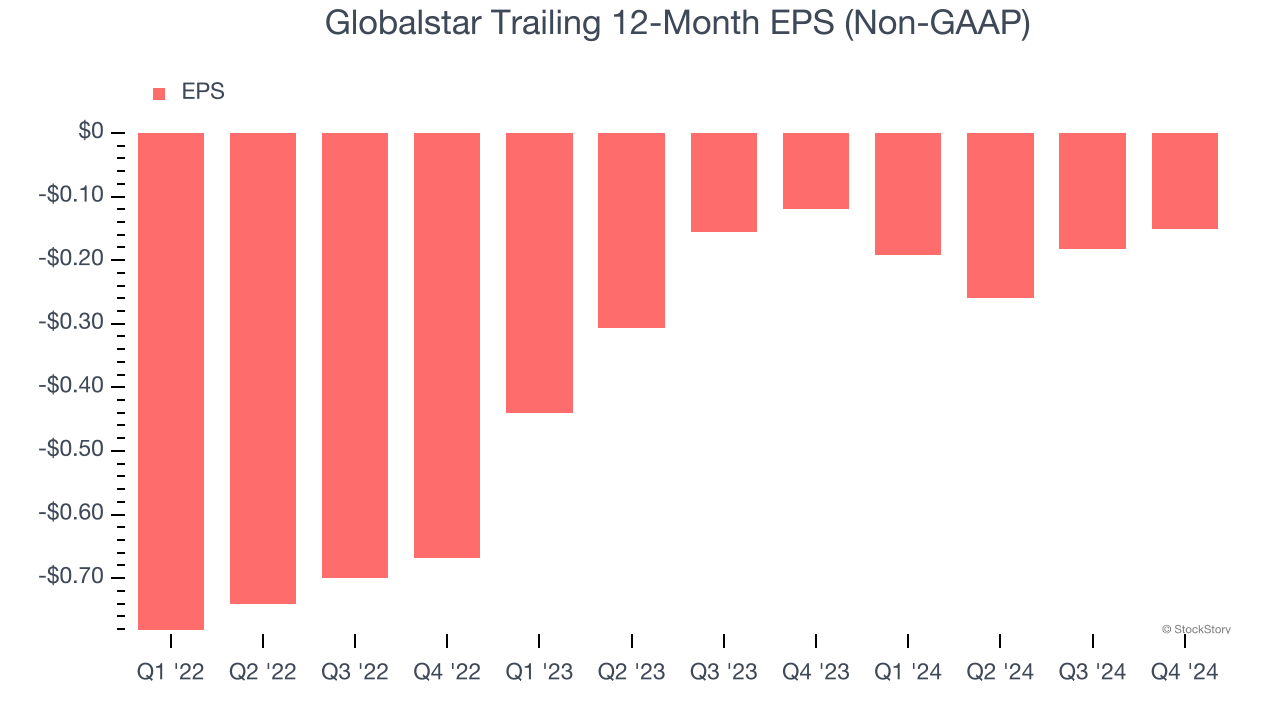

2. EPS Improving Significantly

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Although Globalstar’s full-year earnings are still negative, it reduced its losses and improved its EPS by 44.1% annually over the last three years. The next few quarters will be critical for assessing its long-term profitability. An inflection point could be coming soon.

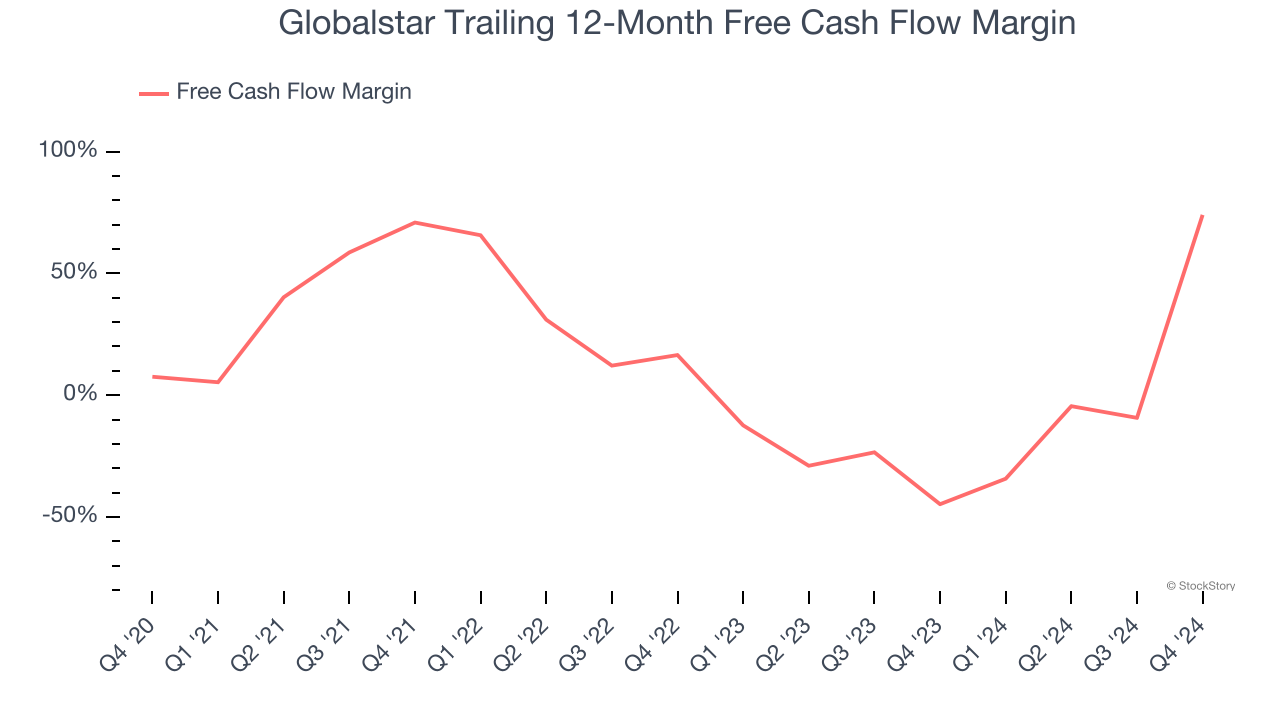

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Globalstar has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 23.7% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Final Judgment

These are just a few reasons Globalstar is a high-quality business worth owning, and with its shares outperforming the market lately, the stock trades at 18.1× forward EV-to-EBITDA (or $19.99 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Globalstar

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.