Traders once fawned over the S&P 500 Index ($SPX), and prior to that, the Dow Jones Industrial Average ($DOWI). But over time, especially since the COVID-19 pandemic, the Invesco Nasdaq QQQ Trust (QQQ) has stolen the spotlight.

How popular has QQQ become? Well, I don’t know why Invesco changed its name to actually include the ticker symbol in 2018. But that seems to be a sign that it has reached star status. So when I’m looking for market direction, I look there.

That’s in part due to my belief that for the foreseeable future, QQQ and the S&P 500 move too much in sync to consider them separately. The rise of the Magnificent 7, all listed on the Nasdaq Stock Exchange, has everything to do with that evolution.

Where Is QQQ’s Price Headed?

Here, I’m about the charts. And how the market tells a story. We just need to listen!

So, what’s the story I hear it saying right now, and how loudly is it speaking? That is, how definitive are the signals and indicators I analyzed?

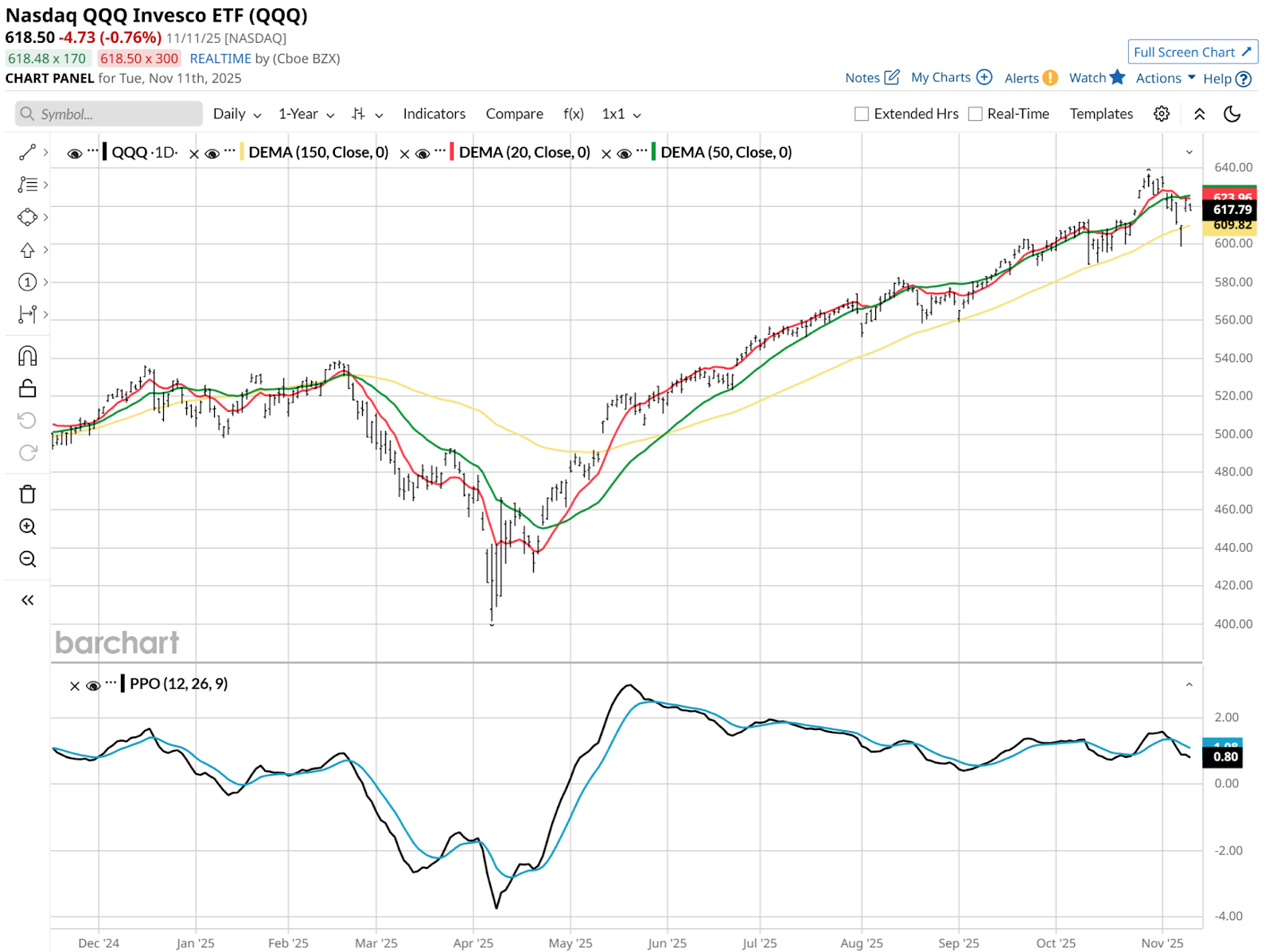

Let’s start with a daily QQQ chart going back 12 months. It has come a long way, but part of the story here is that the rest of the stock market hasn’t. That means QQQ is essentially the last one standing.

I’m not the only one writing that these days. The market knows it very well. So the cost of ignoring a dip that is really a step toward a correction, which begets a crash, is very, very high.

Does that mean I won’t consider QQQ in my portfolio? No, that’s not the translation at all. It just means that the risk is much higher than usual, and it’s important to hedge for this. I’ve referred to the Reward Opportunity and Risk (ROAR) score I created, which is my own method of estimating how much risk of major loss is attached to the effort and capital I’m putting in to try to make profits.

You can review this article on the ROAR score to better understand the approach.

QQQ has a low ROAR score currently. That means that while reward is always possible, the risk that comes with it is much higher than normal. Based on my ROAR analysis, I estimate a much stronger chance that QQQ will fall by 10%-15% before it rises by that much.

That’s based on ROAR, a combination of multiple moving averages, and that fact that it punishes an ETF or stock that has just surged in price. As they say, trees don’t grow to the sky!

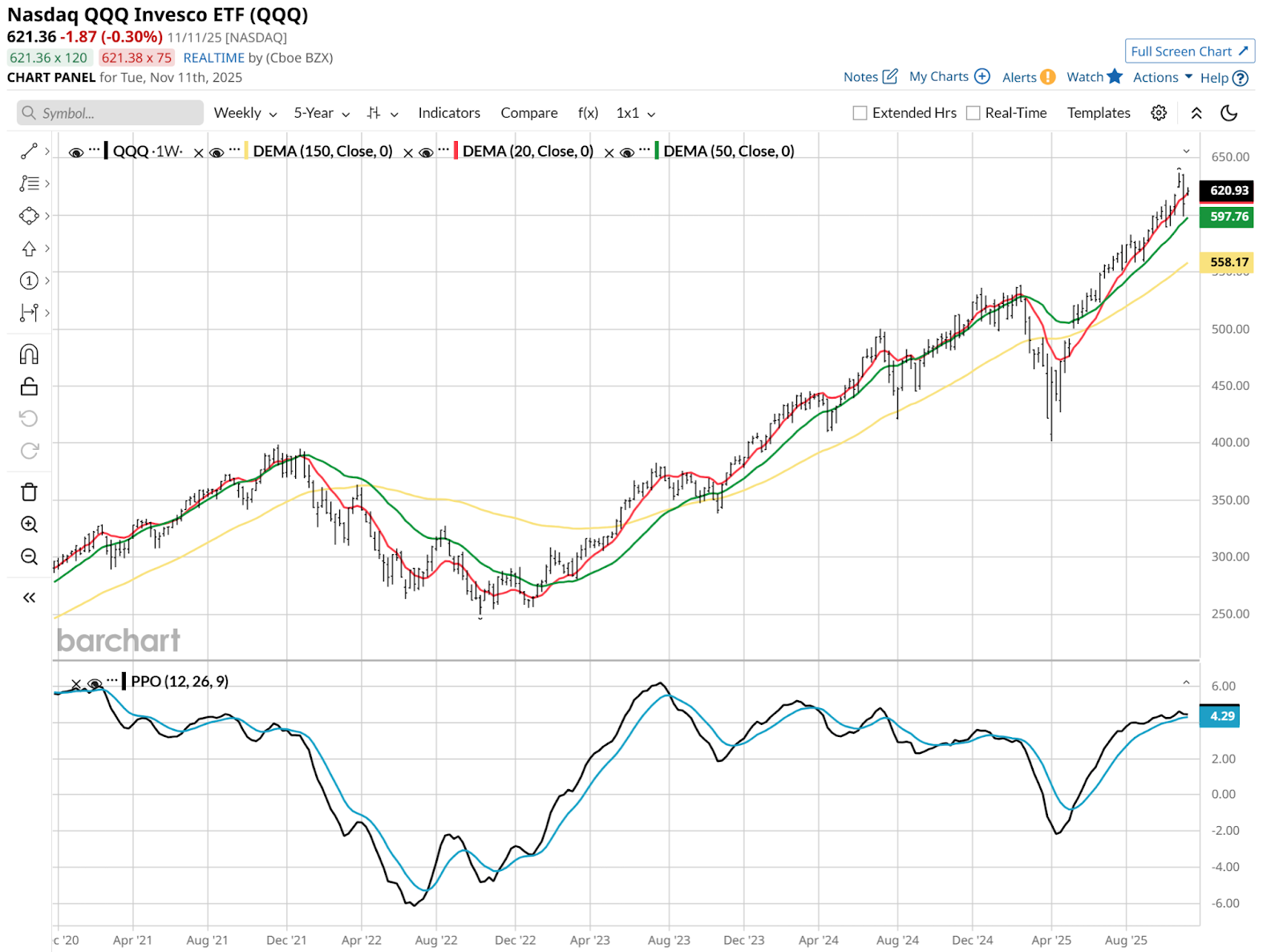

The weekly chart obviously shows the same, stretched picture. But if you look at that Percentage Price Oscillator (PPO) indicator at the bottom of the chart, it has been flat for several weeks. That might just mean QQQ continues to drift upward, based on the strength of those giant stocks within it.

However, I think that part of that picture implies that when the market does break down, it is more likely to be sudden and sharp. A shock to the system, if you will. That’s what happened earlier this year, and during late 2021. In each case, QQQ slowed, drifted higher, then fell decisively. Traders should be on guard for that again.

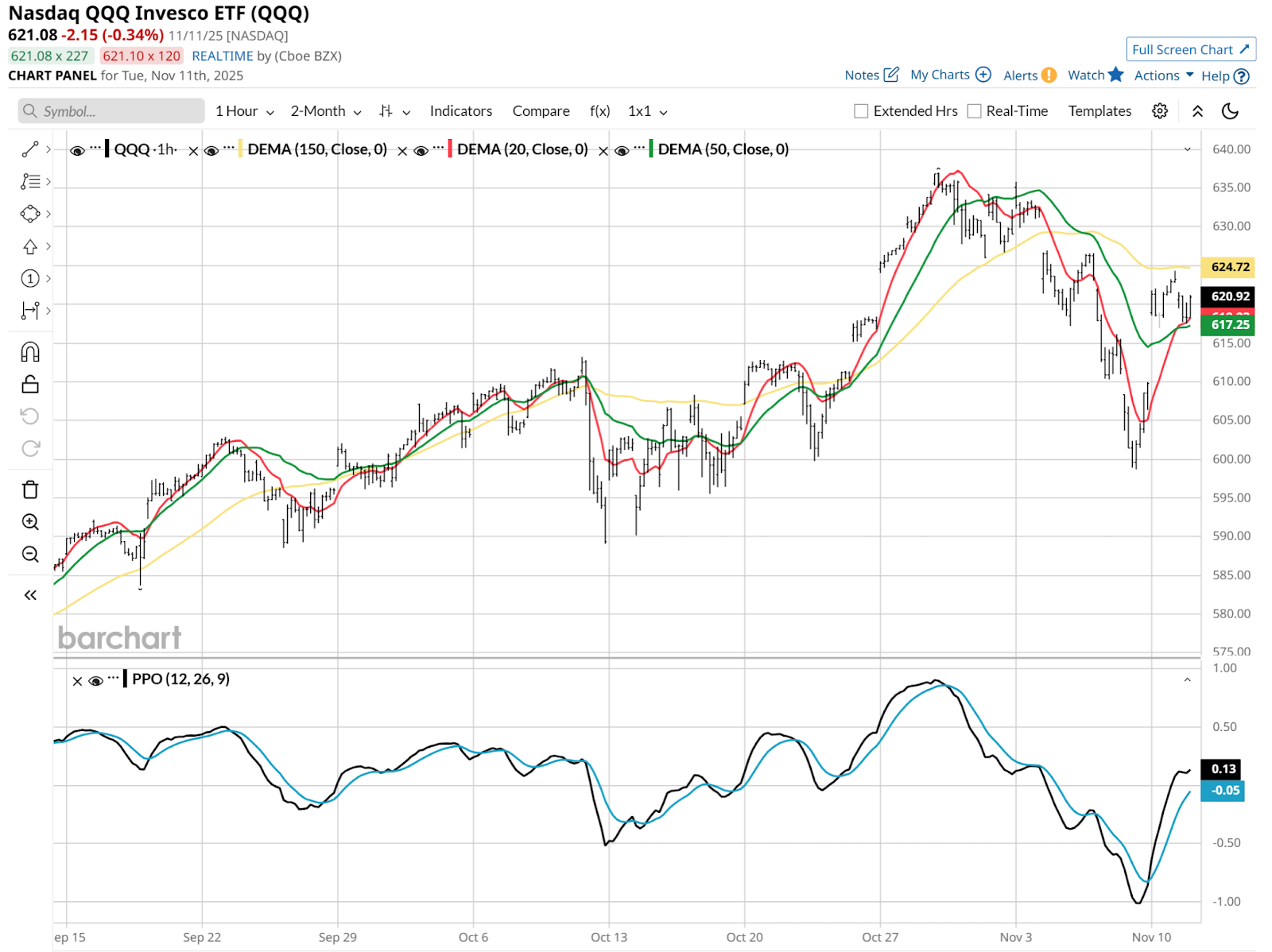

I added in a 4-hour chart below, since the daily and weekly are not showing what I’d consider crystal clear guidance. This shorter-term view shows why. The PPO just “rejected” an attempt to roll over. This is “buy the dip” in a technical analysis picture. That’s good for now, but the issues remain across longer time frames.

As I noted above, the market speaks in varying degrees of clarity. This market is anything but a clear picture. That’s largely due to a combination of massive liquidity, combined with narrow market breadth. Put them together and you get a very top-heavy stock market, with too much money jamming into too few stocks. That can last for a while. But when it ends, it is more likely to be with a bang than a whimper.

My Strategy on QQQ

“Position sizing” is a phrase I hope traders will really take to heart, and learn to personalize for themselves. When a picture like QQQ, important as it is to market functioning and direction, looks like this much of a tossup, hedging positions can be so helpful.

So rather than simply think “should I buy QQQ or not,” I approach QQQ this way: I am in it, and I want to hold it. But I’m going to either own less than usual, or I’m going to add some sort of counter-position. A put option, a collar, or an inverse ETF on something likely to drop when QQQ does, ideally more. The Short Russell 2000 -1X ETF (RWM) is one I’ve used on and off for a long time. Frankly, small-cap stocks look like the weak link in this market to me.

That’s another story for another day. For now, the QQQ story is a tenuous rally still in place, but a growing risk of major loss. To me, that means be long, but be hedged.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- 420 Is Not Just for Weed Smokers and Elon Musk. It’s a Critical Level for the Bond Market and Beloved AI Stocks. Here’s What to Watch.

- These ETFs Prove You Don’t Have to Be Michael Burry of ‘Big Short’ Fame to Profit from Stock Market Dips