Computer peripherals and accessories manufacturer Logitech International SA (NASDAQ: LOGI) stock took a (10%) haircut on the sudden resignation of its CEO of 10 years. On June 13, 2023, Logitech CEO Bracken Darrel abruptly resigned after ten years. Board member Guy Gecht, member of the audit committee and chair of the Technology and Innovation committee, will be the interim CEO until a permanent CEO is found.

Darrel will stick around for a month to ensure a smooth transition to the new CEO. Darrel is leaving Logitech to pursue other opportunities. Investors are nervous about the sudden departure as a sign of impending bad news. At the very least, having your CEO of 10 years suddenly quit in the middle of a turnaround attempt doesn’t inspire confidence. The CFO and COO were also replaced in 2023. Competitors in the computer and gaming accessories segment include Microsoft Co. (NASDAQ: MSFT), Corsair Gaming Inc. (NASDAQ: CRSR), Dell Technologies Inc. (NASDAQ: DELL) and HP Inc. (NYSE: HPQ).

What To Deduce?

Based on the abrupt nature of the resignation after a 10-year-long tenure as CEO, investors are left to assume that either Darrel found an opportunity he couldn't refuse or he was fired or asked to resign by the Board. The fact that the company didn't have a new CEO lined up before the resignation indicates this may not have been planned.

Not a Termination?

For example, when The Walt Disney Co. (NYSE: DIS) abruptly terminated CEO Bob Chapek on Nov. 21, 2022, they already had a replacement, contracting former CEO Bob Iger to take over immediately. Using this example, the sudden departure during a turnaround was likely not due to termination, as the company had no permanent CEO replacement.

During his tenure, Darrel was credited for doubling Logitech's revenues and leading its sustainability initiative intending to be carbon neutral by 2025. If so, the question is, why did Darrel surprise everyone with his out-of-the-blue resignation? What are these new opportunities he wants to pursue? Logitech had just appointed a new CFO. Why does the executive team have a fallout?

Sinking Financials

Logitech has seen its stock price crater along with its financials. Logitech shares have been on a downward trajectory for two years after peaking from a 300% spike in its stock price during the pandemic, where stay-at-home mandates bolstered demand for computer accessories.

The company has seen (22%) revenue plunges for the past two quarters as part of six consecutive quarters of double-digit YoY revenue declines. The pullback in video gaming has impacted its devices, but it's yet to have a refresh cycle, implying the company is still in negative normalization.

Citi Downgrade

On June 14, 2023, Citi downgraded the shares of Logitech to Neutral from a Buy rating. Logitech stock's price target was lowered to $70 from the previous target of $73. Citi says the lack of guidance reaffirmation and the changing of the guards (IE: CFO and CEO) may cause concern and uncertainty.

Its CFO resigned on Jan. 30, 2023, but the company already had a replacement CFO. At the least, it's a sign of the inability of the Board to follow through on its turnaround strategy. Citi is moving to the sidelines until the company can provide color on how it will achieve long-term growth targets.

Logitech International analyst ratings and stock price targets are at MarketBeat.

The definitive beginner’s guide to reading stock charts can be found free on Marketbeat.

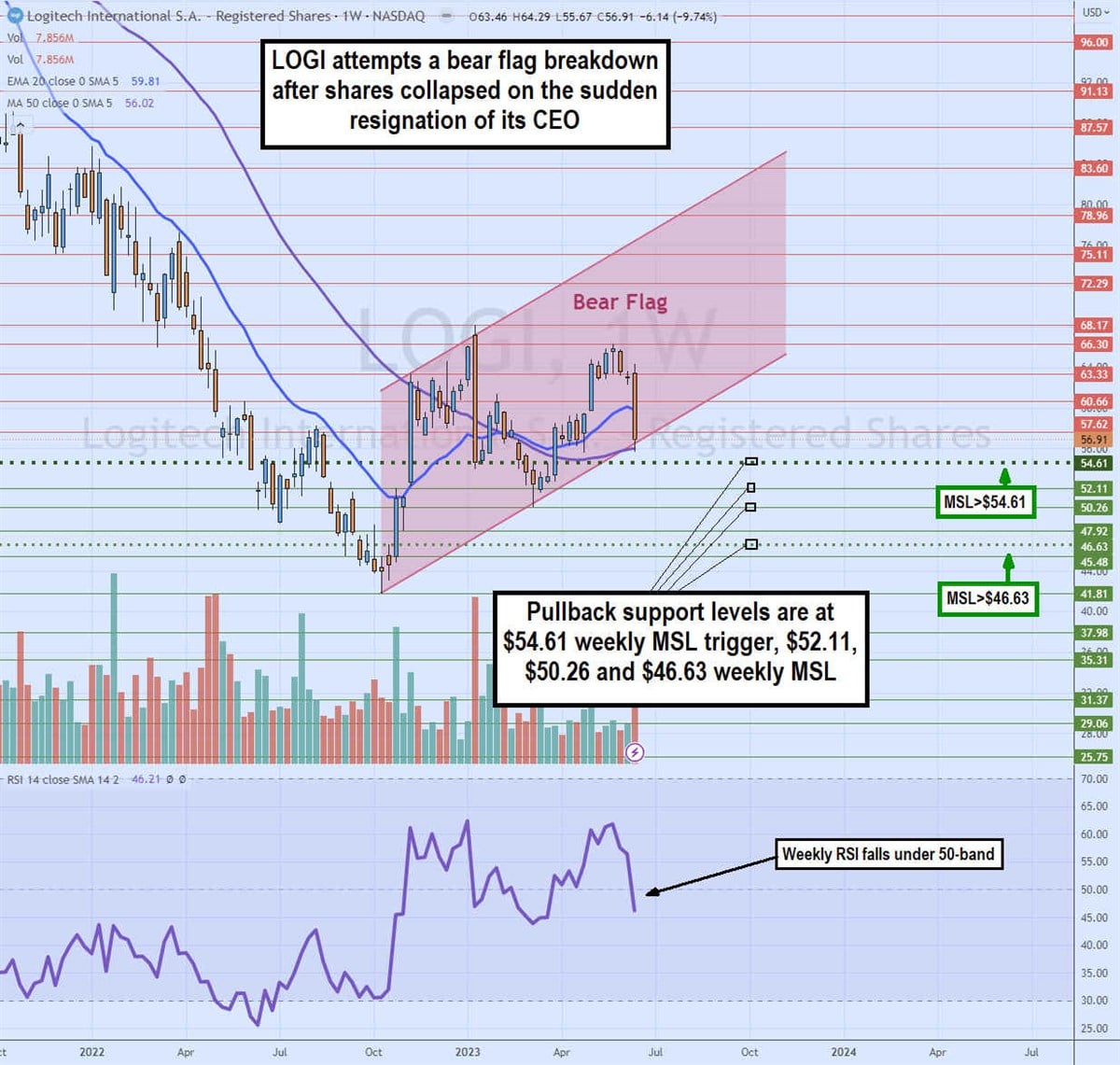

Weekly Bear Flag

The weekly candlestick chart on LOGI shows a bear flag pattern that may be forming a breakdown. The bear flag commenced after LOGI bottomed at $41.81 in October 2022; the flagpole formed on the move down from the $140.17 high in January 2021. LOGI bounced on the weekly market structure low (MSL) breakout through the $46.63 trigger to peak at the rising upper trendline at $63.33.

LOGI made higher lows on pullbacks and higher highs on rallies peaking at $68.12 in January 2023. LOGI triggered a second MSL on the $54.61 breakout, which peaked at $66.30 ahead of the abrupt resignation of its CEO. Shares collapsed to the weekly 50-period moving average (MA) support at $56.02. The weekly RSI is falling through the 50-band. Pullback supports are at $54.61 weekly MSL trigger, $52.11, $50.26 and $46.63 weekly MSL trigger.