Microsoft’s (MSFT) second-quarter financials were a classic “good news is bad news” paradox. While the multinational handily topped Street estimates for both profit and revenue, its stock still cratered 13% on Jan. 29, as cloud business growth failed to impress shareholders.

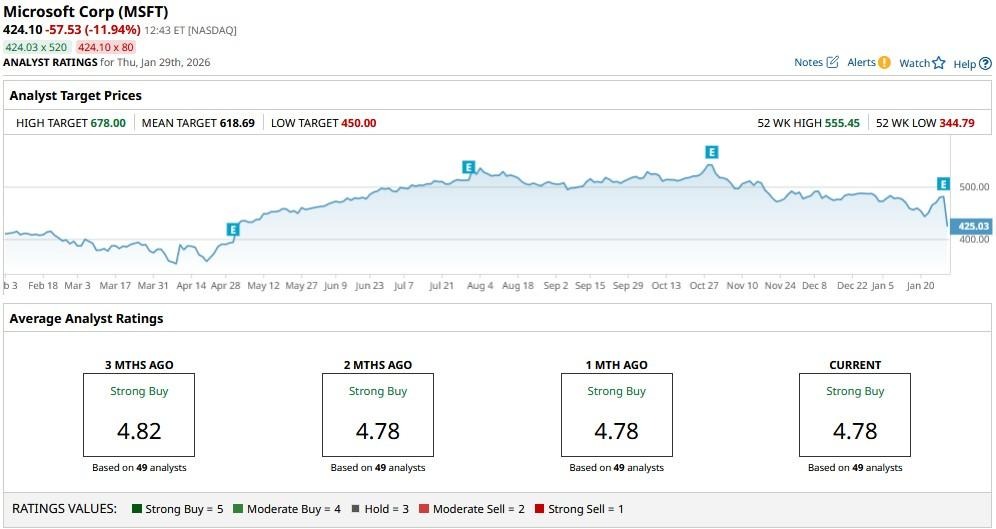

The selloff has even pushed Microsoft stock decisively below its 50-day moving average (MA), indicating continued pressure could follow in the weeks ahead.

Following the post-earnings plunge, the tech behemoth is trading about 22% below its record high.

Should You Buy Microsoft Stock on Post-Earnings Weakness?

The primary source of investor anxiety is the massive price tag on MSFT’s artificial intelligence (AI) ambitions.

In Q2, the tech titan’s capital expenditures stood at a breathtaking $37.5 billion, up 66% versus last year. Still, Azure growth surpassed Street estimates by a razor-thin 0.2%.

With over $72 billion invested in AI buildout in just six months, shareholders are rightfully asking if the returns will ever match the scale of the layout.

As Morgan Stanley’s senior analyst Keith Weiss put it in a post-earnings research note, “CAPEX is growing faster than we expected, and Azure a little slower than we expected.”

This makes MSFT stock a little less attractive to buy on recent weakness.

There Are Better Ways of Playing AI Than MSFT Shares

Even after the price decline, Microsoft shares carry a significant valuation premium that demands perfection, yet the company’s cloud engine is showing signs of friction.

In the current quarter, the firm sees Azure decelerating to 38% growth at best, further challenging management’s endless spending on AI infrastructure.

In short, the combination of a high price-to-earnings (P/E) multiple and cooling cloud momentum suggests the valuation floor might be deeper than many had hoped.

It’s not that MSFT is suddenly a “bad” investment; it’s just that there are more compelling, better-priced names out there for investors to participate in the AI trade.

Wall Street Remains Bullish on Microsoft Corp

Despite the aforementioned early signs of weakness in Azure, Wall Street remains bullish as ever on Microsoft.

The consensus rating on MSFT shares remains a “Strong Buy,” with the mean target of about $619 indicating potential upside of more than 45% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart