Sandisk (SNDK) will release its second-quarter fiscal 2026 financial results on Jan. 29. Shares of SNDK have been among the strongest performers in the S&P 500 ($SPX), climbing more than 98% year-to-date (YTD) and rising over 1,000% during the past six months.

SNDK stock’s explosive run has been driven by accelerating demand for Sandisk’s NAND memory products, driven by the investments in artificial intelligence (AI) infrastructure. As companies continue to invest heavily in data centers and AI infrastructure, demand for high-performance memory and storage solutions has intensified. This secular trend has positioned Sandisk as a key beneficiary of the AI spending cycle, supporting revenue growth.

In addition to robust end-market demand, industry supply constraints have created a favorable pricing backdrop. A global shortage of memory products has enabled suppliers to charge higher prices, and for Sandisk, this dynamic could translate into expanding margins if elevated volumes are sustained. Strong pricing power combined with rising shipments provides a compelling near-term earnings setup.

That said, technical indicators suggest the rally may be stretched in the near term. Sandisk’s 14-day Relative Strength Index currently stands at around 76, well above the 70 level that typically signals overbought conditions. This suggests that optimism may be running high ahead of earnings, raising the risk of a pullback if results or guidance fall short of elevated expectations.

The derivatives market is also signaling heightened volatility around the earnings release. Options pricing suggests a potential post-earnings move of 11% in either direction for options expiring Jan. 30. That is notably higher than Sandisk’s average earnings-related move of 8.2% over the past four quarters. Notably, SNDK stock jumped 15.3% following its previous earnings report.

Sandisk Could Deliver Strong Growth in Q2

Sandisk appears well-positioned to deliver another quarter of solid growth as industry conditions continue to work in its favor. Momentum in the company’s business is expected to carry through Q2, supported by a supply-demand imbalance that management believes will persist for an extended period.

According to the company, demand for Sandisk’s products currently exceeds supply across all end markets, and this dynamic is expected to remain in place through the end of calendar year 2026 and likely beyond. As a result, the company is likely to benefit from meaningful pricing leverage.

For Q2, management expects the top line to be between $2.55 billion and $2.65 billion. This outlook is driven by double-digit price increases alongside higher shipment volumes, reflecting strong customer demand. One of the key growth engines continues to be the data center market, where demand remains robust. Hyperscale cloud providers, emerging neoCloud players, and original equipment manufacturers (OEMs) are deepening their relationships with Sandisk, strengthening the company’s strategic position in high-performance storage. In addition, interest in Sandisk’s storage-optimized solid-state drive platform is gaining traction, supporting long-term growth.

Sandisk’s profitability is also expected to improve meaningfully. Management forecasts adjusted gross margin between 41% and 43% for the quarter, supported by higher pricing and favorable cost dynamics. This margin expansion should translate into strong earnings performance, with adjusted EPS projected between $3.00 and $3.40. Notably, management’s guidance is well above the Street’s current estimate of $2.94, continuing a pattern in which Sandisk has exceeded analysts’ expectations in two of the past three quarters.

Despite ongoing capital investments related to the BiCS8 transition, Sandisk anticipates generating positive free cash flow in the second quarter. This combination of strong demand, favorable pricing, and improving margins bodes well for growth.

What’s Next for SNDK Stock?

The strong demand and favorable pricing environment suggest that SNDK stock’s momentum will sustain. However, the significant rally in Sandisk stock has pushed the firm's valuation higher.

The company’s forward price-to-earnings ratio of 43.4 appears elevated compared to peers. However, it looks reasonable relative to Sandisk’s earnings growth potential. Analysts are forecasting a solid surge in profitability, with EPS expected to jump 552% in fiscal 2026. Growth is projected to remain robust the following year, with EPS estimated to rise another 111% in fiscal 2027.

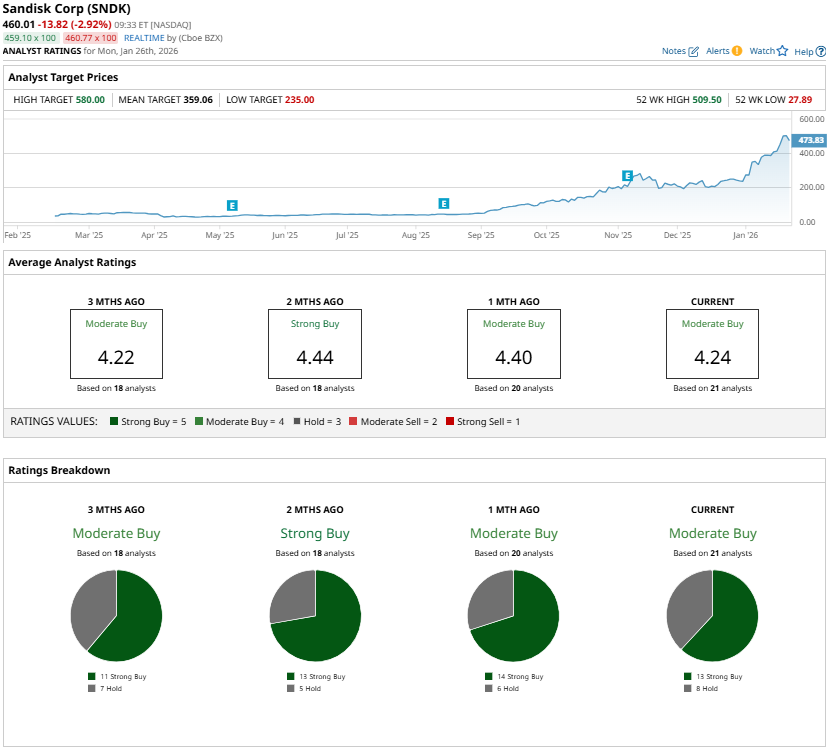

SNDK stock currently has a “Moderate Buy” consensus rating following its significant price rally. However, the Street’s highest price target of $580 indicates further potential upside from current levels, even after a rally of more than 1,000%.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?