Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Hamilton Lane (NASDAQ: HLNE) and its peers.

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

The 12 custody bank stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 1.3%.

While some custody bank stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

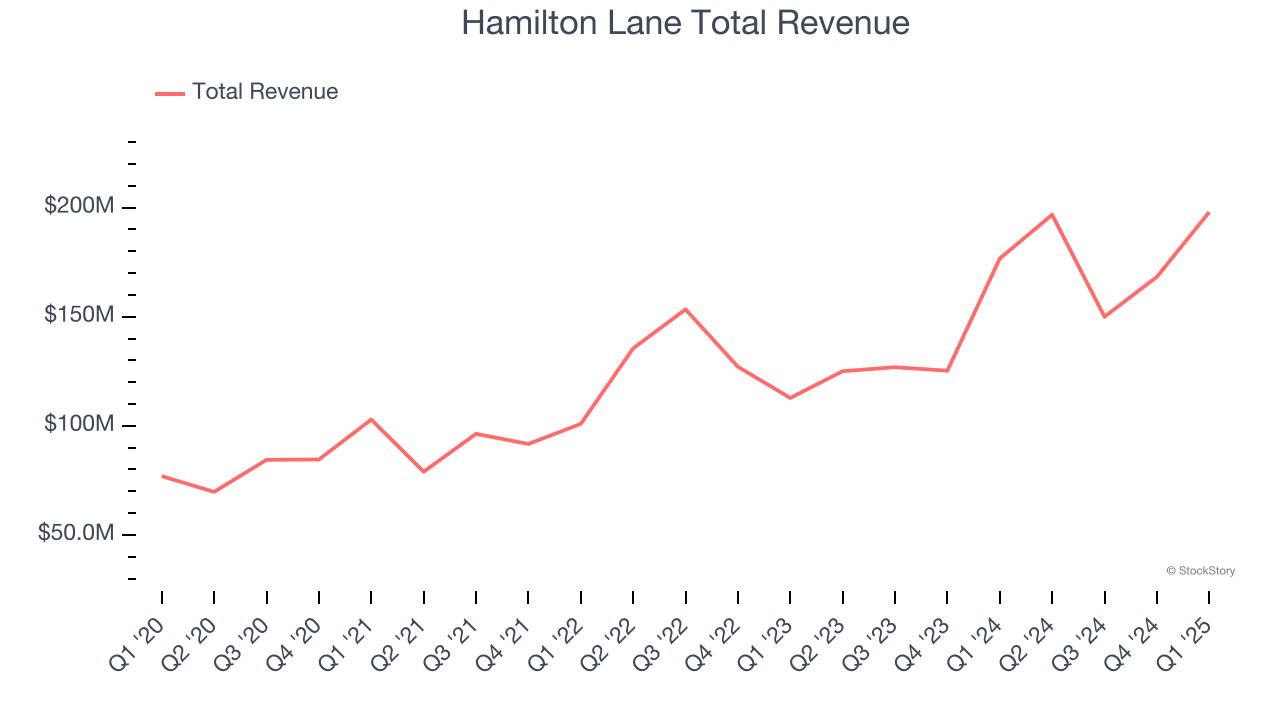

Hamilton Lane (NASDAQ: HLNE)

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

Hamilton Lane reported revenues of $198 million, up 12.1% year on year. This print exceeded analysts’ expectations by 20.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

Hamilton Lane achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 33.9% since reporting and currently trades at $115.90.

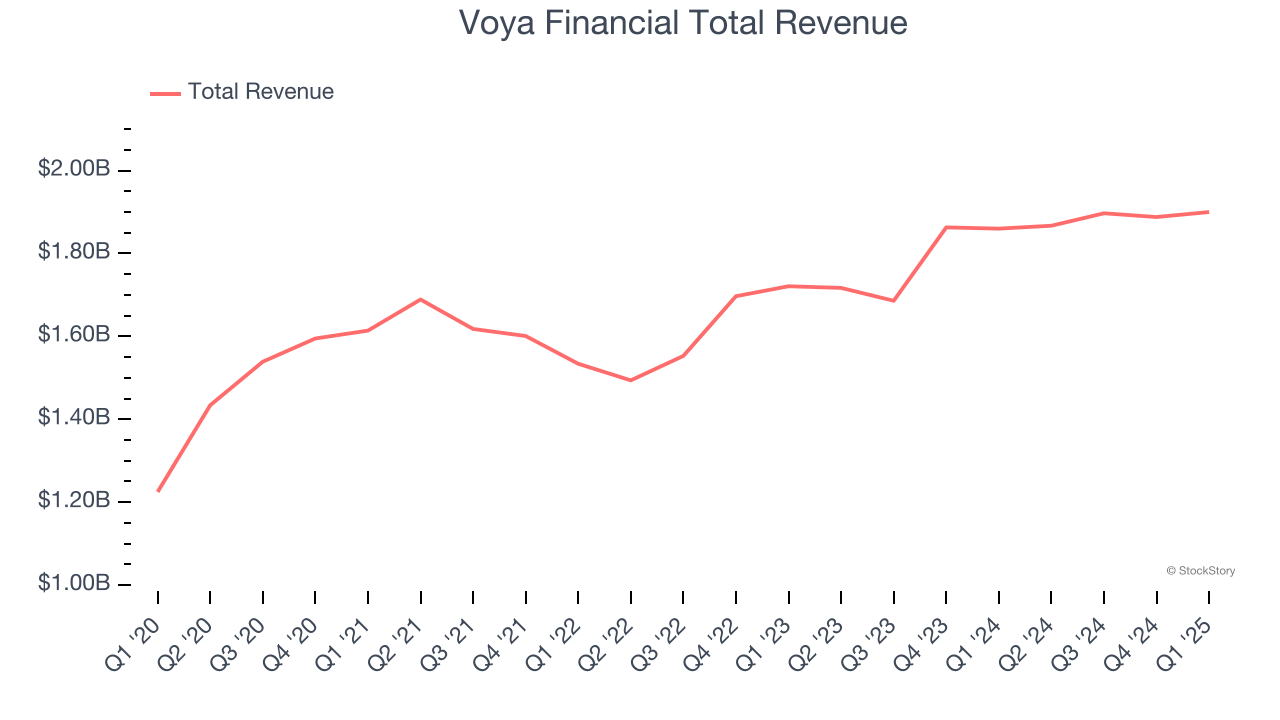

Best Q1: Voya Financial (NYSE: VOYA)

Originally spun off from Dutch financial giant ING in 2013 and rebranded with a name suggesting "voyage," Voya Financial (NYSE: VOYA) provides workplace benefits and savings solutions to U.S. employers, helping their employees achieve better financial outcomes through retirement plans and insurance products.

Voya Financial reported revenues of $1.9 billion, up 2.2% year on year, outperforming analysts’ expectations by 13.5%. The business had a stunning quarter with a solid beat of analysts’ revenue and AUM estimates.

The market seems happy with the results as the stock is up 7% since reporting. It currently trades at $72.60.

Is now the time to buy Voya Financial? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q1: Franklin Resources (NYSE: BEN)

Operating under the widely recognized Franklin Templeton brand since 1947, Franklin Resources (NYSE: BEN) is a global investment management organization that offers financial services and solutions to individuals, institutions, and wealth advisors worldwide.

Franklin Resources reported revenues of $1.59 billion, down 3.7% year on year, falling short of analysts’ expectations by 18.8%. It was a softer quarter as it posted a significant miss of analysts’ revenue and EPS estimates.

Franklin Resources delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 6.1% since the results and currently trades at $22.50.

Read our full analysis of Franklin Resources’s results here.

Affiliated Managers Group (NYSE: AMG)

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE: AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

Affiliated Managers Group reported revenues of $493.2 million, down 1.4% year on year. This print missed analysts’ expectations by 2.8%. It was a slower quarter as it also recorded a miss of analysts’ revenue estimates.

The stock is up 9.6% since reporting and currently trades at $230.78.

Ameriprise Financial (NYSE: AMP)

Founded in 1894 and spun off from American Express in 2005, Ameriprise Financial (NYSE: AMP) provides financial planning, wealth management, asset management, and insurance products to help individuals and institutions achieve their financial goals.

Ameriprise Financial reported revenues of $4.34 billion, up 3.9% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also logged a narrow beat of analysts’ EPS estimates but a slight miss of analysts’ Asset Management segment estimates.

The stock is down 10.6% since reporting and currently trades at $479.19.

Read our full, actionable report on Ameriprise Financial here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.