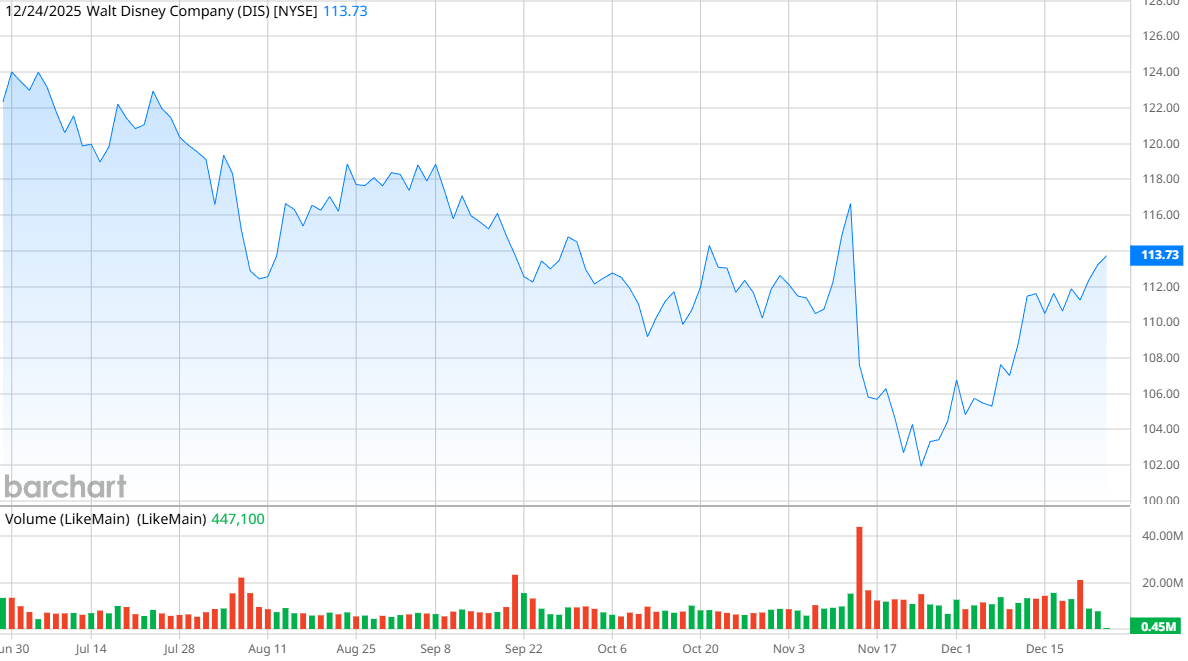

Walt Disney (DIS) stock has been struggling this year, falling more than 25% earlier this year before a summer rally. In recent weeks, the stock has just been treading water, leaving investors with minimal gains in 2025.

However, the chairman of Disney’s board of directors seems to have a bullish forecast on DIS stock. James Gorman, a former Morgan Stanley executive chairman who took over the leadership of Disney’s board nearly a year ago, purchased 18,000 shares of DIS stock, according to financial filings that valued the transaction at $2 million. Gorman purchased the shares at an average price of $111.89 and now holds just over 44,500 shares.

Does Gorman’s insider purchase portend good things ahead for DIS stock?

About Walt Disney Stock

The Walt Disney Company is one of the biggest and most well-known entertainment companies in the world. Headquartered in Burbank, California, Disney owns iconic brands such as Mickey Mouse and Cinderella, as well as Pixar characters such as Woody and Buzz from “Toy Story” and Lightning McQueen from “Cars.”

Disney also acquired the Star Wars and Marvel franchises, granting them access to powerful and popular universes that continue to be the source of numerous popular movie and TV franchises. It operates a streaming platform, Disney+, as well as popular theme parks, movie studios, and cruise lines.

Shares of DIS stock are up only 2.6% this year, which trails the Dow Jones Industrial Average’s ($DOWI) 14.3% gain. It also underperforms other stocks in the consumer discretionary sector, as evidenced by the 7% year-to-date (YTD) gain of the Vanguard Consumer Discretionary Index Fund ETF (VCR).

However, Disney shares can be considered a bargain right now, as they are far below the stock’s typical valuation. Shares trade at a price-to-earnings ratio of just 16.5, versus the 10-year mean P/E of 45. Disney shares haven’t been this affordable, historically, since the COVID-19 pandemic forced lockdowns and shuttered theme parks and resorts.

DIS stock also pays a dividend yield of 1.3%, or $1.50 per share. But unlike other companies, the payout is only twice a year—the upcoming payout of $0.75 per share will be Jan. 15 to shareholders of record as of Dec. 15, 2025. The next payout won’t be until July 22, 2026, to shareholders of record as of June 30, 2026.

Disney Beats on Earnings

Disney’s earnings for the fourth quarter of fiscal 2025 (ending Sept. 27) showed slightly lower revenue and income than the previous year, but the company still comfortably beat analysts’ expectations, earning $1.11 per share versus expectations of $1.03 per share.

Fourth-quarter revenue of $22.46 billion was down slightly from $22.57 billion compared to a year ago, with the company’s Entertainment division—specifically ABC, Disney-branded TV channels, and Hulu’s content arm—pulling it lower. The Entertainment division saw its revenue decline by 6% in the quarter, while the Sports segment, which includes ESPN and its ESPN+ streaming service, gained 2% from a year ago. The Experiences segment, which includes parks and cruise lines, rose by 6%.

For the full year, Disney reported revenue of $94.4 billion, up from $91.4 billion a year ago, and earnings per share of $5.93, up 17% from 2024.

What Do Analysts Expect for DIS Stock?

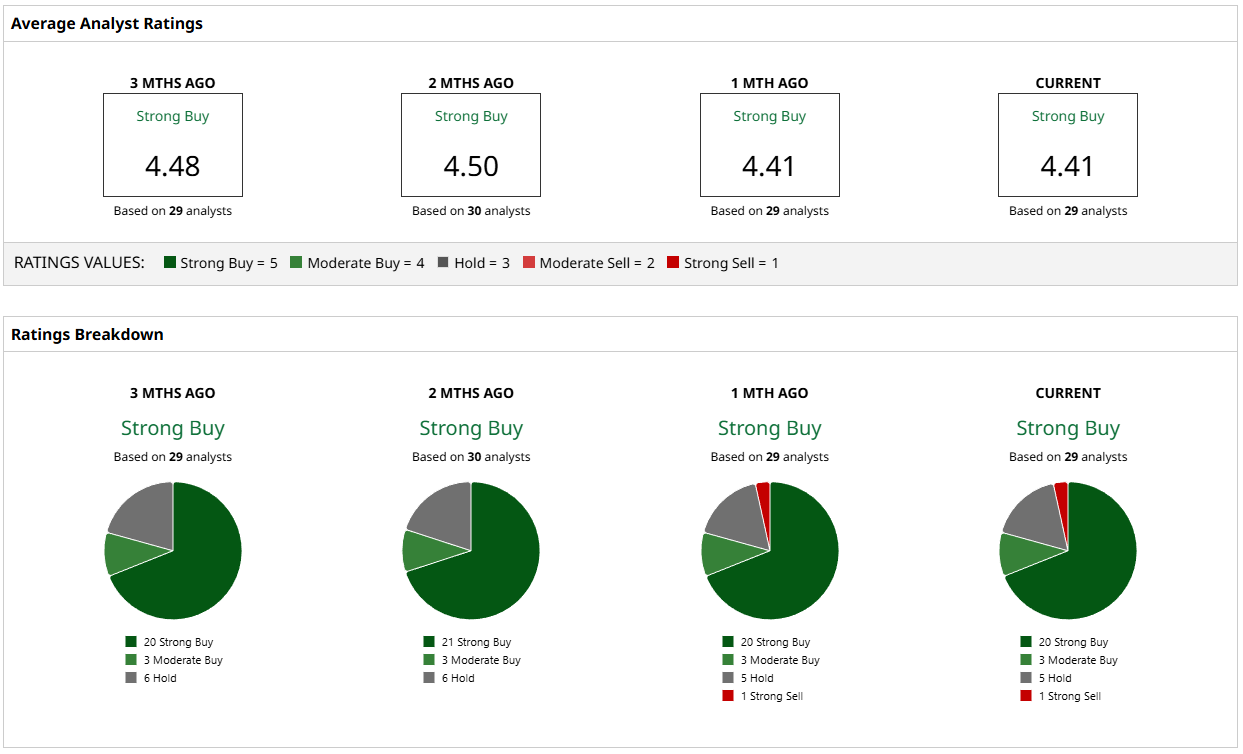

Analysts are exceptionally bullish on Disney, despite the comparatively weak stock performance this year. Twenty of 29 analysts who cover the stock have “Strong Buy” ratings on the stock, with three others giving it a “Moderate Buy” rating. Five suggest holding, and only one analyst keeps a “Strong Sell” rating.

The mean price target of $135.28 indicates a 19% potential gain in stock price in the upcoming months, with the most bullish target of $160 indicating a 40% increase. The most pessimistic target of $77, however, warns of a potential 32% decline.

Disney Defensively Embracing AI

However, Disney is making some strategic moves to ensure that decline doesn’t happen. It recently signed a three-year licensing agreement with OpenAI to allow that company’s text-to-video AI model, Sora, to generate short user-prompted videos that feature more than 200 characters from Disney, Marvel, Pixar, and Star Wars.

The deal also calls for Disney to invest $1 billion into OpenAI, with warrants to purchase additional equity. The agreement positions Disney as the first major content licensing partner on Sora.

“Bringing together Disney’s iconic stories and characters with OpenAI’s groundbreaking technology puts imagination and creativity directly into the hands of Disney fans in ways we’ve never seen before, giving them richer and more personal ways to connect with the Disney characters and stories they love,” Disney CEO Robert Iger said.

I see this deal as more than just another opportunity to promote Disney content. Hollywood studios have been combating impermissible use of their content by AI, and the Disney-OpenAI deal marks a promising model that would allow studios to protect their intellectual property—and potentially profit from it.

Iger told CNBC that the deal will serve as “a way in” to AI, which Iger says will have a long-term impact on Disney’s business. “No human generation has ever stood in the way of technological advance, and we don’t intend to try,” Iger said. “We’ve always felt that if it’s going to happen, including disruption of our current business models, then we should get on board.”

That’s why I think Gorman’s $2 million purchase of DIS stock at market prices makes a lot of sense. And why I think DIS is a good buy heading into 2026.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.