Hoist Capital Corp. (TSXV: HTE.P) ("Hoist") and The Hempshire Group, Inc. ("Hempshire" or the "Company"), a private, non-tobacco and non-nicotine smokable alternatives company based out of Palm Springs, California and incorporated under the laws of the State of Wyoming, are pleased to announce that they have entered into a definitive merger agreement dated December 5, 2021 (the "Agreement") providing for a business combination transaction.

Pursuant to the Agreement, Hoist will: (i) acquire each issued and outstanding common share in the capital of Hempshire (each, a "Hempshire Share") in exchange for the issuance of 26.0 common shares in the capital of Hoist ("Hoist Shares") at a deemed price of C$0.10 per Hoist Share (prior to giving effect to the Consolidation (as defined below)); and (ii) complete a business combination with Hempshire (collectively, the "Transaction"). The Transaction will constitute Hoist's Qualifying Transaction, as such term is defined under Policy 2.4 of the Corporate Finance Manual of the TSX Venture Exchange (the "Exchange"). Hoist is at arm's length to Hempshire. The Transaction is subject to the completion of a non-brokered private placement of units ("Units") of Hempshire at a price of C$2.05 per Unit for minimum gross proceeds C$3.0 million and maximum gross proceeds of C$5.0 million (the "Private Placement") and customary closing conditions, including approval by the Exchange.

Resulting Issuer

Upon completion of the Transaction, the resulting issuer created from the combination of Hoist and Hempshire (the "Resulting Issuer") will be positioned to become a market leader of non-tobacco and non-nicotine smokable alternative products, and will continue the business currently carried on by Hempshire as a Tier 2 Life Sciences issuer under the policies of the Exchange.

The Resulting Issuer will be led by the existing management team of Hempshire, consisting of the following individuals: Martin Marion (President, Chief Executive Officer and Director); Eric Starr (Chief Marketing Officer); and Tom Shuman (Chief Operating Officer). Upon completion of the Transaction, the Resulting Issuer's board of directors will be comprised of Martin Marion, Jeff Ragovin, Gail Hannon and Samuel Isaac.

Hempshire's leadership team includes senior executives who have been instrumental in building iconic, global brands, and who have unique expertise in advertising, marketing, strategic and competitive advantage, and operations in both direct to consumer ("D2C") and business to business ("B2B") markets.

Corporate Overview and Strategy

Incorporated in 2019, Hempshire formulates and markets its own proprietary brands under the MOUNTAIN® Smokes brand name, including MOUNTAIN® Originals cannabidiol hemp smokes ("CBD Hemp Smokes") with <0.3% THC, and MOUNTAIN® Zeros™ CBD Hemp Smokes with non-detectible, <0.0001% THC, and has additional proprietary brands under development. Hempshire also provides private white-labelling services and contract manufacturing services, through its partners, for significant non-owned CBD Hemp Smoke brands in the United States and internationally.

Hempshire's products are now being distributed internationally in Switzerland and South Africa. The Company has received its first purchase order from New Zealand and is in discussions for distribution in multiple additional jurisdictions, including Puerto Rico, Australia, Mexico, the United Kingdom and multiple countries within the European Union and South and Central America.

Management Team of the Resulting Issuer

Upon the completion of the Transaction, the management team of the Resulting Issuer is expected to include the following individuals:

Martin Marion, President, Chief Executive Officer and Director, from Irvine, California, is a former senior executive of Grey Advertising / Grey Direct and D'Arcy Masius Benton & Bowles (DMB&B), two leading ad agencies. Martin has over 35 years' experience as an executive consultant to many global brands, advising clients in product launch and go-to-market competitive strategy, principally in the consumer packaged goods ("CPG"), retail, health products and digital e-commerce arenas. He has expertise in health product and CPG brand positioning, product launch and competitive advantage strategy.

Eric Starr, Chief Marketing Officer, from Los Angeles, California, has over 17 years of marketing and branding experience. He worked for Apple Inc.'s ad agency as Creative Strategy Director at Media Arts Lab, helping launch the iPod, build the Mac brand, and introduce the iPhone and iPad. His work received honors, including the ad campaigns: "I'm a Mac, I'm a PC", which received "Campaign of the Decade", iPod Silhouettes which received "Outdoor Campaign of the Decade", and the agency Eric worked for won the honor of "Agency of the Decade".

Tom Shuman, Chief Operating Officer, from Dallas, Texas, brings more than 30 years of experience leading CPG sales and marketing teams, both as a founder and executive in various roles. He has extensive experience working across the full sales chain, including with brokers, distributors, wholesalers and retailers, for companies such as Procter & Gamble, Coca-Cola and Dr Pepper/SevenUp.

Hempshire was founded by Dan Iannotte, a veteran in the hemp and cannabis industry with over 30 years of experience. His knowledge and understanding of the industry provide Hempshire the ability to procure the highest quality supply inputs and curate products that provide users a very desired and pleasurable experience. Mr. Iannotte holds approximately 56% of the outstanding Hempshire Shares.

Hempshire is currently in discussion with numerous candidates to fulfill the position of Chief Financial Officer and will be in a position to announce the appointment of a Chief Financial Officer contemporaneous with the completion of the Transaction.

Hempshire Products

The Company's first product line, branded under the MOUNTAIN® Originals label, consists of 20 SKUs which include Natural, Mint Squeeze™ and Pineapple Squeeze™ flavors, and have varying levels of CBD content. The product contains only organic hemp flower, organic mullein, and organic sage, with no fillers, preservatives or added chemicals. MOUNTAIN® Smokes looks, feels, burns, and are packaged just like a tobacco cigarette, providing all the ritual pleasures that cigarette smokers have become accustomed to, but without the harmful effects and addictive properties of tobacco and nicotine, and without any additives or chemical preservatives. Hempshire encourages consumers and investors to do their own consumption experience comparative taste tests against other competing products and alternatives.

Hempshire has also recently introduced the MOUNTAIN® Zeros™ line, a CBD Hemp Smoke with a non-detectable (<0.0001%) THC level, and has additional CBD Hemp Smokes under research and development with varying levels of CBD, as well as an herbal smokable line to address the range of regulations of smokable alternatives to tobacco and nicotine in jurisdictions around the world. 15 SKUs of various MOUNTAIN® Zeros™ flavor and size combinations are being introduced worldwide. MOUNTAIN® Zeros™ will also be launched in the United States, for those who may desire a CBD Hemp Smoke without the risk of testing positive for THC.

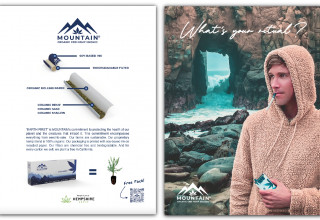

Omni-channel organic marketing and data-driven and strategically placed paid advertising, combined with influencer and social media engagement, are key drivers for Hempshire as it looks to offer a better alternative to millions of tobacco cigarette smokers, e-cigarette and vape users, and consumers of CBD. To date, the Company's MOUNTAIN® Smokes products have been displayed in social media posts from hundreds of significant influencers in the music, TV/film, and social media industries. These posts have been made without any paid endorsements. MOUNTAIN® Smokes was also the first smokable product to be advertised in a national or international publication since big tobacco was banned by the United States Congress in 1970 and is the first hemp brand to be advertised on a national magazine publication in the United States.

MOUNTAIN® Smokes appeared in a four-page cover wrap of FORTUNE magazine's June 2021 edition, as shown below, with its "This Is Not A Cigarette™" campaign.

The Company's products are sold D2C through its MountainSmokes.com website, which is currently undergoing a complete rebuild to become a fully featured, conversion-optimized e-commerce site that enhances the customer experience, introduces the MOUNTAIN® Zeros™ product line, launches a significant loyalty rewards program, and incorporates a private portal for wholesaler, distributor and retailer sales.

In addition to D2C marketing, Hempshire places a significant emphasis on B2B through wholesale distributors and retailers in the United States and worldwide, with a particular focus on retail convenience stores ("C-stores"), smoke shops and dispensaries. Hempshire is also an officially recommended vendor of choice in the new products category with AATAC, one of the United States' largest trade associations for independent convenience stores and gas stations, with a network of over 80,000 C-store locations.

Hempshire has established the foundation and infrastructure to become a global leader in the non-tobacco and non-nicotine smokable alternatives market.

Target Markets

The Company has identified and is targeting three specific current global market segments with an aggregate annualized spend of over C$1.0 trillion, in addition to an emerging international market for CBD and herbal inhalable products.

1. US$932.1 Billion Global Tobacco Market.[1]

Hempshire smokables offer tobacco cigarette smokers the same familiar consumption experience and rituals that have contributed to the massive personal and social appeal of smoking - they look, feel, burn and are smoked like a tobacco cigarette, are packaged in the same familiar foil and carton and, in most jurisdictions, can be sold wherever tobacco cigarettes are available. However, they contain absolutely no tobacco and no nicotine, they are non-addictive, they are made from 100% organic ingredients, they typically have a lower retail price, and users appreciate the healthier alternative of CBD in Hempshire's MOUNTAIN® Smokes CBD Hemp Smokes.

The tobacco market is of particular interest and significance to Hempshire due to its immense size, shifting user preferences, and tightening governmental regulations. These shifts are highlighted in the following statement taken from British American Tobacco's website in September 2021:

"Generational differences and shifts in taste are continuing to emerge, as health and wellness become ever-more important. We anticipate growth in new categories of products, including - and beyond - tobacco and nicotine. Consumers expect these to provide stimulation and pleasure, in ways previously associated with cigarettes. We believe such growth will offset the predicted decline in cigarette consumption."

The Company believes the non-tobacco smokable alternatives category, and Hempshire as a result, will benefit greatly from the changing paradigm in the traditional tobacco-smoker market.

2. US$12.4 Billion Global E-Cigarette and Vape Market.[2]

Demand for e-cigarettes and vapes has grown due to studies presenting these nicotine-based products as a safer alternative to traditional cigarettes and a social association psychology around vaping. With a projected CAGR of over 23%2 through 2027, this market is driven by a younger generation than traditional cigarette smokers. However, local authorities in multiple countries continue to restrict vaping and flavored nicotine-based vape juice, presenting a significant opportunity for Hempshire's smokable alternatives. Hempshire's MOUNTAIN® Smokes provide e-cigarette and vape users the same hand-to-mouth experience, are also available in multiple flavors, and can be sold in the same convenient locations, but they do not contain addictive nicotine or other harmful chemicals, are less costly, and more environmentally friendly.

3. US$2.8 Billion Global CBD Market.[3]

The global CBD market is expected to expand at a compound annual growth rate of 21% from 2021 to 20283 due to its strong demand for health and wellness purposes and increasing government acceptance. Hempshire's CBD Hemp Smokes provide consumers seeking CBD a form of consumption that has relatively low cost per CBD dose and is more bioavailable than most topicals and ingestibles.

Hempshire has partnered with certain service providers, including multiple organic hemp farmers in the United States who practice strictly organic farming and are in full compliance with the United States' Agriculture Improvement Act of 2018 (the "USDA 2018 Farm Bill"), to secure a continuous supply of the finest quality organic CBD-rich hemp flower and to provide manufacturing and packaging services. This has allowed, and is expected to continue to allow, Hempshire to scale with minimal additional capital investment. Hempshire currently has access to manufacturing capacity of 1,500,000 smokes per day, with the capacity to scale rapidly with minimal additional capital expense.

The desired result is to drive a high gross margin for Hempshire while honoring its commitment to using high quality plant material and genetics, as opposed to using by-product or undesirable remnants of processed plants to create a low-cost product.

Environmental sustainability and social responsibility have been guiding principles for Hempshire since inception. Its 'Earth First' approach to business encompasses everything from "seed-to-sale". Hempshire has always sourced ingredients grown under organic protocols to ensure that nutrient run-off does not harm ecological systems and that each farm employs their own organic-based fertilizer program without introducing synthetic nutrients, heavy metals or pesticides. Hempshire's cartons, and most filters, are biodegradable, its printing uses soy-based ink, and its biodegradable tubes are derived from organic rolling paper.

The USDA 2018 Farm Bill resulted in the exclusion of hemp and its constituents (with <0.3% THC) from the definition of marijuana and its removal from the United States' Controlled Substances Act. CBD-rich hemp products grown to the regulatory required standards are not known to have any psychoactive effects.

The Resulting Issuer will not produce or sell medicinal or recreational cannabis or products derived from high-THC cannabis plants. The Resulting Issuer will only sell hemp-derived products which conform to the regulatory framework in the United States on a state-by-state basis and is creating multiple alternative formulations to meet the legal regulatory limits of THC and CBD in multiple jurisdictions internationally.

Private Placement

Hempshire will complete the non-brokered Private Placement of up to 2,439,025 Units at a price of C$2.05 per Unit concurrent with, and conditional on, the completion of the Transaction, which is anticipated to occur in February 2022.

Each Unit will be comprised of one Hempshire Share and one Hempshire Share purchase warrant (each, a "Hempshire Warrant"). Each Hempshire Warrant will entitle the holder thereof to acquire one Hempshire Share for an exercise price of C$4.00 per Hempshire Share at any time up to two years following the date of issue, provided that if, at any time prior to the expiry date of the Hempshire Warrants, the volume weighted average trading price of the Hempshire Shares on such principal exchange on which the Hempshire Shares are listed is greater than C$8.00 for twenty (20) consecutive trading days, Hempshire may, within ten (10) business days of the occurrence of such event, deliver a notice to the holders of Hempshire Warrants accelerating the expiry date of the Hempshire Warrants to the date that is thirty (30) days following the date of such notice (the "Accelerated Exercise Period"). Any unexercised Hempshire Warrants will automatically expire at the end of the Accelerated Exercise Period.

The Private Placement will not result in the creation of a new control person of the Resulting Issuer. No finder's fee or commission is payable in respect of the Private Placement.

The net proceeds of the Private Placement will be used to fund marketing and sales initiatives and for working capital requirements and other general corporate purposes of the Resulting Issuer.

Sponsorship

Hoist expects that the Transaction will be exempt from the sponsorship requirement of the Exchange, or that a waiver will be available. However, there is no assurance that an exemption or waiver from the sponsor requirement can or will be obtained.

Board of Directors of the Resulting Issuer

Upon the completion of the Transaction, the board of directors of the Resulting Issuer is expected to include Martin Marion and the following independent directors:

|

Jeff Ragovin East Hampton, NY |

Jeff is the Chief Commercial Officer for Fyllo, the leader in compliance-first solutions for highly regulated industries. Previously, Jeff was the co-founder and Chief Strategy Officer of Buddy Media, which was acquired by Salesforce for US$745 million. He then acted as Salesforce's Chief Strategy Officer. Jeff is also the founder of Ragovin Ventures. |

|

Gail Hannon Calgary, AB |

Gail is the V.P. Corporate & Financial Planning with Artis Exploration Ltd., a private oil and gas company. She has over 30 years of diverse accounting and reporting experience having worked in various management and executive roles in the energy industry. Gail obtained her CPA, CMA designation in 1996, and currently serves on the board of directors of Crew Energy Inc., a public oil and gas company listed on the facilities of the Toronto Stock Exchange. |

|

Samuel Isaac Panama City |

Samuel is a Chief Financial Officer who has worked with publicly traded and private equity backed businesses in a multitude of industries, including cannabis. His experience includes managing debt financing arrangements, leading financial reporting teams under IFRS and US GAAP, developing financial planning processes and improving internal controls. He conducted his audit experience at PWC and is a CPA, CA. |

Advisors

Everleaf Capital Corp. is acting as strategic advisor to Hempshire in respect of the Transaction. Stikeman Elliott LLP is acting as legal counsel to Hempshire in respect of the Transaction and Private Placement and will act as counsel to the Resulting Issuer upon completion of the Transaction.

The Transaction

Pursuant to the Transaction:

- each issued and outstanding Hempshire Share (including shares issued pursuant to the Private Placement) shall be exchanged for 26.0 Hoist Shares; and

- each Hempshire Warrant entitling a holder thereof to acquire one Hempshire Share, that is not exercised immediately prior to closing of the Transaction, shall remain outstanding and be adjusted in accordance with paragraph (i) above.

Completion of the Transaction is subject to the satisfaction of a number of conditions, including, but not limited to: (i) all conditions under the Agreement having been satisfied or waived, including the completion of the Private Placement; and (ii) receipt of all other required regulatory, governmental and third party approvals.

In connection with the Transaction, the shareholders of Hoist will be asked to approve, among other things, at a special meeting called for such purpose: (i) a change of the Resulting Issuer's name to "The Hempshire Group, Inc."; and (ii) a consolidation of the common shares of the Resulting Issuer on the basis of one post-consolidation common share for up to every five (5) pre-consolidation Common Shares (the "Consolidation").

Approval of the shareholders of Hoist is not required with respect to the Transaction under the policies of the Exchange. In the event any of the conditions set forth above are not completed or the Transaction does not proceed, Hoist will notify its shareholders.

At closing of the Transaction, Everleaf Capital Corp., an arm's length party to Hoist and Hempshire, will be entitled to receive an advisory fee in the form of Units that is equal to 5% of the equity value of Hempshire under the Qualifying Transaction, plus an additional 200,000 Units.

About Hoist

Hoist, a corporation incorporated under the laws of the Province of Alberta, Canada, operates as a capital pool company under Policy 2.4 of the Exchange. Except as specifically contemplated in Policy 2.4, until the completion of its Qualifying Transaction, Hoist will not carry on business, other than the identification and evaluation of businesses or assets with a view to completing a proposed qualifying transaction.

About The Hempshire Group, Inc.

The current officers and directors of Hempshire are as follows: Martin Marion (President, Chief Executive Officer and Director); Eric Starr (Chief Marketing Officer); Tom Shuman (Chief Operating Officer); and Dan Iannotte (Director).

As of the date of this press release, there are 10,325,800 Hempshire Shares, 292,800 warrants to acquire Hempshire Shares and convertible debentures in the principal amount of $600,000 issued and outstanding. As a group, as at the date hereof, the directors and senior officers of Hempshire own or control, directly or indirectly, 6,739,000 Hempshire Shares, representing approximately 65% of the issued and outstanding Hempshire Shares.

Additional Information

Additional information regarding the Transaction, Hempshire, the Resulting Issuer, the financial statements of Hempshire and pro forma financial statements of the Resulting Issuer after giving effect to the Transaction will be made publicly available in due course under a filing statement to be filed on SEDAR at www.sedar.com. A subsequent press release will also be issued by Hoist in due course to satisfy the remaining requirements under Policy 2.4 to provide for comprehensive disclosure in connection with a Qualifying Transaction.

For additional information please contact:

|

Arif Shivji Phone: 604-842-2743 |

Martin Marion The Hempshire Group, Inc. Phone: 954-480-7046 |

Reader Advisory

Completion of the Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange requirements, majority of the minority shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

This press release is not an offer of the securities for sale in the United States. The securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this news release. The TSX Venture Exchange Inc. does not accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "objective", "ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and similar expressions are intended to identify forward-looking information or statements. More particularly, and without limitation, this news release contains forward-looking statements and information concerning the Transaction, the completion and timing of the Transaction, the Private Placement, the completion and timing of the Private Placement, the use of proceeds of the Private Placement, the Resulting Issuer's corporate strategy, and the anticipated benefits of the Transaction. This news release also contains forward-looking statements and information relating to: the Resulting Issuer's business, strategies, expectations, planned operations and future actions; the Resulting Issuer's intention and ability to grow its business, operations and product offerings, including branded products and private labelling; the competitive conditions of the industry in which the Resulting Issuer will operate and the competitive advantages of the Resulting Issuer; expectations regarding growth rates, growth plans and strategies; the management team and the performance thereof; the Resulting Issuer's commitment to environmental, social and governance principles; the competitive and business strategies of the Resulting Issuer; the Resulting Issuer's operations in the United States, and the characterization and consequences of those operations under federal United States law and applicable State law, and the framework for the enforcement of applicable laws in the United States and internationally; and the general economic, financial market, regulatory and political conditions in which the Resulting Issuer operates.

The forward-looking statements and information are based on certain key expectations and assumptions made by Hoist, including expectations and assumptions concerning: Hoist, Hempshire and the Resulting Issuer; the Private Placement; the Transaction, including the satisfaction of (i) all required regulatory, governmental and third party approvals, and (ii) all other closing conditions in accordance with the terms of the Agreement; the securities markets and general business and economic conditions, including the ongoing impact of COVID-19; the future operations of, and transactions completed by, the Resulting Issuer, including its ability to successfully implement its growth strategies and business plan; the availability of sufficient capital; the availability of financing on reasonable terms; the Resulting Issuer's ability to attract and retain qualified personnel; the Resulting Issuer's ability to protect its intellectual property; the Resulting Issuer's ability to maintain strong business relationships with its customers, suppliers, service providers and other third parties; the Resulting Issuer's ability to keep pace with changing consumer preferences; ongoing ability to conduct business in the regulatory environments in which the Resulting Issuer operates and may operate in the future; and applicable laws not changing in a manner that is unfavorable to the Resulting Issuer. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which have been used.

Although Hoistbelieves that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because Hoistcan give no assurance that they will prove to be correct. By its nature, such forward-looking information is subject to inherent risks and uncertainties, which could cause the actual results and expectations to differ materially from the anticipated results or expectations expressed. Without limitation, these risks and uncertainties include: the parties being unable to obtain Exchange approval; risks associated with the cannabis or hemp industries in general; the size of the emerging industrial hemp market; constraints on marketing products; risks inherent in the agricultural business; actions and initiatives of federal and provincial governments and changes to government policies and the execution and impact of these actions, initiatives and policies; the Resulting Issuer's interpretation of and changes to federal and state laws pertaining to hemp; incorrect interpretation of the United States' Agricultural Improvement Act of 2018; international regulatory risks; uncertainty caused by potential changes to regulatory framework; regulatory approval and permits; environmental, health and safety laws; anti-money laundering laws and regulations; banking matters; ability to access public and private capital and banking services; denial of deductibility of certain expenses; liability for actions of employees, contractors and consultants; product viability; accuracy of quality control systems; product recalls, product liability and product returns; positive tests for THC or banned substances; supply risk; reliance on third party suppliers, service providers and distributors; failure of counter-parties to perform contractual obligations; industry and intra-industry competition; changing consumer preferences and customer retention; unfavorable publicity or consumer perception; inability to sustain pricing models; reliance on key inputs; effectiveness and efficiency of advertising and promotional expenditures; retention and recruitment of key officers and employees; inability to renew material leases; obtaining insurance; management of growth; risks related to acquiring companies and entering partnerships; infringement on intellectual property; inability to protect intellectual property; intellectual property claims; litigation; trade secrets may be difficult to protect; data security breaches; global economic uncertainty; emerging industries; limited market for securities; financial reporting and public company obligations; and other factors more fully described from time to time in the reports and filings made by the Hoist or the Resulting Issuer with securities regulatory authorities.

In addition, Hoist cautions that current global uncertainty with respect to the spread of the COVID-19 virus and its effect on the broader global economy may have a significant negative effect on the Resulting Issuer. While the precise impact of the COVID-19 virus on Hoist, Hempshire and the Resulting Issuer remains unknown, rapid spread of the COVID-19 virus may continue to have a material adverse effect on global economic activity, and may continue to result in volatility and disruption to global supply chains, operations, mobility of people and the financial markets, which could affect interest rates, credit ratings, credit risk, inflation, business, financial conditions, results of operations and other factors relevant to the Resulting Issuer.

Readers are cautioned that the assumptions used in the preparation of forward-looking information, although considered reasonable at the time of preparation, may prove to be imprecise. Actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and accordingly there can be no assurance that such expectations will be realized. Hoist undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. The forward-looking information contained herein is expressly qualified by this cautionary statement.

Certain information contained herein has been obtained from published sources prepared by independent industry analysts and third-party sources (including industry publications, surveys and forecasts), including certain reports published by Grand View Research, Inc. While such information is believed to be reliable for the purposes used herein, Hoist and Hempshire do not assume any responsibility for the accuracy of such information. Some of the sources cited in this news release have not consented to the inclusion of any data from their reports, nor have Hoist or Hempshire sought their consent.

[1] Grand View Research, Inc. "Tobacco Market Size, Share & Trends Analysis Report By Product (Smokeless, Cigarettes, Cigar & Cigarillos, Next Generation Products, Waterpipes), By Region, And Segment Forecasts, 2021 - 2028." February 2021.

[2] Grand View Research, Inc. "E-cigarette And Vape Market Size, Share & Trends Analysis Report By Product (Disposable, Rechargeable), By Component (Vape Mod, E-liquid), By Distribution Channel, And Segment Forecasts, 2020 - 2027." February 2020.

[3] Grand View Research, Inc. "Cannabidiol Market Size, Share & Trends Analysis Report By Source Type (Hemp, Marijuana), By Distribution Channel (B2B, B2C), By End-use (Medical, Personal Use), By Region, And Segment Forecasts, 2021 - 2028." February 2021.

Related Images

Press Release Service by Newswire.com

Original Source: Hoist Capital Corp. and the Hempshire Group, Inc. Announce Business Combination and Up to $5.0 Million Equity Financing