Satellite communications provider reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 6.7% year on year to $226.9 million. Its GAAP profit of $0.35 per share was 37.2% above analysts’ consensus estimates.

Is now the time to buy Iridium? Find out by accessing our full research report, it’s free for active Edge members.

Iridium (IRDM) Q3 CY2025 Highlights:

- Revenue: $226.9 million vs analyst estimates of $223.2 million (6.7% year-on-year growth, 1.7% beat)

- EPS (GAAP): $0.35 vs analyst estimates of $0.26 (37.2% beat)

- Adjusted EBITDA: $136.6 million vs analyst estimates of $125.5 million (60.2% margin, 8.9% beat)

- EBITDA guidance for the full year is $497.5 million at the midpoint, above analyst estimates of $492.7 million

- Operating Margin: 30.9%, up from 25.8% in the same quarter last year

- Subscribers: 1.99 million

- Market Capitalization: $2.09 billion

"We continue to execute with discipline, focusing efforts on growth markets where our unique network delivers a competitive advantage, specifically in government, regulated industries, and critical infrastructure," said Matt Desch, CEO of Iridium.

Company Overview

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ: IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $871.7 million in revenue over the past 12 months, Iridium is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

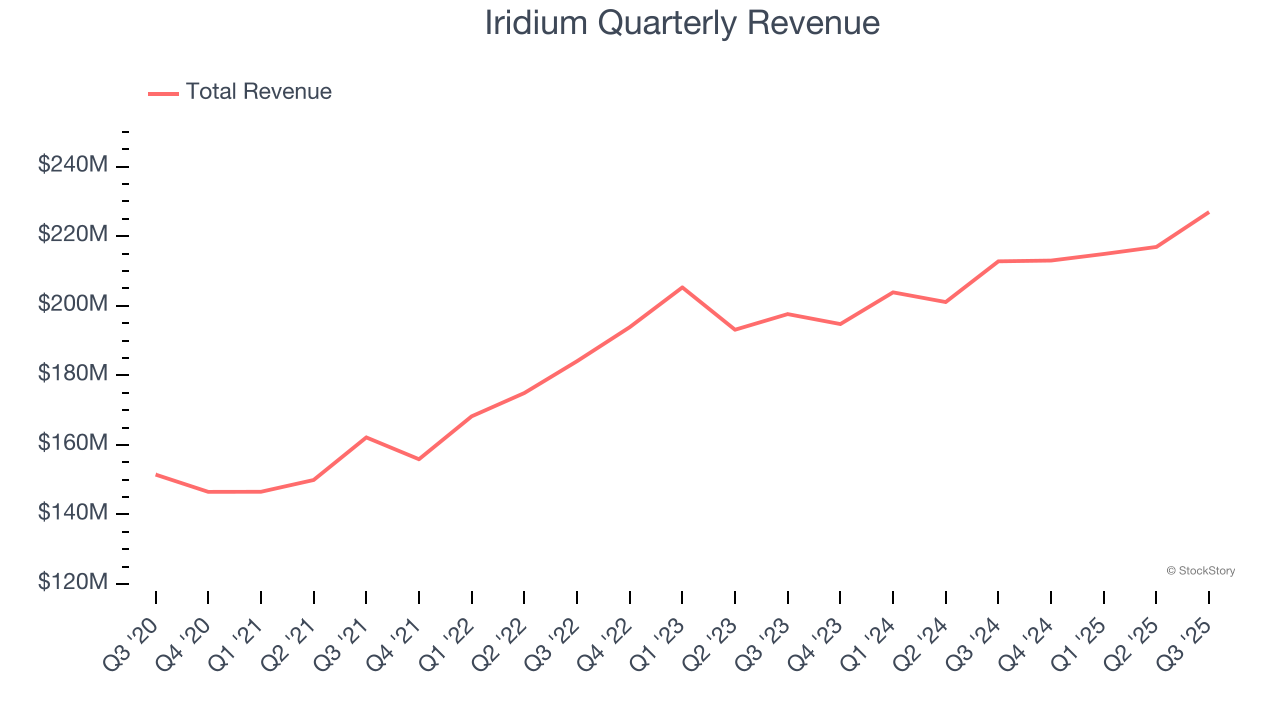

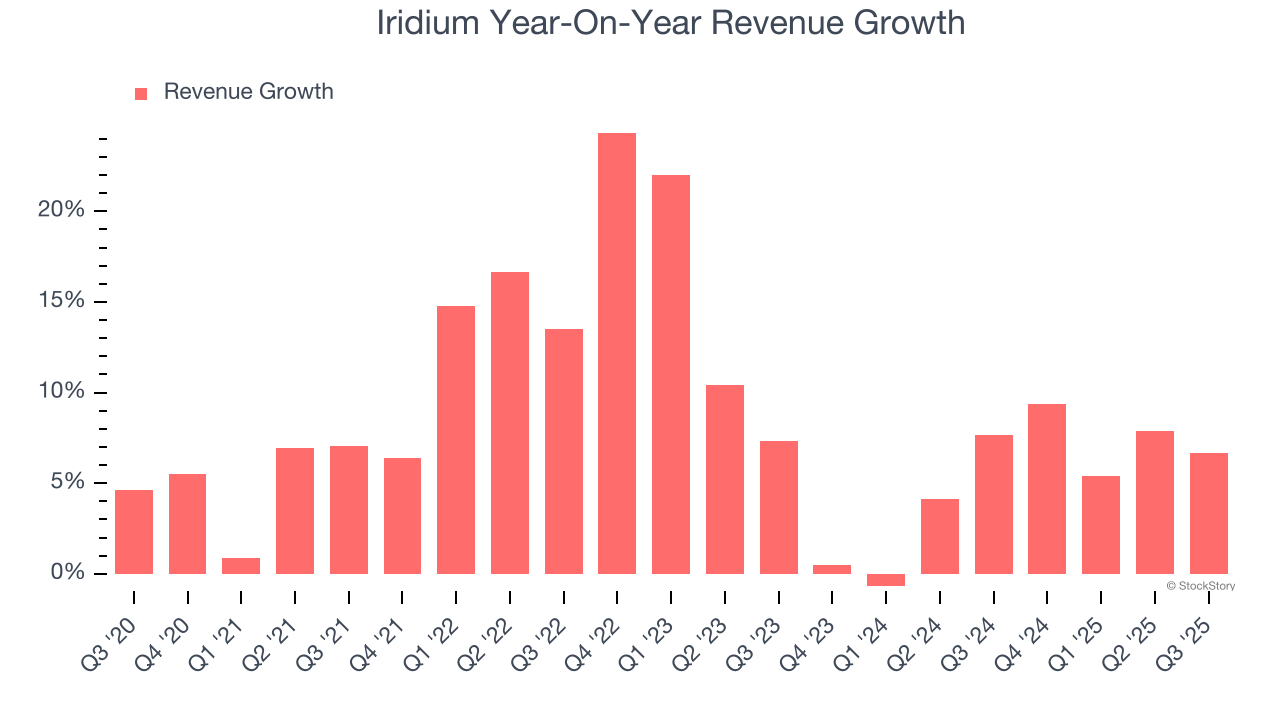

As you can see below, Iridium’s 8.6% annualized revenue growth over the last five years was solid. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Iridium’s annualized revenue growth of 5.1% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Iridium reported year-on-year revenue growth of 6.7%, and its $226.9 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

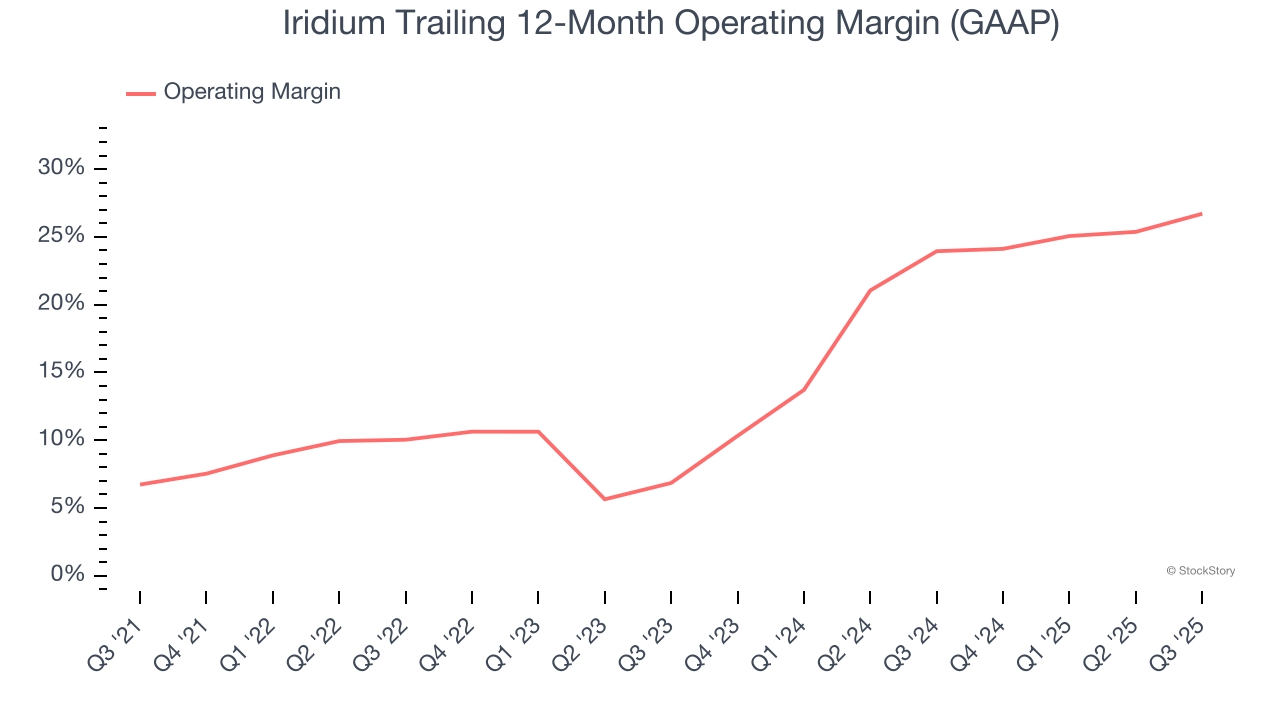

Iridium has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.7%.

Looking at the trend in its profitability, Iridium’s operating margin rose by 20 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Iridium generated an operating margin profit margin of 30.9%, up 5.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

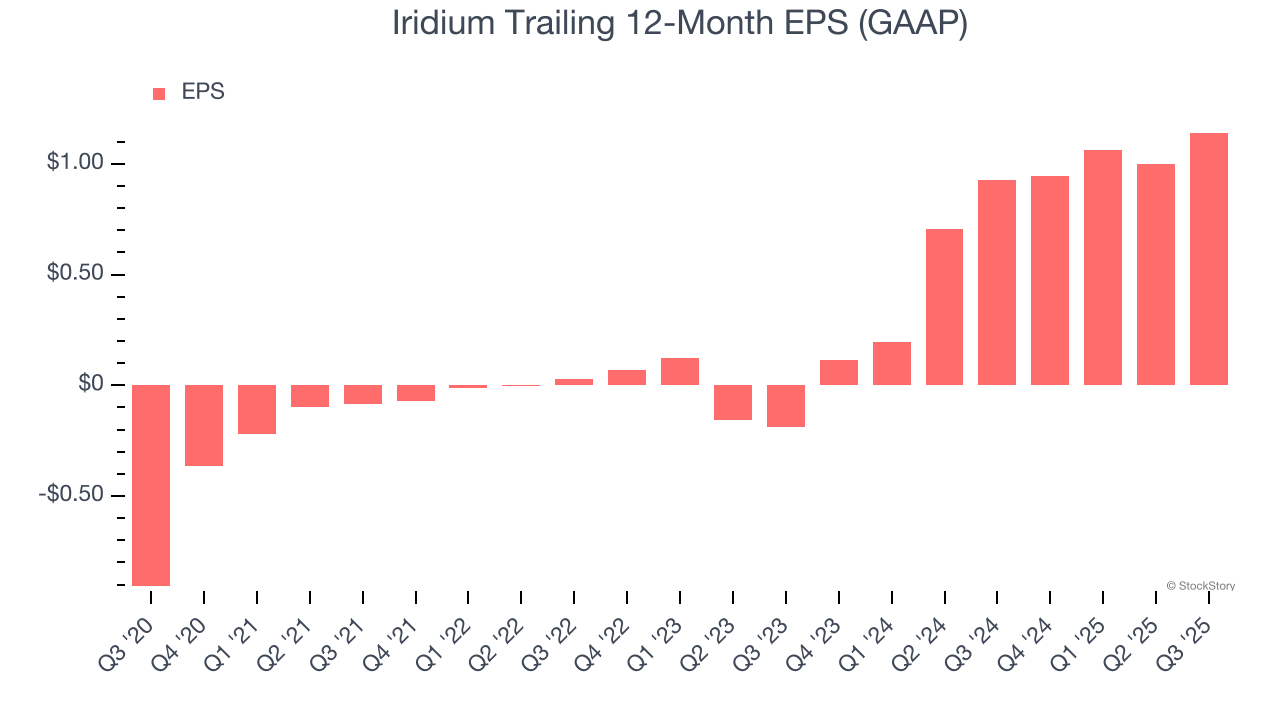

Iridium’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Iridium, its two-year annual EPS growth of 185% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Iridium reported EPS of $0.35, up from $0.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Iridium’s full-year EPS of $1.14 to shrink by 11%.

Key Takeaways from Iridium’s Q3 Results

It was good to see Iridium beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. Investors were likely hoping for more, and shares traded down 3.5% to $19.01 immediately after reporting.

Is Iridium an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.