Alphabet’s Google (GOOG) (GOOGL) has once again reminded the world that it cannot be underestimated. The tech titan jolted Wall Street with the debut of Gemini 3 this month, its most advanced artificial intelligence (AI) system to date, reigniting enthusiasm in the AI race and giving its stock a powerful lift. After months of mounting pressure from aggressive rivals like OpenAI and Anthropic, this launch feels like Google’s big comeback moment.

And the new model is certainly winning applause across the tech universe for its remarkable speed, sharp reasoning, and multimodal brilliance. Even Salesforce (CRM) CEO Marc Benioff couldn’t contain his excitement on X (formerly Twitter) calling Gemini 3 an “insane” leap forward. After spending just “two hours on Gemini 3,” he boldly declared he’s “not going back” to ChatGPT, adding that the upgrade feels like “the world just changed, again.”

With reactions like that pouring in, one big question is echoing now. Has Google finally snatched back the AI crown it lost when ChatGPT took the world by storm in 2022? And more importantly for investors, is now the perfect moment to grab some Google stock?

About Google Stock

With a rich mix of revenue streams behind it, Google’s tech dominance stands out. This California-based powerhouse touches nearly every corner of the digital world, from its massive ad business and expanding cloud arm to ad-supported streaming, self-driving initiatives, and even breakthroughs in healthcare.

But what really distinguishes Google now is its early, strategic commitment to AI and quantum computing. Long before AI took center stage, Google was quietly weaving it into its core offerings, Search, YouTube, Maps, and more. Those early efforts have now come together in Gemini, the company’s flagship AI platform, forming the backbone of its bid to lead the global AI race.

While Google has certainly faced pressure this year from Microsoft (MSFT)-backed OpenAI, which has challenged Google’s core search and browser strengths, the company has shown impressive resilience in defending and now expanding its leadership. And since the rollout of Gemini 3 on Nov. 18, things have clearly shifted in Google’s favor.

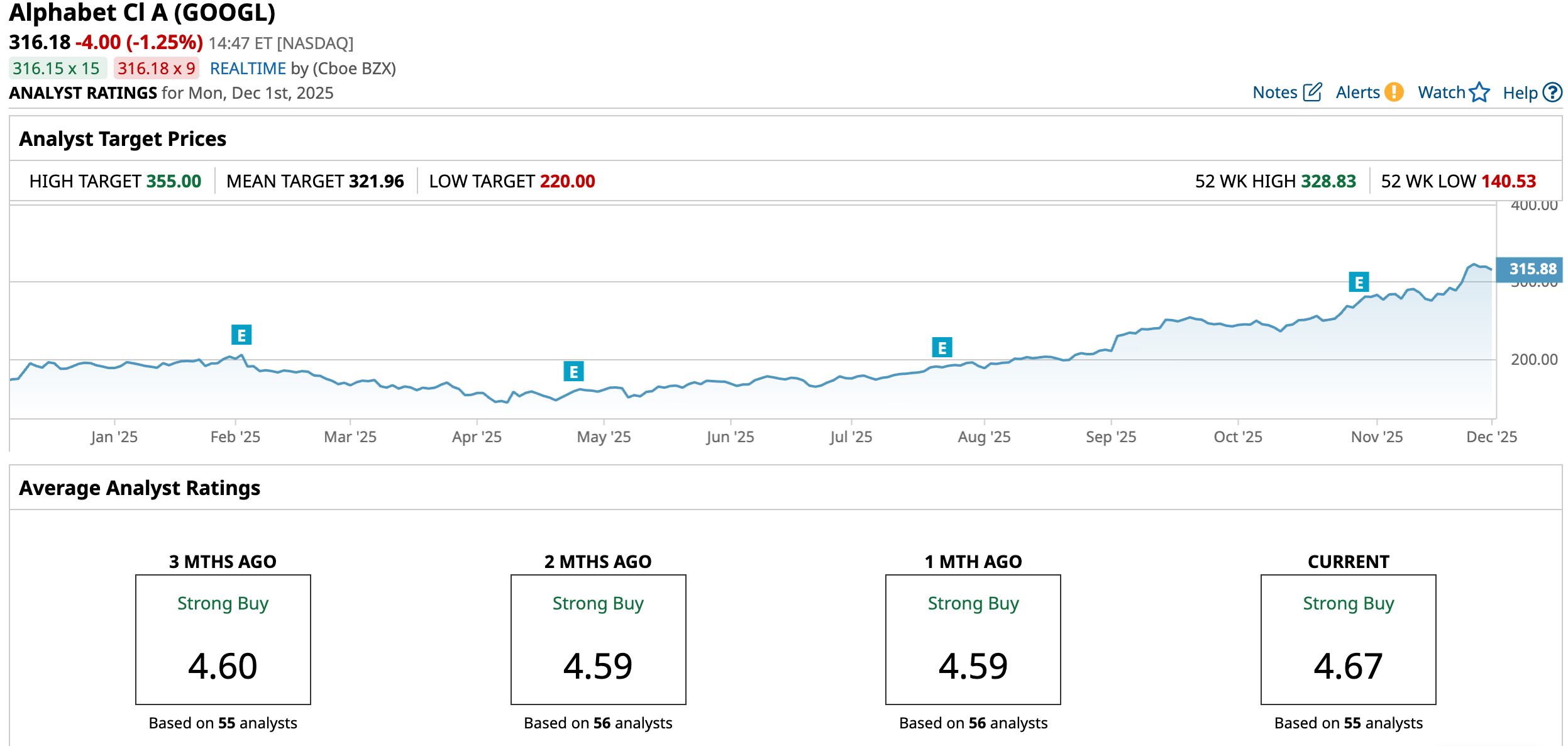

With analysts and users alike raving about the new AI model’s cutting-edge capabilities, Google’s stock hit an all-time high of $328.83 on Nov. 25. With a market capitalization now hovering around $3.9 trillion, Google’s stock is knocking on the door of the exclusive $4 trillion club.

The stock has been nothing short of unstoppable, soaring nearly 68% so far in 2025 and an incredible 84.8% over the past six months. For comparison, the broader S&P 500 Index ($SPX) has climbed a far more modest 16.3% this year and 15.72% over that same six-month stretch, making Google’s surge look all the more impressive.

Quick Financial Overview: Q3 Highlights

Google dropped its fiscal 2025 third-quarter earnings report on Oct. 29, which blew past both Wall Street’s top and bottom line expectations. Total revenue for the quarter jumped 16% year-over-year (YOY) to $102.3 billion and topped the estimated figure of $100.1 billion. The revenue growth was powered by a 14% rise in Google Services revenue to $87.1 billion, which includes strong performances from Google Search, YouTube ads, subscriptions, platforms, and devices.

Also, Google Cloud contributed significantly with a 34% increase in revenue to $15.2 billion, showcasing expanding demand across its business cloud offerings. Additionally, the quarter delivered healthy profitability. Operating income rose 9% to $31.2 billion, with an operating margin of 30.5%. That margin was weighed down by a $3.5 billion antitrust fine from the European Commission. Without that hit, the adjusted margin would have approached a much stronger 34%.

Earnings per share (EPS) didn’t disappoint either. Google delivered an EPS of $2.87, up an impressive 35.4% (YOY), and beating estimates by about 27%. Looking ahead, Google signaled continued ambition. The company forecast capital expenditures between $91 billion and $93 billion for fiscal 2025, underscoring ongoing investment in infrastructure and technology.

On top of that, management also revealed that Google Cloud backlog orders have surpassed $155 billion by the end of the third quarter, highlighting mounting demand for cloud and AI services. All in all, the quarter paints a picture of a company riding a wave of intense AI-driven demand, while gearing up for more growth ahead.

A Deep Dive Into Gemini 3’s Capabilities

Gemini 3 looks like the moment Google has been building toward. Nearly two years after launching the Gemini era, the numbers alone tell a jaw-dropping story. AI Overviews now guide 2 billion users every month. The Gemini app has soared beyond 650 million monthly users. And over 70% of Google Cloud customers are tapping into Gemini’s AI.

Now comes Gemini 3, which CEO Sundar Pichai said is the “most intelligent model” Google has ever created and the one designed to bring ideas to life faster, smarter, and more creatively than before. For the first time in history, a Gemini model launched directly inside Search on day one through AI Mode, giving users a major leap in reasoning and interactive experiences instantly.

How Are Analysts Viewing Google Stock?

Analysts have been downright enthusiastic about Google’s Gemini 3. For instance, investment firm D.A. Davidson called it the “current state-of-the-art” and “its favorite model generally available today.” At the same time, Bank of America Securities praised Gemini 3 as “another positive step” for Google, moving it closer to, if not overtaking, rivals like OpenAI in AI performance. That kind of strong backing only adds weight to the idea that Gemini 3 could significantly reshape Google’s AI lead.

Overall, Wall Street’s conviction in GOOGL remains firmly bullish. Among 55 analysts covering the stock, a commanding 44 rate it a “Strong Buy,” four call it a “Moderate Buy,” and only seven recommend “Hold.” The average price target of $321.96 points to limited upside from current levels, but the most optimistic target of $355 still leaves room for an 12.4% move higher.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart