Vancouver, British Columbia, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Surge Copper Corp. (TSXV: SURG) (OTCQB: SRGXF) (Frankfurt: G6D2) (“Surge” or the “Company”) is pleased to announce that it has entered into a definitive purchase agreement (the “Purchase Agreement”) with Thompson Creek Metals Company Inc. (“TCM”), a wholly-owned subsidiary of Centerra Gold Inc., to acquire a 100% interest in the Berg Property for total consideration of 21,221,165 common shares of Surge, resulting in TCM owning approximately 15% of Surge’s outstanding common shares (the “Transaction”). The Purchase Agreement replaces an earlier December 2020 Option Agreement between Surge and TCM which allowed Surge to earn a 70% interest in the Berg Property by spending C$8 million over five years and issuing to TCM C$5 million in common shares of the Company.

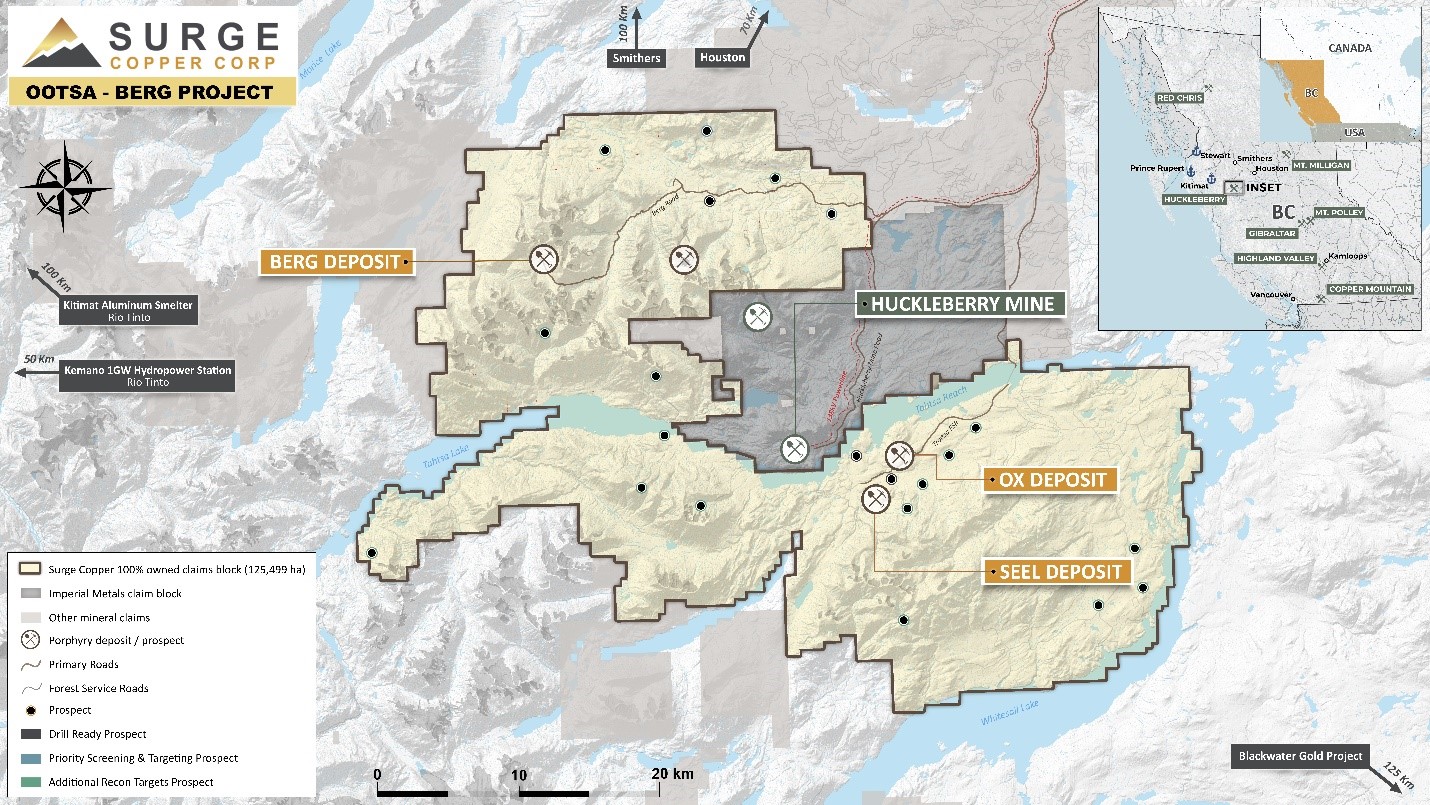

Leif Nilsson, Chief Executive Officer, commented: “We are very pleased to be consolidating a 100% interest in the Berg Property, which firmly establishes our ownership position in the broader Berg-Huckleberry-Ootsa district, results in a more simplified ownership structure for all parties, and provides Surge with significantly more flexibility in future financing choices to advance its assets. Surge now holds a simple 100% ownership interest in a contiguous 125,499-hectare land package that hosts the Berg Project, for which we released a maiden NI 43-101 compliant PEA in June 2023, the Ootsa Project, for which we released an updated NI 43-101 mineral resource estimate in June 2022, and an extensive pipeline of exploration targets prospective for porphyry copper and associated breccia and hydrothermal vein style base metal and precious metal deposits. Looking forward, our goal is to continue to advance and de-risk this large, emerging critical minerals district and systematically explore the high-potential regional targets. We value our partnership with Centerra and look forward to welcoming them as a significant shareholder in Surge going forward.”

Figure 1. District Map.

Please click here to view image

About the Berg Property

The Berg Property subject to the Purchase Agreement is 34,798 hectares in size and is contiguous with the remainder of Surge’s 100%-owned mineral claims. Located on the Berg Property is the Berg deposit, for which Surge announced an NI 43-101 compliant Preliminary Economic Assessment (“PEA”) and an accompanying Mineral Resource Estimate (“MRE”) in June 2023 (see June 13, 2023 Press Release)1. The PEA outlined a large-scale, stand-alone greenfield development project with a simple design and high outputs of critical minerals located in a safe jurisdiction with world-class infrastructure. Highlights from the PEA include:

- Base case after-tax NPV8% of C$2.1 billion and IRR of 20% based on long-term commodity price assumptions of US$4.00/lb copper, US$15.00/lb molybdenum, US$23/oz silver, and US$1,800/oz gold plus foreign exchange of 0.77 USDCAD

- 30-year mine life with total payable production of 5.8 billion pounds (2.6 million tonnes) of copper equivalent (CuEq2), including 3.7 billion pounds (1.7 million tonnes) of copper

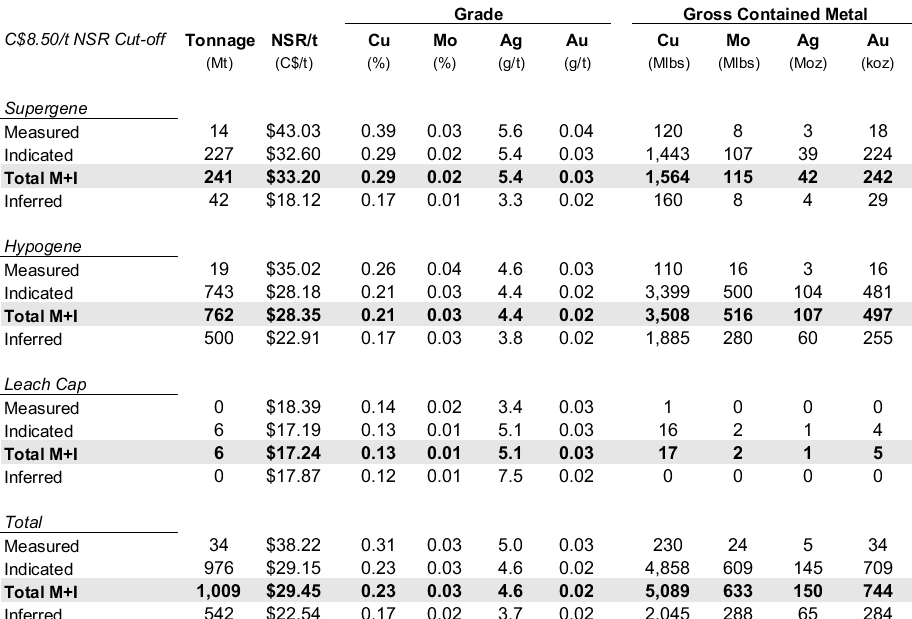

- Updated mineral resource estimate includes combined Measured & Indicated resource of 1.0 billion tonnes grading 0.23% copper, 0.03% molybdenum, 4.6 g/t silver, and 0.02 g/t gold, containing 5.1 billion pounds of copper, 633 million pounds of molybdenum, 150 million ounces of silver, and 744 thousand ounces of gold, plus an additional 0.5 billion tonnes of material in the Inferred category.

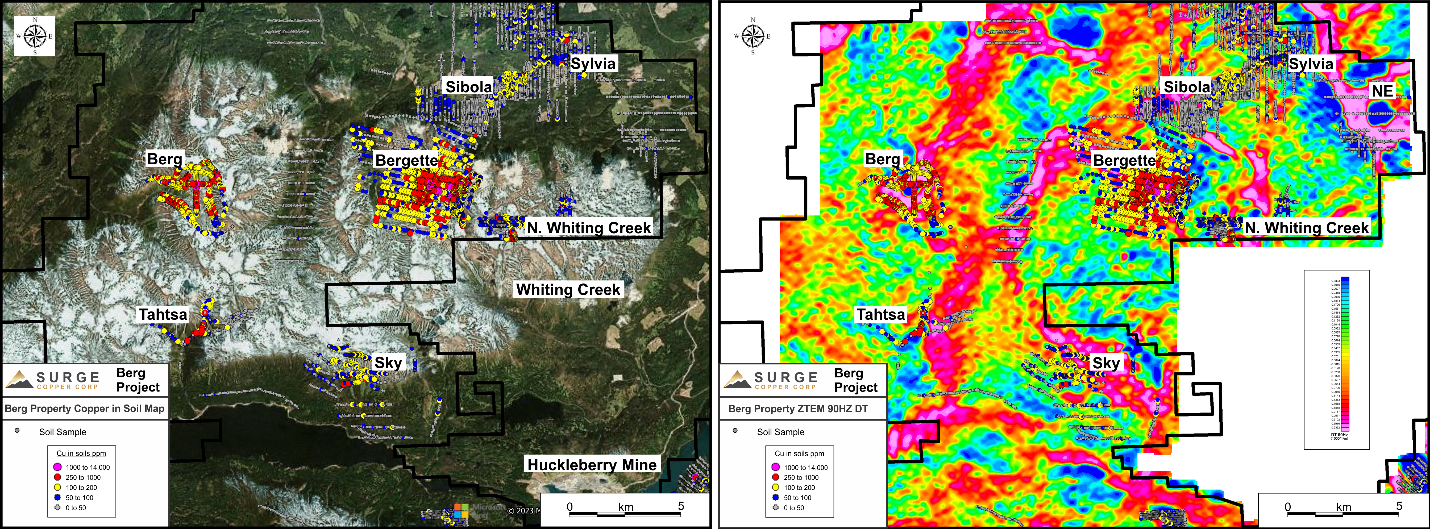

The Berg Property and adjacent claims owned by Surge also host several earlier-stage regional exploration targets, with highlights including:

- The Bergette target, an approximately 2.7 by 1.7 kilometre copper-molybdenum-in-soil anomaly where drilling in 2022 intersected 176 metres grading 0.22% copper, 0.012% molybdenum, 0.03 g/t gold, and 0.80 g/t silver from 8 metres depth in hole BGT22-02 and 143 metres grading 0.23% copper, 0.010% molybdenum, 0.03 g/t gold, and 0.80 g/t silver from 3 metres depth in hole BGT22-01 (see February 27, 2023 Press Release)

- The Sibola target, where surface exploration in 2022 and 2023 has defined a 1.5 kilometre by 300 metre copper-molybdenum-in-soil anomaly in a till-covered area within a wider area containing widespread alteration and intrusive rocks, indicating a setting favourable to porphyry-style mineralization (see April 19, 2023 Press Release and July 12, 2023 Press Release)

- The Sylvia target, which hosts known porphyry-style mineralization associated with a one-kilometre-long intrusion within a mostly till-covered area, where exploration in 2022 outlined a low-level copper-in-soil anomaly, and rock sampling of a 20 metre by 50 metre mineralized outcrop containing disseminated chalcopyrite and malachite returned 1.5% copper and 36.1 g/t silver (see April 19, 2023 Press Release)

- The Tahtsa target, considered to be prospective for porphyry molybdenum-copper mineralization and precious metals, where elevated copper and molybdenum in soils and silver, gold, and copper in rocks have been traced over an area exceeding 2 kilometres in length (see April 19, 2023 Press Release)

- The North Whiting Creek target, located immediately to the north of Imperial Metals Corporation’s Whiting Creek exploration project, where preliminary surface exploration completed in 2022 returned encouraging precious metal grab samples within a 70 metre by 300 metre area, within a larger 400 metre by 500 metre zinc-lead-copper-in-soil anomaly (see April 19, 2023 Press Release)

- The Sky target, a gossanous zone with a 1.4 by 0.8 kilometre copper-silver-gold-in-soil anomaly located along the south slope of an east-west trending mountain where surface prospecting has identified disseminated and vein sulphides in intrusive rocks and surrounding volcanic and sedimentary rocks, and rock sampling has identified zones with anomalous copper and silver

- Numerous additional geophysical targets supported by a regional airborne ZTEM survey completed over the district in 2021, several ground-based IP grids completed in 2022, and additional earlier datasets.

Figure 2. Compilation soil grids over selected deposits and targets over satellite background (LHS) and ZTEM 90Hz DT background (RHS).

Please click here to view image

All the mining claims which are subject to the Purchase Agreement have had sufficient work applied to them to be valid until February 2032 and the current 5-year area-based permit is valid until March 2027.

Additional Details

The Purchase Agreement contains customary representations and warranties from both TCM and Surge. The common shares issued under the Transaction will be subject to a statutory 4-month hold period. No finder’s fee or commission was paid in connection with the issuance of the shares. Closing of the Transaction is subject to the approval of the TSX Venture Exchange.

Early Warning Disclosure by TCM

Pursuant to the Purchase Agreement, TCM will be issued 21,221,165 common shares of the Company at a deemed price of $0.075 per share for total deemed consideration of $1,591,587. TCM currently holds 11,854,218 common shares of the Company which were issued pursuant to the existing 2020 Option Agreement, representing approximately 6% of the Company’s issued and outstanding shares.

Upon closing of the transactions under the Purchase Agreement, it is expected that TCM will hold a total of 33,075,383 common shares of the Company, representing approximately 15% of the Company’s issued and outstanding shares.

The Shares are to be acquired for investment purposes. TCM has no current plans or intentions which relate to, or would result in, acquiring additional securities of the Company, disposing of securities of the Company, or any other actions described in Item 5 of Form 62-103F1 Required Disclosure under the Early Warning Requirements. TCM may, depending on market and other conditions, increase or decrease its beneficial ownership of or control or direction over the Company’s securities, whether in the open market, by privately negotiated agreements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities.

Further to the requirements of National Instrument 62-104 - Take-Over Bids and Issuer Bids and National Instrument 62-103 -The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, TCM will file an early warning report which will be made available on SEDAR+ at www.sedarplus.ca. Further information and a copy of the early warning report may be obtained by contacting Lisa Wilkinson, Vice President, Investor Relations & Corporate Communications of Centerra Gold Inc., 1 University Ave, Toronto, ON M5J 2P1 telephone: 416-204-3780, email: lisa.wilkinson@centerragold.com.

Qualified Person

Dr. Shane Ebert P.Geo., President and VP Exploration of the Company, is the Qualified Person for the Ootsa and Berg projects as defined by National Instrument 43-101 and has approved the technical disclosure contained in this news release.

Additional Disclosure Related to Berg NI 43-101 MRE

| Berg Mineral Resource Estimate by Classification and Oxidation Zone at Base Case NSR Cut-off of C$8.50/t |

Notes: 1) The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person, and has an effective date of June 7, 2023. 2) Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines. 3) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. 4) The Mineral Resource has been confined by a “reasonable prospects of eventual economic extraction” pit using the following assumptions:

|

About Surge Copper Corp.

Surge Copper Corp. is a Canadian company that is advancing an emerging critical metals district in a well-developed region of British Columbia, Canada. The Company controls a large, contiguous mineral claim package that hosts multiple advanced porphyry deposits with pit-constrained NI 43-101 compliant resources of copper, molybdenum, gold, and silver – metals which are critical inputs to the low-carbon energy transition and associated electrification technologies.

The Company’s flagship project is the Berg Project, in which it is acquiring a 100% interest from Centerra Gold. The Company has announced a PEA on the Berg Project which outlines a large-scale, long-life development project with a simple design and high outputs of critical minerals located in a safe jurisdiction near world-class infrastructure. The PEA highlights base case economics including an NPV8% of C$2.1 billion and an IRR of 20% based on long-term commodity prices of US$4.00/lb copper, US$15.00/lb molybdenum, US$23.00/oz silver, and US$1,800/oz gold1. The Berg deposit contains pit-constrained 43-101 compliant resources of copper, molybdenum, silver, and gold in the Measured, Indicated, and Inferred categories.

The Company also owns a 100% interest in the Ootsa Property, an advanced-stage exploration project containing the Seel and Ox porphyry deposits located adjacent to the open pit Huckleberry Copper Mine, owned by Imperial Metals. The Ootsa Property contains pit-constrained NI 43-101 compliant resources of copper, gold, molybdenum, and silver in the Measured, Indicated, and Inferred categories3.

On Behalf of the Board of Directors

“Leif Nilsson”

Chief Executive Officer

For further information, please contact:

Riley Trimble, Corporate Communications & Development

Telephone: +1 604 416 2978

Email: info@surgecopper.com

Twitter: @SurgeCopper

LinkedIn: Surge Copper Corp

https://www.surgecopper.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release contains forward-looking statements, which relate to future events. In some cases, you can identify forward-looking statements by terminology such as "will", "may", "should", "expects", "plans", or "anticipates" or the negative of these terms or other comparable terminology. All statements included herein, other than statements of historical fact, are forward-looking statements, including but not limited to the Company’s plans regarding the Berg Property and the Ootsa Property. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause the Company’s actual results, level of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. Such uncertainties and risks may include, among others, actual results of the Company's exploration activities being different than those expected by management, delays in obtaining or failure to obtain required government or other regulatory approvals, the ability to obtain adequate financing to conduct its planned exploration programs, inability to procure labour, equipment, and supplies in sufficient quantities and on a timely basis, equipment breakdown, impacts of the current coronavirus pandemic, and bad weather. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect the Company's current judgment regarding the direction of its business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggestions herein. Except as required by applicable law, the Company does not intend to update any forward-looking statements to conform these statements to actual results.

__________________

End Notes:

1) See “Berg Project 43-101 Technical Report and Preliminary Economic Assessment” Effective Date June 12, 2023 filed on SEDAR+. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty the PEA will be realized.

2) Copper equivalent (CuEq) refers to recovered and payable metals converted into copper equivalent based on each metal's respective price ratio using metal prices of US$4.00/lb copper, US$15.00/lb molybdenum, US$23.00/lb silver, and US$1,800/oz gold using the formula CuEq (lbs) = Cu (lbs) + 3.75 * Mo (lbs) + 5.75 * Ag (oz) + 450 * Au (oz).

3) See “A Mineral Resource Estimate Update for the Seel and Ox Deposits – Ootsa Property, August 2022” Effective Date February 18, 2022 filed on SEDAR+. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.