SoFi Technologies' (SOFI) stock has experienced notable selling pressure despite the financial technology company delivering firm quarterly performances. It has dropped by about 22% over the past month, and is now trading nearly 35% below its 52-week high.

Much of the recent weakness in SoFi stock appears to be driven by sentiment. Following a steep rally in early 2025, valuation concerns surfaced, prompting some investors to lock in gains. At the same time, worries about potential dilution tied to recent capital raises and macro uncertainty weighed on the stock. Together, these factors have overshadowed a period of meaningful operational progress for the company.

However, for long-term investors, this sharp correction in SoFi stock may be exactly the opportunity they have been waiting for. SoFi’s core businesses continue to perform well, and the company remains well-positioned to sustain solid growth momentum into 2026.

Are Investors’ Concerns Overblown?

Investors worry that SoFi’s recent capital raises could dilute shareholders' value. However, these concerns appear to be overblown.

SoFi recently stated that the capital it raised added real value to the business. Its tangible book value (TBV) has grown to $8.9 billion by the fourth quarter of 2025 from $3.3 billion at the end of the first quarter of 2023. On a per-share basis, TBV rose to $7.01 from $3.49 over the same period.

The company also used the money it raised to reduce funding costs. A large portion was used to pay down expensive debt, which immediately lowered interest costs. The rest was invested in income-generating assets. By the end of 2025, SoFi had fully exited high-cost funding tied to personal and student loans, leaving the company with a cheaper funding structure.

Financially, this shift matters. Lower interest expenses and higher interest income are expected to boost net interest income. These gains can help offset the dilution from issuing new shares and could even increase earnings per share.

In the bigger picture, SoFi’s recent capital raises create financial flexibility, support growth, and improve profitability. With a stronger balance sheet and more options to invest and expand, management believes the company is better positioned to drive long-term value for shareholders.

SoFi to Deliver Strong Growth in 2026

Despite investor concerns, SoFi is well-positioned to deliver strong growth in 2026. The company’s biggest strength is its fast-growing customer base. In the most recent quarter, SoFi added over one million new members, bringing total membership to 13.7 million. That is a 35% increase from a year ago and shows rising adoption of SoFi’s all-in-one platform, which combines banking, investing, lending, and technology services.

Growth is not just coming from new customers. Total products reached 20.2 million, up 37% year-over-year (YOY), and about 40% of new products were taken up by existing users. This means customers are using more SoFi services over time, helping boost revenue without sharply increasing customer acquisition costs.

SoFi is also shifting toward more fee-based businesses, which tend to be more scalable and profitable, thereby reducing its dependence on lending. Its Financial Services and Technology Platform segments grew revenue by 61% YOY in the fourth quarter. Fee-based revenue rose 50% and now runs at nearly $1.8 billion annually, which should make earnings more stable.

At the same time, lending remains healthy. Lending revenue rose 15%, driven by rising net interest income. Further, deposits climbed to $37.5 billion, reducing funding costs, and profitability continues to improve. Together, these trends support a positive investment outlook for SoFi.

The Bottom Line

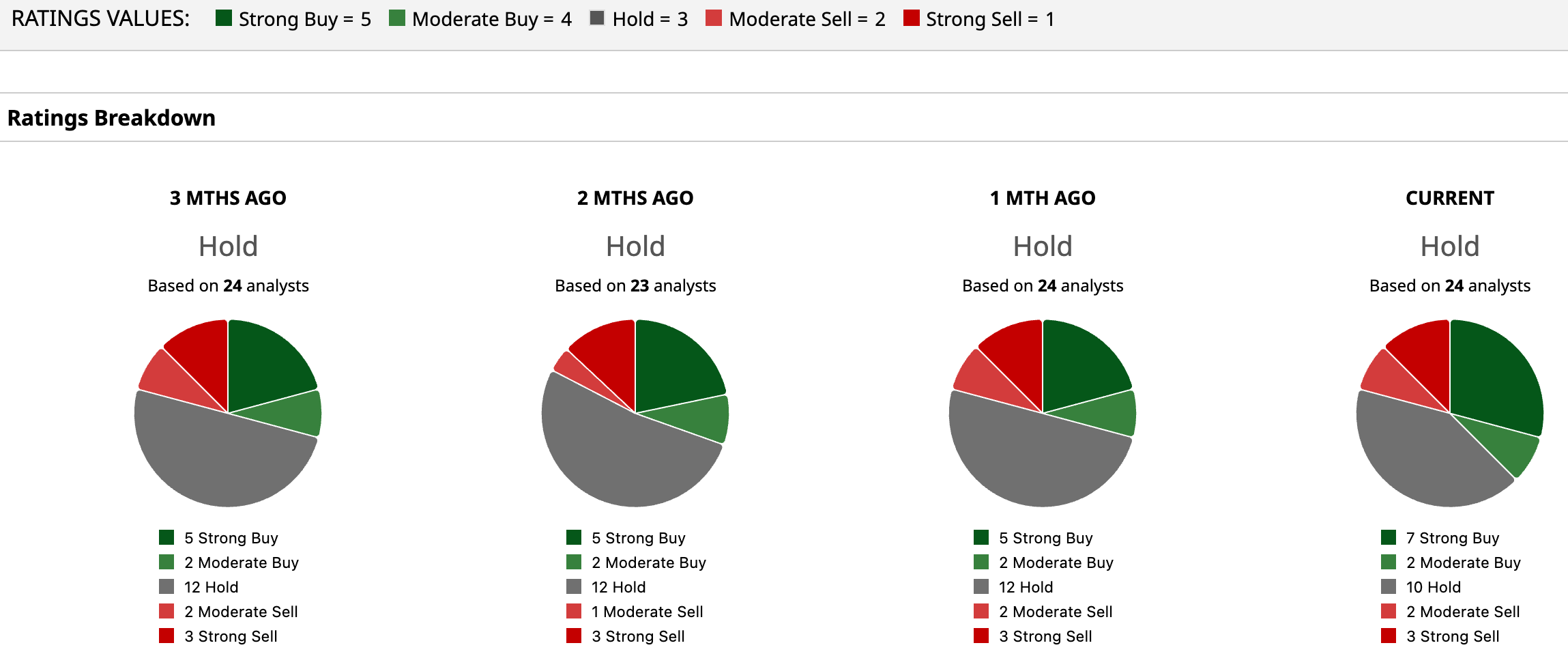

Despite the recent selloff, analysts maintain a “Hold” consensus rating on SoFi stock. However, fundamentals remain strong. SoFi’s growing member and product base, strength in fee-based earnings, ongoing momentum in the lending segment, and rising low-cost deposit base augur well for growth in 2026. Further, the recent decline in SoFi's stock price has eased prior valuation concerns and offers an attractive entry point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart