Artificial intelligence (AI) may grab the headlines, but the quieter money in this cycle has been flowing into the infrastructure that keeps AI running. Models can only scale if data can be stored, accessed, protected, and moved efficiently. In 2025, that reality showed up clearly in market performance, as data storage emerged as one of the strongest themes tied to the global data center buildout.

Well-known names set the pace. Sandisk (SNDK) delivered a historic run, turning into the S&P 500 Index’s ($SPX) top performer of the year, while Western Digital (WDC) followed closely, benefiting from surging demand for high-capacity and enterprise-grade storage. As returns in mega-cap AI leaders began to normalize, investors started rotating toward the next layer of the trade, the “picks and shovels” behind hyperscaler spending.

That shift brings Pure Storage (PSTG) into focus. The company designs modern data storage and management platforms built around its Purity software, which runs across its systems to deliver always-on data reduction, protection, encryption, and support for block, file, and object storage.

After a standout year for legacy leaders, analysts anticipate double-digit upside potential for PSTG stock, which could represent the next phase of the data center storage story heading into 2026.

About Pure Storage Stock

Valued at about $22.12 billion, Pure Storage is at the center of the modern data center shift, building software-driven, all-flash storage designed for speed, scale, and cloud flexibility. The company helped rewrite the storage playbook by pushing a model that grows with customers, reducing complexity while keeping costs predictable.

Its core platforms, FlashArray and FlashBlade, are powered by the Purity operating environment and supported by Pure1’s cloud-based management tools. Through FlashStack, developed alongside Cisco (CSCO), Pure offers a tightly integrated infrastructure for enterprise workloads. Founded in 2009 and rebranded from OS76, Inc. in 2010, Pure Storage is headquartered in Santa Clara, California.

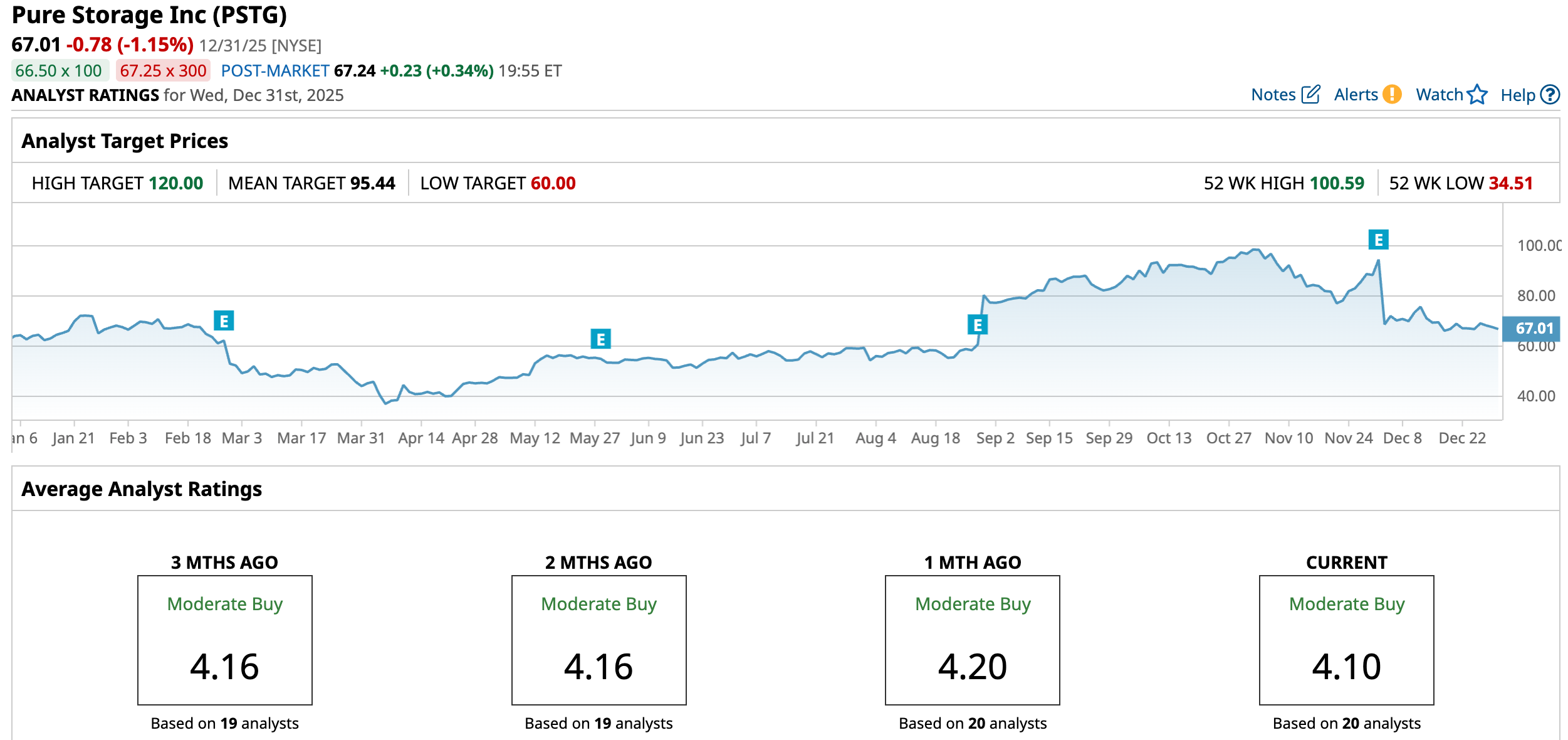

Pure Storage’s 2025 chart tells a story of strong upside followed by a needed reset. The stock finished the year up 10.4% and sprinted to a November peak of $100.59 as enthusiasm around data center spending built. That rally overheated, and shares have since slid about 50% from the highs. Even so, the bigger picture is not broken. PSTG stock is still up 16.38% over the past six months.

On the technical side, momentum is quietly improving. The 14-day RSI is hovering 38.75, signaling the stock has worked off its excess selling pressure. Meanwhile, the MACD is flashing early signs of a turn, with the MACD line moving above the signal line and the histogram flipping positive. That combination points to fading downside momentum and a potential consolidation phase taking hold.

From a valuation standpoint, PSTG trades at a clear premium, with shares priced at 34.47 times forward adjusted earnings and 6.09 times forward sales. Still, that earnings multiple sits below the stock’s five-year average, suggesting some expectations have already been tempered.

Pure Storage Delivered Mixed Q3 Results

Pure Storage’s third quarter of fiscal 2026 was less about flashy headlines and more about disciplined execution, and that’s exactly why the numbers landed with weight. Reported on Dec. 2, the quarter showed a business quietly compounding strength as data center spending continues to favor scalable, software-led storage platforms.

Revenue rose 16% year-over-year (YOY) to $964.5 million, powered by steady enterprise demand and a growing subscription base. The top line beat Wall Street’s projections. Subscription services revenue climbed 14% annually to $429.7 million, while subscription annual recurring revenue (ARR) reached $1.8 billion, up 17%.

Profitability kept pace. Non-GAAP operating income came in at $196.2 million, translating into a healthy 20.3% operating margin. Non-GAAP EPS of $0.58 rose 16% YOY, but missed the projections slightly.

Cash generation remained solid, with $116 million in operating cash flow and $52.6 million in free cash flow. Pure ended the quarter with $1.5 billion in cash, cash equivalents, and marketable securities, and still found room to return $53 million to shareholders through share repurchases.

Meanwhile, Pure Storage’s strategy is getting sharper. Pure continued simplifying workload expansion by pushing its Enterprise Data Cloud deeper into the public cloud. The launch of Pure Storage Cloud Azure Native, built jointly with Microsoft, marked a first-of-its-kind, fully managed, enterprise-grade block storage service. On the hardware side, the FlashArray lineup evolved with the XL190 R5, X R5, and C R5, reinforcing Pure’s all-flash leadership.

The control plane is where things get interesting. Pure expanded its Pure1 AI Copilot, including an AI-powered platform engineering assistant for Portworx customers and integration with Model Context Protocol servers. By integrating Portworx and Pure Fusion, the company is narrowing the gap between traditional enterprise workloads and modern, cloud-native applications.

Also, security was not treated as an afterthought. New Pure Protect Recovery Zones and cyber resilience services with Veeam were rolled out, alongside deeper integrations with CrowdStrike (CRWD) and Superna to improve real-time detection, monitoring, and remediation.

Management’s confidence showed up in guidance. For Q4 fiscal 2026, revenue is expected between $1.02 billion and $1.04 billion, with non-GAAP operating income of $220 million to $230 million. Full-year guidance was raised, with revenue projected at $3.63 billion to $3.64 billion and non-GAAP operating income of $629 million to $639 million.

Analysts tracking Pure Storage expect an EPS of $0.53 in 2026, up 15.2% YOY, before rising by another 43.4% annually to $0.76 in fiscal 2027.

What Do Analysts Expect for Pure Storage Stock?

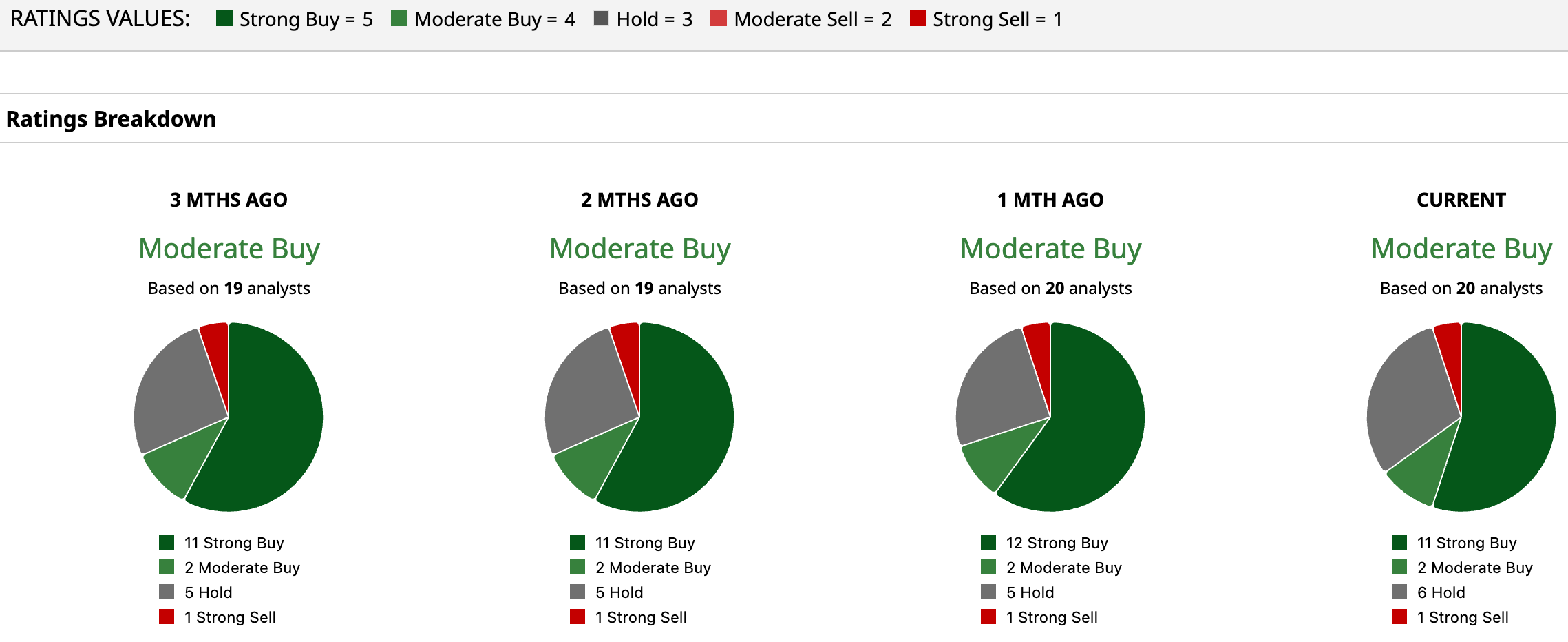

Wall Street’s view on PSTG is bullish but with a dash of caution. The stock has a consensus “Moderate Buy” overall. Out of 20 analysts offering recommendations on the stock, most lean bullish, with 11 advising a “Strong Buy.” Meanwhile, two analysts advise a “Moderate Buy” rating, six are playing it safe with a “Hold” rating, and the remaining one is an outright skeptic with a “Strong Sell” rating.

The stock’s average analyst price target of $95.44 suggests PSTG has an upside potential of 42.43%. The Street-high target of $120 implies that the data center stock could rally almost 80% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026

- As Goldman Sachs Funds the Next Era of AI, Should You Buy, Sell, or Hold the Iconic Bank Stock?

- NVDA, NKE, and CM: Bet on These 3 Stocks With Surging Unusual Options Activity for 2026 Gains