On Tap Credit Union®, a leader in crafting personalized financial solutions across Colorado, has announced the launch of its newly enhanced digital switch tool, making it faster and easier than ever for members to activate accounts from anywhere, anytime.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260217829040/en/

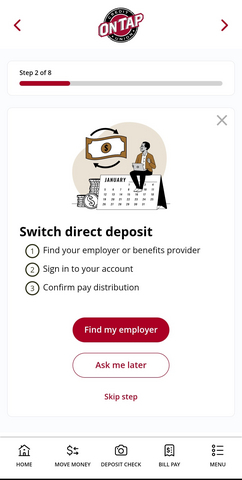

Simple instructions for members to transfer their direct deposit.

This streamlined digital experience is part of On Tap Credit Union’s ongoing commitment to innovation and member-centric service. The updated platform significantly eases the account onboarding process, while also allowing members to seamlessly transition their direct deposits and subscriptions (Amazon, Apple, Netflix, Uber) to On Tap CU, while maintaining the credit union’s trusted security and service standards.

"For years, banks and credit unions have promised an easy way to switch your direct deposit and update your card info, but too often, it was just a checklist with no real support,” states Janelle Herrera, VP of Marketing and Business Development. “We're proud to change that. With our new integrated digital switch tool, members can now seamlessly update their direct deposit and recurring payments right inside online banking. It’s fast, secure, and truly convenient – exactly what today’s members expect."

Key Features of the New Onboarding Platform:

- Supports new members in funding accounts, establishing direct deposit, and transferring recurring payments to maximize account value from day one.

- Guides indirect members into full-service everyday banking (in the next phase), transforming a single loan relationship into deeper engagement.

- Leverages behavior- and timing-based prompts to drive completion of critical onboarding steps.

- Shares engagement insights with marketing and service teams to align member activity with timely, personalized follow-up.

The upgrade aligns with On Tap’s mission to provide financial empowerment with great rates, local insight, and a fresh take on banking. It also reflects the credit union’s broader digital transformation efforts aimed at simplifying financial life for members.

About On Tap Credit Union®

Formerly known as Coors Credit Union, On Tap Credit Union is a full-service cooperative financial institution dedicated to serving individuals living and working in Jefferson, Denver, Boulder, and Larimer counties. Established in 1954, the credit union manages $400 million in assets and boasts a membership of 20,000 individuals who are also owners of the organization. On Tap Credit Union offers personalized financial consultations and a wide range of financial solutions, including a host of consumer banking solutions from a robust deposit suite to vehicle, mortgage, and home equity loans, credit cards, insurance, investment accounts, and financial guidance. Additionally, the credit union provides a comprehensive array of business services, featuring a variety of commercial lending solutions. All of these products and services are delivered on an advanced online banking platform to ensure service anytime, anywhere. To learn more about On Tap Credit Union, follow them on Facebook, Instagram, or LinkedIn.

To learn more, visit www.OnTapCU.org.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260217829040/en/

"With our new integrated digital switch tool, members can now seamlessly update their direct deposit and recurring payments right inside online banking."

Contacts

Nicole Zimmerman

Director of Marketing

On Tap Credit Union

303.215.4675

nzimmerman@ontapcu.org