In the wake of the most heavily traded political event in history, a landmark study from Vanderbilt University has sent shockwaves through the burgeoning prediction market industry. The report, titled "Prediction Markets? The Accuracy and Efficiency of $2.4 Billion in the 2024 Presidential Election," reveals a startling inverse relationship between raw capital and predictive precision. While the 2024 cycle saw billions of dollars flow into contracts on a potential Trump-Harris matchup, the massive liquidity often cited as the primary strength of these markets appears to have been their greatest vulnerability.

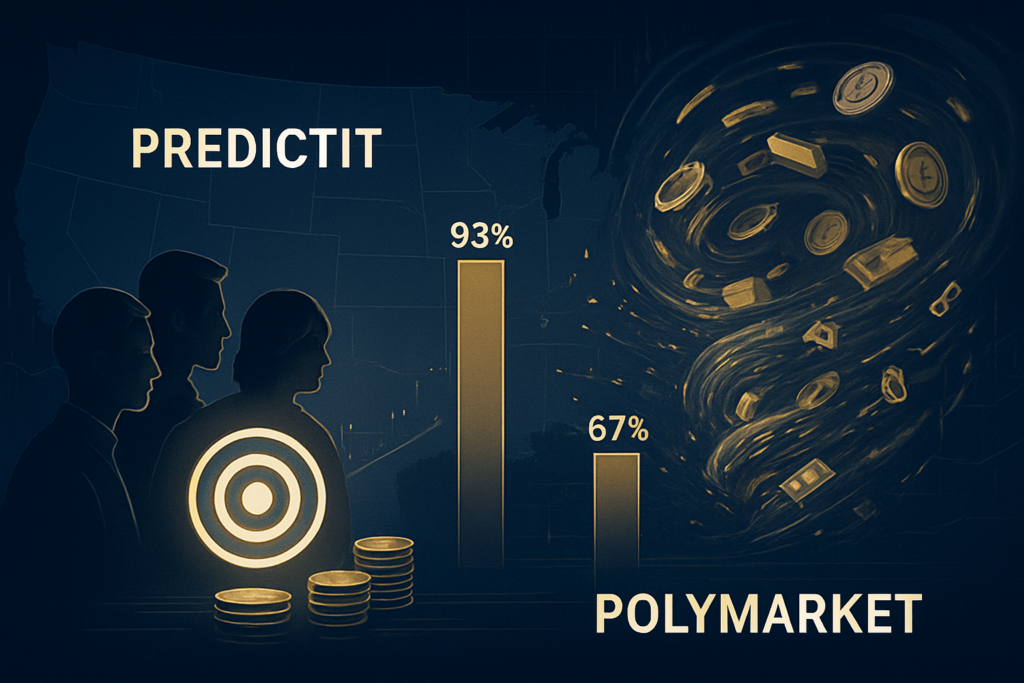

The study, led by Joshua D. Clinton and TzuFeng Huang, analyzed over 2,500 political contracts across the final five weeks of the campaign. It found that PredictIt, the academic-aligned platform known for its stringent $850 individual betting limit, achieved a staggering 93% accuracy rate on Election Eve. This outperformed the federally regulated Kalshi (78%) and the decentralized volume-leader Polymarket (67%), the latter of which became a global phenomenon for its nine-figure "whale" positions but struggled to separate signal from noise.

The Market: What's Being Predicted

The focus of the Vanderbilt research was the 2024 U.S. Presidential Election, a cycle that transformed prediction markets from niche hobbies into mainstream financial instruments. The primary contracts involved the winner of the Presidency, individual state outcomes, and control of the House and Senate. By November 2024, Polymarket had recorded over $2.4 billion in total volume on its primary presidential winner contract, while Kalshi, which recently gained legal clearance to offer election betting, saw its volume surge in the final weeks following a partnership with Robinhood (Nasdaq: HOOD).

Prices on these exchanges function as implied probabilities: a contract trading at $0.52 indicates a 52% consensus chance of an event occurring. Throughout the cycle, these odds fluctuated wildly. In October 2024, Polymarket prices famously diverged from traditional polling, at one point giving Donald Trump a 67% chance of victory while national polls remained within the margin of error. This divergence created massive arbitrage opportunities—situations where traders could bet on opposite outcomes across different platforms to lock in a guaranteed profit—which Vanderbilt researchers found peaked just days before the vote.

Why Traders Are Betting

The 2024 election was characterized by a fundamental clash between "data-driven" traders and "sentiment-driven" whales. On Polymarket, a single anonymous French trader, dubbed the "Théo" whale, reportedly wagered over $30 million on a Republican sweep. This outsized position single-handedly shifted the platform's odds, a move that researchers now believe contributed to Polymarket's lower 67% accuracy rating by creating a "feedback loop" of artificial confidence.

Conversely, PredictIt’s success is being attributed to its "enforced diversity." Because no single user can risk more than $850 on a single contract, the price is determined by the collective wisdom of thousands of unique participants rather than a handful of deep-pocked speculators. This structure effectively neutralized the impact of institutional influence from players like Interactive Brokers (Nasdaq: IBKR), which launched its own ForecastEx exchange to cater to high-net-worth hedgers. While traditional forecasting methods like polling struggled with non-response bias, the Vanderbilt study suggests that markets with lower entry barriers and tighter limits may actually provide a "purer" signal.

Broader Context and Implications

The Vanderbilt findings arrive at a critical juncture for the industry. The perceived accuracy of prediction markets has led to major media integration, with real-time odds now a staple of coverage on CNBC, owned by Comcast (Nasdaq: CMCSA), and CNN, owned by Warner Bros. Discovery (Nasdaq: WBD). However, the 26-point accuracy gap between PredictIt and Polymarket suggests that these media outlets may be anchoring their coverage to the wrong data sets.

Furthermore, the study highlights a failure in market efficiency. Theoretically, if the same event is being predicted on two different platforms, the prices should be identical. Vanderbilt found this was rarely the case. The lack of correlation between platforms suggests that traders were often reacting to internal "social media vibes" rather than external political developments. This has already triggered a regulatory response in Washington. Following reports of potential insider trading on international events, Representative Ritchie Torres introduced the "Public Integrity in Financial Prediction Markets Act of 2026," which seeks to restrict government officials from participating in these markets to prevent information asymmetry.

What to Watch Next

As we move toward the 2026 midterm elections, the industry is undergoing a massive consolidation. DraftKings Inc. (Nasdaq: DKNG) and Flutter Entertainment (NYSE: FLUT), the parent of FanDuel, are reportedly exploring the integration of event contracts directly into their sports betting apps, which would introduce tens of millions of new users to the ecosystem. The key question for 2026 is whether these platforms will adopt the "whale-friendly" model of Polymarket or the "capped-signal" model of PredictIt.

The next major milestone for the industry will be the first quarterly report from the Commodity Futures Trading Commission (CFTC) under its new oversight framework. This report is expected to address the "Vanderbilt Gap" and could potentially lead to new rules regarding maximum position sizes for political contracts. Investors should also monitor the stock performance of Intercontinental Exchange (NYSE: ICE), which has a strategic stake in the infrastructure powering these markets, as a bellwether for institutional confidence in the sector.

Bottom Line

The Vanderbilt University study serves as a sobering reality check for the "liquidity is king" mantra. The 93% accuracy of PredictIt proves that a well-designed market with restricted participation can significantly outperform a multi-billion-dollar global pool dominated by speculative capital. It suggests that for prediction markets to fulfill their promise as a superior forecasting tool, they must prioritize the breadth of their participant base over the depth of their order books.

As we look toward the 2026 and 2028 cycles, the "Vanderbilt Gap" will likely define the debate over market regulation and design. For now, the takeaway is clear: if you want to know who will win an election, look to the market where the many bet a little, rather than the market where the few bet a lot. The $2.4 billion experiment of 2024 has shown that in the world of high-stakes forecasting, volume is no substitute for variety.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets. Visit the PredictStreet website at https://www.predictstreet.ai/.