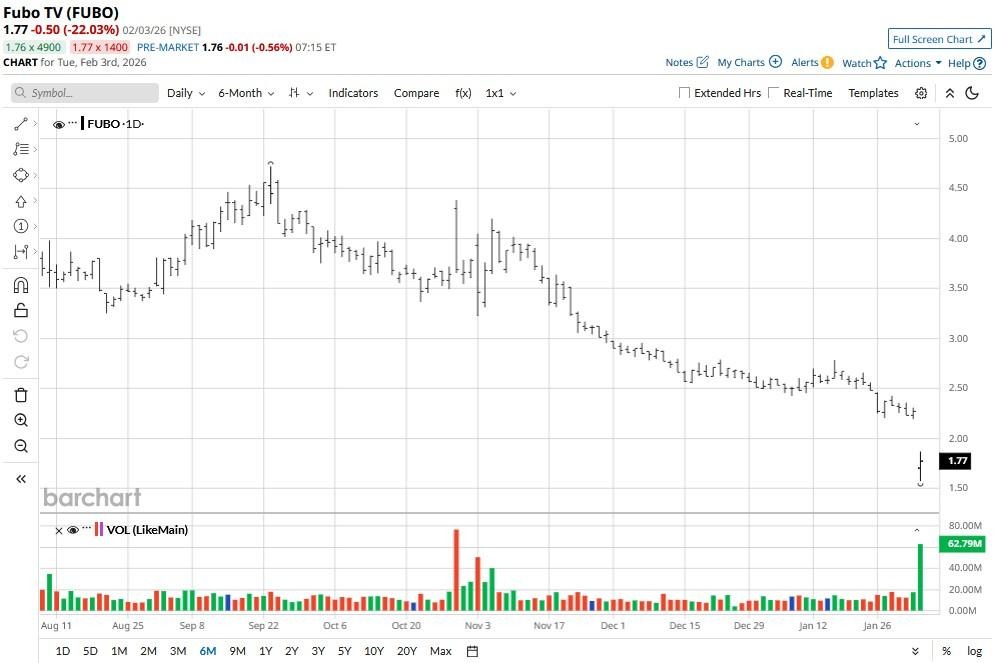

FuboTV (FUBO) stock plummeted more than 20% on Feb. 3, after the subscription-based streaming service announced plans of a reverse stock split in the range of 1-for-8 to 1-for-12. The selloff that crashed FUBO’s relative strength index (14-day) to about 21 — indicating deeply oversold territory — reflects investor sentiment toward reverse splits, which often signal financial distress.

Following this plunge, FuboTV shares are down more than 30% versus the start of this year (2026).

Why FuboTV Stock Is Still Worth Owning

Long-term investors should consider loading up on FUBO stock at current levels since the NYSE-listed firm’s underlying financials are improving at a rapid pace.

Despite headline loss in Q1, its combined adjusted EBITDA now sits at nearly $78 million on a trailing-12-month pro forma basis, signaling operational improvements masked by the reported net loss.

Put together with a total of 6.2 million subscribers in North America, FuboTV remains a relevant player in the pay television market with meaningful scale.

Plus, FUBO is going for less than 0.4x annual revenue after the Q1 print, which makes it unusually cheap even for a struggling media company.

Disney Deal To Push FUBO Shares Higher

FuboTV shares are worth owning also because the company inked a landmark agreement to merge its sports-first streaming platform with Disney’s (DIS) Hulu and Live TV last year.

The management expects this integration to drive double-digit percentage improvements in both cost-per-thousand impressions (CPM) and fill rates.

FUBO expects synergies from this ad-tech integration to begin realizing in the first quarter of 2026.

In short, for risk-tolerant investors, the extreme oversold conditions paired with expected synergies from the Disney deal and improving operational metrics present a tactical buying opportunity with a multi-quarter investment horizon.

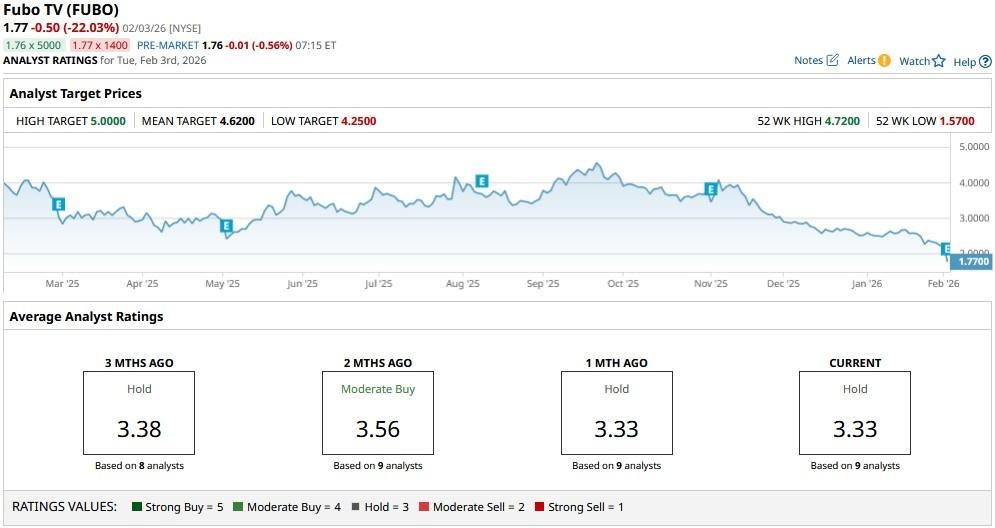

How Wall Street Recommends Playing FuboTV

Investors could also take heart in the fact that Wall Street analysts seem to agree that FUBO shares’ selloff has indeed gone a bit too far.

According to Barchart, while the consensus rating on FuboTV remains at a “Hold," the mean target of about $4.62 suggests potential upside of a staggering 165% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon’s ‘Melania’ Film Earns $7 Million Opening Weekend, But The Benefits For Shareholders Could Be Billions

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?