Nvidia Corporation’s (NVDA) rise has been nothing short of remarkable. What began as a niche graphics chip maker now sits at the heart of modern computing, powering data centers, artificial intelligence (AI) systems, and next-generation vehicles. That success, however, has come with turbulence. After briefly brushing the rare $5 trillion market-cap mark, the stock pulled back as valuation concerns and fatigue around infrastructure spending surfaced.

Now, just a month into the new year, Nvidia is making headlines again, with the company’s role in the AI boom continuing to evolve. Reports suggest the chipmaker is considering joining OpenAI’s latest funding round – a massive $50 billion raise that could value the ChatGPT creator at more than $800 billion. Microsoft (MSFT) and Amazon (AMZN) are also said to be in the mix, following OpenAI CEO Sam Altman’s recent investor discussions in the Middle East.

The timing is no coincidence. Rival Anthropic is already on the verge of raising about $20 billion at a $350 billion valuation, underscoring the rapid pace in which capital is flooding into the race to power next-generation AI.

For Nvidia, this moment builds on a long and deeply intertwined relationship with OpenAI. The company participated in OpenAI’s $6.6 billion funding round in October 2024 and has since committed up to $100 billion to support its massive data-center expansion. In return, OpenAI has agreed to lease millions of Nvidia chips, a deal reportedly valued at hundreds of billions of dollars. Add Nvidia-backed CoreWeave (CRWV) supplying data center capacity to OpenAI while buying Nvidia GPUs – and the money flows begin to circle.

With Nvidia at the center of this AI web, should investors buy this chip stock, hold steady, or step back from NVDA here?

About NVIDIA Stock

Santa Clara-based Nvidia hardly needs an introduction. Once celebrated as the king of gaming graphics, it quietly reinvented itself as the backbone of modern computing. Its GPUs now power data centers, AI, robotics, and immersive digital worlds. The CUDA software platform locked developers into a powerful ecosystem, turning Nvidia into an industry standard rather than a supplier. With a market capitalization of nearly $4.7 trillion, Jensen Huang’s company has become the engine of the AI economy.

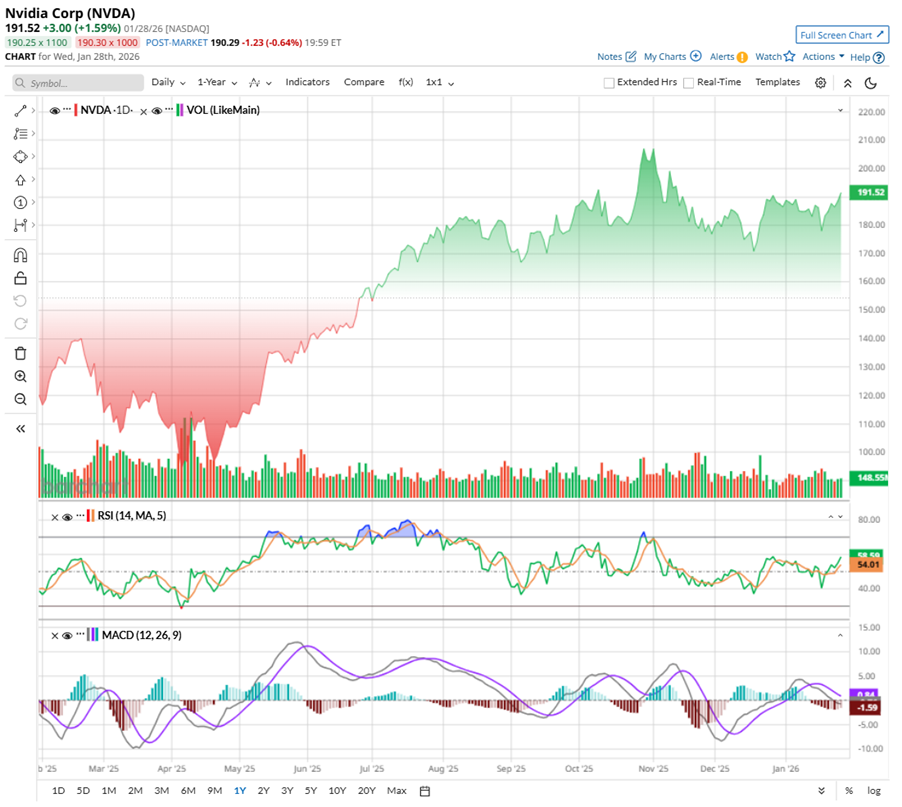

Over the past year, shares of the AI chip giant have moved higher in strong bursts, stepping back at intervals to reassess, rather than racing ahead unchecked. That pattern reflects investors who remain broadly confident in the company’s long-term position, even as near-term caution sets in. After reaching a high of $212.19 on Oct. 29, the stock pulled back about 9.7%. Even so, it remains up roughly 53.2% over the past 52 weeks, underscoring the strength of the broader trend.

From a technical standpoint, the chart suggests consolidation, not deterioration. Momentum has cooled, but it has not broken. The 14-day RSI, which climbed above 80 during October’s peak, has eased back to 55.35. That reset indicates that earlier excess optimism has been worked off, allowing prices to stabilize rather than slide sharply. Trading volumes have also normalized, reinforcing the view that the stock is pausing, not being aggressively sold.

The MACD oscillator offers a measured note of caution. The MACD line has slipped below the signal line, pointing to near-term softness, and the histogram has turned modestly negative. Still, the move lacks sharp acceleration. Overall, the stock appears to be stabilizing after recent gains rather than changing its longer-term direction.

At first glance, NVDA stock’s valuation can feel like walking into a room where prices run high. Trading near 42.56 times forward adjusted earnings, it clearly stands above most peers. Yet history softens that sticker shock – this multiple sits below Nvidia’s own long-term average. For a business still delivering strong double-digit earnings growth and elite margins, that premium starts to feel earned. Even more telling, its forward PEG ratio hovers at 1.08, suggesting the price reflects progress, not excess.

NVIDIA Beats Q3 Numbers

Stepping into Nvidia’s universe, the exits disappear fast. Once customers build on its chips, software, and networking stack, moving away is not easy, and the numbers prove it. Growth keeps compounding, cash keeps piling up, and the balance sheet stays rock solid. Over the past decade, Nvidia’s top and bottom lines have accelerated impressively, with revenue rising at a 44% annual clip and earnings climbing at eye-popping 65%.

Under Jensen Huang’s leadership, Nvidia continues to sustain its pace, with the fiscal Q3 earnings report being another proof point of the company’s momentum. Revenue jumped to $57.1 billion, up 62% year-over-year (YOY), while adjusted EPS climbed 60% annually to $1.30 per share, comfortably ahead of expectations.

Data centers remained the backbone, growing 66% YOY to $51.2 billion as AI demand stayed relentless. Networking added fresh energy, jumping 162% to $8.2 billion as NVLink, InfiniBand, and Spectrum-X gained traction. Gaming stayed solid with 30% growth, and automotive quietly advanced 32%, showing Nvidia’s strength is not confined to a single lane.

The cash story was just as impressive. Operating cash flow rose to $23.8 billion, free cash flow climbed 65% to $22.1 billion, and Nvidia returned $37 billion to shareholders in the first nine months of fiscal 2026. Even after that, $62.2 billion in buyback authorization remains. The balance sheet showcases strength, with $60.6 billion in cash and cash equivalents, long-term debt of just $7.5 billion, and short-term debt under $1 billion.

Management’s tone matched the numbers. CFO Colette Kress pointed to Blackwell Ultra as the top-selling chip, while CEO Jensen Huang noted cloud GPUs are effectively sold out.

NVIDIA is gearing up to release its Q4 report on Wednesday, Feb. 25. The management estimates revenue to be around $65 billion, plus or minus 2%. Meanwhile, analysts tracking Nvidia forecast its Q4 fiscal 2026 revenue to be $65.6 billion, and EPS is anticipated to grow 70.6% YOY to $1.45.

For the full fiscal 2026, the bottom line is projected to increase 51.2% annually to $4.43 per share before rising by another 58.9% to $7.04 in fiscal 2027.

What Do Analysts Expect for Nvidia Stock?

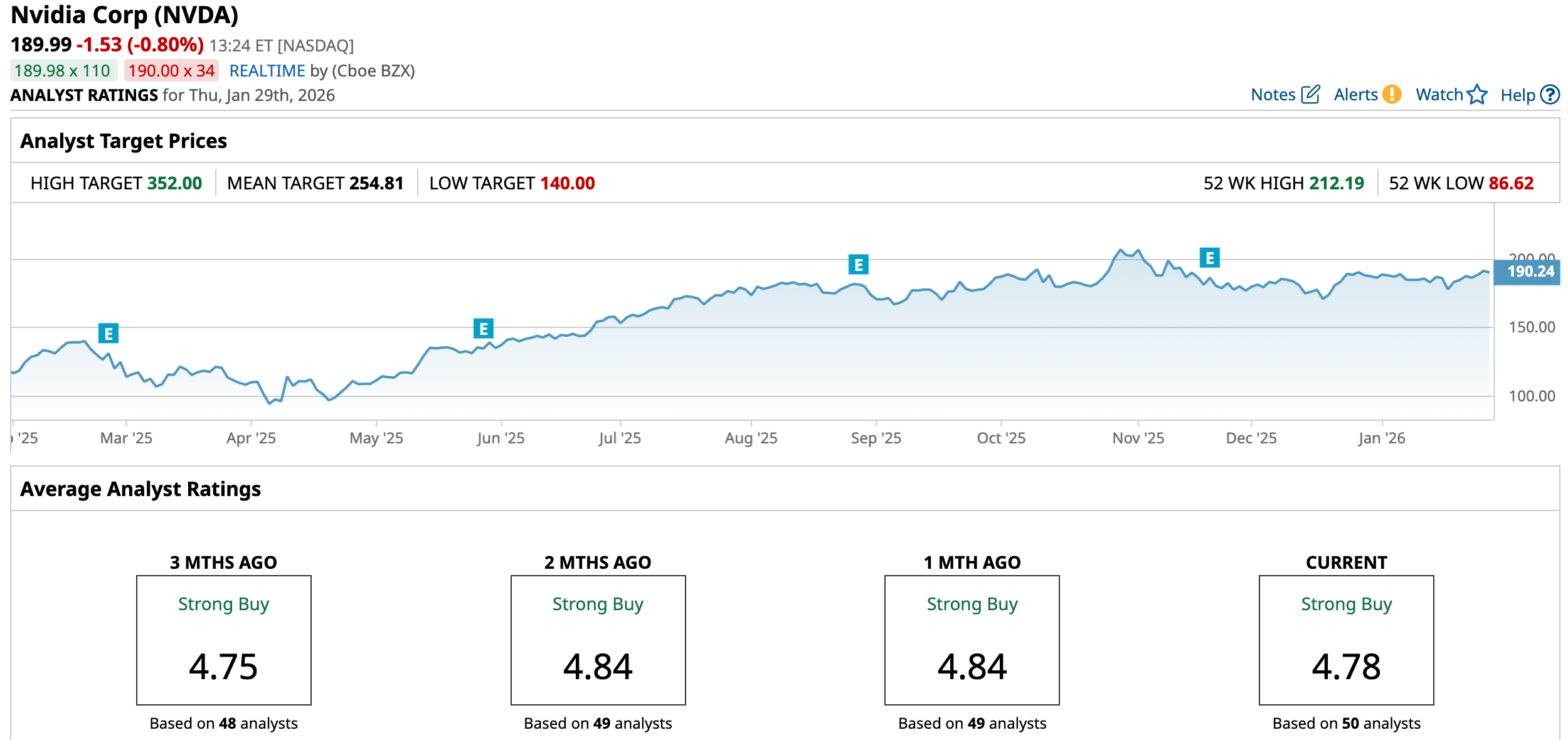

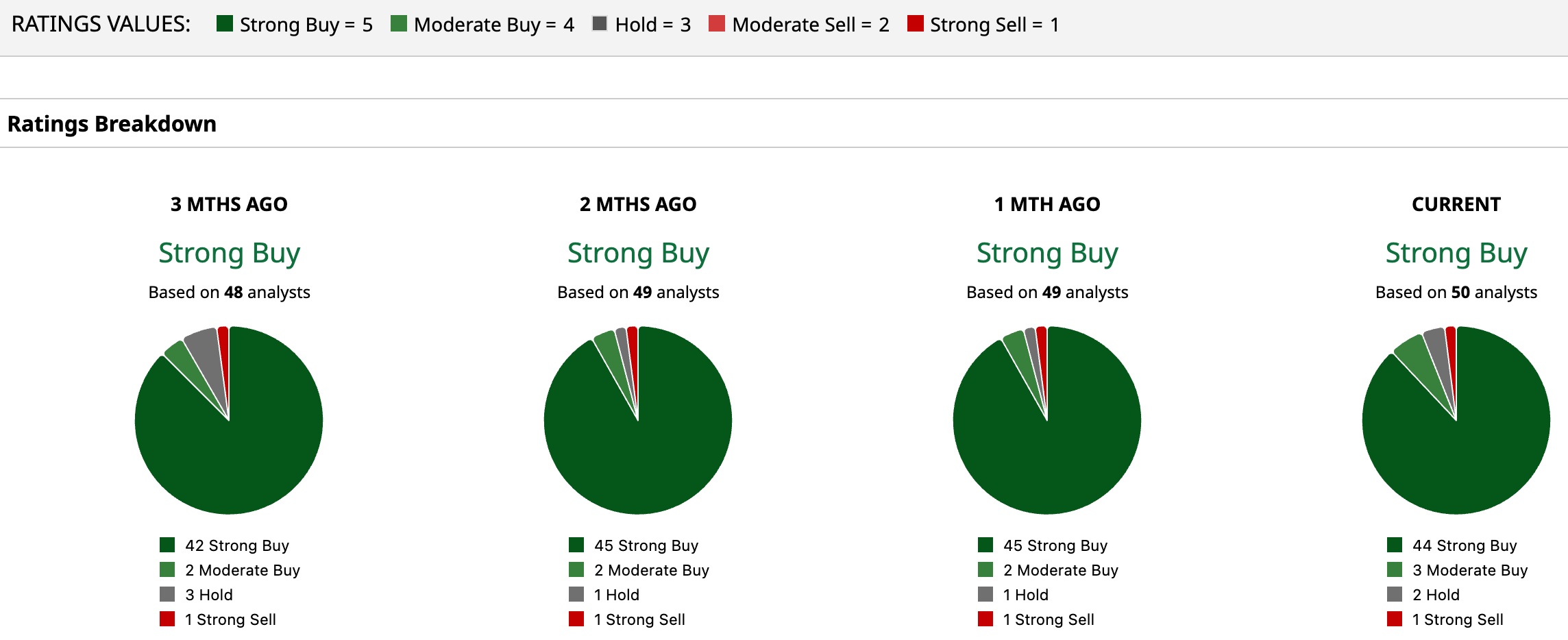

Overall, analysts are bullish about NVDA’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 50 analysts covering the stock, 44 advise a “Strong Buy,” while three suggest “Moderate Buy,” two advise a “Hold,” and only one suggests a “Strong Sell.”

The average analyst price target for NVDA is $254.81, indicating potential upside of 34%. Evercore ISI’s Street-high target price of $352 suggests that the stock could rally as much as 85% from here.

Final Thoughts on NVIDIA

Looking at the full picture, NVIDIA remains a business built on scale, execution, and market leadership. Its operating strength and financial position are hard to dispute. Still, the company’s growing involvement in large funding rounds, including a possible investment in OpenAI, added a layer of exposure.

If OpenAI’s long-term plans were to falter, NVIDIA could feel the impact indirectly – through capital commitments, demand expectations, or shifts in investor sentiment. At the same time, the stock is not cheap, and recent price action shows the market growing more selective.

For existing shareholders, NVDA looks like a stock to hold rather than rush to trade. For new investors, patience may matter as much as confidence.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart