Let’s dig into the relative performance of Norwegian Cruise Line (NYSE: NCLH) and its peers as we unravel the now-completed Q3 travel and vacation providers earnings season.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 17 travel and vacation providers stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

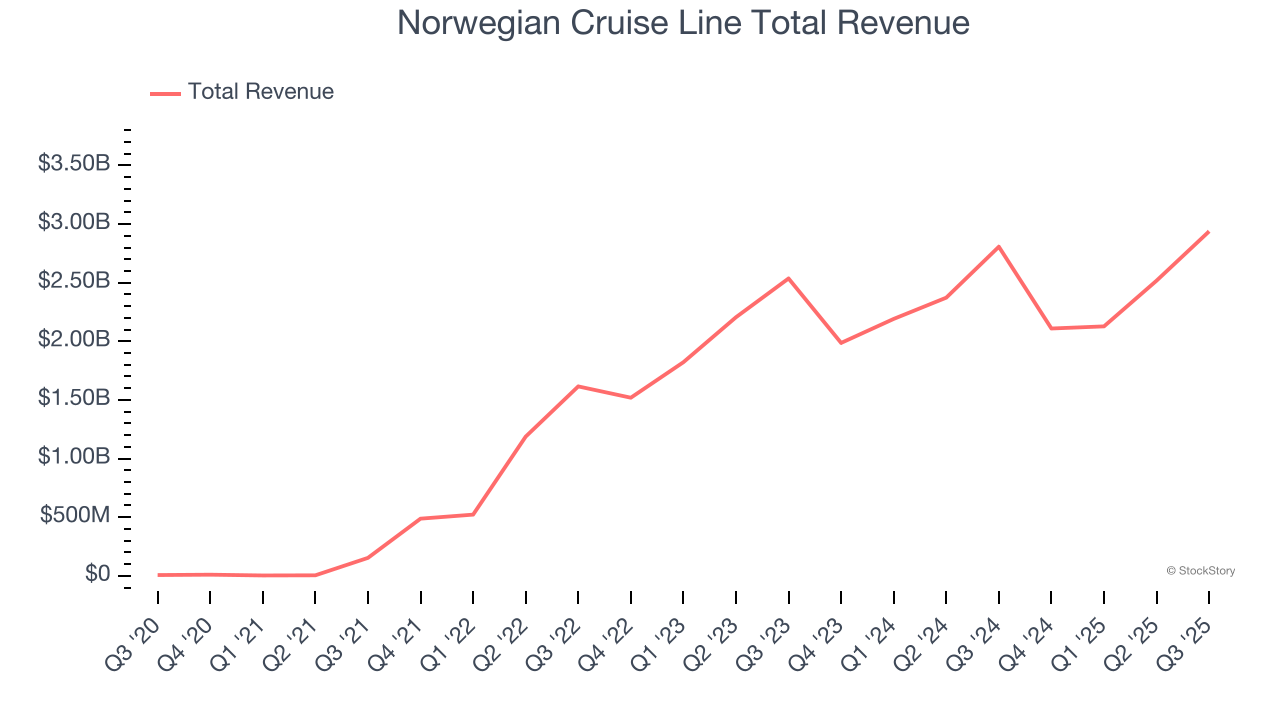

Norwegian Cruise Line (NYSE: NCLH)

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE: NCLH) is a premier global cruise company.

Norwegian Cruise Line reported revenues of $2.94 billion, up 4.7% year on year. This print fell short of analysts’ expectations by 2.7%. Overall, it was a slower quarter for the company with a miss of analysts’ revenue estimates and EBITDA guidance for next quarter missing analysts’ expectations.

“We delivered another record-breaking quarter, with strong performance across all brands. These results highlight the strength of our business, the broad appeal of our multi-brand portfolio, and the outstanding execution by our teams both shoreside and shipboard,” said Harry Sommer, president and chief executive officer of Norwegian Cruise Line Holdings Ltd.

Unsurprisingly, the stock is down 7.4% since reporting and currently trades at $20.54.

Read our full report on Norwegian Cruise Line here, it’s free for active Edge members.

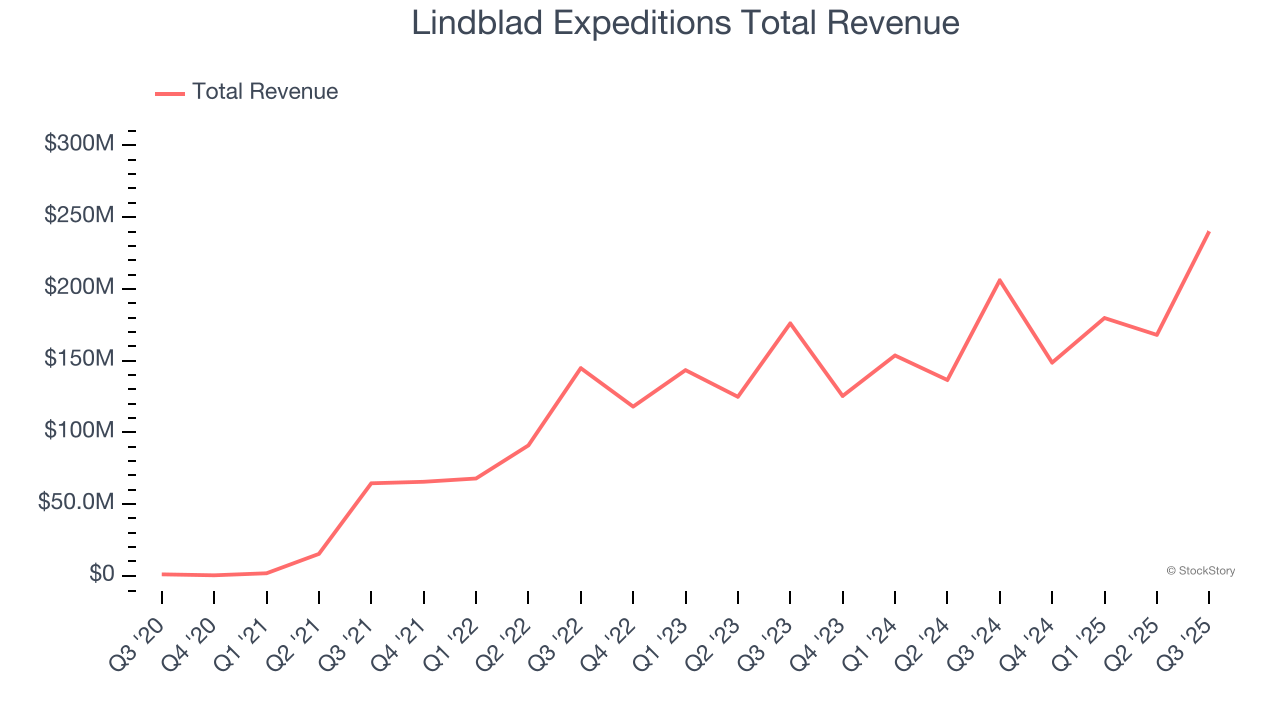

Best Q3: Lindblad Expeditions (NASDAQ: LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $240.2 million, up 16.6% year on year, outperforming analysts’ expectations by 4.6%. The business had a very strong quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Lindblad Expeditions delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 11.1% since reporting. It currently trades at $13.56.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Hilton Grand Vacations (NYSE: HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE: HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.3 billion, flat year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 2% since the results and currently trades at $43.26.

Read our full analysis of Hilton Grand Vacations’s results here.

American Airlines (NASDAQ: AAL)

One of the ‘Big Four’ airlines in the US, American Airlines (NASDAQ: AAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

American Airlines reported revenues of $13.69 billion, flat year on year. This result met analysts’ expectations. Overall, it was a very strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The stock is up 23.7% since reporting and currently trades at $14.95.

Read our full, actionable report on American Airlines here, it’s free for active Edge members.

Hyatt Hotels (NYSE: H)

Founded in 1957, Hyatt Hotels (NYSE: H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.79 billion, up 9.6% year on year. This number lagged analysts' expectations by 1.7%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ EPS estimates and full-year EBITDA guidance missing analysts’ expectations.

The stock is up 17% since reporting and currently trades at $161.40.

Read our full, actionable report on Hyatt Hotels here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.