Walmart (WMT) is the world's largest retailer, offering everyday low prices on groceries, electronics, clothing, and household essentials through its vast network of supercenters, discount stores, and Sam's Club warehouses. It blends physical stores with a booming e-commerce platform, powered by tech innovations like drone delivery, AI-driven supply chains, and advertising via Walmart Connect.

Founded in 1962, Walmart is headquartered in Bentonville, Arkansas. The company operates over 10,800 stores and e-commerce sites in 19 countries while serving some 270 million customers weekly.

Walmart Stock Outshines

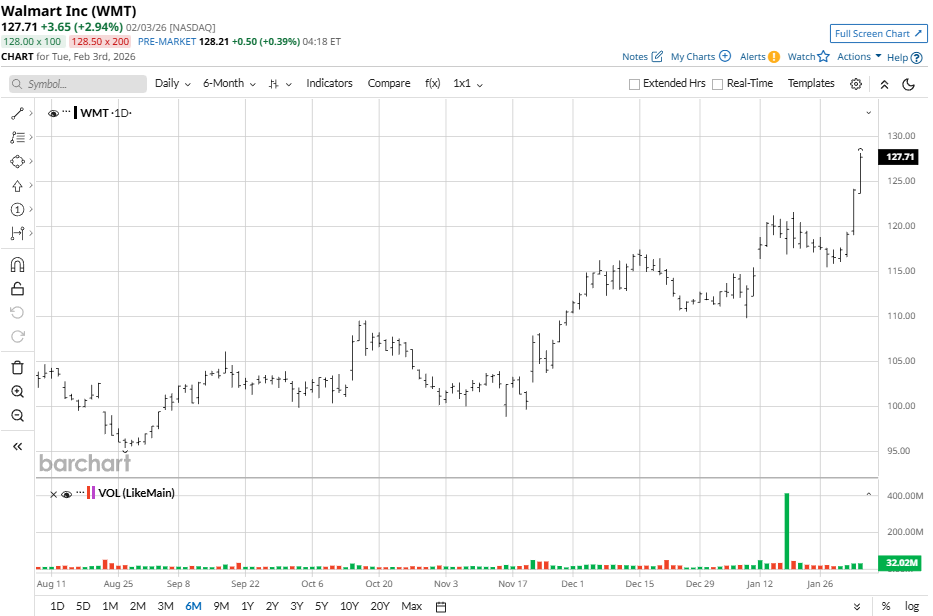

Walmart has delivered robust gains recently, with shares climbing more than 8% over the past five days and 13% over the past month. WMT stock has delivered roughly 28% returns in six months while trading near its 52-week high of $129.60, roughly 60% above its lows.

Walmart also easily outpaces the S&P 500 Consumer Staples Index ($SRCS), which has about 11% returns in a year and 15% in a quarter. That showcases resilience amid defensive sector strength.

Walmart Results Beat Estimates

Walmart released strong third-quarter fiscal 2026 results on Nov. 20, 2025. Revenue grew 5.8% year-over-year (YOY) to $179.5 billion, beating analyst estimates of $177.5 billion. Adjusted EPS hit $0.62, surpassing forecasts of $0.61, showing healthy profit growth amid rising sales.

Financials highlighted stability, where operating margin held at 3.7%, matching last year. Same-store sales jumped 4.4%, with e-commerce fueling gains. Global transactions and units drove performance, while inventory and costs were well-managed for resilience.

Walmart raised its full-year fiscal 2026 outlook. Revenue growth is now forecast between 4.8% and 5.1%, while adjusted EPS is expected to be $2.58 to $2.63, instilling confidence among investors for another strong quarter and margin expansion ahead.

Walmart Hits $1 Trillion Milestone

Walmart's value reached $1 trillion after WMT stock hit a record high earlier this month. This makes Walmart one of the world's most valuable companies. Shares have climbed 14% so far this year, beating Amazon's (AMZN) 3% year-to-date (YTD) drop. Over the past year, Walmart has also climbed 24%, topping the S&P 500's ($SPX) 12% rise and Amazon's 5% decline.

To rival Amazon, Walmart embraced AI, same-day delivery, and pharmacy growth, which boosted memberships by 12% and delivered its best-ever Q2 profits.

Sam Walton opened the first store in 1962 in Rogers, Arkansas. Using low prices, wide product variety, and smart supply chains, the company hit $1 billion in sales by 1980. Walmart went public in 1970 at $16.50 per share, starting on the over-the-counter markets before joining the New York Stock Exchange in 1972. Walmart shifted to the Nasdaq 100 recently to highlight its tech focus.

Early investors won big. One IPO share, after 12 splits (mostly 2-for-1), equals around $500,000 today, not counting dividends or the 2024 3-for-1 split.

Should You Bet on WMT Stock?

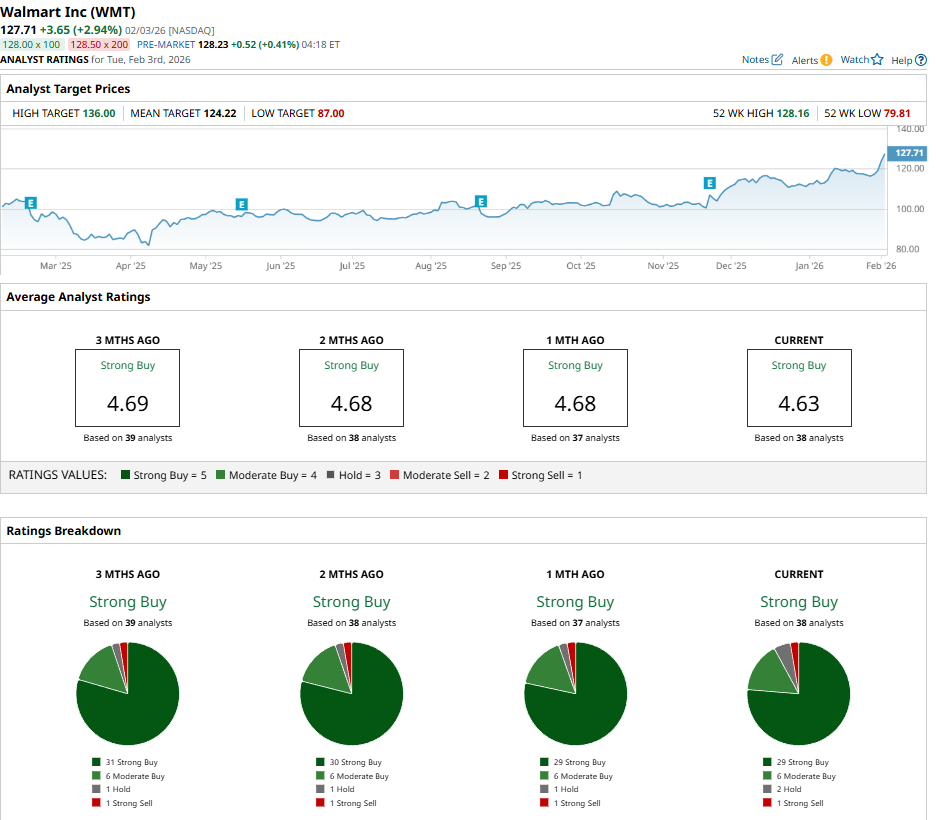

As the company reaches a historic milestone, market analysts provide WMT stock with a consensus “Strong Buy” rating. The mean price target of $124.67 is roughly in line with the stock’s current trading price.

Out of 38 analysts with coverage, 29 have a “Strong Buy” rating, six have a “Moderate Buy” rating, two have a “Hold” rating, and one analayst has a “Strong Sell."

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.

- This Overlooked Biotech Giant Could Surprise Investors This Quarter