IMX moves up 3% in September despite month’s market volatility

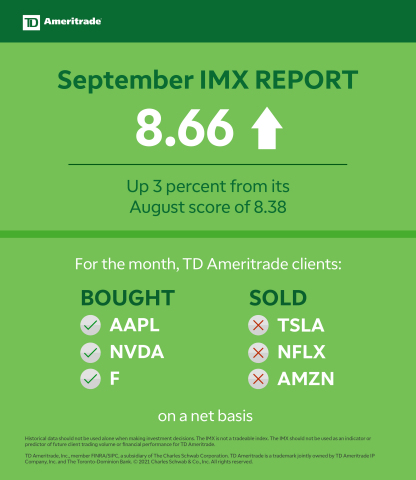

The Investor Movement Index® (IMXSM) moved higher to 8.66 in September, up from 8.38 in August. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211004005774/en/

TD Ameritrade September 2021 Investor Movement Index (Graphic: TD Ameritrade)

The reading for the five-week period ending September 24, 2021 ranks “High” compared to historic averages.

“After seeing record highs across all indices recently, we saw a September slump hit the markets at the end of the month,” said JJ Kinahan, chief market strategist, TD Ameritrade. “While market volatility was elevated compared to recent levels, TD Ameritrade clients used this volatility to help make their investment decisions. As we hit new highs to start September, clients saw this as an opportunity to sell equities and the ensuing pullback as a buying opportunity.”

Equity markets were highly volatile over the September period, driven by global economic concerns and continued supply chain issues. Investor concerns had been slowly building up leading into September and finally led to strong selling across the three major indices. All major sectors moved lower over the month except the energy sector, which benefited from a rise in the price of crude oil amid supply concerns. After selling off initially, the S&P 500 attempted to rally back only to make another gap lower. This drop snapped a seven-month streak of positive gains, leaving the potential to finish positive for the 3rd quarter.

TD Ameritrade clients were net buyers of products overall during the September IMX period, increasing their holdings of equities and fixed income assets. Some of the popular equity names bought during the period were:

- Apple Inc. (AAPL)

- Alibaba Group Holding Ltd. (BABA)

- Ford Motor Co. (F)

- Nvidia Corp. (NVDA)

- SoFi Technologies Inc. (SOFI)

TD Ameritrade clients took advantage of rising prices to sell some equities during the period, including:

- Tesla Inc. (TSLA)

- Netflix Inc. (NFLX)

- Amazon.com, Inc. (AMZN)

- American Airlines Group Inc. (AAL)

- Delta Air Lines, Inc. (DAL)

- Bank of America Corporation (BAC)

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from September 2021, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.amtd.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2021 Charles Schwab & Co. Inc. All rights reserved.

Source: TD Ameritrade, Inc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211004005774/en/

Contacts

Christina Goethe

Corporate Communications

(201) 369-8510

christina.goethe@tdameritrade.com