Winnebago has gotten torched over the last six months - since August 2024, its stock price has dropped 20.2% to $44.65 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Winnebago, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about Winnebago. Here are three reasons why there are better opportunities than WGO and a stock we'd rather own.

Why Do We Think Winnebago Will Underperform?

Created to provide high-quality, affordable RVs to the post-war American family, Winnebago (NYSE: WGO) is a manufacturer of recreational vehicles, providing a range of motorhomes, travel trailers, and fifth-wheel products for outdoor and adventure lifestyles.

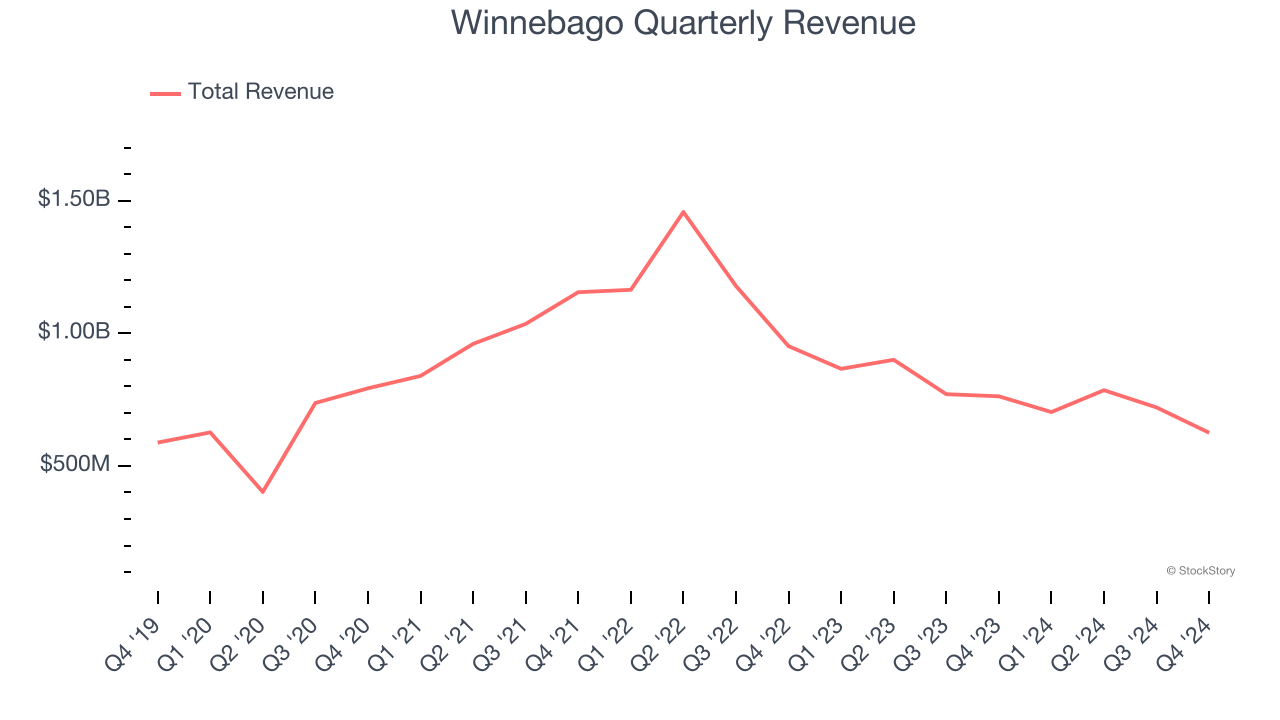

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Winnebago grew its sales at a mediocre 6.4% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

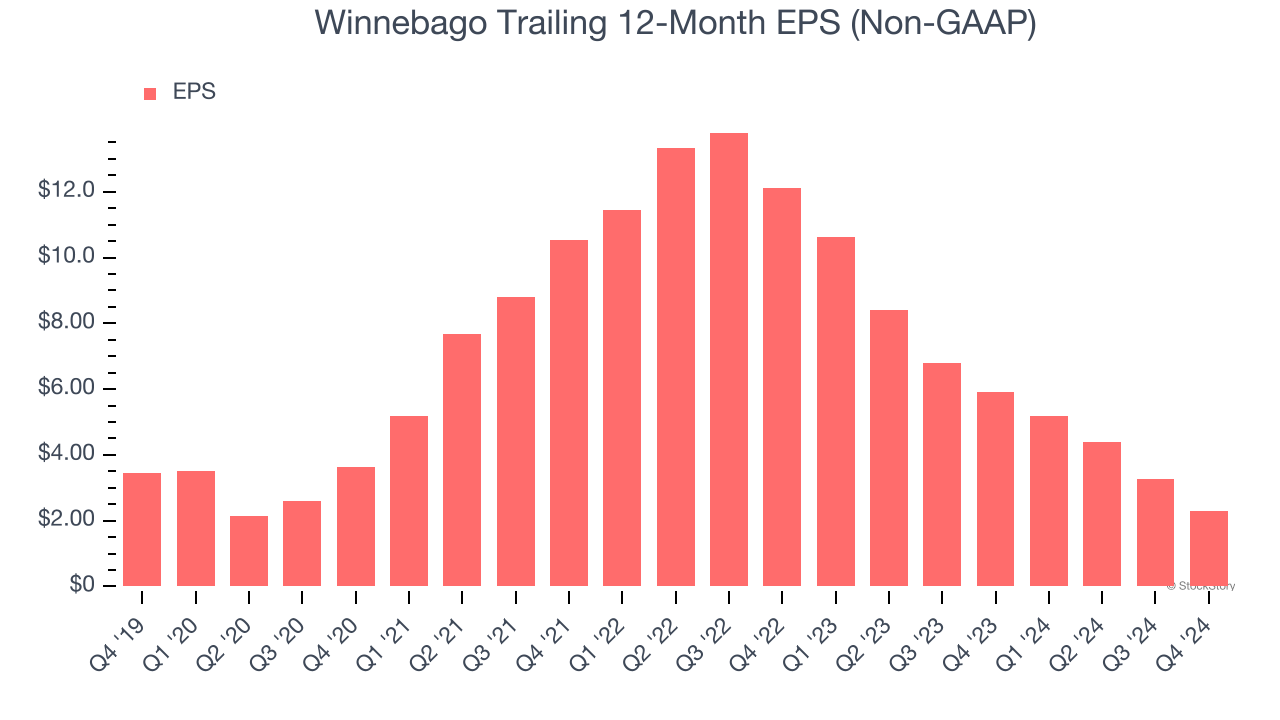

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Winnebago, its EPS declined by 8% annually over the last five years while its revenue grew by 6.4%. This tells us the company became less profitable on a per-share basis as it expanded.

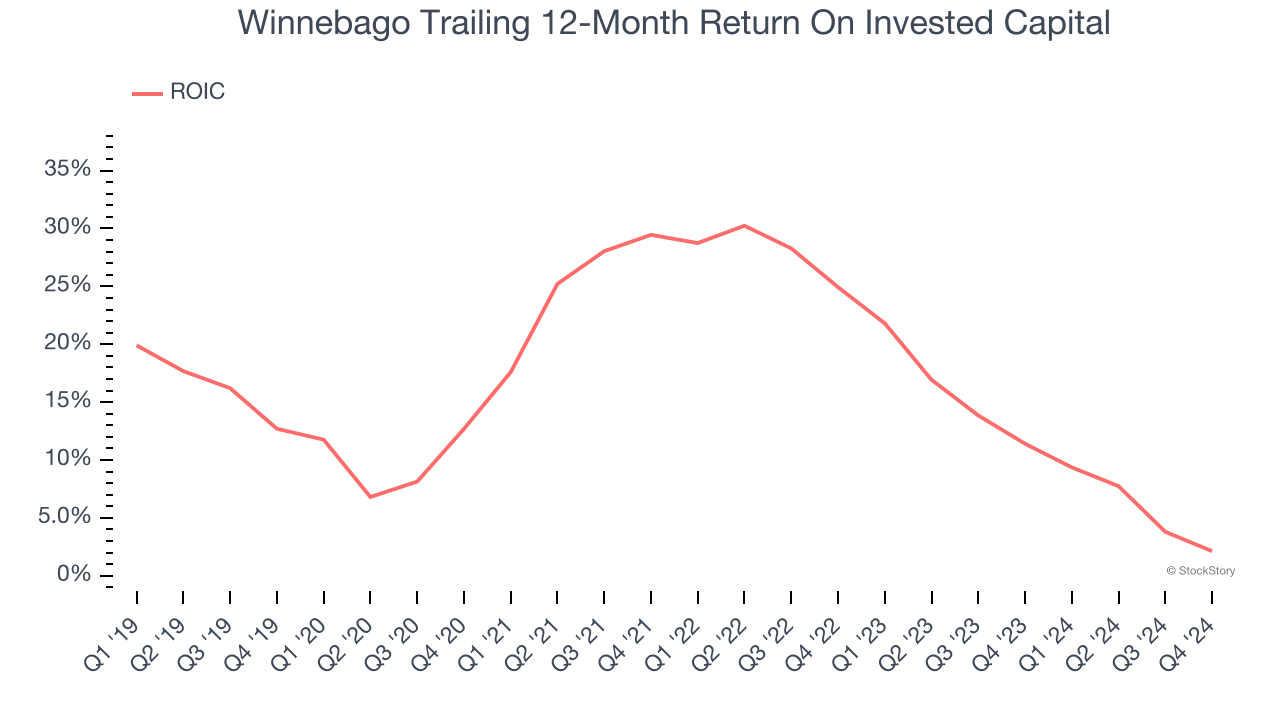

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Winnebago’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Winnebago, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 11.3× forward price-to-earnings (or $44.65 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Winnebago

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.