- Alamos Gold (AGI) is trading at a new all-time high on Monday, and shares are up more than 118% over the past 52 weeks.

- AGI is benefiting from gold (GCG26) hitting new record highs on Monday.

- Some experts are calling the recent price action part of a “Sell America” trade as investors react to news that Federal Reserve Chair Jerome Powell is under criminal investigation.

- Alamos Gold has strong technical momentum, and maintains a 100% “Buy” opinion from Barchart.

Today’s Featured Stock

Valued at $17.6 billion, Alamos Gold (AGI) is a Canadian gold company. It runs three mines, including two in Canada and one in Mexico.

On Sunday, Federal Reserve Chair Jerome Powell revealed that he was under criminal investigation related to a $2.5 billion renovation of the Fed’s headquarters and his related congressional testimony. Monday’s resulting trading has some declaring that “Sell America” is in vogue. The U.S. Dollar Index ($DXY) fell nearly 0.3%, and safe-haven investments like gold have hit new record highs.

This bodes well for Alamos and other gold miners and producers, which move in sympathy with the underlying precious metal.

Plus, AGI stock has already benefitted over the past year from a strong move higher in gold on the back of central bank demand and geopolitical turmoil, among other catalysts.

What I’m Watching

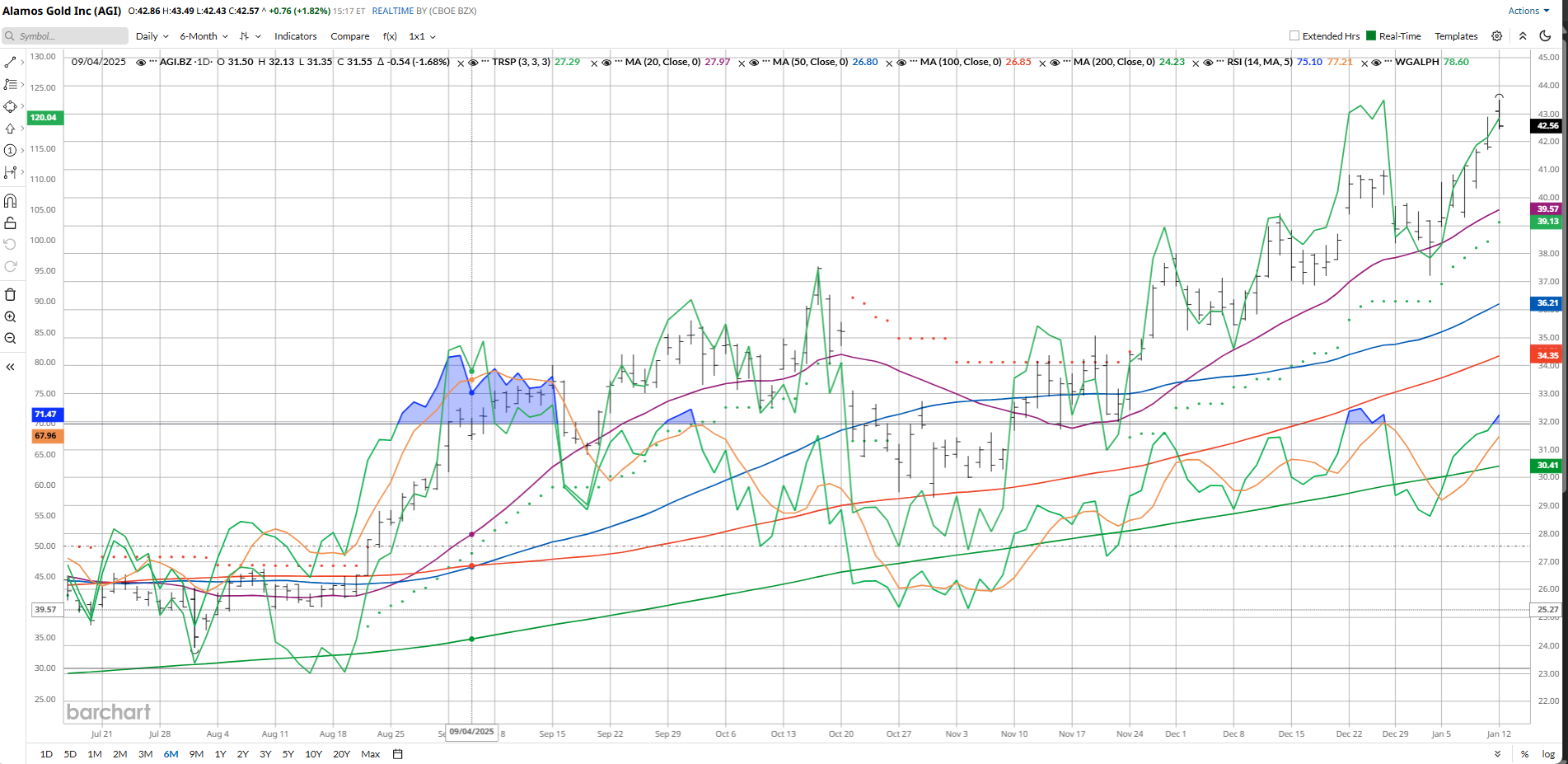

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. AGI checks those boxes. Since the Trend Seeker signaled a new “Buy” on Nov. 25, the stock has gained 23.21%.

Barchart Technical Indicators for Alamos Gold

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Alamos Gold scored a new all-time high of $43.47 on Jan. 12.

- AGI has a Weighted Alpha of +119.90.

- Alamos Gold has a 100% “Buy” opinion from Barchart.

- The stock gained 118.45% over the past year.

- AGI has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $42.55 with a 50-day moving average of $36.21.

- Alamos Gold made 7 new highs and gained 10.73% in the last month.

- Relative Strength Index (RSI) is at 71.44.

- There’s a technical support level around $41.38.

Don’t Forget the Fundamentals

- $17.6 billion market capitalization.

- 38.01x trailing price-earnings ratio.

- 0.23% dividend yield.

Analyst and Investor Sentiment on Alamos Gold

- The analysts tracked by Barchart rate Alamos Gold a “Strong Buy” with price targets ranging between $39 and $53.

- Short interest is low at 3% of the float.

The Bottom Line on Alamos Gold

According to JPMorgan on Monday, the “Sell America” trade could be the dominant move in the market to start the week.

And there’s more to the gold narrative than the latest concerns over Fed independence. Gold stocks have been moving higher over the past 12 months as the underlying precious metal has hit multiple new record highs. My colleague Jim Wyckoff wrote recently that there are higher price floors now under gold and silver which should continue to support the longer-term bull markets in both metals. As long as that trend continues, AGI and its peers are positioned to trend up, too.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.