NiSource Inc. (NI) is an Indiana-based regulated energy holding company that provides natural gas distribution and electric utility services to nearly four million customers across several Midwestern and Eastern states. With a market cap of $20.3 billion, the company delivers energy to residential, commercial, and industrial users.

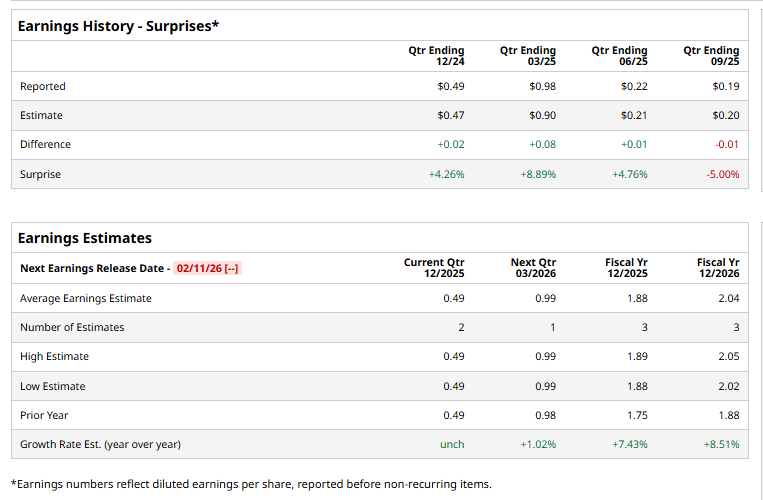

The leading natural gas distribution company is expected to announce its Q4 2025 earnings for 2025 soon. Ahead of this event, analysts predict the company will report an adjusted EPS of $0.49, unchanged from the year-ago quarter value. It has exceeded Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For the full year, analysts anticipate NiSource to report EPS of $1.88, representing a 7.4% increase from $1.75 in fiscal 2024. Its EPS is expected to rise 8.5% year over year to $2.04 in fiscal 2026.

NI stock has surged 17.9% over the past year, trailing the S&P 500 Index’s ($SPX) 18.6% gains but surpassing the Utilities Select Sector SPDR Fund’s (XLU) 14.1% gains over the same time frame.

On Oct. 31, NiSource announced the launch of an at-the-market equity offering program that allows the company to sell up to $1.5 billion of its common stock through December 31, 2028. The shares may be issued from time to time at prevailing market prices under agreements with a broad syndicate of major financial institutions acting as sales agents and forward sellers. Its shares popped 1.1% in the following trading session.

Analysts’ consensus on NI stock is highly bullish, with an overall “Strong Buy” rating. Out of 15 analysts covering the stock, 11 advise a “Strong Buy” rating, and four suggest a “Hold.” NI’s average analyst price target is $47.08, indicating a potential upside of 8.7% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart