Philadelphia, Pennsylvania-based Comcast Corporation (CMCSA) operates as a media and technology company worldwide. With a market cap of $108.1 billion, Comcast operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments.

The telecoms and entertainment giant has substantially underperformed the broader market over the past year. CMCSA stock prices experienced a 24% decline in 2025 and a 32.2% plunge over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 17.2% gains on a YTD basis and 18.1% surge over the past year.

Zooming in further, Comcast has also underperformed the iShares U.S. Telecommunications ETF’s (IYZ) 23% gains on a YTD basis and 27.8% returns over the past 52 weeks.

Comcast’s stock prices gained 2.3% in the trading session following the release of its solid Q2 results on Jul. 31. The company observed early progress in its go-to-market pivot in residential broadband. Moreover, its wireless business had its best quarter ever, adding 378,000 lines during Q2. Overall, its revenues for the quarter inched up 2.1% year-over-year to $30.3 billion, exceeding the Street expectations by 1.6%. Meanwhile, its adjusted EPS increased by 3.3% to $1.25, surpassing the consensus estimates by 6.8%. On an even more positive note, Comcast’s operating cash flows during the quarter surged 65.4% year-over-year to $7.8 billion.

For the full fiscal 2025, ending in December, analysts expect CMCSA to deliver a 1.2% decline in adjusted EPS to $4.28. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

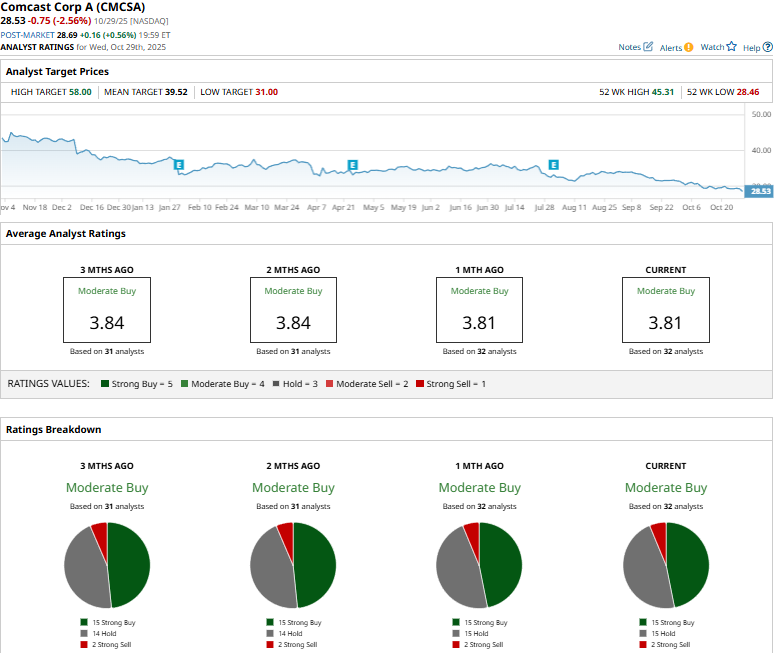

CMCSA has a consensus “Moderate Buy” rating overall. Of the 32 analysts covering the stock, 15 recommend “Strong Buy,” 15 advise “Hold,” and two suggest a “Strong Sell” rating.

This configuration has remained mostly stable over the past months.

On Oct.17, Rosenblatt analyst Barton Crockett maintained a “Neutral” rating on CMCSA and reduced the price target from $38 to $33.

Comcast’s mean price target of $39.52 represents a 38.5% premium to current price levels. Meanwhile, the street-high target of $58 suggests a massive 103.3% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart