Since September 2024, AECOM has been in a holding pattern, posting a small return of 0.8% while floating around $96.60.

Is now the time to buy AECOM, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

We're cautious about AECOM. Here are three reasons why ACM doesn't excite us and a stock we'd rather own.

Why Is AECOM Not Exciting?

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE: ACM) provides various infrastructure consulting services.

1. Backlog Is Unchanged, Sales Pipeline Stalls

We can better understand Engineering and Design Services companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into AECOM’s future revenue streams.

Over the last two years, AECOM failed to grow its backlog, which came in at $23.88 billion in the latest quarter. This performance was underwhelming and shows the company faced challenges in winning new orders. It also suggests there may be increasing competition or market saturation.

2. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

AECOM has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 6.3% gross margin over the last five years. That means AECOM paid its suppliers a lot of money ($93.68 for every $100 in revenue) to run its business.

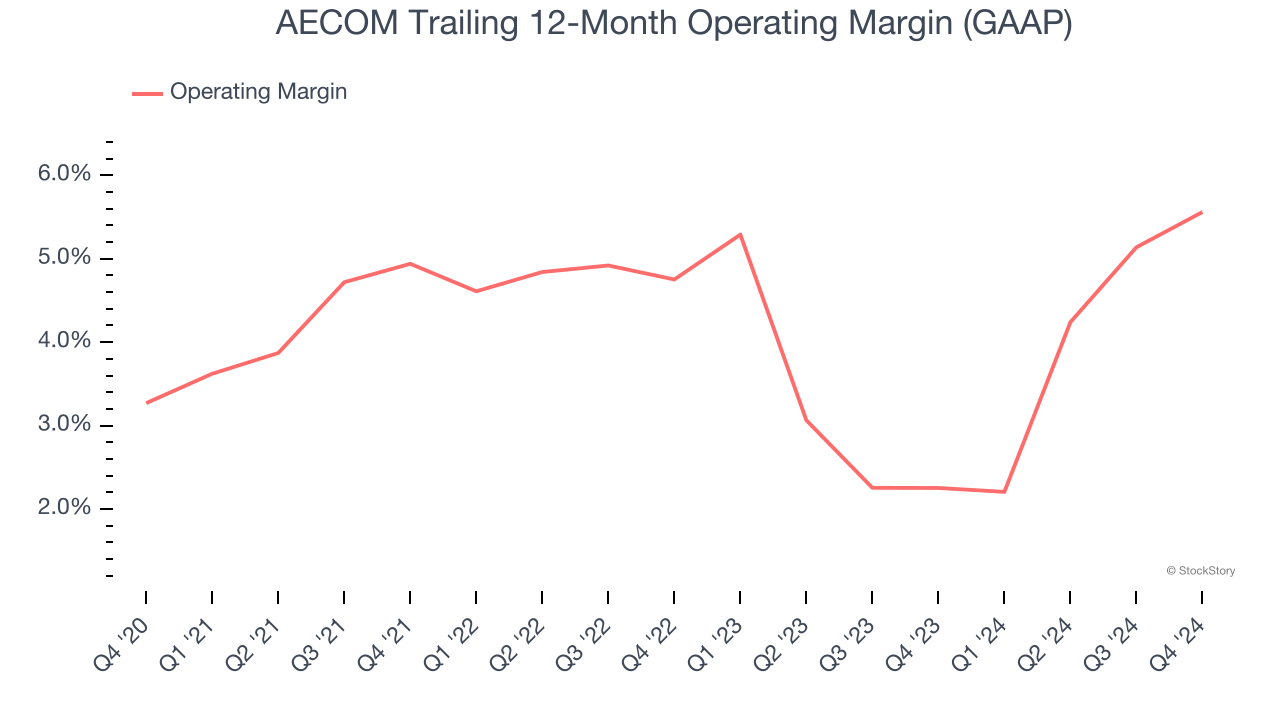

3. Weak Operating Margin Could Cause Trouble

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

AECOM was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

AECOM’s business quality ultimately falls short of our standards. That said, the stock currently trades at 18.6× forward price-to-earnings (or $96.60 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward the most dominant software business in the world.

Stocks We Would Buy Instead of AECOM

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.